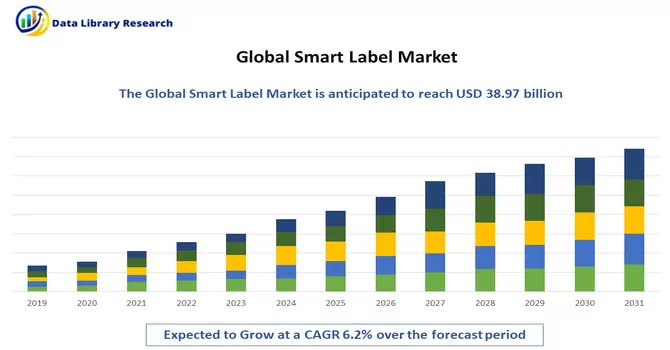

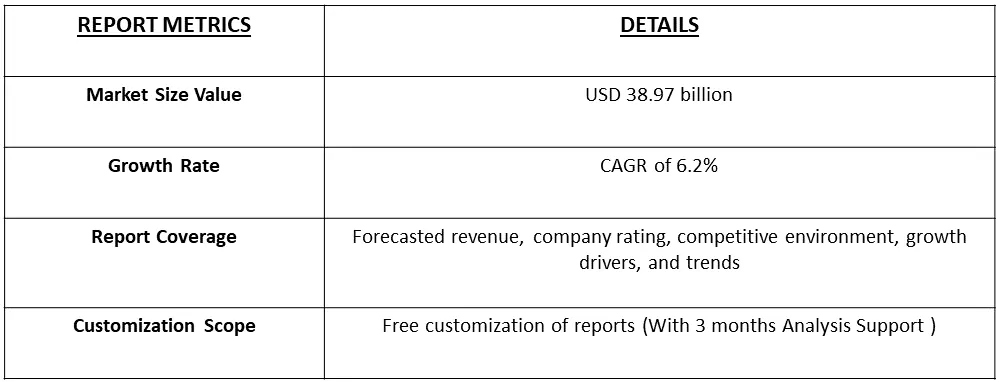

The global smart label market demonstrated a value of USD 38.97 billion in 2022, with an anticipated compound annual growth rate (CAGR) of 6.2% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Smart labels, functioning as responsive electronic devices embedded within objects, serve as identification slips. Equipped with chips, antennas, and bonding wires, they enable real-time tracking of assets and goods. The design of smart labels incorporates advanced technology, offering advantageous features such as automated reading, swift identification, re-programmability, high tolerance, and reduced errors. Smart labels represent cutting-edge identification and tracking solutions that have revolutionized traditional labelling systems. These labels go beyond the static nature of conventional labels, incorporating electronic components for dynamic functionality. : Smart labels are equipped with embedded microchips, which serve as the brain of the label. These microchips can store and process information, making the label dynamic and responsive.

These labels are gaining prominence, especially in sectors like retail, fast-moving consumer goods (FMCG), and logistics, where they are increasingly preferred over conventional barcode systems. Smart labels are typically crafted from materials such as plastics, paper, and fibres. This market's trajectory is indicative of the growing demand for innovative and technologically advanced solutions for asset and inventory management across diverse industries.

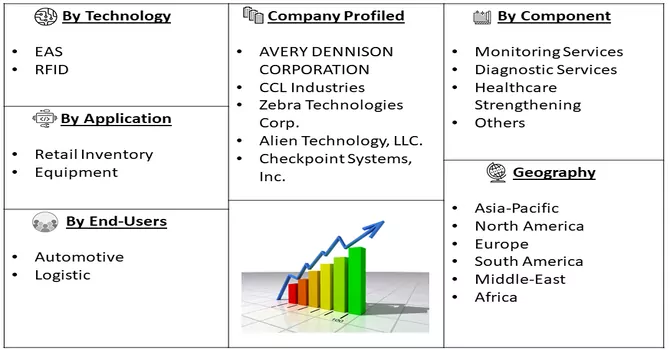

Market Segmentation: The Smart Label Market is Segmented By Technology (EAS, and RFID), Component (Transceivers, and Memories), By Application (Retail Inventory, and Equipment), End-use (Automotive, and Logistic), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The smart labels market is witnessing a surge in the adoption of RFID technology. RFID-enabled smart labels offer enhanced data capture, real-time tracking, and improved visibility across various industries, including retail, logistics, and healthcare. Sustainability is a key trend in the smart labels market. There is a rising demand for smart labels made from eco-friendly materials such as recyclable plastics, biodegradable materials, and paper. Manufacturers are focusing on reducing the environmental impact of labelling solutions. Moreover, smart labels are increasingly integrated with IoT, enabling seamless connectivity and communication. This integration enhances the capabilities of smart labels, allowing them to collect and transmit real-time data for improved decision-making and operational efficiency.

