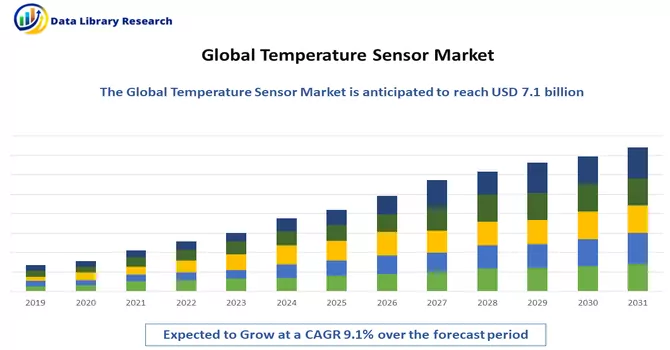

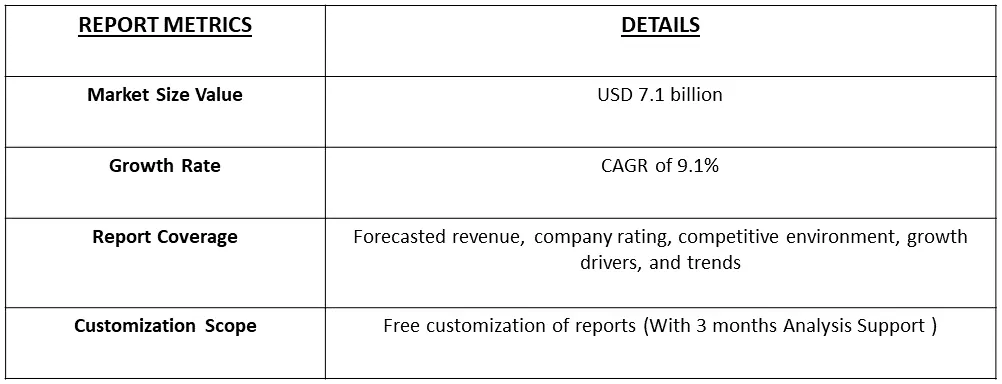

Global temperature sensor market was valued at USD 7.1 billion in 2023 and is expected to register a CAGR of 9.1% during the forecast period of 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Temperature sensors are devices designed to measure and monitor the temperature of an environment or a specific object accurately. They convert temperature variations into electrical signals, facilitating the measurement, control, and regulation of temperature in various applications. Temperature sensors play a crucial role in ensuring the efficient and safe operation of equipment, processes, and systems across industries. These sensors are utilized in diverse sectors, including consumer electronics, automotive, healthcare, industrial automation, and environmental monitoring.

The automotive industry is a significant driver for the temperature sensor market. As modern vehicles become more sophisticated, the need for precise temperature monitoring in engines, exhaust systems, and climate control systems is paramount. Temperature sensors contribute to engine efficiency, emission control, and overall vehicle performance. The increasing integration of electric vehicles (EVs) further amplifies the demand for temperature sensors in battery management systems, ensuring optimal operating conditions and safety. The healthcare sector is emerging as a prominent growth driver for the temperature sensor market. The demand for accurate temperature monitoring has surged, driven by the need for reliable medical devices, such as thermometers, patient monitoring systems, and incubators. Additionally, the ongoing development of wearable health devices and smart medical implants relies on temperature sensors to provide real-time data for diagnostics and treatment. The growing focus on telehealth and remote patient monitoring further enhances the demand for temperature-sensing technologies in the healthcare industry, contributing to market expansion.

A notable trend in the temperature sensor market is the increasing integration with Internet of Things (IoT) technologies. Temperature sensors are becoming part of connected ecosystems, allowing real-time data monitoring and remote control. This trend aligns with the broader movement towards smart homes, smart cities, and industrial IoT applications. Enhanced connectivity facilitates seamless communication between temperature sensors and other devices, enabling automated responses to temperature variations. This trend not only improves operational efficiency but also opens up new possibilities for data analytics and predictive maintenance in various industries.

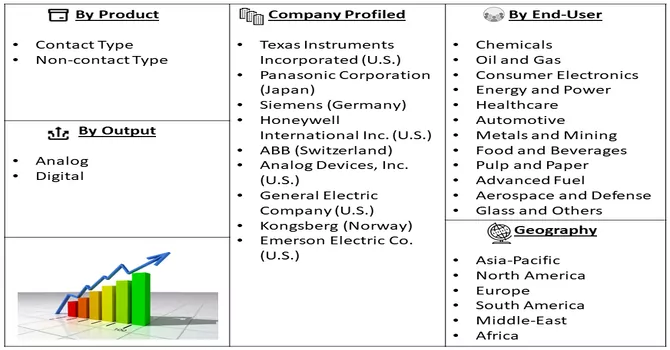

Market Segmentation: The Global Temperature Sensor Market, By Product (Contact Type and Non-contact Type), Output (Analog and Digital), End-User (Chemicals, Oil and Gas, Consumer Electronics, Energy and Power, Healthcare, Automotive, Metals and Mining, Food and Beverages, Pulp and Paper, Advanced Fuel, Aerospace and Defense, Glass and Others) and Geography (North America, Europe, Asia Pacific, Middle East, and Africa, and South America). The market size and forecasts are provided in terms of value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rising Demand in Consumer Electronics:

