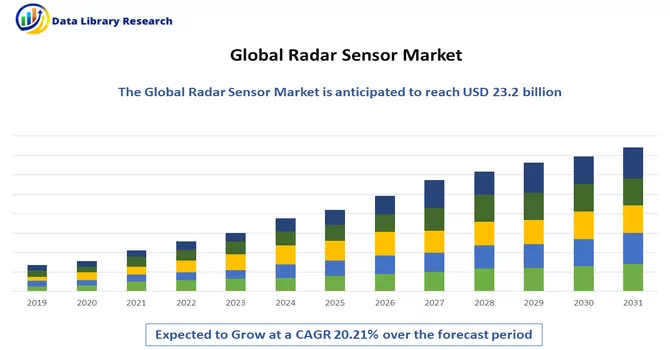

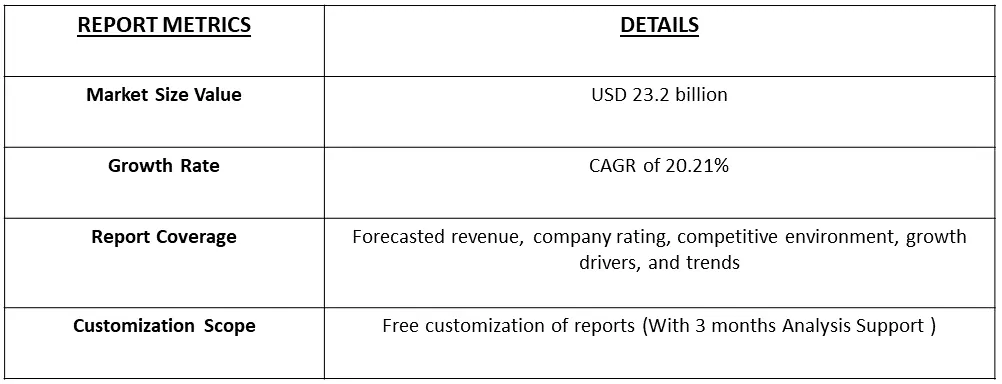

The Radar Sensors Market size is estimated at USD 23.2 billion in 2023 and is expected to have a CAGR of 20.21% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Radar sensors, short for Radio Detection and Ranging sensors, are devices that use radio waves to detect, locate, and track objects in their surrounding environment. These sensors operate on the principle of emitting radio frequency (RF) signals and analyzing the reflections or echoes received from objects in their vicinity. Radar sensors are widely utilized in various applications, including aviation, automotive systems, weather monitoring, defence, and industrial settings, due to their ability to provide accurate and real-time information about the position, speed, and characteristics of objects. Radar sensors come in different types and configurations, such as continuous-wave radar, pulse radar, and frequency-modulated continuous-wave (FMCW) radar, each designed for specific applications. In the automotive industry, radar sensors are integral to advanced driver assistance systems (ADAS) for features like collision avoidance, adaptive cruise control, and blind-spot detection. In military applications, radar sensors play a crucial role in surveillance, target tracking, and missile guidance systems. The versatility and effectiveness of radar sensors make them indispensable in a wide range of technological and industrial contexts.

The escalating trend towards greater automation, notably in advancements like autonomous driving and the evolution of Industry 4.0, underscores a growing requirement for enhanced safety and control through presence and motion detection. This surge in automation is a pivotal factor propelling the demand for radar sensors. These sensors play a crucial role in facilitating a safer and more controlled operational environment by detecting the presence and movements of objects. Whether it be in the context of autonomous vehicles navigating complex road scenarios or within smart manufacturing systems embracing Industry 4.0 principles, radar sensors are becoming increasingly indispensable for ensuring heightened safety and efficiency in automated processes.

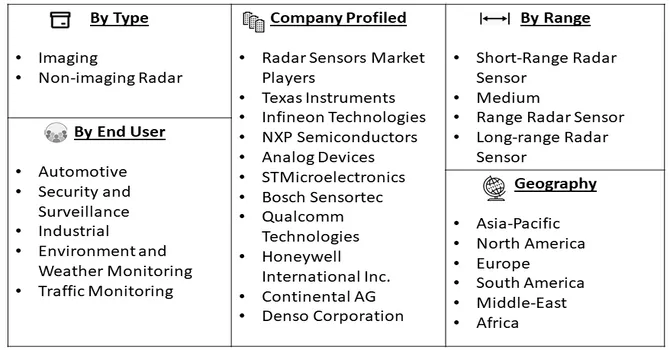

Market Segmentation: The Global Radar Sensor Market is Segmented by Type (Imaging and Non-imaging Radar), Range (Short-Range Radar Sensor, Medium, Range Radar Sensor, and Long-range Radar Sensor), End User (Automotive, Security and Surveillance, Industrial, Environment and Weather Monitoring, Traffic Monitoring), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The value is provided (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global radar sensor market is experiencing a notable surge in demand, driven by the increasing integration of radar sensors in the automotive sector. The adoption of advanced driver assistance systems (ADAS) and the progression towards autonomous vehicles are key factors propelling market growth. Radar sensors are being increasingly integrated into smart infrastructure, including smart cities and intelligent transportation systems. These sensors play a crucial role in traffic management, pedestrian detection, and overall urban planning for enhanced safety and efficiency. The proliferation of the Internet of Things (IoT) and connected devices is influencing the radar sensor market. Integration with IoT platforms allows for real-time data exchange, enabling more responsive and adaptive applications across various industries. Thus, these market trends are expected to boost the studied market growth over the forecast period.

