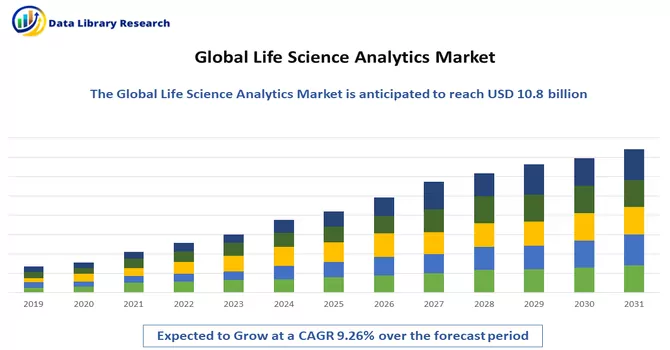

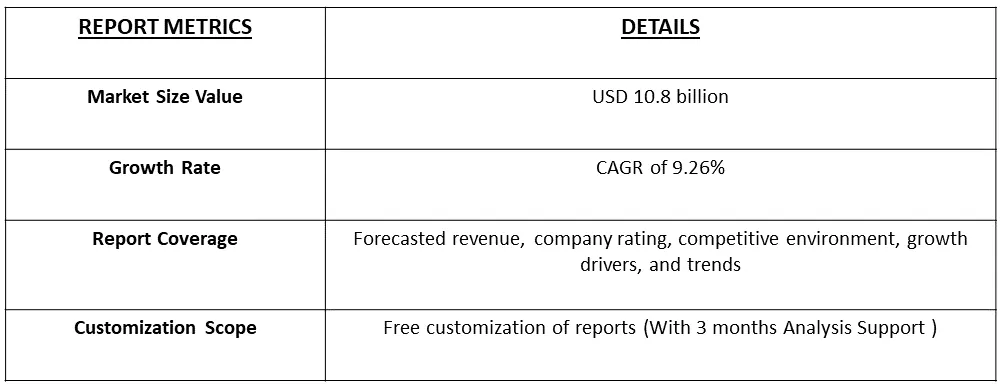

The global life science analytics market size was valued at USD 10.8 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.26% from 2023 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Life Science Analytics refers to the application of data analytics and business intelligence techniques to the field of life sciences, which includes areas such as pharmaceuticals, biotechnology, healthcare, and medical research. The goal of life science analytics is to gather, process, and analyze data to extract valuable insights that can be used to make informed decisions in these industries. Life science analytics involves handling large and complex datasets related to clinical trials, patient records, drug development, genomics, and other aspects of the life sciences. Analytical tools and techniques help researchers, healthcare professionals, and pharmaceutical companies gain a deeper understanding of trends, patterns, and correlations within the data. This information can be crucial for improving patient outcomes, optimizing research and development processes, and making strategic business decisions.

The life science sector is quickly embracing analytics, leveraging descriptive and reporting analyses for database construction, while also incorporating prescriptive and predictive analyses to forecast future trends and outcomes. This trend is expected to fuel market growth. Another influential factor shaping the life sciences industry is the increasing impact of social media and the internet. This directly affects patient engagement and stimulates the adoption of analytical solutions. Healthcare facilities and life science entities are swiftly integrating analytical solutions to improve clinical, financial, and operational outcomes, aiming to reduce overall healthcare expenditure. This widespread adoption is anticipated to drive growth in the market.

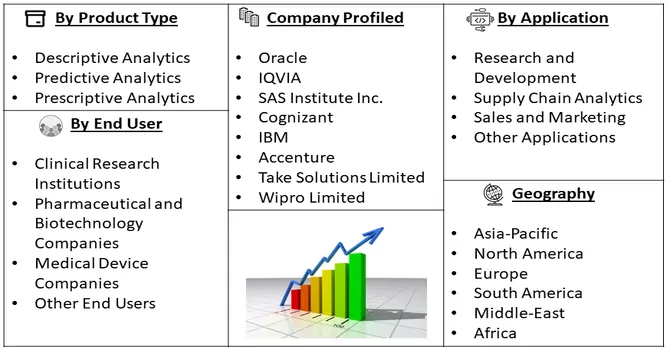

Market Segmentation: The Global Life Science Analytics Market is Segmented by Product Type (Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics), Application (Research and Development, Supply Chain Analytics, Sales and Marketing, and Other Applications), End User (Clinical Research Institutions, Pharmaceutical and Biotechnology Companies, Medical Device Companies, and Other End Users) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The adoption of advanced analytics techniques, such as predictive and prescriptive analytics, has gained substantial momentum. This shift has empowered companies to extract meaningful insights from intricate biological and clinical data, thereby contributing to advancements in drug discovery, personalized medicine, and treatment optimization. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) remains a key driver, facilitating pattern recognition, data interpretation, and more informed decision-making processes. Real-world evidence (RWE) has taken center stage, with life science organizations increasingly incorporating real-world data into their research and development endeavours to gain insights into the real-world effectiveness and safety of drugs.

