Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Overview and Analysis

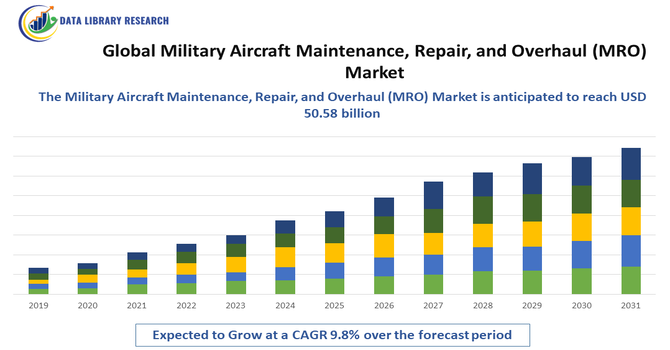

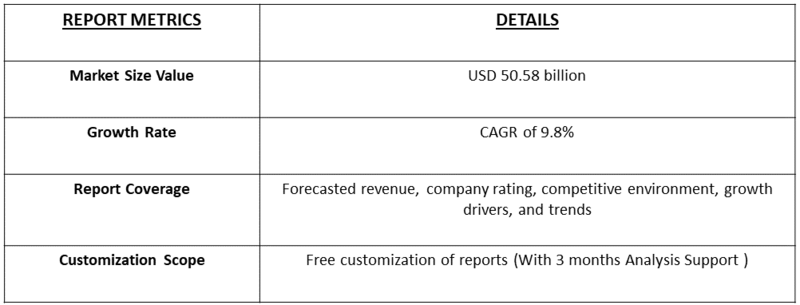

- The Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market size is currently valued at USD 44.63 billion and is projected to reach USD 50.58 billion by 2032, growing with a CAGR of 9.8% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market refers to the industry involved in servicing, repairing, and upgrading military aircraft to ensure operational readiness, safety, and extended lifespan. It includes routine maintenance, engine overhauls, component replacement, and modernization programs, supporting air forces globally while meeting stringent defense standards and operational requirements.

The growth of the Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market has been driven by increasing defense budgets, rising global geopolitical tensions, and the need to maintain operational readiness of aging military fleets. Technological advancements in aircraft systems, engines, and avionics require specialized MRO services, while modernization and upgrade programs for legacy aircraft further boost demand. Additionally, the expansion of air forces in emerging economies and long-term government contracts have fueled consistent market growth.

Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Latest Trends

The Global Military Aircraft MRO Market has witnessed a shift toward predictive and condition-based maintenance driven by advanced sensors, data analytics, and digital twins. Governments and defense contractors increasingly rely on integrated MRO solutions that minimize downtime and extend aircraft life cycles. Outsourcing to specialized independent MRO providers has grown, complementing in-house military capabilities. Additionally, modernization programs for legacy fleets and the adoption of next-generation fighter jets and unmanned aerial vehicles (UAVs) are shaping market demand.

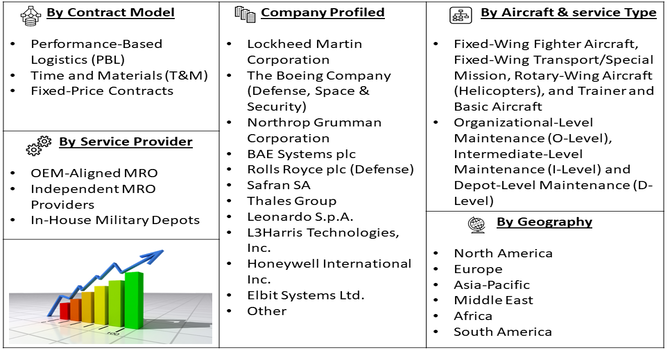

Segmentation: The Military Aircraft Maintenance, Repair, and Overhaul (MRO) market is segmented by Aircraft Type (Fixed-Wing Fighter Aircraft, Fixed-Wing Transport/Special Mission, Rotary-Wing Aircraft (Helicopters), and Trainer and Basic Aircraft), Service Type (Organizational-Level Maintenance (O-Level), Intermediate-Level Maintenance (I-Level) and Depot-Level Maintenance (D-Level)), Service Provider (OEM-Aligned MRO, Independent MRO Providers and In-House Military Depots), Contract Model (Performance-Based Logistics (PBL), Time and Materials (T&M) and Fixed-Price Contracts), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Defense Spending

The main drivers of the global military aircraft MRO market is the steady rise in defense budgets worldwide. Governments are investing heavily to modernize their air forces, maintain readiness, and replace aging fleets. These investments include spending on maintenance, repairs, and upgrades of fighter jets, transport aircraft, and helicopters. For instance, in 2025, the Government of India highlighted that the country’s defence sector had transformed significantly over the past eleven years. The defence budget rose from INR 2.53 lakh crore in 2013–14 to INR 6.81 lakh crore in 2025–26, supporting innovation, indigenous platforms, private industry participation, and long-term military preparedness. As countries focus on keeping their aircraft operational and technologically advanced, the demand for MRO services grows. This ensures that aircraft remain mission-ready, safe, and efficient, while defense organizations can meet national security objectives without having to buy entirely new fleets.