The increasing integration of temperature sensors in smartphones, wearables, and other consumer electronic devices is a key driver for the temperature sensor market. As these devices become more advanced, the need for accurate temperature monitoring for efficient performance and safety has grown substantially. Temperature sensors contribute to features like thermal management and protection, enhancing the overall functionality and reliability of consumer electronics.

Growing Industrial Automation:

The surge in industrial automation across various sectors, including manufacturing, healthcare, and automotive, is propelling the demand for temperature sensors. These sensors play a crucial role in monitoring and controlling processes, ensuring optimal operational conditions. With Industry 4.0 initiatives gaining momentum, temperature sensors are integral components for smart factories, driving the market forward by enhancing efficiency, reducing downtime, and improving overall production quality.

Market Restraints:

Challenges in Calibration and Accuracy:

One significant restraint for the temperature sensor market lies in the calibration and accuracy issues associated with these sensors. Achieving precise temperature measurements across diverse operating conditions can be challenging, impacting the reliability of temperature-sensitive applications. Variations in calibration standards and the need for consistent accuracy pose hurdles for manufacturers, as deviations can lead to suboptimal performance in critical processes. Addressing these challenges is crucial for ensuring the widespread adoption of temperature sensors across industries and maintaining their effectiveness in diverse environments.

The COVID-19 pandemic has accelerated the adoption of temperature sensors, especially in healthcare applications. With the heightened focus on monitoring and managing body temperatures as a preventive measure, temperature sensors have gained prominence in the development of contactless thermometers, fever screening systems, and wearable health devices. The pandemic has underscored the importance of early detection and monitoring of elevated temperatures, driving the demand for accurate and reliable temperature sensing technologies. As a result, the temperature sensor market has experienced a surge in demand from the healthcare sector, contributing to its resilience during these challenging times.

Segmental Analysis:

Non-Contact Type Segment is Expected to Witness Significant Growth Over the Forecast Period

Non-contact temperature sensors, also known as infrared or pyroelectric sensors, have become indispensable in temperature monitoring by detecting infrared radiation emitted by an object without physical contact. Renowned for their versatility, they find applications across industries like industrial processes, automotive, medical, and consumer electronics, offering rapid and real-time temperature readings. These sensors prove particularly valuable in scenarios where physical contact is impractical, ensuring sterility, preventing contamination, and maintaining the integrity of delicate materials. Despite their advantages, challenges such as sensitivity to ambient conditions and accuracy concerns persist, necessitating ongoing research and development. Overall, non-contact temperature sensors continue to play a pivotal role in diverse environments, providing innovative solutions for precise and efficient temperature measurement.

Digital Segment is Expected to Witness Significant Growth Over the Forecast Period

The digital segment of temperature sensors represents a significant advancement in temperature measurement technology, offering precise and accurate readings with digital output signals. These sensors, often integrated with analog-to-digital converters, facilitate seamless data processing and transmission. Widely adopted across industries, including automotive, electronics, and healthcare, digital temperature sensors provide enhanced sensitivity and reliability. Their ability to communicate directly with microcontrollers and digital systems streamlines integration into complex applications, enabling real-time monitoring and control. With features like high resolution, low power consumption, and compatibility with digital interfaces, these sensors contribute to the efficiency of modern systems and contribute to the broader trend of digitalization in sensor technology. The digital segment continues to evolve, driven by the demand for smart, connected devices, fostering innovations in temperature sensing for diverse industrial and consumer applications.

Energy and Power Segment is Expected to Witness Significant Growth Over the Forecast Period

