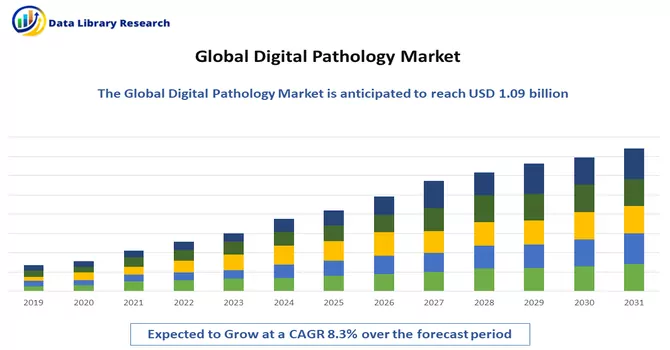

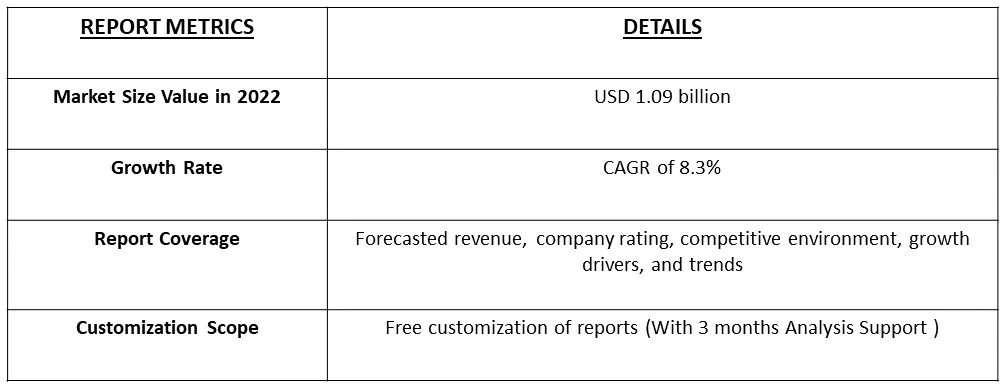

The digital pathology market is valued at approximately USD 1.09 billion in 2022 and is anticipated to experience a compound annual growth rate (CAGR) of 8.3% throughout the forecast period, 2023-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Pathology, a crucial subfield of medical science, focuses on understanding the nature, origin, and causes of diseases. It plays a vital role in diagnostic pathways for various diseases, particularly in the detection of cancer. A significant portion, ranging from 70-80%, of healthcare decisions related to diagnosis or treatment relies on pathological assessments. The International Agency for Research on Cancer (IARC) predicts a surge in new cancer cases, reaching 27 million annually by 2040.

This increase, combined with the aging global population, is expected to substantially elevate the workload in pathology. However, despite the growing demand for skilled pathologists, there is a diminishing number of active professionals in the field. A recent study suggests a projected 30% decline in the count of active pathologists by 2030 compared to the figures in 2010. Furthermore, a notable 63.2% of currently practicing pathologists are expected to retire within the next decade. This trend poses a significant challenge, as there is an impending gap of approximately 30% between the expected demand for pathology services and the available supply of pathologists by the year 2030.

The ongoing advancements in technology, coupled with strategic collaborations between companies like Paige and healthcare institutions, indicate a dynamic landscape for digital pathology. These collaborations aim to enhance diagnostic capabilities and contribute to the evolution of pathology practices. Moreover, companies like Paige and Mindpeak are at the forefront of integrating AI tools into pathology. Paige, through its collaboration with Ohio State Wexner Medical Center, focuses on AI tools like Paige Prostate Detect, the only FDA-approved AI tool for prostate cancer detection. Mindpeak, in partnership with Proscia, aims to leverage AI-based pathology for improved cancer diagnosis.

