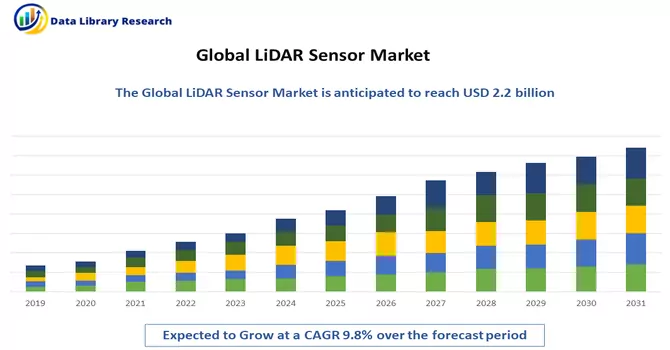

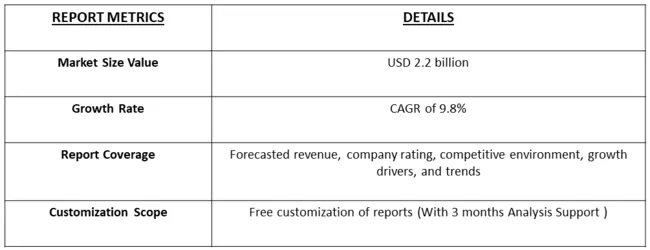

The global LiDAR market size was valued at USD 2.2 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.8% from 2022 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

LiDAR stands for Light Detection and Ranging. It is a remote-sensing technology that uses laser light to measure distances with high precision. LiDAR systems typically consist of a laser sensor that emits laser pulses towards the target and a receiver that detects the reflected light. By measuring the time it takes for the laser pulses to travel to the target and back, LiDAR systems can calculate the distance to objects or surfaces with great accuracy. LiDAR is commonly used for mapping and surveying terrain, creating three-dimensional models of landscapes, and generating point cloud data. It is widely employed in various applications, including forestry, urban planning, autonomous vehicles, environmental monitoring, and archaeology. In the context of autonomous vehicles, LiDAR is crucial for providing real-time, high-resolution data about the surroundings, helping the vehicle navigate and avoid obstacles.

The improvement in the spatial resolution of LiDAR-based digital terrain models represents a significant technological advancement. This enhancement has led to increased accuracy in applications such as change detection on hillsides, assessment of water runoff for agriculture or mining operations, and monitoring of inland waterways. The market for LiDAR technology is experiencing notable growth, driven by the escalating demand for automation. By leveraging LiDAR's capabilities, industries aim to reduce human efforts and enhance operational efficiency. The integration of LiDAR technology is particularly beneficial in scenarios where precise and detailed terrain information is crucial, enabling more effective decision-making processes in various sectors, including agriculture, mining, and environmental monitoring.

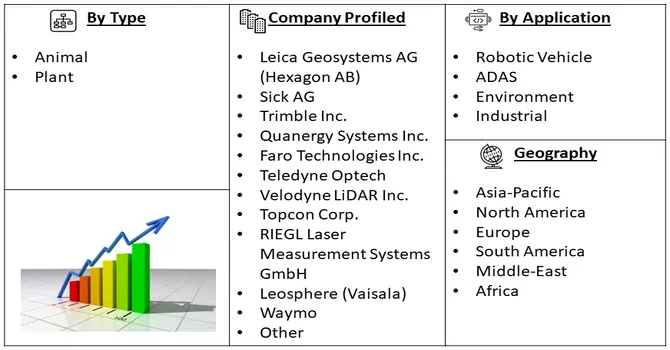

Market Segmentation: The report covers the LiDAR market share by Company and is segmented by Application (Robotic Vehicle, ADAS, Environment (Topography, Wind, and Agriculture and Forestry), and Industrial), Type (Aerial and Terrestrial), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

An escalating emphasis is being placed on leveraging LiDAR technology for environmental applications, encompassing vital areas like deforestation monitoring, carbon sequestration analysis, and biodiversity assessments. Environmental agencies and organizations are progressively acknowledging the substantial potential of LiDAR in tackling ecological challenges and facilitating informed decision-making for sustainable resource management. Thus, the evolution of solid-state LiDAR technology is proving to be a transformative development. This innovative approach involves replacing traditional mechanical components with solid-state counterparts, promising heightened reliability, cost reduction, and an expanded scope of LiDAR adoption across diverse applications. The shift towards solid-state LiDAR not only holds the prospect of enhancing performance but also serves as a catalyst for increased integration into various industries, amplifying its role in addressing complex challenges and contributing to environmental conservation efforts.

