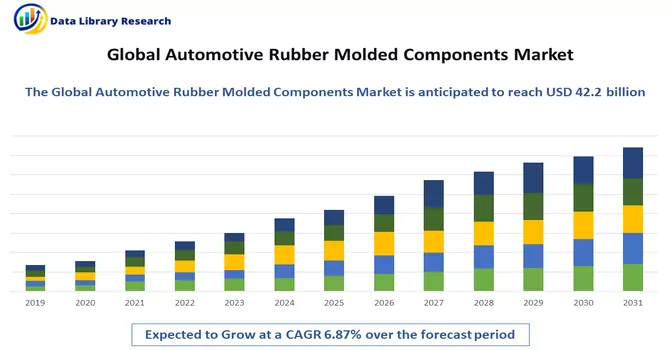

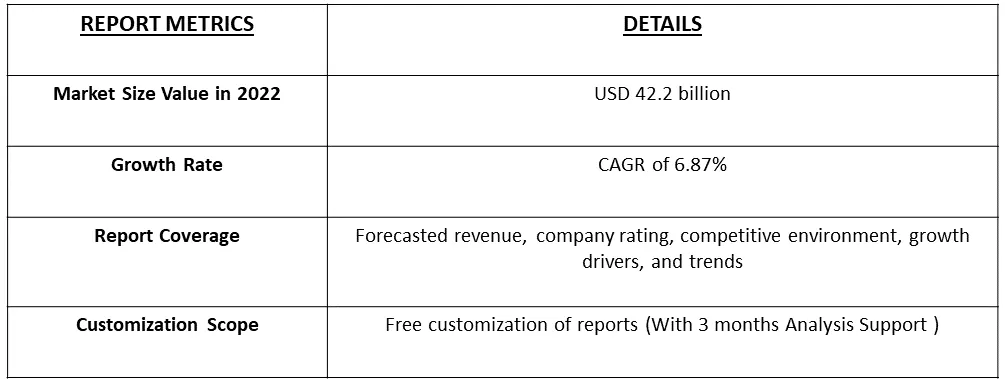

The Automotive Rubber-Molded Component Market is currently valued at USD 42.2 billion in the year 2022 and is anticipated to register a CAGR of about 6.87%, during the forecast period (2023 – 2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

An automotive rubber-molded component refers to a specialized part or element used in the construction and assembly of vehicles, such as automobiles, trucks, and motorcycles, which is made from rubber or rubber-like materials. These components are designed to serve various functions within a vehicle, including sealing, dampening vibrations and noise, providing cushioning and insulation, and facilitating the movement of mechanical parts. Automotive rubber-molded components are typically produced through a molding process, where rubber material is shaped and cured into specific forms, ensuring their suitability for use in vehicles.

These driving factors collectively shape the automotive rubber-molded component market are overall growth in the automotive industry, including the production and sales of passenger cars, commercial vehicles, and electric vehicles, drives the demand for rubber-molded components. The growing adoption of electric and hybrid vehicles has increased the demand for specialized rubber components that can withstand the unique challenges of these vehicles, such as exposure to high-voltage systems and different temperature ranges. Thus, these factors are contributing to the studied market’s growth.

The shift toward electric and hybrid vehicles is driving demand for specialized rubber components capable of withstanding high-voltage systems and different environmental conditions. As consumers demand quieter and more comfortable rides, there is an increasing need for rubber components that reduce noise and vibration. Innovations in materials and designs are addressing this trend.

