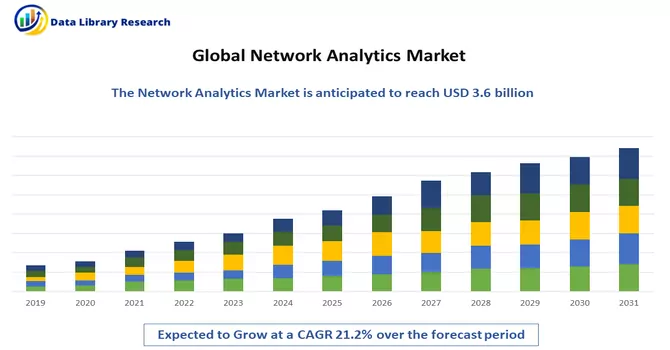

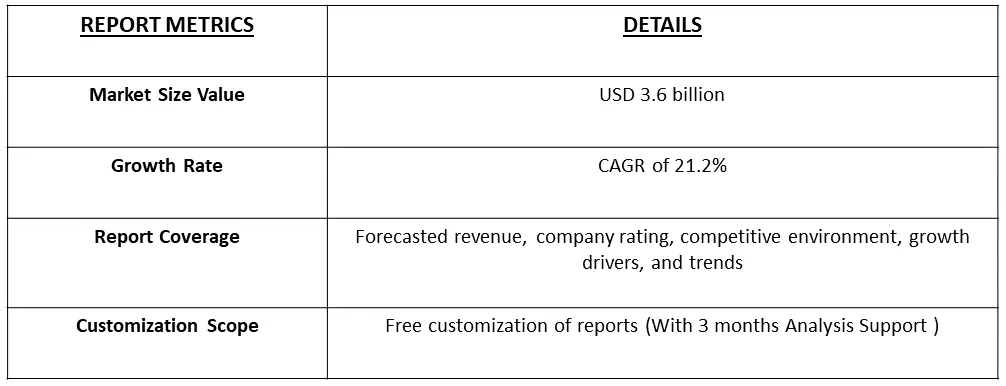

The Network Analytics Market size is projected to reach USD 3.6 billion by 2022, at a CAGR of 21.2% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Network analytics refers to the process of using advanced data analysis and statistical techniques to examine, interpret, and derive insights from data related to network activity, performance, and infrastructure. This field of analytics focuses on studying and understanding the patterns, behaviors, and interactions within computer networks. The goal is to enhance network efficiency, security, and overall performance by gaining valuable insights into the functioning of the network. Gathering data from various sources within a network, such as routers, switches, servers, and other network devices. This data may include information about traffic, bandwidth usage, packet flows, and other relevant network parameters.

The factors that are driving the growth of the studied market are the rise of digital transformation initiatives, businesses are increasingly dependent on their network infrastructure to deliver seamless and high-performance services. Network analytics enables organizations to monitor and optimize network performance in real-time. This includes identifying bottlenecks, optimizing bandwidth usage, and ensuring low latency, ultimately improving the end-user experience. Moreover, the growing threat landscape and the sophistication of cyber attacks make network security a top priority for organizations. Network analytics plays a crucial role in enhancing security by continuously monitoring network traffic for anomalies, identifying potential security threats, and facilitating rapid response and mitigation. The demand for effective cybersecurity solutions drives the adoption of network analytics tools.

The integration of network analytics with Application Performance Monitoring (APM) tools is a growing trend. This enables organizations to gain insights into how network performance impacts application performance, enhancing overall user experience. The rollout of 5G networks has led to a focus on analytics solutions tailored to the unique requirements and complexities of 5G infrastructure. This trend addresses the need for efficient management and optimization of high-speed, low-latency networks. These trends highlight the evolving landscape of network analytics, driven by the need for enhanced performance, security, and adaptability in the face of emerging technologies and changing network architectures.