Market Drivers:

Rising Demand in Automotive Sector and Integration into Smart Infrastructure

The global radar sensor market is experiencing a notable surge in demand, driven by the increasing integration of radar sensors in the automotive sector. The adoption of advanced driver assistance systems (ADAS) and the progression towards autonomous vehicles are key factors propelling market growth. Radar sensors are being increasingly integrated into smart infrastructure, including smart cities and intelligent transportation systems. These sensors play a crucial role in traffic management, pedestrian detection, and overall urban planning for enhanced safety and efficiency.

Surge in IoT and Connected Devices and Advancements in Radar Technology

The ongoing advancements in radar technology, including the development of millimeter-wave radar and frequency-modulated continuous-wave (FMCW) radar, are shaping the market landscape. These innovations contribute to improved detection capabilities, accuracy, and reliability. Moreover, the proliferation of the Internet of Things (IoT) and connected devices is influencing the radar sensor market. Integration with IoT platforms allows for real-time data exchange, enabling more responsive and adaptive applications across various industries. In July 2022, Gapwaves, a prominent Swedish technology company, and Bosch, a leading global automotive supplier, unveiled their collaboration aimed at the development and large-scale production of high-resolution radar antennas designed for automotive vehicle applications. This strategic partnership involves Gapwaves leveraging its expertise in antenna technology, while Bosch brings its knowledge in radar sensors and automated driving to the table. The synergistic collaboration is poised to facilitate the creation of advanced radar antenna solutions, catering to the specific needs of the automotive industry. Gapwaves' proficiency in antennas, combined with Bosch's prowess in radar sensors and automated driving technologies, underscores a concerted effort to drive innovation and enhance the capabilities of radar systems in the automotive sector. Thus, such developments are expected to boost the studied market’s growth over the forecast period.

The global lockdowns and restrictions imposed to curb the spread of the virus led to disruptions in the radar sensor supply chain. Manufacturing facilities faced closures or reduced operational capacities, affecting the production and availability of radar sensor components. The pandemic prompted a shift in application priorities for radar sensors. While certain applications, such as those related to automotive safety and autonomous driving, remained crucial, other sectors experienced shifts in demand. For instance, there was increased interest in radar sensors for health and safety applications, including social distancing monitoring and crowd management. Thus, the COVID-19 pandemic brought about disruptions and challenges for the radar sensor market, particularly in the early stages. However, it also accelerated certain trends, emphasizing the adaptability and resilience of radar sensor applications. As industries recover and adapt to the new normal, the market is poised for renewed growth and opportunities in various sectors.

Segmental Analysis:

Imaging Segment is Expected to Witness Significant Growth Over the Forecast Period

Imaging and radar sensors are integral components of modern sensing technologies, each offering unique capabilities and applications across various industries. These sensors play crucial roles in diverse fields, ranging from automotive and aerospace to healthcare and security. Imaging sensors, commonly associated with cameras, capture visual information from the environment. These sensors utilize technologies such as charge-coupled devices (CCDs) or complementary metal-oxide-semiconductor (CMOS) sensors to convert light into electronic signals. In healthcare, imaging sensors play a crucial role in various diagnostic tools, such as X-ray machines, magnetic resonance imaging (MRI), and computed tomography (CT) scanners. These sensors enable the visualization of internal structures for medical diagnosis. Radar sensors operate on the principle of radio frequency (RF) sensing. They emit radio waves and detect the reflections or echoes from objects in their vicinity. This allows radar sensors to determine the distance, speed, and presence of objects, regardless of lighting conditions. Thus, imaging imaging and radar sensors represent powerful technologies with diverse applications. While imaging sensors excel in capturing visual information, radar sensors provide essential capabilities in radio frequency sensing. The integration of these sensors, especially in autonomous systems, holds the potential to revolutionize perception and enhance safety across various industries. Thus, owing to such factors the segment is expected to witness significant growth over the forecast period.