Market Drivers:

Growing Adoption of Automation and Industry 4.0

The growing adoption of automation and the Industry 4.0 paradigm represents a transformative shift in industrial processes, heralding a new era of efficiency, connectivity, and intelligent manufacturing. This trend is significantly impacting various industries, driving advancements in technology and fostering the evolution of smart labels. Automation and Industry 4.0 emphasize real-time data exchange between machines, systems, and entities within the manufacturing environment. Smart labels contribute to this by facilitating efficient communication, ensuring that relevant information is instantly accessible throughout the production and logistics chain. The evolution of smart label technologies aligns with the dynamic nature of Industry 4.0. Innovations such as advanced RFID functionalities, connectivity features, and compatibility with emerging technologies contribute to the ongoing synergy between smart labels and Industry 4.0. Thus, owing to the above-mentioned factors, the market is expected to witness significant growth over the forecast period.

Increased Production Flexibility and Predictive Maintenance Strategies

Automation and Industry 4.0 principles demand end-to-end traceability of products. Smart labels enhance traceability by providing a digital footprint, enabling manufacturers to track the journey of each product from production to delivery. This traceability aids in quality control and regulatory compliance. Smart labels facilitate predictive maintenance strategies by continuously monitoring the condition of machinery and assets. Through the collection of data on usage patterns and performance metrics, manufacturers can predict when maintenance is required, reducing downtime and preventing unexpected failures. Thus, owing to such advantages, the demand for smart labels is growing and the market is expected to witness significant growth over the forecast period.

Market Restraints:

Privacy Issues and Limited Standardization

The use of smart labels in retail and consumer goods raises concerns about consumer privacy. Businesses must navigate the delicate balance between collecting data for operational purposes and respecting consumer privacy, which can be a restraint in some markets. Moreover, a lack of standardization in smart label technologies may result in interoperability challenges. This lack of uniformity can hinder the seamless integration of smart labels across different systems and applications. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

The pandemic disrupted global supply chains, affecting the production and distribution of smart label components and technologies. Lockdowns, restrictions, and logistical challenges led to delays in the supply chain, impacting the availability of smart label materials. The surge in e-commerce during the pandemic accelerated the adoption of smart labels in logistics and fulfilment operations. The need for efficient tracking, real-time visibility, and contactless processes in e-commerce logistics drove the demand for smart labelling solutions. Thus, the COVID-19 pandemic acted as a catalyst, accelerating certain trends and reshaping priorities within the smart labels market. While short-term disruptions were evident, the industry adapted to the changing landscape, identifying new opportunities for growth and innovation.

Segmental Analysis:

RFID Segment is Expected to Witness Significant Growth Over the Forecast Period

Radio-frequency identification (RFID) technology and smart labels represent a dynamic synergy that has revolutionized the landscape of identification, tracking, and data management across various industries. This transformative duo brings efficiency, real-time visibility, and enhanced security to supply chains, logistics, retail, healthcare, and beyond. RFID is a wireless communication technology that utilizes radio waves for the identification and tracking of objects, assets, and even living beings. It comprises tags (or transponders), readers (or interrogators), and a backend system for data processing. RFID tags store information that can be wirelessly retrieved by RFID readers, enabling seamless and automated data capture. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Transceiver Segment is Expected to Witness Significant Growth Over the Forecast Period

A transceiver, short for transmitter-receiver, is a device that combines both functions in a single unit. In the context of smart labels, transceivers serve as the communication bridge, enabling bidirectional data exchange between the RFID reader and the smart label. The integration of transceivers with edge computing capabilities is a growing trend. This allows for data processing at the edge of the network, reducing latency and enhancing real-time decision-making. Also, ongoing developments focus on incorporating advanced security features within transceivers to safeguard data integrity and protect against unauthorized access. Thus, the synergy between transceivers and smart labels forms the backbone of efficient and intelligent data communication within the IoT ecosystem. As technology continues to advance, the integration of transceivers in smart labels will play a pivotal role in shaping the future of connected systems across industries.