Moreover, there is a heightened focus on regulatory compliance, driven by the industry's handling of sensitive patient data. Analytics solutions that prioritize robust security features and adhere to stringent regulatory standards are increasingly sought after. Another noteworthy trend is the industry's pivot towards patient-centric analytics, where data is leveraged to comprehend patient behaviors, preferences, and treatment outcomes. This aligns with the broader healthcare trend of transitioning towards patient-centered care and the development of personalized treatment plans. While these trends were evident in the market landscape as of my last update in January 2022, it is advisable to consult the latest market reports for the most current insights into the dynamic and evolving field of life science analytics.

Market Drivers:

Rising Adoption of Analytics Solutions in Pharmaceuticals and Clinical Trials

The pharmaceutical industry is undergoing a transformative shift with the widespread adoption of analytics solutions, particularly evident in the optimization of drug development processes and clinical trials. Leveraging advanced techniques such as machine learning and artificial intelligence, these analytics solutions empower pharmaceutical companies to efficiently analyze vast datasets, extract valuable insights, and make informed, data-driven decisions. In the realm of clinical trials, analytics plays a pivotal role in designing targeted studies, forecasting patient recruitment rates, and optimizing trial protocols. These tools address challenges related to patient recruitment and retention by tailoring strategies based on historical trial data and real-world evidence, ultimately contributing to more successful trial outcomes. The increasing integration of analytics is driven by the industry's recognition of the need for precision, efficiency, and evidence-based decision-making, particularly as regulatory agencies emphasize data quality and transparency. As pharmaceutical companies continue to embrace analytics, the landscape of drug development is evolving towards faster, more innovative, and patient-centric approaches, promising safer and more effective treatments.

In October 2023, Salesforce unveiled its Life Sciences Cloud, a secure and reliable platform designed specifically for pharmaceutical (pharma) and medical technology (MedTech) organizations. This innovative platform aims to accelerate the processes of drug and device development, enhance patient recruitment and retention throughout the clinical trial journey, and harness the power of artificial intelligence (AI) to provide personalized experiences for customers. This development signifies a strategic move towards integrating advanced technologies, data analytics, and personalized engagement strategies within the life sciences sector. As pharmaceutical and MedTech organizations increasingly leverage the capabilities of Life Sciences Cloud, the demand for analytics solutions is likely to surge, driven by the industry's pursuit of enhanced operational efficiency, personalized healthcare solutions, and accelerated innovation in drug and device development. The announcement reflects a broader trend of technology integration within the life sciences, signalling a positive trajectory for the market as it adapts to the evolving needs and challenges of the industry. Thus, such factors are expected to drive the growth of the market over the forecast period.

Growing Pressure to Reduce Healthcare Spending and the Need for Improved Patient Outcomes

The healthcare landscape is experiencing growing pressure to reduce spending while simultaneously improving patient outcomes. This dual challenge is driven by various factors, including rising healthcare costs, an aging population, and an increasing prevalence of chronic diseases. As healthcare expenditures continue to escalate, governments, payers, and healthcare providers are under heightened scrutiny to find cost-effective solutions without compromising the quality of patient care. The demand for improved patient outcomes further amplifies this pressure. Healthcare stakeholders, including providers, insurers, and regulatory bodies, are increasingly focused on achieving better results in terms of patient health, satisfaction, and overall well-being. This shift reflects a paradigm that emphasizes value-based care, where the effectiveness of healthcare interventions is measured not only by cost but also by the positive impact on patients' lives. Thus, the imperative to reduce healthcare spending while enhancing patient outcomes is reshaping the healthcare landscape. The application of advanced analytics, technological innovations, and a shift towards value-based care are integral components of the industry's response to these challenges. As healthcare systems continue to evolve, the effective use of data and technology is anticipated to play a pivotal role in achieving the delicate balance between financial sustainability and improved patient well-being.

Market Restraints:

Lack of Skilled Personnel

One significant challenge that may impede the growth of the life science analytics market is the shortage of skilled personnel. The increasing complexity of data analytics tools and technologies within the life sciences sector demands a workforce equipped with specialized skills in data science, bioinformatics, and analytics methodologies. However, the scarcity of professionals possessing the requisite expertise poses a bottleneck in the effective utilization of analytics solutions. The intricate nature of life science data, encompassing genomics, clinical trials, and healthcare records, requires individuals with a nuanced understanding of both the life sciences domain and advanced analytics techniques.