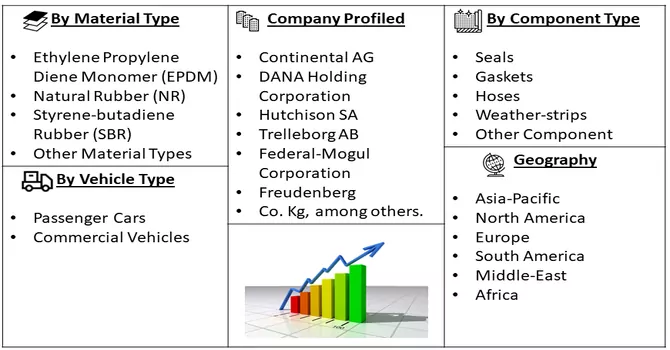

Market Segmentation: The Automotive Rubber-molded Component Market is segmented by Material Type (Ethylene Propylene Diene Monomer (EPDM), Natural Rubber (NR), Styrene-butadiene Rubber (SBR), and Other Material Types), Component Type (Seals, Gaskets, Hoses, Weather-strips, and Other Component Types), Vehicle Type (Passenger Cars and Commercial Vehicles) and Geography and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increase in Demand for Electric and Hybrid Vehicles and Increased Vehicle Customization

The automotive industry is undergoing a significant transformation with the increasing demand for electric and hybrid vehicles (EVs and HEVs). This shift is driven by several factors, including concerns about environmental sustainability, government incentives, and advancements in battery technology. Electric and hybrid vehicles have unique requirements due to high-voltage systems, thermal management, and distinct structural designs. This demand has led to the development of specialized rubber components that can withstand the challenges posed by these vehicles. For example, rubber grommets and insulators designed for high-voltage wiring protection, battery enclosure seals, and thermal management components have become crucial in EV and HEV manufacturing. Thus, due to these advantages the market is expected to witness significant growth over the forecast period.

Advances in Rubber Manufacturing Technologies

The most notable advance is the development of new rubber materials and compounds with enhanced properties. These materials offer better resistance to heat, cold, chemicals, and wear and tear, making them suitable for a broader range of automotive applications. For instance, high-performance elastomers are now used in critical components like engine mounts, suspension bushings, and seals, providing better durability and performance. The use of innovative additives and fillers in rubber formulations has improved component properties. Reinforcements like carbon black, silica, and nanomaterials have been employed to enhance tensile strength, elasticity, and other characteristics, making rubber-molded components more resilient and durable. Thus, due to the above-mentioned factors the market is expected to witness significant growth over the forecast period.

Market Restraints:

Limited Product Differentiation and Recycling and Disposal Challenges

Rubber-molded components are often viewed as commodity products with little differentiation. Many suppliers produce similar components, making it challenging for manufacturers to distinguish their offerings in a highly competitive market. The disposal of rubber-molded components can pose environmental challenges. Rubber materials may not be biodegradable, and improper disposal can lead to pollution and harm to ecosystems. Furthermore, recycling rubber components is often complex, as they may contain various materials or additives. Sorting, processing, and reusing rubber components can be challenging and costly. Thus, the above-mentioned reasons are expected to slow down growth of the studied market.

The outbreak of COVID-19, caused by the novel coronavirus SARS-CoV-2, had far-reaching implications for the global automotive industry, including the automotive rubber-molded component market. The pandemic's effects were multifaceted and influenced various aspects of the market. The pandemic disrupted supply chains across the globe, affecting the availability of raw materials and components required for rubber-molded component production. Lockdowns, travel restrictions, and factory closures led to delays and shortages, affecting manufacturing. The pandemic brought renewed attention to sustainability and environmental concerns. As a result, manufacturers and consumers showed increased interest in eco-friendly and recyclable rubber materials for components.

Market Segmentation:

The Ethylene Propylene Diene Monomer (EPDM) Segment is Expected to Witness Significant Growth Over the Forecast Period

Ethylene Propylene Diene Monomer (EPDM) is a synthetic rubber compound known for its outstanding properties, making it a preferred material for various applications in the automotive rubber-molded component market. EPDM has gained prominence due to its excellent resistance to environmental factors, durability, and versatility. Moreover, EPDM-based weatherstrips are commonly used to provide effective sealing for windows, doors, and other parts of the vehicle, improving insulation, reducing noise, and enhancing overall comfort. EPDM's resistance to UV radiation ensures long-lasting performance in various weather conditions. Thus, due to such advantages the segment is expected to witness significant growth over the forecast period.