The energy and power segment in temperature sensors plays a pivotal role in ensuring the efficient operation and safety of various power-generation and energy-utilization systems. Temperature sensors are integral components in power plants, renewable energy facilities, and electrical distribution systems, where accurate temperature monitoring is essential for preventing equipment overheating and optimizing performance. In power generation, such as in fossil fuel and nuclear power plants, temperature sensors contribute to monitoring critical components like turbines and transformers, ensuring they operate within safe temperature limits. Additionally, in renewable energy applications like solar and wind power, temperature sensors aid in optimizing the efficiency of energy conversion processes. The energy and power segment also encompasses applications in electrical grids, where temperature sensors contribute to preventing electrical fires and ensuring the reliability of power transmission and distribution systems. As the energy sector continues to evolve towards sustainability and increased efficiency, the role of temperature sensors in monitoring and controlling temperature-related parameters becomes even more crucial in ensuring the reliability and longevity of energy infrastructure.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, temperature sensors play a vital role across a spectrum of industries, contributing to advancements in technology, industrial processes, and everyday applications. The region witnesses a robust demand for temperature sensors in diverse sectors such as healthcare, manufacturing, automotive, and aerospace. In the healthcare industry, temperature sensors are integral to medical devices, ensuring accurate body temperature measurements and aiding in the development of innovative health monitoring solutions. The manufacturing sector in North America extensively relies on temperature sensors for process control, equipment monitoring, and quality assurance. These sensors contribute to the optimization of industrial processes, enhancing efficiency and reducing energy consumption. In the automotive industry, temperature sensors are crucial components for monitoring engine performance, exhaust systems, and climate control, contributing to the overall reliability and safety of vehicles. Moreover, North America's commitment to technological innovation is reflected in the widespread adoption of temperature sensors in smart home devices, consumer electronics, and IoT applications. As the region continues to focus on energy efficiency and environmental sustainability, temperature sensors play a key role in achieving these goals by enabling precise control and monitoring of heating, ventilation, and air conditioning (HVAC) systems. Government initiatives and regulations regarding food safety and environmental monitoring further drive the demand for temperature sensors in North America. These sensors ensure compliance with standards and regulations, particularly in the food and pharmaceutical industries.i With a robust research and development landscape, North American companies continually contribute to advancements in temperature sensor technology. The region's strong market presence is marked by the presence of key players investing in innovation, expanding production capacities, and forming strategic partnerships to meet the evolving demands of various industries. As North America continues to be a hub for technological innovation, temperature sensors remain essential for fostering progress across a wide array of applications and industries.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive landscape of the global temperature sensor market offers a comprehensive overview of key players in the industry. Pertinent details encompass company profiles, financial standings, revenue generation, market potential, research and development investments, new market strategies, global reach, production sites, capacities, strengths, weaknesses, product launches, and application dominance. It is essential to note that the provided information is specifically tailored to each company's endeavors within the global temperature sensor market. Each company's profile includes an insightful examination of their core competencies, such as financial robustness and revenue generation. Market potential is explored to underscore the opportunities companies are positioned to leverage. A focus on investment in research and development sheds light on a company's commitment to innovation, providing a glimpse into their technological advancements and future market strategies. New market initiatives showcase the proactive measures companies are taking to explore and capture emerging opportunities. The global presence section elucidates the extent of a company's operations across different geographies. Production sites and capacities detail the physical infrastructure supporting manufacturing, showcasing a company's operational scale. Analyzing strengths and weaknesses aids in understanding a company's internal dynamics, contributing to a nuanced evaluation of their market positioning. Product launches and the breadth of product offerings highlight a company's adaptability and responsiveness to market demands. Application dominance indicates which sectors a company excels in, offering insights into their specialization within the temperature sensor market. In summation, this competitive landscape delves into the intricacies of each company's strategic focus within the global temperature sensor market, providing a holistic perspective on their standing, capabilities, and future trajectories in this dynamic industry. Some of the major players operating in the global temperature sensor market are:

Recent Development:

1) HHKLIn June 2022, Renesas Electronics unveiled an innovative series of relative humidity and temperature sensors, along with associated solutions. These cutting-edge sensors are engineered to deliver exceptional precision, rapid measurement response times, and remarkably low power consumption, all packaged within a compact form factor. This design ensures their suitability for integration into portable devices or products specifically crafted for challenging environmental conditions. Renesas Electronics' latest offering represents a significant advancement, providing enhanced accuracy and efficiency in temperature and humidity monitoring, particularly in applications. temperature and humidity monitoring, particularly in applications.

2) In the year 2021, Fitgo unveiled its newest line of infrared thermometers, introducing cutting-edge technology to the market. These innovative products are readily available both online and offline, catering to customers in India and internationally. The standout feature of these infrared thermometers lies in their ability to provide precise temperature readings in just one second, making them versatile for use with infants, adults, seniors, objects, or even room temperature.

Q1. What was the Temperature Sensor Market size in 2023?

As per Data Library Research the global temperature sensor market was valued at USD 7.1 billion in 2023.

Q2. At what CAGR is the market projected to grow within the forecast period?

Temperature Sensor Market is expected to register a CAGR of 9.1% during the forecast period.

Q3. What are the factors driving the Temperature Sensor Market?

Key factors that are driving the growth include the Rising Demand in Consumer Electronics and Growing Industrial Automation.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model