Market Drivers:

Fast Paced Developments and Increasing Application of Drone

The Drone and LiDAR market is currently witnessing fast-paced developments and a surge in applications, driven by technological advancements and the integration of these technologies across various industries. Drones equipped with LiDAR sensors are becoming increasingly popular for their ability to capture high-resolution, three-dimensional data, revolutionizing fields such as agriculture, forestry, construction, and environmental monitoring. The agriculture sector, in particular, is benefiting from drone-LiDAR solutions for precision farming, crop monitoring, and yield optimization. In forestry, LiDAR-equipped drones facilitate accurate mapping of forests, aiding in conservation efforts and resource management. The construction industry leverages this technology for topographic surveys, project planning, and progress monitoring, contributing to enhanced efficiency and reduced costs. Moreover, the environmental monitoring capabilities of drone-LiDAR systems play a crucial role in disaster response, habitat mapping, and climate change research. The rapid evolution of both drone and LiDAR technologies, coupled with their expanding range of applications, underscores the transformative impact they are having on diverse sectors, promising continued growth and innovation in the foreseeable future.

Increasing Adoption in the Automotive Industry

The automotive industry is experiencing a notable surge in the adoption of LiDAR technology, marking a pivotal shift in the landscape of vehicle autonomy and safety. LiDAR, with its precise and real-time three-dimensional mapping capabilities, is increasingly recognized as a critical component for advanced driver-assistance systems (ADAS) and autonomous vehicles. This technology plays a fundamental role in enhancing situational awareness, enabling vehicles to navigate complex environments and detect obstacles with unparalleled accuracy. The automotive sector's growing reliance on LiDAR is evident in the integration of these sensors into prototypes and test vehicles, demonstrating a commitment to achieving higher levels of autonomy. As automakers strive to enhance vehicle safety and performance, LiDAR technology is becoming integral to the development and deployment of self-driving vehicles. This increasing adoption not only underscores the transformative potential of LiDAR in redefining the future of transportation but also signals a paradigm shift towards safer, more efficient, and intelligent automotive systems.

Market Restraints:

High Cost of LiDAR System

The high cost of LiDAR systems stands as a significant factor that could potentially impede the rapid growth of the LiDAR market. While LiDAR technology offers unparalleled precision and plays a pivotal role in various industries such as autonomous vehicles, environmental monitoring, and surveying, the expense associated with acquiring and implementing LiDAR systems remains a considerable barrier. The intricate engineering and advanced components required for LiDAR sensors contribute to their elevated costs, limiting accessibility for some businesses and industries. This affordability challenge is particularly pronounced in sectors where cost-effectiveness is crucial for widespread adoption. Efforts to reduce the price of LiDAR systems through technological advancements, economies of scale, and increased competition are underway, and as the industry addresses this cost hurdle, it is likely to pave the way for broader market penetration and accelerated growth in diverse applications.

The LiDAR market has experienced significant impacts from the COVID-19 pandemic, characterized by disruptions in the supply chain, particularly affecting the production and distribution of LiDAR components and systems. The automotive sector, a major consumer of LiDAR technology, faced slowdowns in production and sales, directly influencing the demand for LiDAR sensors. Infrastructure and construction projects, where LiDAR is extensively utilized for surveying and mapping, encountered delays or postponements due to lockdowns and economic uncertainties. However, amidst these challenges, the pandemic prompted a shift in focus towards remote sensing applications, emphasizing LiDAR's capacity for contactless data collection. Some LiDAR companies adapted their technologies to address pandemic-related challenges, exploring applications such as social distancing monitoring. Additionally, the crisis highlighted the importance of automation, with LiDAR technology gaining attention for its role in autonomous systems. Furthermore, the market exhibited resilience and innovation, as companies explored new healthcare applications and refined existing technologies to meet evolving needs. As the global situation continues to evolve, ongoing uncertainties and recovery efforts will shape the post-COVID-19 trajectory of the LiDAR market.

