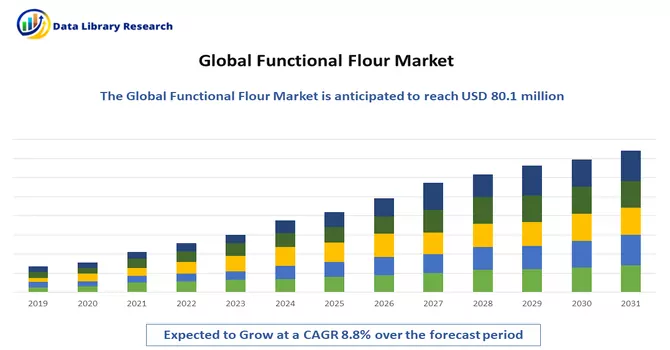

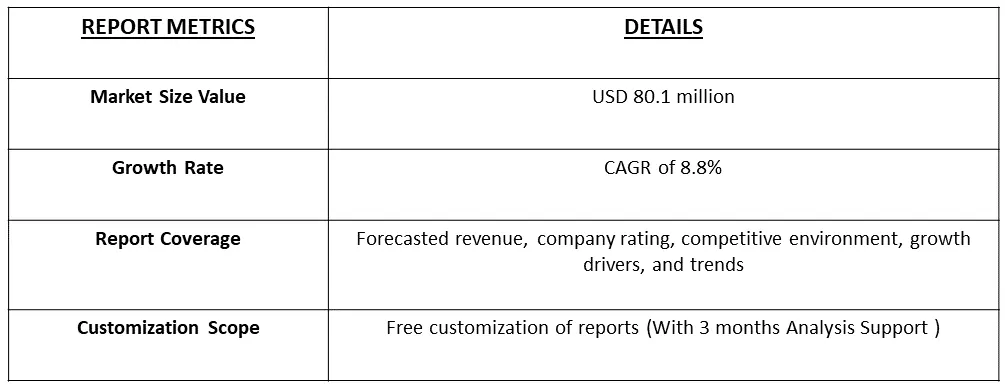

The projected valuation of the global functional flour market is estimated to reach USD 80.1 million in 2022, with an expected compound annual growth rate (CAGR) of 8.8% forecasted for the period spanning from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Functional flour denotes a specially formulated type of flour that undergoes modification or enrichment to enhance its nutritional content, improve its functional attributes, or fulfil specific dietary and manufacturing requirements. These tailored flours are crafted to provide a range of advantages, including heightened fiber content, improved texture, prolonged shelf life, or enhanced baking qualities.

Amidst a growing global focus on healthier eating habits, functional flour emerges as a pivotal player, facilitating the creation of products with augmented nutritional profiles. These may include attributes such as increased fiber content or reduced sugar levels, thereby catering to the preferences of health-conscious consumers. The surge in conditions like gluten intolerance, allergies, and evolving dietary choices, such as keto or paleo diets, has spurred a demand for alternative flours like almond flour, coconut flour, or gluten-free flour blends. These alternatives are designed to meet the specific needs of consumers who seek healthier and more tailored options in their diet, reflecting the dynamic landscape of contemporary food preferences.

The rising incidence of gluten intolerance and celiac disease has spurred an increased need for gluten-free functional flours. This demand has given rise to flours derived from alternative sources such as almond, coconut, quinoa, and chickpeas, providing gluten-free options for both baking and cooking purposes. In response to a growing awareness of health considerations, consumers are placing a premium on flours that offer enhanced nutritional profiles. A notable trend in the market is the popularity of functional flours fortified with essential vitamins, minerals, and proteins. This fortification aligns with the preferences of health-conscious consumers who seek products that contribute to their overall well-being. Moreover, there is a discernible demand for whole grain and high-fiber flours, driven by the perceived health benefits associated with these ingredients. As the landscape of dietary preferences evolves, the functional flour market is adapting to cater to diverse consumer needs, encompassing gluten-free alternatives, fortified options, and those rich in whole grains and fiber. These developments underscore a broader shift towards healthier and more tailored choices in the realm of functional food products.

Market Segmentation: The Functional Flour market is segmented by Source (Cereals and Legumes), Type (Specialty Flour and Conventional Flour), Application (Bakery, Savory Snacks, Soups and Sauces, Ready-to-Eat (RTE) Products, and Other Applications); and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa. The report offers the market size and values in (USD Million) during the forecast years for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Health and Wellness Trends:

The growing consumer awareness and emphasis on health and wellness are significant drivers in the functional flour industry. Consumers are increasingly seeking healthier food options, leading to a higher demand for functional flours that offer specific health benefits. These flours might include whole grain flours, gluten-free options, high-fiber variants, or those fortified with vitamins and minerals. The desire for natural, minimally processed ingredients is also driving the demand for functional flours derived from alternative sources like nuts, seeds, and ancient grains. For instance, Mar 2021, with the introduction of Homecraft Create 835 and Homecraft Create 865 multifunctional rice flours, Ingredion EMEA extended its portfolio of functional starches and flours to assist manufacturers in producing clean-label baby food products. Multifunctional rice flours provide the viscosity, process tolerance, and stability of modified starch and are suitable for dry foods such as cook-up cereals but with an emphasis on wet baby food applications. Thus, such instances are expected to contribute towards the growth of the studied market over the forecast period.