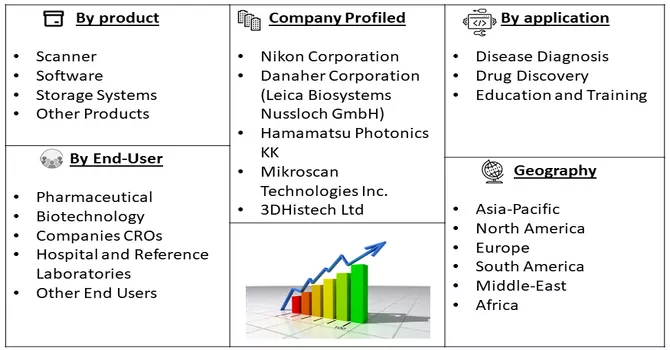

Market Segmentation: The Digital Pathology Companies and the Market is segmented by product (Scanner, Software, Storage Systems, and Other Products), application (Disease Diagnosis, Drug Discovery, and Education and Training), end user (Pharmaceutical, Biotechnology, Companies, and CROs, Hospital and Reference Laboratories, and Other End Users), and geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Number of Tele-consultations

Rising Adoption of Digital Pathology to Enhance Lab Efficiency and Increasing Application in Drug Discovery and Companion Diagnostics

Market Restraints:

Stringent Regulatory Concerns for Primary Diagnosis and Lack of Standard Guidelines for Digital Pathology

Throughout the COVID-19 pandemic, governmental bodies worldwide, research institutions, and numerous biotech and pharmaceutical companies dedicated their efforts to the swift development of effective diagnostic technologies for COVID-19 and the creation of vaccines and therapeutics to combat the ongoing crisis. The pandemic posed significant challenges to diagnostic services, especially in histopathology departments already grappling with reduced staffing and heightened workloads. In 2020, the global health crisis had a profound impact on routine pathology services. Digital pathology emerged as a critical player in upholding clinical services and pathology-based research during the tumultuous period of 2020. Notably, a publication by BMJ Publishing Group Ltd & Association of Clinical Pathologists in September 2021 highlighted a substantial increase in pathologists adopting home offices. The use of digital pathology for primary diagnoses and consultations experienced a significant surge, with half of the respondents acknowledging its role in facilitating diagnostic practices. Furthermore, investments in laboratory expansion and the market penetration of key manufacturers are poised to drive market growth. A Department of Health and Human Services (HHS) report in 2022 revealed that, during the pandemic from March 2020 to February 2021, there were over 28 million telehealth visits, a notable increase compared to the pre-pandemic period. This surge in telehealth consultations is anticipated to contribute significantly to the growth of the market.

Segmental Analysis:

Software Segment is Expected to Hold Significant Share Over the Forecast Period

The software and digital pathology market is experiencing significant growth and evolution, driven by technological advancements and the increasing adoption of digital solutions in the field of pathology. This market encompasses a diverse range of software applications designed to enhance and streamline various aspects of pathology practices. Image analysis software plays a pivotal role in digital pathology, allowing for the automated interpretation and quantification of pathology images. This software assists pathologists in making more accurate and efficient diagnoses, particularly in areas such as tumor analysis and grading. Digital pathology software facilitates collaboration among pathologists, enabling remote viewing and consultation on pathology images. Telepathology, made possible by advanced software solutions, allows pathologists to share and discuss cases in real-time, overcoming geographical barriers and improving the efficiency of pathology services. Thus, the segment is expected to witness significant growth over the forecast period.

Pharmaceutical, Biotechnology, Companies and CROs Segment is Expected to Hold Significant Share Over the Forecast Period

Pharmaceutical and biotechnology firms often collaborate with CROs to leverage their expertise in conducting clinical trials and research studies. The integration of digital pathology in these collaborations enhances the efficiency of data analysis and accelerates the overall drug development timeline. Thus, the integration of digital pathology in pharmaceutical and biotechnology research, coupled with collaborations with CROs, is transforming the way medical research and diagnostics are conducted. This convergence enhances efficiency, accelerates drug development timelines, and contributes to the overall advancement of precision medicine. As a result the segment is expected to witness significant growth over the forecast period.