- Adoption of Advanced Technologies

The increasing use of advanced technologies is also fueling growth in the military aircraft MRO market. Predictive maintenance, digital monitoring systems, robotics, and AI-driven diagnostics help detect problems before they become critical, reducing downtime and maintenance costs.

Additionally, upgrades to avionics, engines, and airframes are more efficient with modern tools. For instance, in September 2025, Honeywell unveiled its new small-thrust-class engine, the HON1600, for collaborative combat aircraft and unmanned systems at the Air, Space & Cyber Conference in Washington, D.C. The engine met critical performance standards, including high-altitude operations up to 40,000 feet and demanding G-level maneuvers. Designed for rapid production, many engine components were additively manufactured or produced via high-volume techniques, enhancing speed, efficiency, and supply chain resilience for the USAF’s manned-unmanned teaming programs. As a result, MRO providers are seeing higher demand for specialized services that combine traditional maintenance expertise with cutting-edge digital solutions.

Market Restraints:

The global military aircraft MRO market faces a major challenge from high operational costs. Maintaining and repairing advanced military aircraft requires skilled labor, specialized equipment, and costly spare parts. Long maintenance cycles and complex overhauls further increase expenses. Additionally, fluctuating fuel prices, supply chain disruptions, and the need for compliance with strict safety regulations add financial pressure. Smaller militaries or independent MRO providers may find these costs prohibitive, limiting market expansion in certain regions. These high expenses can slow adoption of new technologies and services, acting as a restraint on overall market growth.

Socioeconomic Impact on Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market

The military aircraft MRO sector significantly contributes to job creation, supporting highly skilled engineers, technicians, and logistics professionals. Its activities bolster local economies near defense bases and manufacturing hubs. Efficient MRO services enhance national security by ensuring operational readiness of air forces, which also indirectly stabilizes regions. Investment in MRO technology drives innovation and industrial capabilities, fostering advancements in aerospace engineering and manufacturing. Moreover, defense contracts for MRO stimulate partnerships between governments and private enterprises, supporting research and development. The sector also influences training programs and educational institutions, creating a pipeline of specialized workforce for aerospace and defense industries globally.

Segmental Analysis:

- Fixed-Wing Fighter Aircraft segment is expected to witness the highest growth over the forecast period

The fixed-wing fighter aircraft segment is projected to experience the highest growth in the global military aircraft MRO market due to rising defense budgets and modernization programs across major military powers. These aircraft, critical for national security, require frequent maintenance, upgrades, and overhauls to maintain operational readiness and extend service life. Increasing investments in fifth-generation and advanced fighter platforms, along with heightened geopolitical tensions, are driving demand for specialized MRO services. Additionally, technological advancements in avionics, propulsion, and stealth systems necessitate sophisticated maintenance protocols, contributing to the expanding market for fixed-wing fighter aircraft MRO globally.

- Organizational-Level Maintenance (O-Level) segment is expected to witness the highest growth over the forecast period

Organizational-Level Maintenance (O-Level) is anticipated to lead growth in the military aircraft MRO market, as it encompasses routine inspections, repairs, and preventive maintenance performed directly by operational units. The O-Level approach ensures immediate aircraft availability, minimizes downtime, and addresses minor defects before escalation. With increasing fleet sizes and deployment of advanced aircraft, militaries are prioritizing O-Level maintenance to sustain readiness and mission capability. The growing complexity of modern military aircraft, combined with defense forces’ focus on reliability and operational efficiency, is intensifying the need for structured O-Level maintenance programs, making this segment a high-growth driver in the coming years.

- Independent MRO Providers segment is expected to witness the highest growth over the forecast period

The independent MRO providers segment is projected to register the highest growth in the military aircraft maintenance market due to cost efficiency, flexibility, and specialized service offerings. Independent providers complement OEM services, offering scalable solutions without long-term contractual dependencies. Many defense organizations are outsourcing maintenance to reduce operational costs, extend aircraft lifecycles, and leverage advanced diagnostic and repair technologies. The rising adoption of public-private partnerships, combined with a growing number of aging fleets requiring upgrades and maintenance, positions independent MRO providers as a key growth driver. Their ability to offer rapid turnaround times, specialized expertise, and customized maintenance packages is fueling market expansion globally.

- Performance-Based Logistics (PBL) segment is expected to witness the highest growth over the forecast period

Performance-Based Logistics (PBL) is forecasted to experience significant growth in military aircraft MRO due to its focus on outcomes rather than individual services. PBL contracts tie payments to aircraft availability, reliability, and performance metrics, incentivizing service providers to optimize maintenance schedules, spare parts provisioning, and system readiness. Defense forces are increasingly adopting PBL to reduce lifecycle costs, enhance operational efficiency, and ensure fleet readiness under budget constraints. The shift from traditional maintenance contracts to performance-oriented models, coupled with the growing adoption of advanced analytics and predictive maintenance technologies, is driving robust growth for the PBL segment, making it a pivotal component of modern military logistics strategies.