Innovation and Product Differentiation

In a fiercely competitive market, food manufacturers are consistently engaged in the pursuit of innovation to set their products apart. Functional flours have emerged as a key tool in this endeavor, enabling the creation of distinctive textures, flavors, and nutritional profiles across a spectrum of food products, encompassing baked goods, snacks, pasta, and beyond. Companies are strategically leveraging these specialized flours to formulate products that address specific dietary requirements, deliver heightened nutritional value, and provide novel taste and texture experiences. This dynamic drive for innovation is a driving force behind the increasing development and widespread utilization of functional flours throughout the food industry. By incorporating these flours into their product formulations, manufacturers can not only meet the evolving demands of health-conscious consumers but also introduce unique and appealing attributes that contribute to the overall differentiation of their offerings. As a result, functional flours have become integral to the landscape of food innovation, serving as a versatile and impactful ingredient for companies striving to stay at the forefront of market trends and consumer preferences.

Market Restraints:

Cost Constraints and Taste and Texture Challenges:

The production of functional flours frequently entails specialized processing methods or the use of alternative ingredients, contributing to an increase in overall production costs. This cost element presents a potential constraint on widespread adoption, particularly in markets sensitive to price considerations or for manufacturers aiming to uphold competitive pricing strategies. Notably, certain functional flours, especially those derived from alternative sources such as gluten-free grains or seeds, may exhibit distinct taste profiles or textures in comparison to conventional wheat flour. This divergence in sensory attributes poses a challenge when attempting to replicate the desired culinary experience in specific food products, thereby impacting consumer acceptance. The unique characteristics of some functional flours may necessitate additional efforts in formulation and product development to align with consumer expectations and preferences. The delicate balance between cost considerations and the need to achieve sensory familiarity underscores the complexities inherent in the broader adoption of functional flours in the food industry.

The pandemic prompted a heightened emphasis on home cooking and baking as individuals spent more time indoors. Consequently, there was a notable increase in the demand for baking ingredients, with functional flours experiencing a surge in popularity. Consumers, driven by a desire for healthier options, demonstrated an elevated interest in purchasing whole grain and gluten-free functional flours specifically for creating homemade bread, cakes, and various baked goods. However, the global supply chains encountered disruptions during the pandemic, impacting the sourcing and availability of raw materials essential for functional flour production. Challenges such as restrictions on transportation, labor shortages, and fluctuations in commodity prices exerted pressures on the supply of grains, seeds, and other ingredients integral to these specialized flours. As a result, occasional shortages and price fluctuations were observed, creating a dynamic environment in the functional flour market. Despite these challenges, the increased focus on home baking and the demand for healthier ingredients underscored the resilient appeal of functional flours during a period of significant global disruptions.

Segmentation Analysis:

Cereals and Legumes Segment is Expected to Witness Significant Growth Over the Forecast Period.

Wheat, rice, corn, and oats are common cereals used in functional flour production. These grains are often processed and milled into various flours with distinct properties. For instance: Wheat flour serves as a base for many functional flours. Whole wheat flour, with its higher fiber content, is considered a healthier alternative to refined wheat flour. It's often used in the production of functional flours for baking. Cereals like rice, corn, and oats are utilized to create gluten-free flours, addressing the needs of individuals with gluten intolerance or celiac disease. These flours serve as alternatives in baking and cooking. Legumes such as chickpeas, lentils, peas, and beans are increasingly used in functional flour production due to their nutritional value and functional properties. Legume-based flours are naturally high in protein, making them attractive for consumers seeking plant-based protein sources. They're used in gluten-free blends and as supplements to enhance the nutritional profile of various products. Legume flours, particularly chickpea flour, are popular gluten-free alternatives. They contribute unique flavors and textures to baked goods and are rich in nutrients like fiber and vitamins.