Disease Diagnosis Segment is Expected to Hold Significant Share Over the Forecast Period

Digital diagnosis plays a pivotal role in identifying and understanding the causes of various chronic diseases, positioning itself as a crucial tool in routine diagnostics. The prominence of digital pathology is on the brink of widespread adoption for routine diagnostic practices. The COVID-19 pandemic and associated social distancing measures have accelerated the acceptance of digital pathology, making it a crucial player in the diagnostic landscape. In January 2022, responding to the urgent need for advanced COVID-19 diagnostic reporting tools, the Health and Human Services (HHS) initiated a rapid two-month build cycle utilizing the "TOPx Toolkit" developed by the U.S. Census Bureau, collaborating with 15 industry-led teams. This initiative streamlined the reporting of positive/negative test results, providing a safer and more efficient way for individuals and organizations to share crucial diagnostic information.

Globally, the burden of chronic and infectious diseases, encompassing conditions like cardiovascular diseases, cancer, diabetes, influenza, orthopedic and neurology disorders, has been on the rise, adversely affecting both physical and mental well-being. As of January 2022, statistics from the British Heart Foundation revealed approximately 7.6 million people in the United Kingdom suffering from heart disease due to cardiovascular disorders (CVDs). The escalating prevalence of cardiovascular diseases has sparked a heightened demand for innovative technologies capable of diagnosing these conditions, thereby propelling the growth of the digital pathology market. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American digital pathology market is experiencing substantial growth, driven by several key factors. The increasing prevalence of chronic diseases, a growing emphasis on technology adoption in chronic disease management, heightened investments, frequent product launches, and strategic initiatives by key market players are pivotal drivers of this growth. Notably, the United States is anticipated to witness significant expansion throughout the study period.

The rise in chronic diseases such as cancer and Alzheimer's disease is a major catalyst for the digital diagnostics market in North America. For instance, the American Cancer Society's 2022 estimates project approximately 236,740 new cases of lung cancer in the United States. Additionally, kidney cancer is expected to account for 79,000 new cases in 2022. The International Diabetes Federation's data from December 2021 indicates that an estimated 14 million adults in Mexico were living with diabetes in the same year. Furthermore, the government of Canada reported in August 2021 that over 3 million Canadians, or 8.8% of the population, were diagnosed with diabetes, with 6.1% of Canadian adults being at high risk of developing the condition. The significant burden of chronic diseases, especially cancer, is driving the demand for digital pathology solutions, fueling market growth.

Product and service launches are also contributing significantly to market expansion in the region. For instance, in March 2022, Digital Diagnostics and Baxter International Inc. unveiled a long-term strategic partnership. This collaboration aims to empower frontline care providers by offering Digital Diagnostics' IDx-DR autonomous AI software as a diagnostic service, coupled with the Welch Allyn RetinaVue 700 Imager. This integrated solution provides care providers with valuable diagnostic information, enhancing the quality of care and treatment planning, and subsequently, propelling market growth. The dynamic interplay of these factors positions the North American digital pathology market for substantial growth in the foreseeable future.

Get Complete Analysis Of The Report - Download Free Sample PDF

The digital pathology market exhibits a consolidated structure, characterized by the dominance of a select number of companies with a global and regional operational presence. The competitive landscape is shaped by the market shares held by well-established international and local players. Notable entities in this landscape include:

Recent Developments:

1. In August of 2023, Paige initiated a collaboration with the Ohio State Wexner Medical Center to conduct research on AI tools, specifically leveraging Paige Prostate Detect. This particular AI tool holds the distinction of being the sole FDA-approved pathology tool for the detection of prostate cancer.

2. In June 2023, Mindpeak forged a partnership with Proscia with the aim of expanding its capabilities in providing enhanced diagnostic solutions for cancer patients. This collaboration involves the utilization of AI-based pathology techniques.

Q1. What was the Digital Pathology Market size in 2022?

The digital pathology market is valued at approximately USD 1.09 billion in 2022.

Q2. At what CAGR is the Digital Pathology Market projected to grow within the forecast period?

Digital Pathology Market is anticipated to experience a compound annual growth rate (CAGR) of 8.3% over the forecast period.

Q3. What are the factors driving the Digital Pathology Market?

Key factors that are driving the growth include the Growing Number of Tele-consultations and Rising Adoption of Digital Pathology to Enhance Lab Efficiency and Increasing Application in Drug Discovery and Companion Diagnostics

Q4. Which region has the largest share of the Digital Pathology Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model