Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Overview and Analysis:

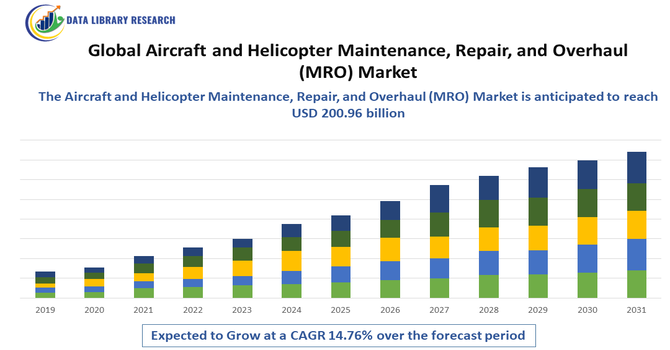

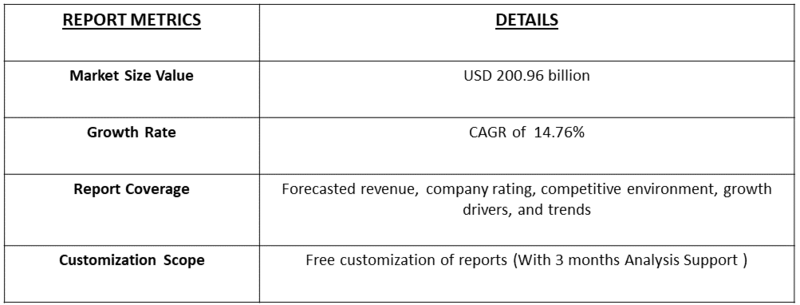

- The Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) market size was estimated at USD 120.85 billion in 2025 and is projected to reach USD 200.96 billion by 2032, growing at a CAGR of 14.76% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) market refers to the industry that ensures aircraft and rotorcraft remain safe, reliable, and airworthy through regular inspections, repairs, component replacements, and system upgrades. It includes line maintenance, heavy checks, engine and component services, and modernization work. This market supports airlines, operators, and defense fleets by enhancing performance, extending asset life, reducing downtime, and maintaining regulatory compliance across worldwide aviation operations.

The global aircraft and helicopter MRO market is growing because more people are flying, so airlines and operators need more planes and helicopters in the air. Older aircraft need more repairs and regular checkups to stay safe. Governments also require strict safety rules, which increases maintenance needs. At the same time, new technology and digital tools make maintenance easier and more efficient, and many airlines prefer to outsource MRO work, adding to overall market growth.

Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Latest Trends

The major trends in the global aircraft and helicopter MRO market include growing use of digital tools like predictive maintenance, AI, and real-time monitoring to reduce downtime and improve efficiency. Moreover, the demand for engine and component MRO is rising as fleets age, while lightweight materials and advanced avionics require specialized repair skills. More airlines are outsourcing MRO work to reduce costs, and partnerships between OEMs and independent MRO providers are increasing to handle expanding global fleets.

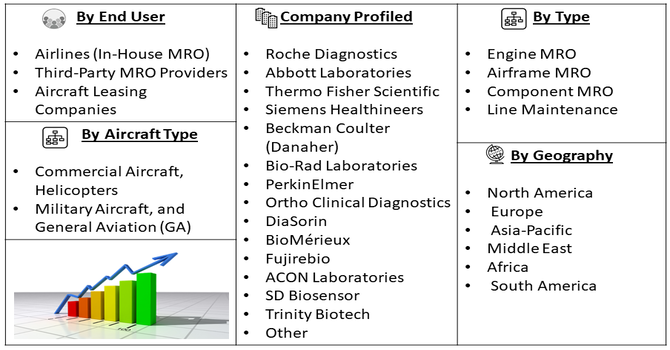

Segmentation: The Global Aircraft and Helicopter MRO Market is Segmented by Service Type (Engine MRO, Airframe MRO, Component MRO and Line Maintenance), Aircraft Type (Commercial Aircraft, Helicopters, Military Aircraft, and General Aviation (GA)), End-User (Airlines (In-House MRO), Third-Party MRO Providers, and Aircraft Leasing Companies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Global Air Traffic and Expanding Fleets

The major driver for the global aircraft and helicopter MRO market is the steady increase in global air travel, which pushes airlines and operators to expand their fleets. More commercial flights, rising tourism, and increased cargo operations lead to higher aircraft utilization, which means more wear and tear and a greater need for maintenance, repairs, and regular inspections.

In August 2025, Alaska Airlines’ expansion with new nonstop routes to London Heathrow and Reykjavik, along with its growing fleet of up to 17 widebody 787 Dreamliners, significantly impacted the growing global air traffic and expanding fleets, thereby boosting demand in the global aircraft and helicopter MRO market. The addition of long-haul flights and advanced aircraft increased maintenance, repair, and overhaul needs, driving greater utilization of MRO services, fleet upkeep, and support infrastructure to ensure safe and efficient operations. As airlines add new aircraft while keeping older ones flying longer, the demand for engine overhauls, component repairs, and system upgrades continues to rise.