- North America Region is expected to witness the highest growth over the forecast period

North America is anticipated to lead growth in the global military aircraft MRO market due to significant defense spending, a large fleet of advanced military aircraft, and the presence of leading aerospace and defense companies. The U.S. Department of Defense continues to invest in fleet modernization, upgrades, and advanced MRO technologies to maintain operational superiority. The region also benefits from a well-established industrial base, advanced manufacturing capabilities, and cutting-edge maintenance infrastructure.

Rising geopolitical tensions and the adoption of performance-based logistics and predictive maintenance solutions further drive demand. Also, North America’s robust defense ecosystem, coupled with increasing partnerships between OEMs and independent MRO providers, positions it as the fastest-growing regional market. For instance, in November 2025, Palladyne AI Corp. acquired GuideTech LLC and two Crucis companies, forming a new division called Palladyne Defense. By combining AI-driven drone systems, advanced engineering, and U.S.-based manufacturing, the division quickly began delivering programs and scalable production. This move boosted the Global Military Aircraft MRO market by bringing in smarter, more efficient maintenance technologies, supporting modernization, and reshoring critical defense manufacturing, ultimately improving aircraft readiness and reducing costs.

Thus, such factors together are driving the above market’s growth in this region.

To Learn More About This Report - Request a Free Sample Copy

Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Competitive Landscape

The global military aircraft MRO market is very competitive, with big defense companies and specialized independent providers leading the way. Some of the major names include Lockheed Martin, Boeing, Northrop Grumman, Safran, Rolls-Royce, BAE Systems, General Electric, and MTU Aero Engines. These companies compete by offering services like engine overhauls, airframe repairs, avionics upgrades, and aircraft modernization. Building strong partnerships with governments and securing long-term contracts give them an edge.

The major players for the above market are:

- Lockheed Martin Corporation

- The Boeing Company (Defense, Space & Security)

- Northrop Grumman Corporation

- BAE Systems plc

- Rolls Royce plc (Defense)

- Safran SA

- Thales Group

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- Textron Inc. (including Bell)

- Honeywell International Inc.

- Elbit Systems Ltd.

- Airbus Defence and Space

- Korean Air Aerospace Division (KAL ASD)

- ST Engineering Aerospace

- RUAG Aviation

- Israel Aerospace Industries (IAI) – Bedek MRO division

- AAR Corporation

- Hindustan Aeronautics Limited (HAL)

- AMMROC (Advanced Military Maintenance, Repair, and Overhaul Center)

Recent Development

- In February 2025, GE Aerospace signed a five-year agreement with the Indian Air Force to handle the maintenance and repair of T700-GE-701D engines installed on AH-64E-I Apache helicopters. The goal of this contract is to improve engine availability, make maintenance operations more efficient, and ensure the Apache fleet remains mission-ready at all times.

- In February 2025, Safran Aircraft Engines and Abu Dhabi Aviation (ADA) signed a Strategic Memorandum of Understanding. This partnership focuses on boosting military aviation maintenance capabilities and expanding international cooperation, aiming to strengthen the aerospace MRO sector in the region.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The main driver is increasing global geopolitical instability which demands high fleet readiness and maintenance efficiency. Growth is also fueled by ongoing military aircraft modernization and life extension programs for aging fighter, transport, and reconnaissance fleets. Governments are focusing on maximizing the operational lifespan of existing assets due to the immense cost of new platforms, ensuring consistent demand for MRO services.

Q2. What are the main restraining factors for this market?

A significant restraint is the cyclical nature of government defense budgets, leading to unpredictable MRO spending and program delays. The market also suffers from a chronic shortage of highly skilled technicians who require strict security clearances to work on sensitive defense platforms. Finally, the proprietary nature of Original Equipment Manufacturer (OEM) technology and spare parts creates monopolies, inflating service costs.

Q3. Which segment is expected to witness high growth?

The Fixed-Wing Fighter Aircraft Segment is expected to witness the highest growth. This is driven by massive, long-term maintenance contracts for new-generation stealth fighters, such as the F-35, globally. Furthermore, extensive life-extension programs for workhorse platforms like the F-16 and aging bombers require complex structural overhauls and avionics upgrades. This segment commands the highest average contract value, ensuring revenue expansion.

Q4. Who are the top major players for this market?

The market is dominated by large Original Equipment Manufacturers (OEMs) that hold the intellectual property for their platforms. Top players include Lockheed Martin, Boeing Defense, and BAE Systems. They often operate through long-term performance-based logistics (PBL) contracts directly with governments. Specialized independent providers, like ST Engineering Aerospace, also play a key role by offering comprehensive maintenance solutions for military transport and training fleets globally.

Q5. Which country is the largest player?

The United States is the largest country player, both as a service provider and a consumer. This dominance is due to its immense active military fleet size, the world's largest defense budget, and a sophisticated, multi-tiered MRO infrastructure run by both the military and major contractors. U.S. defense policy also often mandates that foreign buyers of U.S. aircraft (Foreign Military Sales) procure specialized MRO services from U.S. contractors.

List of Figures

Figure 1: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Military Aircraft Maintenance, Repair, and Overhaul (MRO) Market Revenue (USD Billion) Forecast, by Country, 2018-2029