Retail Inventory Segment is Expected to Witness Significant Growth Over the Forecast Period

Smart labels enable real-time tracking of products throughout the supply chain and within the retail environment. This visibility is crucial for retailers to stay informed about the location, movement, and status of each item in their inventory. RFID-enabled smart labels contribute to loss prevention efforts. By providing continuous visibility into the movement of items, retailers can quickly identify discrepancies, track stolen merchandise, and implement security measures to minimize losses. The integration of smart labels with advanced analytics tools is a growing trend. Retailers can leverage data generated by smart labels to gain insights into consumer behaviour, preferences, and trends. Thus, the adoption of smart labels in retail inventory management marks a paradigm shift in how retailers handle their stock. With enhanced visibility, efficiency, and accuracy, smart labels are proving to be a cornerstone technology in the ongoing transformation of the retail industry.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In the global landscape of smart labels, North America stands out as a powerhouse market, with the United States leading the charge and contributing significantly to the region's prominence. The surge in demand within the United States can be attributed to the extensive presence of retail establishments, ranging from small enterprises to retail giants like Walmart. The substantial influence of retail behemoths has propelled the region's growth in the smart label market, with Walmart, in particular, implementing electronic identification tags on items like men's clothing, including jeans, to enhance inventory management.

One of the driving forces behind the escalating demand for smart labels in the United States is the innovative use of technology by food companies. Leveraging smart labels, these companies connect with consumers by providing additional nutritional and ingredient information, contributing to the reduction of food waste. The recent collaborative efforts of the USDA (United States Department of Agriculture) and the FDA (Food and Drug Administration) to establish a framework for labelling cell-based meats and other food products are expected to further amplify the market's size in the country. Furthermore, technological investments by vendors in the United States emphasize the importance of enhancing traceability throughout supply chains. The integration of blockchain technology alongside smart labels has become increasingly prevalent, empowering businesses to achieve greater transparency and efficiency in their operations. The retail landscape in the United States has also witnessed a concerning rise in retail crimes, including employee theft and shoplifting, often orchestrated by organized retail crime groups. In response to this growing challenge, stakeholders are turning to smart labels based on RFID (Radio-Frequency Identification) to track textiles and garments, bolstering security measures and mitigating losses.

Across the border in Canada, the printing industry has undergone a transformative phase, embracing digital technologies to stay competitive. Investments in digital printing, integrated systems, customer interface software, and post-process automation have elevated operational efficiency within the Canadian printing sector. These advancements underscore the region's commitment to staying at the forefront of technological innovation. Thus, North America, spearheaded by the United States, continues to be a dynamic force in the smart label market, driven by a confluence of factors ranging from retail giants' innovative strategies to collaborative efforts in food labelling and a proactive approach to security challenges. The region's unwavering commitment to technological advancements positions it as a key player in shaping the future of smart labels and their diverse applications.

Get Complete Analysis Of The Report - Download Free Sample PDF

Companies are actively diversifying their product portfolios by introducing innovative smart label solutions. This approach involves the development of labels equipped with advanced technologies, catering to diverse industry needs and applications. Strategic partnerships and collaborations are key facets of the growth strategy. Companies are actively seeking collaborations with industry players, technology partners, and research institutions to foster innovation, share expertise, and jointly develop cutting-edge smart label solutions. Key Smart Label Companies:

Recent Development:

1) In January 2023, AVERY DENNISON CORPORATION finalized an agreement to acquire Thermopatch, a prominent player renowned for its expertise in labelling. Thermopatch is set to become part of the Apparel Solutions segment within the Retail Branding and Information Solutions (RBIS) division of AVERY DENNISON. The integration of Thermopatch's proficiency in labelling, coupled with AVERY DENNISON's commitment to quality and service, positions the merged entity to leverage its collective industry knowledge. This strategic move is anticipated to drive growth in external embellishments, further enhancing the company's standing in the market.

2) In January 2023, Pod Group announced a strategic collaboration with SODAQ and Lufthansa Industry Solutions, unveiling an innovative monitoring tool in the form of a Smart Label. This groundbreaking Smart Label, characterized by its paper-thin design, is poised to revolutionize the logistics sector. The tool brings a transformative capability to track small and lightweight products, overcoming previous limitations associated with existing tracking tools. This collaboration marks a significant advancement in logistics technology, enabling enhanced tracking and traceability in sectors that were previously challenging to monitor effectively.

Q1. What was the Smart Label Market size in 2023?

As per Data Library Research the global smart label market demonstrated a value of USD 38.97 billion in 2022.

Q2. At what CAGR is the smart label market projected to grow within the forecast period?

Smart Label Market is anticipated growth at a compound annual growth rate (CAGR) of 6.2% over the forecast period.

Q3. What segments are covered in the Smart Label Market Report?

By Technology, By Component, By Application, End-User and Geography these segments are covered in the Smart Label Market Report.

Q4. What are the Growth Drivers of the Smart Label Market?

Growing Adoption of Automation and Industry 4.0 and Increased Production Flexibility and Predictive Maintenance Strategies are the Growth Drivers of the Smart Label Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model