Specialty Flour Segment is Expected to Witness Significant Growth Over the Forecast Period

Specialty flour refers to a category of flour that goes beyond the traditional all-purpose or whole wheat flours, offering unique characteristics, flavors, and applications. These flours are crafted from various grains, seeds, nuts, or other unconventional sources, and they cater to specific culinary needs, dietary preferences, or desired outcomes in baking and cooking. Specialty flours can be derived from a variety of grains such as rice, oat, quinoa, amaranth, or alternative sources like chickpeas, almonds, and coconut. Each source imparts distinct flavors, textures, and nutritional profiles to the flour. Specialty flours are frequently used in the production of specialty baked goods like gluten-free bread, pastries, cakes, and other confections. They contribute to the expanding market for alternative and health-conscious baked products. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Savory Snacks Segment is Expected to Witness Significant Growth Over the Forecast Period

The savory snacks and flour market represents a dynamic sector within the broader food industry, encompassing a diverse range of products that cater to consumers' preferences for convenient, flavorful, and indulgent snack options. This market comprises both ready-to-eat savory snacks and various types of flours used in snack preparation, adding versatility and innovation to culinary endeavors. Savory snacks include an extensive array of products such as potato chips, pretzels, nuts, popcorn, crackers, and savory biscuits. The market continually evolves with new flavors, shapes, and ingredients to meet consumer demands for variety. Thus, the savory snacks and flour market is characterized by innovation, diverse flavor profiles, and a balance between indulgence and health-conscious choices. This market reflects the evolving preferences and lifestyles of consumers seeking convenient, flavorful, and satisfying snack options.

North America Region Segment is Expected to Witness Significant Growth Over the Forecast Period.

Consumers in North America are displaying an escalating commitment to health-conscious choices, actively seeking products that deliver substantial nutritional benefits. This heightened demand aligns seamlessly with the abundant availability of functional flours that cater to specific dietary preferences, including gluten-free, high-fiber, or low-carb options. The region is witnessing a surge in awareness regarding the profound impact of diet on overall health, contributing significantly to the burgeoning popularity of functional flours. Given the diverse dietary preferences within North America, ranging from gluten-free and paleo to keto and other specialized diets, there exists a vibrant market for a wide spectrum of functional flours. Crafted from different grains, seeds, and nuts, these flours are designed to meet the varied dietary requirements of the population.

A noteworthy trend in the United States functional bars sector indicates a rising demand for functional food products. The fortification of granola/muesli bars and other food items with essential elements such as omega-3 fatty acids, calcium, and fiber is gaining prominence in the U.S. marketplace. The prevalence of gluten intolerance, affecting approximately 6% to 7% of the U.S. population (equivalent to 20 million individuals), has led to a substantial 20% of American consumers opting for gluten-free products. The upswing in the consumption of nutritive convenience and fortified foods, coupled with a growing awareness of health considerations, is propelling the adoption of healthier diets in the country. The evolving healthcare expenditure patterns and a focus on preventive healthcare measures, including dietary choices, contribute to the overall upward trajectory in sales. Additionally, the increasing influence of Western culture is fostering a heightened demand for high-protein and nutrient-rich foods. This multifaceted landscape underscores the dynamic interplay between consumer preferences, dietary trends, and the burgeoning market for functional flours in North America.

Get Complete Analysis Of The Report - Download Free Sample PDF

The functional flour market is fragmented and competitive, with a large number of players operating at regional and local levels. The key players in the market adopted expansions and investments in function flour as their growth strategies. Some of the major companies in the functional flour market are Cargill Inc., Archer Daniels Midland Company, Associated British Foods, Ingredion Inc., and Bunge Limited, among others. Product innovation and development is the most adopted strategy by the players operating in the market, followed by mergers and acquisitions and expansions for increasing their visibility and portfolio of offerings. Manufacturers are focusing on providing ingredients that increase the shelf-life of the product. Some of the major players working functional Flour Market are:

Recent Developments:

1) Oct 2021: Cargill launched a rice flour-based maltodextrin substitute. Cargill's new soluble SimPure rice flour is a clean label that has a similar taste, texture, and functionality as maltodextrin. This ingredient can be used as a one-to-one replacement for maltodextrin.

2) Jul 2021: Ulrick & Short launched a functional flour aimed specifically at improving viscosity, texture, and structure in gluten-free bakery applications. The ingredient, called fazenda Nutrigel, is an addition to the company's functional flour range launched in 2020. The ingredient acts as a viscosity regulator in bakery applications and has been designed to improve the moisture, softness, and structure in a range of products.

Q1. What was the Functional Flour Market size in 2022?

As per Data Library Research the global functional flour market is estimated to reach USD 80.1 million in 2022.

Q2. What is the Growth Rate of the Functional Flour Market?

Functional Flour Market is expected to grow at a compound annual growth rate (CAGR) of 8.8% over the forecast period.

Q3. What are the factors on which the Functional Flour market research is based on?

By Source, By Type, By Application, By Product and Geography are the factors on which the Functional Flour market research is based.

Q4. What are the Growth Drivers of the Functional Flour market?

Health and Wellness Trends and Innovation and Product Differentiation are the Growth Drivers of the Functional Flour market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model