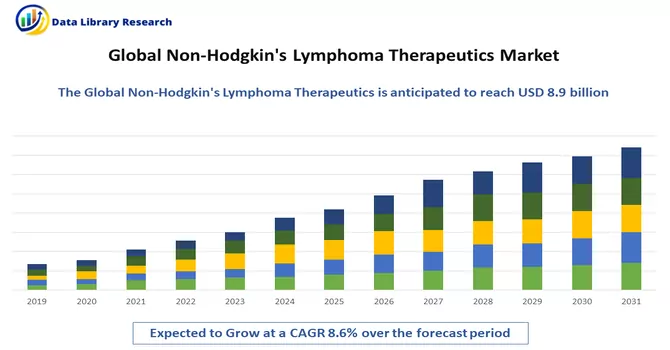

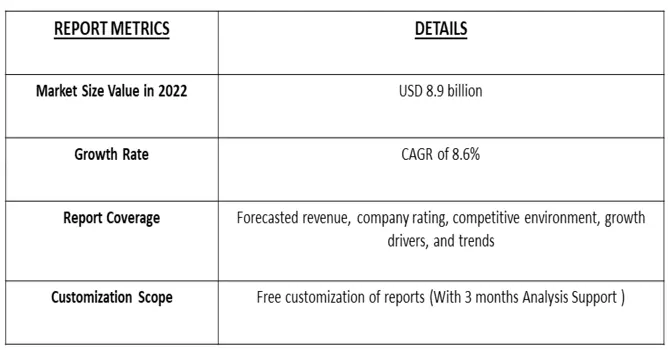

The Non-Hodgkin Lymphoma Therapeutics Market is currently valued at USD 8.9 billion in the year 2022 and is expected to register a CAGR of 8.6% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The factors that are driving the market growth include the growing burden of non-Hodgkin lymphoma (NHL), demand for innovative drugs and novel technologies, and an increase in the number of regulatory approvals for NHL therapy drugs.

Non-Hodgkin's lymphoma is a type of cancer that begins in your lymphatic system, which is part of the body's germ-fighting immune system. In non-Hodgkin's lymphoma, white blood cells called lymphocytes grow abnormally and can form growths (tumors) throughout the body. The therapy used in the treatment of this cancer is called non-Hodgkin's lymphoma therapeutics.

Monoclonal antibodies, a targeted therapy, use laboratory-made proteins to treat non-Hodgkin lymphoma. Antibodies attach to a target on cancer cells and either kill them, block their growth or stop them from spreading. Thus, such treatments are expected to contribute to the growth of the studied market.

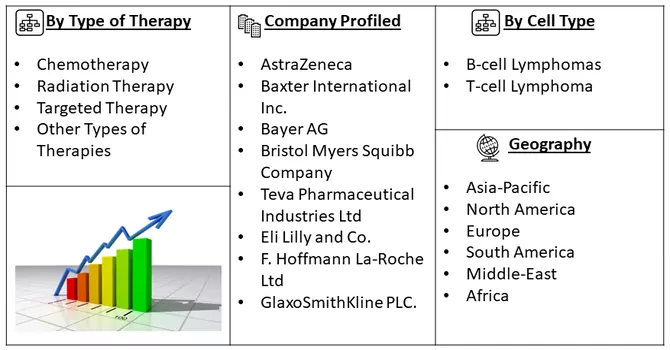

Segmentation:

The Non-Hodgkin Lymphoma Therapeutics Market is Segmented

By Type of Therapy :

Cell Type :

Geography :

The report offers the value (in USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers :

Increasing Cancer Cases

In the study published in the American Society of Hematology in November 2022, it is estimated that 779,000 new NHL cases were projected to occur by 2040, with an increase of 43% increase from 2020. Therefore, the rising burden of the NHL is expected to drive market growth due to the rising adoption of NHL therapeutics. Rising drug Approval

The rising approvals of drugs for the NHL are also expected to drive market growth. For instance, in November 2022, the United States Food and Drug Administration (FDA) accepted for Priority Review the Biologics License Application (BLA) for Genmab's subcutaneous epcoritamab (DuoBody-CD3xCD20), an investigational bispecific antibody, for the treatment of patients with relapsed/refractory large B-cell lymphoma (LBCL) after two or more lines of systemic therapy. In addition, in January 2022, a new gene therapy treatment named Breyanzi (lisocabtagene maraleucel) for the treatment of adult patients with diffuse large B-cell lymphoma received marketing authorization in the European Union. Such approvals are anticipated to drive the market growth due to accelerated drug discovery, driving the market growth.

Restraints :

The high cost of drugs used in non-Hodgkin's lymphoma (NHL) therapy is a significant concern for patients, healthcare providers, and healthcare systems. Developing new cancer drugs, including those for NHL, is a lengthy and expensive process. Pharmaceutical companies invest heavily in research, clinical trials, and regulatory approval, which can drive up the cost of these drugs. Thus, these factors may slow down the growth of the studied market over the forecast period.

