3D Imaging See Through Wall Radar Market Overview and Analysis

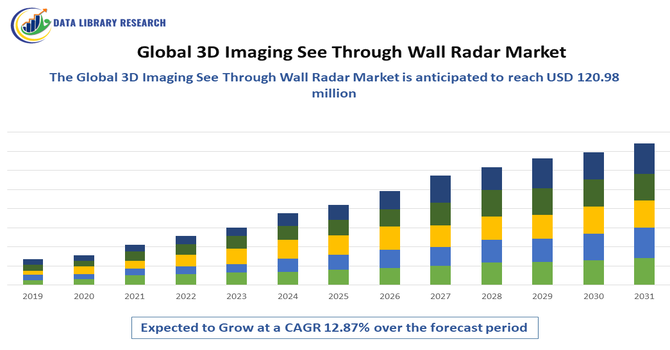

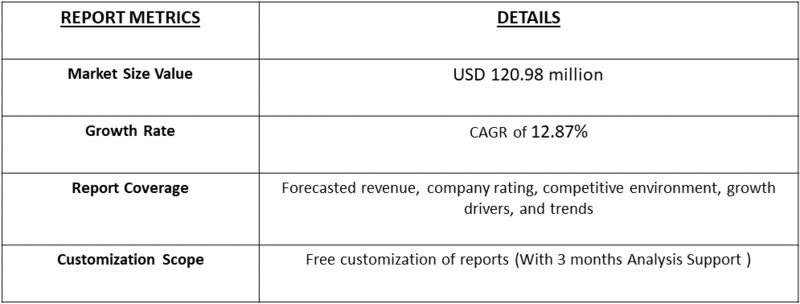

- The Global 3D Imaging See-Through-Wall Radar Market was valued at USD 90.2 million in the year 2025 and expected to reach USD 120.98 million by 2032, growing with a healthy CAGR of 12.87% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Growth in the Global 3D Imaging See-Through-Wall Radar Market is primarily driven by the rising need for advanced situational awareness in urban combat, counter-terrorism, and hostage-rescue missions, as defense forces modernize equipment for complex indoor operational environments. Expanding adoption by law-enforcement agencies and first responders for search-and-rescue, disaster response, and human detection in collapsed structures is adding momentum.

Rapid technological advancements—including ultra-wideband radar, AI-assisted signal processing, and high-resolution 3D imaging—are significantly improving detection accuracy, range, and portability, boosting deployment across tactical and emergency applications. Additionally, increasing homeland security budgets, growing emphasis on public-safety infrastructure, and rising demand for compact, rugged, and operator-friendly systems support sustained market expansion over the forecast period.

3D Imaging See Through Wall Radar Market Latest Trends

Global 3D Imaging See-Through-Wall Radar market include rapid adoption of AI/ML-based signal processing and imaging algorithms that reduce false positives and enable higher-fidelity 3D reconstructions from noisy UWB/MIMO returns. Miniaturization and portability are accelerating vendors are shipping lighter, backpack/hand-held systems and edge-compute solutions that expand use beyond military customers into police, fire, and SAR teams, supporting a rising commercial market value. Sensor fusion (radar + thermal/optical) and improved UX/visualization tools are becoming standard to make outputs actionable for non-specialist operators, while modular architectures let manufacturers offer mission-specific payloads (vital-sign detection, structural mapping).

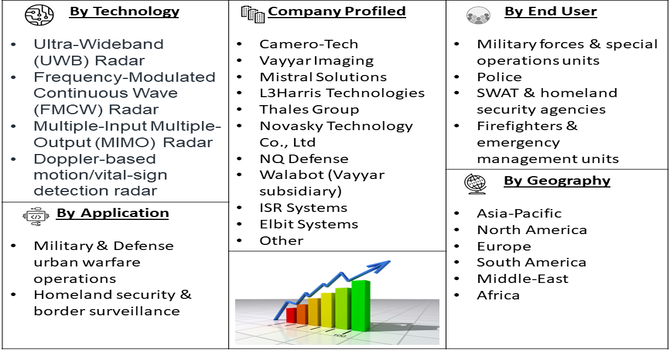

Segmentation: Global 3D Imaging See Through Wall Radar Market is segmented By Type (Portable handheld through-wall radar systems, Backpack-mounted, Vehicle-mounted surveillance radars), Technology (Ultra-Wideband (UWB) Radar, Frequency-Modulated Continuous Wave (FMCW) Radar, Multiple-Input Multiple-Output (MIMO) Radar, Doppler-based motion/vital-sign detection radar), Application (Military & Defense urban warfare operations, Homeland security & border surveillance), End User (Military forces & special operations units, Police, SWAT & homeland security agencies, Firefighters & emergency management units), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising demand for enhanced tactical situational awareness in defense and homeland security

Increasing urban warfare scenarios, counter-terrorism operations, and law-enforcement deployments are driving demand for see-through-wall radar systems that enable operators to detect hidden threats, identify human presence, and plan safe entry operations. Governments worldwide are prioritizing advanced sensing and surveillance technologies to improve mission success and reduce personnel risk, supporting continuous investment in 3D imaging through-wall radar platforms.