The shortage of skilled personnel can result in slower adoption and implementation of analytics solutions, hindering the industry's ability to extract meaningful insights from complex datasets. This, in turn, may limit the optimization of drug development processes, personalized medicine initiatives, and other critical areas within the life sciences. To address this challenge, concerted efforts are needed to invest in education, training programs, and collaborative initiatives that bridge the gap between life sciences and analytics expertise. By nurturing a skilled workforce capable of navigating the intricacies of both domains, the life science analytics market can overcome this hurdle and continue its trajectory towards providing valuable insights for enhanced healthcare outcomes and advancements in the life sciences industry.

The surge in demand for analytics was notably catalyzed by the onset of the COVID-19 pandemic, primarily driven by the urgent need for comprehensive insights during the extensive clinical trials conducted for COVID-19 vaccines. In March 2020, a collaborative effort involving the US Department of Veterans Affairs (VA), Department of Energy (DOE), Department of Health and Human Services (HHS), and the National Security Council (NSC) materialized in the establishment of the COVID-19 Insights Partnership. This strategic alliance harnessed big data analytics tools to delve into research aimed at identifying potential treatments for the virus. An exemplary instance of the efficacy of life sciences analytics emerged in November 2021 when a predictive analytics model, founded on an artificial neural network (ANN) model, was developed. This model aimed to forecast the future daily cases and deaths caused by COVID-19 in a generalized manner. Impressively, it demonstrated an approximate 86% overall accuracy in predicting mortality rates and an 87% accuracy in predicting the number of cases. Consequently, the tangible success of life sciences analytics models in navigating the challenges posed by the COVID-19 pandemic has significantly contributed to the growth of the market. The positive impact of the pandemic on the market is undeniable, further underscored by the establishment of the COVID-19 Insights Partnership and the successful deployment of predictive analytics models. As analytics continues to prove its value, the anticipation of substantial future growth in the demand for life science analytics remains high. The inherent significance of analytics in addressing healthcare challenges positions it as a crucial component in shaping the future landscape of the life sciences analytics market.

Segmental Analysis:

Descriptive Analytics Segment is Expected to Witness Significant Growth Over the Forecast Period

Descriptive analytics holds a pivotal role in the life sciences, serving as a foundational step in the analytical process by delving into historical data to answer the question of "what happened?" In clinical trials, it aids researchers and pharmaceutical companies in summarizing and interpreting past trial data, informing future research endeavors and optimizing trial designs. Within healthcare, descriptive analytics is applied to patient data, offering insights into disease prevalence, treatment efficacy, and healthcare utilization patterns. In drug development, it assists in assessing the performance of existing drugs, refining formulations, and targeting specific patient populations. Operational aspects within life science organizations also benefit from descriptive analytics, optimizing supply chain processes, inventory management, and resource allocation. While providing valuable hindsight, descriptive analytics lays the groundwork for more advanced analytics techniques, contributing to better anticipation of future scenarios and informed decision-making to enhance patient outcomes and drive innovation in the life sciences. Thus, the segment si expected to witness significant growth over the forecast period.

Research and Development Segment is Expected to Witness Significant Growth Over the Forecast Period

Research and Development (R&D) in the life sciences industry has been significantly enhanced by the integration of life science analytics. This synergy has revolutionized the traditional R&D processes, offering a data-driven approach that accelerates drug discovery, clinical trials, and overall research efficiency. Life science analytics encompasses a range of advanced techniques, including predictive modeling, machine learning, and data mining, which enable researchers to extract meaningful insights from vast and complex datasets. In drug discovery, life science analytics plays a pivotal role in identifying potential drug candidates, predicting their efficacy, and optimizing the overall development process. By analyzing biological data, genomics, and clinical trial results, researchers can make more informed decisions, reducing the time and resources required for bringing new drugs to market.

Clinical trials, a critical component of the R&D pipeline, benefit immensely from life science analytics. Analytics tools assist in patient recruitment, cohort building, and trial planning, optimizing study designs and ensuring more effective and efficient trials. Predictive analytics, for example, can forecast patient recruitment rates and help in the identification of potential challenges, streamlining the entire clinical trial process. Furthermore, life science analytics aids in real-world evidence (RWE) generation, offering insights into the effectiveness and safety of treatments in diverse patient populations outside controlled clinical settings. This RWE is crucial for gaining regulatory approvals and understanding the long-term impact of therapies. The integration of analytics in R&D also addresses challenges related to regulatory compliance and reporting. With increasingly complex regulatory requirements, life science analytics provides the tools for organizations to navigate compliance issues, ensuring that R&D activities adhere to the necessary standards. Thus, life science analytics has become an indispensable tool in the modern life sciences R&D landscape. Its ability to transform data into actionable insights not only expedites the research process but also contributes to more informed decision-making, ultimately leading to advancements in healthcare and the development of innovative treatments. As technology continues to evolve, the synergy between R&D and life science analytics is expected to play a pivotal role in shaping the future of the life sciences industry.