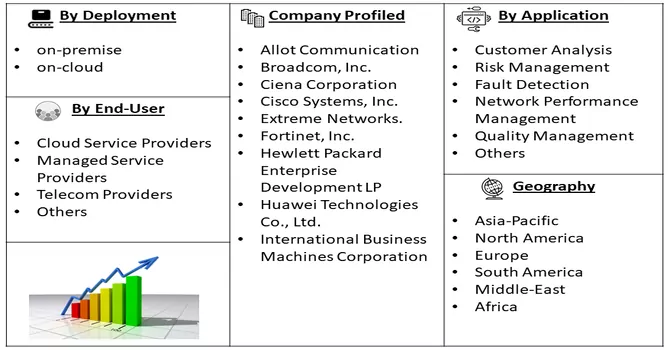

Market Segmentation: The network analytics market is segmented by deployment (on-premise and on-cloud), type (Network Intelligence Solutions and Services (Managed Services, Professional Services)), end user (Cloud Service Providers and Communication Service Providers (Telecom Providers, Internet Service Providers, Satellite Communication Providers, Cable Network Providers)), and geography (North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa). The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers :

Growing Adoption for Internet of Things (IoT) and Industry 4.0

The widespread deployment of IoT devices across various industries has led to a massive increase in the volume of data generated by these connected devices. Network analytics plays a crucial role in managing and analyzing the data flows from IoT devices, ensuring efficient communication, and identifying patterns or anomalies. IoT ecosystems are inherently complex, comprising diverse devices, protocols, and communication standards. Network analytics solutions are essential for providing visibility into this complexity, optimizing data transfer, and ensuring seamless connectivity within the IoT infrastructure. The scalability and flexibility of network analytics solutions are crucial in adapting to the dynamic and evolving nature of IoT and Industry 4.0 environments. Organizations seek solutions that can scale with the growing number of connected devices and accommodate changes in network configurations. Thus, such factors are expected to witness significant growth over the forecast period.

Technological Developments

The market is currently witnessing a series of strategic moves, including mergers, partnerships, and acquisitions that underscore the industry's dynamic nature. One notable example is the expanded partnership between Nokia and BT, outlined in a five-year deal announced in December 2022. This collaboration is poised to have a significant impact, as Nokia will be providing its AVA Analytics software for fixed networks to BT. The significance of this partnership lies not only in the technological advancements brought by Nokia's AVA Analytics software but also in the practical benefits it offers to BT. By integrating ML and AI capabilities into network monitoring, BT stands to gain a more proactive and efficient approach to handling network-related challenges. The real-time insights provided by Homeview equip call center agents with the means to identify and address issues promptly, contributing to improved customer experiences. In essence, this strategic collaboration exemplifies the industry's commitment to staying at the forefront of technological innovation. The partnership between Nokia and BT showcases a concerted effort to leverage advanced analytics, ensuring that network monitoring is not only comprehensive but also adaptable to the evolving landscape of telecommunications. As the market continues to evolve, such strategic alliances are expected to shape the trajectory of technological advancements and service delivery in the telecommunications sector. Thus, such factors are expected to witness significant growth over the forecast period.

Market Restraints. :

Complex Integration Process and High Initial Cost

The implementation of network analytics solutions can be intricate and time-consuming. Integrating these solutions into existing network infrastructures, especially in large enterprises, may pose challenges in terms of compatibility and customization, leading to delays and complexities. The upfront costs associated with acquiring and implementing network analytics solutions can be substantial. This financial barrier may deter smaller businesses or organizations with limited budgets from adopting advanced analytics tools, limiting market penetration. Thus, such factors are expected to slow down the growth of the studied market over the Forecast Period.

The global impact of the COVID-19 pandemic created significant social and economic challenges, leading to the temporary closure and struggles of thousands of businesses worldwide. Faced with unprecedented disruptions, companies had to enact substantial changes in their operations, including workforce layoffs and diversification of products and services. To swiftly adapt to these transformations, businesses embraced agile risk management, implemented AI systems, and leveraged data analytics as integral components of their business intelligence strategies. These measures aimed to enhance decision-making processes and optimize overall business operations in response to the dynamic and challenging circumstances brought about by the pandemic.