- Growing adoption in search-and-rescue and disaster response applications

As natural disasters, building collapses, and emergency incidents increase, agencies need technology that can detect trapped survivors behind debris and walls. 3D see-through-wall radar enables rapid location of motion and vital signs such as breathing and heartbeat, significantly improving rescue timelines and boosting survival rates. This expanding civil-emergency use case, combined with advancements in portable rugged systems, is accelerating market growth beyond military domains.

Market Restraints

- High Procurement and Maintenance Costs

The adoption of 3D imaging see-through-wall radar systems is limited by high procurement and maintenance costs, which make deployment challenging for budget-constrained law-enforcement and civil rescue agencies compared to defense buyers. Technical limitations also remain significant signal interference, reduced penetration in dense reinforced structures, and performance loss in complex indoor environments can hinder operational accuracy. Regulatory and privacy concerns surrounding surveillance technology complicate procurement and deployment, especially in urban civilian areas. Additionally, these systems require skilled operators and specialized training to interpret radar imagery and avoid false readings, slowing adoption where trained personnel are limited. Long government procurement cycles and export-control restrictions in sensitive defense markets further constrain rapid commercialization and cross-border sales.

Socio Economic Impact on 3D Imaging See Through Wall Radar Market

The Global 3D Imaging See-Through Wall Radar Market has significant socioeconomic impacts, particularly in security, defense, and emergency response sectors. By enabling real-time visualization of objects and people behind walls, this technology enhances situational awareness, improving safety for military personnel, law enforcement, and rescue teams. It accelerates search and rescue operations during disasters, potentially saving lives and reducing economic losses. The market’s growth drives technological innovation, creates high-skilled jobs, and boosts related industries such as electronics and defense manufacturing. Additionally, improved security and surveillance capabilities contribute to public safety and crime reduction, fostering a more stable social environment. Thus, the market supports enhanced operational efficiency, economic growth, and societal well-being globally.

Segmental Analysis

- Handheld Through-Wall Radar Systems segment is expected to witness highest growth over the forecast period

Handheld radars are gaining rapid traction due to their ultra-compact form, ability to be used by single operators, and suitability for dynamic entry operations in urban settings. These systems provide quick directional scans, enabling security forces and first responders to detect human presence and movement behind walls during critical missions. Their ergonomic design, ease of use, and rapidly improving battery life make handheld devices preferred for tactical teams, particularly in confined or hostile environments.

- UWB (Ultra-Wideband) Radar segment is expected to witness highest growth over the forecast period

Ultra-Wideband technology leads this segment due to its superior wall-penetration performance and ability to detect fine movements such as breathing. UWB technology enables high-resolution 3D imaging with minimal interference, making it ideal for portable tactical equipment. Its compatibility with compact antennas and low-power electronics further drives its adoption in handheld and backpack-mounted solutions used in close-range operations.

- Urban Warfare & Counter-Terrorism segment is expected to witness highest growth over the forecast period

Urban warfare and counter-terrorism missions represent the primary application segment, driven by rising security threats and complex combat environments where adversaries operate within multi-story structures and dense urban blocks. Portable 3D see-through-wall radar gives soldiers and special forces real-time situational intelligence—locating concealed threats, identifying hostages, and supporting safe breaching maneuvers—enhancing mission effectiveness and survivability.

Furthermore, the application extends significantly to Public Safety and Disaster Relief. In scenarios like earthquakes, building collapses, or large-scale fires, 3D see-through-wall radar becomes a crucial tool for Search and Rescue (SAR) teams. It enables the non-invasive detection of vital signs (like breathing and heartbeat) through rubble and debris, accurately locating trapped survivors. This capability enhances rescue efficiency, prioritizes resource allocation in complex environments, and drastically improves the chances of saving lives where visibility is zero, without exposing rescuers to unnecessary risks.

- North America region is expected to witness highest growth over the forecast period

North America leads growth due to high defense spending, advanced homeland-security infrastructure, and increasing investment in modern tactical systems by federal and local agencies. U.S. military modernization initiatives, tactical law-enforcement funding, and homeland-security programs support rapid adoption. Continued counter-terrorism training and border-security initiatives further reinforce the region’s leadership in portable see-through-wall radar deployment.