Segmental Analysis:

Robotic Vehicles Segment is Expected to Witness Significant Growth Over the Forecast Period

The integration of LiDAR technology with robotic vehicles represents a transformative synergy that is reshaping industries such as autonomous transportation, logistics, and robotics. LiDAR, with its ability to provide accurate and real-time three-dimensional mapping of the surroundings, plays a crucial role in enabling robotic vehicles to navigate and interact with their environment autonomously. In the realm of autonomous vehicles, LiDAR sensors contribute to enhanced perception, allowing the vehicle to detect obstacles, pedestrians, and other vehicles with exceptional precision. This technology is instrumental in ensuring the safety and reliability of autonomous transportation systems. In logistics and warehousing, LiDAR-equipped robotic vehicles are employed for tasks such as inventory management, material handling, and navigating through complex environments. The high-resolution mapping capabilities of LiDAR sensors contribute to efficient route planning and obstacle avoidance, optimizing operations in dynamic settings. The use of LiDAR in robotic vehicles extends to various other domains, including agriculture, where autonomous drones equipped with LiDAR sensors facilitate precision farming and crop monitoring. Additionally, LiDAR technology is harnessed in search and rescue missions, environmental monitoring, and surveillance, where robotic vehicles equipped with LiDAR sensors can operate effectively in challenging and hazardous conditions. While LiDAR enhances the autonomy and operational capabilities of robotic vehicles, ongoing efforts to miniaturize and reduce the cost of LiDAR systems are crucial for expanding their integration across a broader range of robotic applications. As these technologies continue to evolve and become more accessible, the synergy between robotic vehicles and LiDAR is poised to unlock new possibilities, contributing to advancements in automation and robotics across various industries.

Aerial (Topographic and Bathymetric) Segment is Expected to Witness Significant Growth Over the Forecast Period

Aerial LiDAR, encompassing both topographic and bathymetric applications, represents a powerful tool for comprehensive and precise mapping of both terrestrial and underwater environments. In the realm of topographic mapping, aerial LiDAR technology utilizes laser pulses emitted from an airborne platform to measure distances to the Earth's surface, generating highly accurate and detailed three-dimensional representations of the landscape. This is invaluable for applications such as urban planning, infrastructure development, forestry management, and environmental monitoring. In topographic mapping, LiDAR aids in creating Digital Elevation Models (DEMs) and Digital Surface Models (DSMs), providing insights into terrain features, land cover, and elevation variations with unparalleled precision. This data is crucial for infrastructure planning, flood modelling, and natural resource management, among other applications. Bathymetric LiDAR, on the other hand, extends the capabilities of LiDAR technology beneath the water's surface. By utilizing LiDAR sensors designed to penetrate water and measure the seafloor's depth, bathymetric LiDAR is instrumental in mapping underwater topography, identifying submerged features, and characterizing coastal zones. This technology is particularly valuable for coastal zone management, hydrographic surveying, and environmental assessments related to aquatic ecosystems. The fusion of topographic and bathymetric LiDAR data provides a holistic view of the environment, offering insights into the interplay between land and water. This integrated approach is crucial for understanding coastal dynamics, monitoring changes in shoreline morphology, and managing water resources comprehensively. While aerial LiDAR has proven highly effective in these applications, ongoing advancements in LiDAR sensor technology, data processing algorithms, and integration with other remote sensing methods continue to refine and expand its capabilities. As a result, aerial LiDAR remains at the forefront of cutting-edge geospatial technologies, facilitating a deeper understanding of our planet's diverse landscapes and water bodies.