Pharmaceutical and Biotechnology Companies Segment is Expected to Witness Significant Growth Over the Forecast Period

Pharmaceutical and biotechnology companies are increasingly leveraging life science analytics to enhance various facets of their operations, from drug discovery and development to commercialization and market access. Life science analytics has become a cornerstone in these industries, providing invaluable insights and optimizing decision-making processes. In drug discovery, life science analytics empowers pharmaceutical and biotech researchers to sift through massive datasets, including genomics, clinical trial results, and molecular information. Advanced analytics techniques, such as machine learning and predictive modeling, enable these companies to identify potential drug candidates more efficiently, predict their efficacy, and optimize the overall drug development pipeline. This data-driven approach accelerates the discovery of promising compounds and reduces the time and resources required for bringing new drugs to market. In clinical trials, life science analytics plays a pivotal role in improving trial design, patient recruitment, and overall trial management. Analytics tools enable companies to analyze historical trial data, forecast patient recruitment rates, identify potential challenges, and optimize protocols, ultimately leading to more effective and efficient clinical studies. Real-world evidence generated through analytics is also crucial for demonstrating the safety and effectiveness of therapies in diverse patient populations. Thus, such factors are expected to drive the growth of the studied segment over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America dominates the life science analytics market due to its well-established healthcare research and development (R&D) landscape, heightened government healthcare spending, and the growing recognition of life science analytics' significance, particularly in drug development. The region's commitment to analytics is exemplified by the partnership between the SDG Group and Snowflake, launching the Healthcare and Life Sciences Data Cloud in March 2022 to optimize patient care and business outcomes through secure data and analytics utilization. In response to challenges posed by the Affordable Care Act (ACA) and evolving regulatory frameworks, U.S. companies are increasingly adopting analytics solutions, ranging from clinical research data analysis to adverse event monitoring and revenue forecasting. The acquisition of Performix Inc. by Honeywell in September 2021 exemplifies this trend, focusing on an integrated software platform for the life sciences industry. Canada is also experiencing significant growth, driven by the government's strategic initiatives, aiming to strengthen the domestic biomanufacturing and life sciences sector. With life sciences and pharmaceutical companies in the U.S. relying on third-party solution providers for diverse operational aspects, the life science analytics market in the region is poised for substantial growth in the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Prominent players in the market are actively crafting sophisticated analytical solutions and systems. These companies are placing a strong emphasis on formulating inventive product development strategies to broaden their range of offerings. Additionally, they are reassessing and strengthening their partnerships and collaborations throughout the market landscape. This strategic approach is aimed at extending their business footprint and effectively addressing the increasing demand for analytical solutions. The focus on innovation, product diversification, and strategic collaborations underscores their commitment to meeting evolving market needs and staying at the forefront of technological advancements in the field of analytics. Some prominent players in the global life science analytics market include:

Recent Development:

1) In September 2023, TS Corporation acquired Avidity Science, LLC. This strategic move by ATS Corporation in acquiring Avidity Science is poised to have a notable impact on the growth of the life science analytics market. The incorporation of Avidity's expertise in automated water purification solutions for biomedical and life science applications aligns with the industry's increasing reliance on advanced analytics. As ATS expands its capabilities through this acquisition, it is likely to contribute to the broader trend of companies within the life sciences sector adopting advanced analytical solutions to enhance their operational efficiency, research capabilities, and overall outcomes.

2) In October 2023, WhizAI, a premier provider of generative AI-powered analytics for the life sciences and healthcare sectors, unveiled and made widely accessible its innovative feature named "ExplAIn." This groundbreaking capability was integrated into the WhizAI augmented analytics platform, catering specifically to life sciences analysts and power users. ExplAIn harnessed state-of-the-art AI/ML algorithms, unmatched domain expertise, and cutting-edge generative AI technology to automate insights. This empowered professionals to make data-driven decisions with greater efficiency, speed, and intelligence. The introduction of ExplAIn marked a significant milestone in enhancing the analytical capabilities within the life sciences and healthcare industries.

Q1. What was the Life Science Analytics Market size in 2023?

As per Data Library Research the global life science analytics market size was valued at USD 10.8 billion in 2023.

Q2. What is the Growth Rate of the Life Science Analytics Market?

Life Science Analytics Market is expected to expand at a compound annual growth rate (CAGR) of 9.26% Over the forecast period.

Q3. What are the factors on which the Life Science Analytics Market research is based on?

By Product Type, Application, End-User and Geography are the factors on which the Life Science Analytics Market research is based.

Q4. Which are the major companies in the Life Science Analytics Market?

Oracle, IQVIA, SAS Institute Inc. and Cognizant are some of the major companies in the Life Science Analytics Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model