The COVID-19 pandemic had some adverse impacts on the growth of the non-Hodgkin lymphoma therapeutics market, as indicated by various research studies. For example, a research study published in BMC Infectious Diseases in August 2021 highlighted the concern that chemotherapeutic and immunosuppressive treatments, which are pillars of cancer therapy, may worsen comorbid COVID-19 infections in patients with non-Hodgkin’s lymphoma. Another research study published in August 2021 by the American Society of Hematology reported that patients diagnosed with B-cell non-Hodgkin’s lymphoma (B-NHL) are at risk of severe COVID-19 disease. Effective vaccination against SARS-CoV-2 may help protect lymphoma patients from COVID-19, but the intrinsic immune deficiency associated with B-NHL and the anti-lymphoma treatment itself may hinder responsiveness to vaccinations. These studies shed light on the adverse impact of COVID-19 on the growth of the non-Hodgkin lymphoma therapeutics market during the initial phase of the pandemic. However, the market has shown a positive shift in the later stages of the pandemic and is expected to grow significantly over the forecast period.

Segmental Analysis:

Radiation Therapy Segment is Expected to Witness Significant growth Over the Forecast Period

Radiation therapy (RT) plays a crucial role in the management of non-Hodgkin’s lymphoma (NHL) and remains the most powerful therapeutic intervention for aggressive subtypes of NHL. Rising initiatives from key market players, such as launches and partnerships, are major factors contributing to the growth of this segment. For example, Oncodesign, Covalab, CheMatech, and ABX-CRO entered into a partnership to launch the DRIVE-MRT (Molecular Radiotherapy) solution, which encompasses technologies related to target validation, vector generation and optimization, and radiochemistry and PET/SPECT imaging techniques. Similarly, United Imaging, a China-based company involved in medical imaging and radiotherapy equipment, launched its uAIFI Technology Platform for MR and uExcel Technology Platform for PET/CT at the China International Medical Equipment Fair (CMEF). The rising importance of radiation therapy in the management of NHL is expected to drive the growth of this segment. Involved-field radiotherapy has been found to be very useful in the treatment of extranodal and nodal NHL, providing tailored treatments. The advantages of radiation therapy in the effective treatment of NHL in individual patients are expected to further drive the growth of this segment. Thus, owing to the diverse advantages of radiation therapy in the management of NHL and the rising initiatives from key market players, the radiation therapy segment is expected to show growth over the forecast period.

North American Region is Expected to Witness Significant Growth Over the Forecast Period

Due to increasing technological advancements and the rising incidences of non-Hodgkin’s lymphoma (NHL), the North American region is expected to exhibit healthy growth in the non-Hodgkin’s lymphoma therapeutics market. NHL is one of the most common cancers in the United States, with an estimated 80,550 people diagnosed with NHL in January 2023, including 44,880 males and 35,670 females. Similarly, according to the Canadian Cancer Society, approximately 11,400 Canadians are projected to be diagnosed with non-Hodgkin lymphoma in May 2022, comprising 6,600 men and 4,800 women.

The high incidence of NHL in North America is likely to contribute to regional growth, driven by increased adoption of NHL therapeutics. Additionally, the approval of innovative therapies for NHL, such as axicabtagene ciloleucel (Yescarta) for adult patients with large B-cell lymphoma (LBCL) and C-CAR039, a novel autologous bi-specific CAR-T therapy targeting CD19 and CD20 antigens for the treatment of patients with relapsed or refractory diffuse large B-cell lymphoma (r/r DLBCL), has further boosted the market’s growth.

Hence, the rising incidence of NHL and product launches by key market players are expected to drive the non-Hodgkin’s lymphoma therapeutics market in North America over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The non-Hodgkin lymphoma therapeutics market is highly competitive and consists of several major players. The factors owing to the competition include rising initiatives from the key market players for the launch of innovative therapies, partnerships for drug development, and rising advancements in cancer research, among others. Some of the companies operating in the market include

Key Players :

Recent Development:

1. May 2023: The US FDA approved the investigational new drug (IND) application of SIRPant Immunotherapeutics for the initiation of a first-in-human phase I clinical trial to treat relapsed refractory non-Hodgkin lymphoma

2. May 2023: The US FDA approved AbbVie's EPKINLY (epcoritamab-bysp), a T-cell engaging bispecific antibody for the treatment of adult patients with relapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL).

Q1. What is the current Non-Hodgkin's Lymphoma Therapeutics Market size?

The Non-Hodgkin Lymphoma Therapeutics Market is currently valued at USD 8.9 billion.

Q2. What is the Growth Rate of the Non-Hodgkin's Lymphoma Therapeutics Market?

Non-Hodgkin's Lymphoma Therapeutics Market is expected to register a CAGR of 8.6% over the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North American Region is expected to hold the highest Market share.

Q4. What are the Growth Drivers of the Non-Hodgkin's Lymphoma Therapeutics Market ?

Increasing Cancer Cases are the Growth Drivers of the Non-Hodgkin's Lymphoma Therapeutics Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model