Segmental Analysis. :

Cloud Based Segment is Expected to Witness Significant growth over the Forecast Period

Cloud-based deployment has become increasingly integral to the field of network analytics, transforming the way organizations monitor, manage, and optimize their networks. This deployment model leverages cloud infrastructure and services to host network analytics solutions, providing several advantages and enhancing overall operational efficiency. Cloud-based deployment centralizes data storage, providing a single repository for network data. This facilitates streamlined data management and ensures a cohesive view of network activities. Centralized storage simplifies data retrieval, analysis, and reporting processes. Thus, such factors are expected to contribute to the growth of the studied segment over the forecast period

Network Analytics Segment is Expected to Witness Significant growth over the Forecast Period

Professional services play a vital role in the effective implementation, utilization, and optimization of network analytics solutions. As organizations increasingly recognize the value of leveraging data insights to enhance their network performance, professional services become essential in guiding them through the complexities of deploying and managing robust network analytics platforms. Professional services providers offer consultation services to understand the unique needs and objectives of organizations. This involves conducting a thorough needs assessment to identify specific challenges, goals, and the desired outcomes related to network analytics. Thus, owing to such benefits, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness significant Growth Over the Forecast Period

Due to early adoption by key players, North America is poised to maintain its leading position in the network analytics market, exhibiting moderate growth. The United States, in particular, has witnessed a surge in cloud-based analytics startups specializing in network analytics, reinforcing the region's dominance.The prevalence of network analytics tools in numerous U.S. businesses positions the country as the largest market for this technology. The rapid expansion of the network analytics market in the United States can be attributed to robust infrastructure development, coupled with substantial growth in Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and cloud computing.

The region's growth is further fueled by increased technological availability, heightened cyber threats prompting the need for advanced analytics, and a rapid embrace of technology. Leading telecom giants such as AT&T and Verizon, renowned for their extensive use of network analytics, contribute significantly to the market's vitality.North America stands as a global technological hub, characterized by swift adoption of emerging technologies. The United States and Canada play pivotal roles in technological advancements, with U.S. businesses heavily investing in network analytics to glean insights from network traffic, enhance customer service, and optimize network efficiency.

Businesses in the region are strategically leveraging opportunities in the market, aiming to reach new customers through the development of tailored products. A notable example is Juniper Networks, Inc., which, in May 2023, introduced the Mist Access Assurance service—a pioneering cloud-native offering. This service encompasses network access control (NAC) and policy management capabilities, utilizing Mist AI and a modern microservices cloud to enhance wired access, wireless access, indoor location, SD-WAN, and secure client-to-cloud portfolio. This strategic move exemplifies the continuous efforts in North America to innovate and lead in the dynamic landscape of network analytics.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive dynamics within the market have spurred significant investments by companies in research and development initiatives. These investments aim to foster the creation of advanced products and the automation of various operational processes. The intense competition among these key players underscores the industry's commitment to staying at the forefront of technological advancements and meeting the evolving needs of consumers. This competitive environment is expected to drive continuous innovation, ultimately benefiting end-users with state-of-the-art solutions and services.

Some prominent players in the global network analytics market include:

Recent Development

1) October 2022: Oracle has introduced the Network Analytics Suite, a novel set of virtualized cloud infrastructure products designed for Communication Service Providers (CSPs). This suite offers CSPs valuable insights into the performance and stability of their 5G data centers. By collecting data from various sources, including 5G network functions (NFs), app functions (AFs), and operations, administration, and maintenance (OAM) components that adhere to industry standards, the Network Analytics Suite empowers CSPs with comprehensive knowledge for effective network management.

2) June 2022: IBM has revealed its acquisition plans for Randori, a prominent player in attack surface management (ASM) and offensive cybersecurity based in the Boston region. This announcement was made during RSAC 2022. Randori specializes in assisting clients in identifying external assets visible to potential attackers, whether located on-premises or in the cloud. The company prioritizes these assets, highlighting the most critical ones. This strategic move by IBM reinforces its commitment to bolstering its cybersecurity capabilities through the incorporation of Randori's expertise and technologies.

Q1. What was the Network Analytics Market size in 2022?

As per Data Library Research the Network Analytics Market size is projected to reach USD 3.6 billion by 2022.

Q2. What is the market size of the Network Analytics Market?

Network Analytics Market is expected to grow at a CAGR of 21.2% during the forecast period.

Q3. What are the factors driving the Network Analytics Market?

Key factors that are driving the growth include the Growing Adoption for Internet of Things (IoT) and Industry 4.0 and Technological Developments.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model