Gaskets Segment is Expected to Witness Significant Growth Over the Forecast Period

Gaskets are a crucial category of automotive rubber-molded components, playing a vital role in ensuring the integrity of various systems within a vehicle. They are designed to create a seal between two or more mating surfaces, preventing the leakage of fluids, gases, and contaminants. Gaskets are integral to the proper functioning and safety of an automobile. Gaskets are employed in a wide range of automotive applications, including the engine, transmission, exhaust system, cooling system, and various fluid handling components. They create seals in engine cylinder heads, exhaust manifolds, valve covers, water pumps, and more. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Commercial Vehicle Segment is Expected to Witness Significant Growth Over the Forecast Period

Commercial vehicles, including trucks, buses, vans, and other heavy-duty vehicles, are a significant segment of the automotive industry. The market for automotive rubber-molded components is greatly influenced by the unique needs and challenges presented by commercial vehicles. Commercial vehicles are subjected to more demanding operating conditions compared to passenger vehicles. They often require rubber-molded components that can withstand higher loads, extended use, and exposure to harsh environments.

Asia-Pacific is Expected to Witness Significant Growth Over the Forecast Period

China is a significant global producer of vehicles, contributing approximately 28% of the world's total vehicle production in 2019. While the majority of vehicles manufactured in the country are internal combustion (IC) engine vehicles, the automotive market experienced a decline of 8.2% in total sales in 2019, according to the China Association of Automobile Manufacturers. Notably, the premium car market in China demonstrated stable growth during the same year, with luxury brands like Mercedes-Benz, Audi, and BMW dominating the sector. China has shown a strong commitment to the development of hybrid and electric vehicles (EVs) following the government's 2012 development plan that emphasized the importance of new energy vehicles, including electric, hybrid, and fuel-cell vehicles. A significant policy shift by the Chinese government involves phasing out petrol and diesel cars, with an ambitious target of having at least one-fifth of vehicles on the roads as electric-battery cars and plug-in hybrid cars by 2025. This transition is expected to impact the market for rubber-molded components, as their applications in traditional internal combustion engine (IC) vehicles will decrease.

In Japan, the electric vehicle market is experiencing substantial growth, driven by increasing demand for emission-free vehicles. The Japanese government is actively investing in the electric vehicle market, with a goal to transition all newly sold cars in the country to electric or hybrid vehicles by 2050. Additionally, the government aims to reduce carbon dioxide emissions and other greenhouse gases by approximately 80% per vehicle by 2050. This transition towards electric and hybrid vehicles in Japan is expected to have implications for the rubber-molded component market, as these components have reduced applications in electric vehicles compared to traditional IC engine vehicles. Thus the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The automotive rubber molded component market is moderately fragmented one and dominated by various players which include:

Recent Development:

1) In March 2019, Hubner Manufacturing Corporation has invested USD 9.6 million to establish a new manufacturing facility in Dunlap, Tennessee.

2) In September 2018, Zeon Corporation (Zeon) announced that it will establish a wholly owned subsidiary for the production and sales of acrylic rubber in Thailand. The new plant will be Zeon’s third acrylic rubber plant after its Japanese and US plants. Demand for acrylic rubber is expected to increase in Asia.

Q1. What is the current Automotive Rubber Molded Components Market size?

The Automotive Rubber-Molded Component Market is currently valued at USD 42.2 billion.

Q2. At what CAGR is the Automotive Rubber Molded Components Market projected to grow within the forecast period?

Automotive Rubber Molded Components Market is anticipated to register a CAGR of about 6.87%, during the forecast period.

Q3. Which Region is expected to hold the highest Market share?

Asia-Pacific region is expected to hold the highest Market share.

Q4. What segments are covered in the Automotive Rubber Molded Components Market Report?

By Material Type, By Component Type, By Vehicle Type and Geography are the segments covered in the Automotive Rubber Molded Components Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model