The technological ecosystem in the U.S. further strengthens its market dominance. Robust collaborations between defense technology firms, research institutions, and government agencies drive rapid prototyping and deployment of cutting-edge radar solutions tailored to specific mission needs. Furthermore, the existence of a high-value customer base willing to invest in premium, high-accuracy equipment, combined with well-established domestic supply chains for specialized components, ensures continuous innovation and commercial availability of the latest generation of portable see-through-wall radar systems.

To Learn More About This Report - Request a Free Sample Copy

3D Imaging See Through Wall Radar Market Competitive Landscape:

The global 3D imaging see-through-wall radar market is moderately consolidated, led by defense technology firms, sensor innovators, and emerging UWB/MIMO radar startups. Competition centers on imaging accuracy, penetration capabilities, AI-enhanced analytics, portability, ruggedization, and real-time situational-awareness features. Companies are focusing on miniaturized platforms for urban warfare, counter-terrorism, and first-responder applications, while strategic collaborations with military forces and law-enforcement agencies remain key to securing long-term contracts. Continuous R&D in software-defined radar, real-time 3D visualization, and integration with drones and tactical gear further fuels competitive differentiation.

Key Players

- Camero-Tech

- Vayyar Imaging

- Mistral Solutions

- L3Harris Technologies

- Thales Group

- Novasky Technology Co., Ltd

- NQ Defense

- Walabot (Vayyar subsidiary)

- ISR Systems

- Elbit Systems

- Quantum Radar Systems

- HENSOLDT

- Raytheon Technologies

- Leonardo S.p.A.

- SafeZone Technologies

- SRICO Industries

- SpotterRF

- Echodyne Corp

- ABAKO Radar Systems

- Lockheed Martin Corporation

Recent Development

- In June 2022, Camero-Tech, an Israel-based company, developed a next-generation portable, high-performance imaging device capable of “seeing” through walls. Named the Xaver 1000, the company officially expanded its product line with this advanced solution. As part of the Samy Katsav Group (SK Group), Camero-Tech leveraged its expertise in pulse-based UWB micro-power radar to pioneer this technology. The launch strengthened its leadership in the sector, driving innovation and adoption in defense, security, and emergency response, positively impacting the growth and technological advancement of the Global 3D Imaging See-Through Wall Radar Market.

- In June 2022, Law enforcement, rescue teams, and police relied on real-time information of live targets behind walls for strategic planning and mission success. The invention of Ultra Wide Band (UWB) radar enabled accurate detection of target positions, movements, and numbers through concrete, soil, rock, and brick. NovoQuad developed 2D and 3D See-Through Wall Radar Systems featuring high penetration, resolution, and long detection range for anti-terrorism, disaster rescue, and avalanche recovery. The technology enhanced 3D positioning and target posture visualization, driving adoption and growth in the Global 3D Imaging See-Through Wall Radar Market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth driving factors for this market?

The main drivers are the escalating demand for advanced security and surveillance solutions in national defense, law enforcement, and counter-terrorism operations. These systems provide crucial, real-time situational awareness during critical events like hostage situations or building searches. Continuous technological innovation, including miniaturization and the integration of advanced AI for enhanced resolution and object identification, also expands the market's applications and appeal.

Q2. What are the main restraining factors for this market?

Major restraining factors include the high initial development and procurement costs of these advanced radar systems, limiting adoption, especially for smaller law enforcement agencies. Significant ethical and privacy concerns arise from the ability to "see" into private spaces, leading to complex regulatory and legal hurdles that restrict usage. Furthermore, environmental factors like wall material thickness and RF interference can sometimes impact system performance and reliability.

Q3. Which segment is expected to witness high growth?

The National Defense application segment is expected to witness high growth due to substantial, continuous government investment in modernizing military and tactical reconnaissance systems. By type, the Handheld segment is also projected to grow rapidly, driven by the increasing need for portable, user-friendly, and compact devices that provide quick situational awareness for immediate deployment by police and specialized tactical units.

Q4. Who are the top major players for this market?

The market is dominated by defense contractors and specialized technology firms. Key players include large defense contractors like L3Harris Technologies, Inc., and technology innovators such as Camero-Tech Ltd. and Vayyar Imaging Ltd. Other major companies, including AKELA Inc. and those specializing in Ultra-Wideband (UWB) radar, also compete by focusing on continuous advancements in signal processing and miniaturization to enhance device performance.

Q5. Which country is the largest player?

North America, specifically the United States, is the largest market player by revenue share. This dominance stems from substantial government investment in homeland security and defense technologies, a well-established ecosystem for technological innovation, and the proactive adoption of advanced surveillance tools by federal and local law enforcement agencies. The Asia Pacific region, however, is forecast for the fastest growth due to rising defense spending.

List of Figures

Figure 1: Global 3D Imaging See Through Wall Radar Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global 3D Imaging See Through Wall Radar Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa 3D Imaging See Through Wall Radar Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa 3D Imaging See Through Wall Radar Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa 3D Imaging See Through Wall Radar Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model