Short-Range Radar Sensor Segment is Expected to Witness Significant Growth Over the Forecast Period

Short-range radar sensors are specialized devices designed to operate within limited distances, typically ranging from a few centimetres to a few dozen meters. These sensors utilize radio frequency (RF) waves to detect and measure the presence, distance, and speed of objects in their immediate vicinity. Their compact size, high precision, and suitability for close-range applications make them invaluable across various industries. Short-range radar sensors excel in providing accurate distance measurements, making them ideal for applications such as parking assistance, blind-spot detection, and obstacle avoidance in vehicles. Short-range radar sensors will likely witness innovations in gesture recognition technologies, influencing user interfaces in consumer electronics and human-machine interaction. Thus, short-range radar sensors are pivotal in applications demanding precise proximity detection. Their adaptability, efficiency, and ongoing innovations make them essential components in various sectors, contributing to advancements in safety, automation, and the overall evolution of smart technologies. Thus, owing to such factors the segment is expected to witness significant growth over the forecast period.

Automotive Segment is Expected to Witness Significant Growth Over the Forecast Period

The drive for advancing radar technology is fueled by the New Car Assessment Programme adopted by car manufacturers. This program integrates radar systems with camera devices to enhance Advanced Driver Assistance Systems (ADAS) applications, providing improved safety and collision avoidance information when combined with other sensors.

In the United States, there's a notable focus on safety, exemplified by the recent release of federal guidance for automated vehicles, known as Automated Vehicles 3.0 by the NHTSA. This focus has extended the market potential for ADAS to mid-range cars, leading to an increase in production volume. Many automotive brands are adopting radar sensors as part of this trend, significantly influencing the radar sensor market. The growing interest in smart and self-driving cars is another crucial factor driving the radar sensor market. The automotive sector is experiencing substantial developments, and various vendors are actively contributing to this growth. For instance, Infineon is offering a range of radar sensor ICs, specifically designed for driver assistance systems like collision warning and adaptive cruise control, showcasing ongoing advancements in automotive radar sensor technology.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American radar sensor market is propelled by a confluence of factors, including prominent applications in high-end defence systems, widespread smartphone adoption, the surge in autonomous vehicle deployment, and the integration of radar sensors in consumer electronic devices. Notably, the region exhibits a notable uptick in Frequency Modulated Continuous Wave (FMCW) applications, particularly in short-range scenarios, bolstered by its status as the world's highest spender on defence. Being at the forefront of technology adoption, North America pioneers various sectors such as smart grids, smart homes, intelligent transport, and infrastructure, leveraging radar sensor technology. The continuous evolution of radar sensor technology is anticipated to unlock new use cases across these industries, presenting lucrative growth prospects for market vendors.

The prolific penetration of smartphones in North America is poised to drive a heightened demand for radar sensors, given the trend of smartphone manufacturers incorporating innovative sensors and features. According to GSMA projections, nearly two-thirds of mobile connections in North America are expected to be powered by 5G technology by the end of 2025, reaching approximately 270 million connections. Recognizing the manifold benefits associated with radar sensors, both public and private entities are intensifying their research and development endeavors to enhance the efficiency of these sensors. A noteworthy example is a leading U.S. automotive manufacturer, which, in June 2022, successfully registered a cutting-edge high-resolution radar unit with the U.S. Federal Communications Commission (FCC). This commitment to innovation underscores the positive trajectory anticipated for the radar sensor market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The radar sensors market exhibits fragmentation owing to the multitude of players operating within the industry. This fragmentation is characterized by the presence of numerous companies, each contributing to the market landscape with its unique offerings, technologies, and competitive strategies. The diverse array of participants in the radar sensors market underscores the dynamic nature of the industry, fostering competition, innovation, and a wide range of solutions catering to various applications and end-user needs. The presence of multiple players encourages a competitive environment that fuels advancements, product differentiation, and strategic collaborations, ultimately contributing to the overall growth and evolution of the radar sensors market.

Recent Developments:

1) In December 2022, Continental, a technology company, expanded its exclusive support for the Indy Autonomous Challenge (IAC), a collaborative initiative involving public-private partnerships and academic institutions. The project's objective is to conceptualize, construct, and demonstrate cutting-edge automated vehicle software for fully autonomous racecars. Continental is set to provide its ARS540 4D imaging radar sensors to the IAC, integrating them into the Dallara AV-21, recognized as the world's fastest autonomous racecar equipped with highly automated driving capabilities.

2) In February 2022, NXP Semiconductor reported a noteworthy milestone through its partner, Innovative Micro, which introduced a 4D imaging radar sensor. This sensor leverages NXP's flagship radar processor S32R45 and incorporates four TEF8232 transceivers to deliver an impressive 192 virtual channels, achieving a remarkable angular resolution of one degree at distances of up to 300 meters. This development signifies a significant advancement in radar sensor technology with enhanced imaging capabilities.

Q1. What was the Radar Sensor Market size in 2023?

As per Data Library Research the Radar Sensors Market size is estimated at USD 23.2 billion in 2023.

Q2. What is the Growth Rate of the Radar Sensor Market?

Radar Sensor Market is expected to have a CAGR of 20.21% during the forecast period.

Q3. What Impact did COVID-19 have on the Radar Sensor Market?

The global lockdowns and restrictions imposed to curb the spread of the virus led to disruptions in the radar sensor supply chain. For detailed insights request a sample here.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model