- Aging Aircraft and Rising Safety Regulations

Another key driver is the growing number of aging aircraft that require frequent checkups and extensive repair work to maintain safe and reliable operations. Older aircraft and engines undergo more heavy maintenance, part replacements, and structural inspections, all of which significantly boost MRO demand. For instance, in 2025, the DGCA’s proposal to raise the aircraft import age limit to 20 years impacted the aging aircraft and rising safety regulations, as well as the helicopter MRO market, by increasing the number of older aircraft in Indian fleets. This change heightened demand for inspections, maintenance, and component overhauls to ensure airworthiness. Operators faced greater reliance on MRO services to comply with safety standards, manage wear and tear, and maintain reliable operations amid fleet shortages caused by supply chain delays, thereby boosting this market’s growth.

Market Restraints

- High Costs and Labor Shortages in MRO Operations

The major restraint in the market is the rising cost of MRO operations, fueled by expensive spare parts, advanced engine technologies, and the need for highly trained technicians. Modern aircraft use complex materials and digital systems that require specialized skills, making maintenance more costly. At the same time, the aviation industry faces a global shortage of skilled mechanics and engineers, leading to longer turnaround times and higher labor expenses. These challenges make it difficult for smaller operators and MRO providers to manage costs efficiently. As a result, high expenses and limited workforce availability can slow down market growth and reduce operational flexibility.

Socio Economic Impact on Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market

The global aircraft and helicopter MRO market has a strong socioeconomic impact by supporting millions of jobs, both directly in maintenance facilities and indirectly across supply chains, training centers, logistics, and aviation services. It helps strengthen national economies by boosting exports, attracting foreign investment, and supporting tourism through safer and more reliable air travel. The market also drives technological advancement, encouraging countries to develop skilled labor and adopt digital tools, which benefits wider industries. Additionally, MRO activities support regional development by creating high-skill employment opportunities in emerging markets. Thus, the industry enhances connectivity, economic growth, workforce development, and long-term aviation safety worldwide.

Segmental Analysis:

- Engine MRO segment is expected to witness highest growth over the forecast period

The Engine MRO segment is expected to grow the fastest because aircraft engines are the heart of every plane and require the most attention to stay safe and efficient. As airlines fly more and keep older engines in service longer, they need frequent inspections, part replacements, and performance upgrades. Newer engines are built with advanced materials and technology, so they need highly skilled experts to maintain them. For instance, July 2023, The Safran Helicopter Engines and Hindustan Aeronautics Limited (HAL) joint venture in Bangalore significantly impacted the Engine MRO segment of the global aircraft and helicopter MRO market. By establishing India’s first in-house engine design and manufacturing facility, it enhanced local capabilities for maintenance, repair, and overhaul of advanced helicopter engines. The venture strengthened engine production, reduced dependence on imports, and supported the development of specialized MRO services for defense and naval helicopters, boosting regional expertise and market growth.

- Commercial Aircraft segment is expected to witness highest growth over the forecast period

The Commercial Aircraft segment is expected to see the highest growth because more people worldwide are choosing to fly, leading airlines to add new planes and keep existing ones operating longer. As aircraft fly more frequently, they need regular checks, repairs, cabin upgrades, and new technology installations to stay safe and comfortable for passengers.

Modern planes use advanced systems that require specialized maintenance skills, further increasing demand. Low-cost carriers are expanding quickly and need consistent, affordable MRO support. Airlines also face pressure to reduce delays and follow strict safety rules, which pushes them to invest more in proper upkeep. With digital tools making maintenance faster and more accurate, the commercial aircraft MRO market will continue to grow strongly.

- Airlines (In-House MRO) segment is expected to witness highest growth over the forecast period

The Airlines (In-House MRO) segment is expected to grow rapidly because many airlines prefer to handle their own maintenance instead of relying on outside companies. Doing repairs in-house gives airlines more control over quality, costs, and scheduling. As carriers expand their fleets and operate more flights, they need quicker turnaround times and reliable maintenance support, which is easier to achieve with internal teams.

Airlines are also investing in new tools like real-time monitoring and predictive maintenance to make their internal operations more efficient. Building skilled teams and advanced facilities helps reduce delays, lower long-term costs, and keep aircraft available for service. This growing focus on independence and efficiency is driving strong growth in the in-house MRO segment.

- North America Region is expected to witness highest growth over the forecast period

North America is expected to grow the fastest in the MRO market because it has one of the world’s largest and busiest aircraft fleets, both commercial and military. The region has strong aviation infrastructure, experienced technicians, and major MRO companies that provide high-quality maintenance services.