Latin America is Expected to Witness Significant Growth Over the Forecast Period

Latin America, characterized by dense forest cover and its status as a developing economy, presents substantial opportunities for expansion and excavation, particularly with the integration of LiDAR technology. The native nature of the region, combined with advancements in LiDAR, foretells robust growth in the market. According to the Food and Agriculture Organization (FAO) of the United Nations, a significant 49% of Latin America and the Caribbean is enveloped by forests, totaling 891 million hectares, contributing about 22% to the global forest area. This region is home to a staggering 57% of the world's primary forests, making it a critical hub for biodiversity and conservation efforts. Recent research studies exemplify the application of LiDAR technology in mapping tree diversity within the tropical forest region of Choco-Columbia. Published in April 2021, these studies detail the integration of discrete LiDAR, among other technologies, showcasing the potential for accurate tree α-diversity mapping in tropical forest regions by combining vegetation inventories and remote sensing data. The use of LiDAR data has proven instrumental in deriving forest structural metrics in conjunction with optical and Synthetic Aperture Radar (SAR) image data. Moreover, FAO reports that 14% of the total forest area in the region is designated for productive functions, presenting a ripe opportunity for LiDAR adoption in forestry. LiDAR-equipped drones, when deployed over these forested areas, can generate 3D models illustrating the impact of human activities. The capability of LiDAR to penetrate thick tree cover adds to its utility in effectively surveying the densely forested regions. Beyond forestry applications, Latin America stands out for its agricultural lands. Designated by FAO as a pillar for global food security, the region is on a mission to transform agri-food systems to feed a projected 10 billion people by 2050. Ambitious goals, coupled with rising regional agricultural exports, are expected to drive the adoption of LiDAR technology in the agricultural sector. The multifaceted applications of LiDAR technology in both forestry and agriculture underscore its pivotal role in shaping sustainable practices and resource management in the dynamic landscape of Latin America.

Get Complete Analysis Of The Report - Download Free Sample PDF

The LiDAR market is characterized by fragmentation, with numerous large and small players contributing to intense competition within the industry. To secure a competitive advantage, these entities employ various strategies, including the introduction of new products and technologies, forming strategic partnerships, engaging in acquisitions, expanding their market presence, and fostering collaborations. This dynamic landscape reflects a concerted effort among players to stay ahead in the market by continuously innovating, enhancing their technological capabilities, and exploring synergies through strategic alliances and business expansions.

Recent Development:

1) May 2022: RoboSense LiDAR, a provider of smart LiDAR system technology, has formed a strategic partnership with dSPACE, a leading supplier of simulation and validation tools. This collaboration aims to accelerate the development, testing, and validation processes for LiDAR in intelligent driving applications. As part of this initiative, multiple RoboSense LiDAR sensors will be integrated into the comprehensive dSPACE simulation and validation toolchain.

2) Jan 2022: Innoviz Technologies Ltd, a supplier known for delivering high-performance, reliable, and cost-effective LiDAR sensors and perception software, has introduced the Innoviz360 to its product lineup. This next-generation sensor follows the successful fulfilment of promises associated with the InnovizTwo LiDAR. The Innoviz360 comes bundled with perception software from Innoviz, designed to process raw point cloud data generated by the third-generation LiDAR. This software ensures exceptional object detection, categorization, and tracking, further enhancing the capabilities of the third-generation LiDAR solution.

Q1. What was the LiDAR Sensor Market size in 2023?

As per Data Library Research the global LiDAR market size was valued at USD 2.2 billion in 2023.

Q2. At what CAGR is the LiDAR Sensor market projected to grow within the forecast period?

LiDAR Sensor Market is expected to expand at a compound annual growth rate (CAGR) of 9.8% over the forecast period.

Q3. Which Region is expected to hold the highest Market share?

Latin America region is expected to hold the highest Market share.

Q4. What segments are covered in the LiDAR Sensor market Report?

By Application, By Type, Geography these segments are covered in the LiDAR Sensor market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model