Airlines and defense organizations are investing heavily in upgrades, modern equipment, and digital tools like predictive analytics to keep their aircraft in top condition. Many planes in the region are aging and need more frequent repairs and inspections, adding to the demand. Strict safety regulations and a strong focus on reliability also drive steady MRO activity. For instance, The US mandate requiring all new aircraft after May 16, 2025, to have 25-hour CVRs, and retrofitting existing aircraft by 2030, significantly impacted aging aircraft and rising safety regulations, as well as the US helicopter MRO market. Operators accelerated upgrades to meet compliance, driving demand for avionics installation, inspections, and maintenance. MRO providers expanded services to retrofit older aircraft, ensuring regulatory adherence, improving safety, and supporting continued airworthiness of the aging fleet.

With new facilities opening and technology becoming more advanced, North America is set for strong and continuous growth in the MRO market. For instance, in March 2025, the partnership between Skyryse and United Rotorcraft impacted the US helicopter MRO market by advancing technology adoption and opening new service opportunities. United Rotorcraft provided FAA Part 145 MRO support for Skyryse One helicopters and facilitated the integration of the SkyOS digital operating system into Airbus H-125, H-130, and Black Hawk variants. This collaboration accelerated the adoption of advanced digital systems and created demand for specialized maintenance and retrofit services across the US rotorcraft fleet.

Thus, such factors are driving the growth of this market in this region.

To Learn More About This Report - Request a Free Sample Copy

Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Competitive Landscape:

The competitive landscape of the global aircraft and helicopter MRO market is shaped by a mix of major OEMs, independent MRO providers, and airline-operated maintenance centers, all competing to offer faster, safer, and more cost-effective services. Leading companies focus on expanding their global networks, investing in digital tools like predictive maintenance, and forming partnerships to handle growing fleet sizes and complex new aircraft technologies. Independent MRO firms compete by offering flexible pricing and specialized expertise, while OEMs maintain an advantage with access to proprietary parts and technical data.

The major players for above market are:

- Lufthansa Technik

- GE Aerospace (GE Aviation)

- Rolls-Royce plc

- Safran Aircraft Engines

- Pratt & Whitney

- ST Engineering Aerospace

- AAR Corp

- Collins Aerospace

- Honeywell Aerospace

- Airbus MRO Services

- Boeing Global Services

- MTU Aero Engines

- Singapore Airlines Engineering Company (SIAEC)

- Delta TechOps

- SR Technics

- HAECO Group

- StandardAero

- Barnes Aerospace

- Turkish Technic

- Leonardo Helicopters (MRO Services)

Recent Development

- In November 2025, Robinson Helicopter Company (RHC) and Safran Helicopter Engines showcased progress on the R88 helicopter at European Rotors, featuring the 950 shp Arriel 2W engine and the Safran Serenity support package. Robinson became the first helicopter manufacturer to include the Serenity package as standard with every new R88. The Cologne event marked the R88’s overseas debut and highlighted the continued collaboration between the two companies since the helicopter’s

- In November 2025, Airbus and Østnes Helicopters announced a contract for 10 Airbus H125s at European Rotors, adding to four H125s already ordered, bringing the total to 14 aircraft. The deal highlighted the strong Nordic demand for versatile, reliable rotorcraft capable of utility work and passenger transport. Østnes Helicopters emphasized that the strategic procurement ensured short delivery times, high availability, and continued access to the world’s most successful single-engine helicopter for their customers.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the massive, aging global fleet of commercial aircraft and helicopters that mandates increasingly rigorous maintenance checks. Growth is also fueled by airlines' focus on maximizing aircraft utilization and avoiding costly unplanned outages. Furthermore, the rising adoption of predictive maintenance powered by big data and AI increases the need for specialized, sophisticated MRO services.

Q2. What are the main restraining factors for this market?

A key constraint is the severe global shortage of certified, highly skilled aircraft technicians and engineers, which drives up labor costs and causes maintenance backlogs. The market also suffers from supply chain volatility for spare parts and components, leading to long aircraft ground times. Additionally, the high capital investment required for sophisticated hangars and tooling poses a barrier to entry.

Q3. Which segment is expected to witness high growth?

The Engine MRO Segment is projected to witness the highest growth. Engines are the most technically complex and expensive components to maintain, requiring specialized tools and long shop visits. Driven by the introduction of newer, more efficient engine models (like the geared turbofan) and airlines' need to maximize fuel efficiency, the high-value, mandatory nature of engine overhaul ensures this segment's leading position.

Q4. Who are the top major players for this market?

The market is dominated by Original Equipment Manufacturers (OEMs) and major airline-affiliated MROs. Top major players include Lufthansa Technik, GE Aerospace, Safran, and Air France Industries KLM Engineering & Maintenance (AFI KLM E&M). Competition focuses on expanding global hangar networks, securing exclusive long-term engine service contracts with airlines, and investing heavily in digital tools to streamline maintenance processes and reduce aircraft downtime.

Q5. Which country is the largest player?

The United States is the largest country player by revenue. This dominance is due to the largest number of commercial, private, and military aircraft in its fleet, creating immense and consistent MRO demand. The country benefits from a vast existing infrastructure of certified MRO facilities and is a key hub for many major airline maintenance bases, ensuring continuous, high-value service activity.

List of Figures

Figure 1: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Aircraft and Helicopter Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029