Automotive Mirror Actuator Market Overview and Analysis

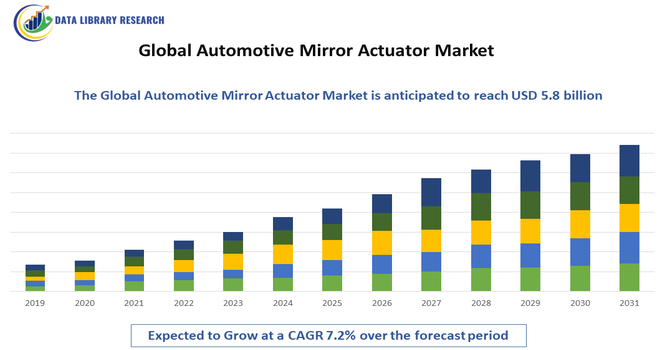

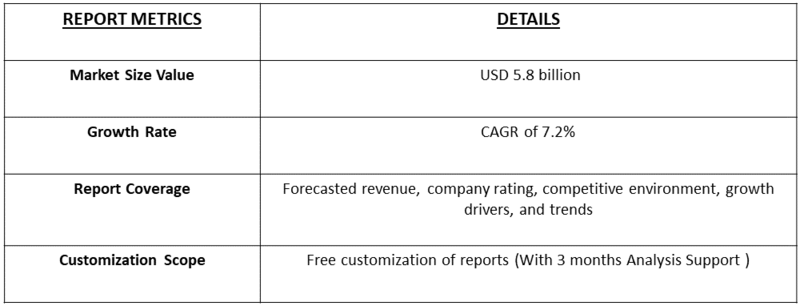

- The market is projected to reach around USD 5.8 billion by 2032, from USD 1.2 billion in 2025. The market is forecasted to expand at a healthy rate, with a CAGR of 7.2% over the forecast period, 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Automotive Mirror Actuator Market is experiencing steady growth, driven by the increasing adoption of advanced driver assistance systems (ADAS), rising vehicle production, and the growing demand for comfort and safety features in modern automobiles. The integration of powered and automated mirror systems in both passenger and commercial vehicles has become a key differentiating feature as automotive manufacturers continue to focus on enhancing driver convenience and reducing blind spots.

Automotive Mirror Actuator Market Latest Trends:

The Global Automotive Mirror Actuator market’s latest trends center on the rapid shift from purely mechanical actuators toward electronically controlled, smart mirror systems—driven chiefly by ADAS integration and the rise of camera-based/virtual exterior mirrors that demand precise, compact actuation and electronic control. Manufacturers are increasingly offering power-folding and memory-position actuators as standard or optional features, raising actuator complexity and creating demand for higher-reliability, miniaturized motors and gear trains.

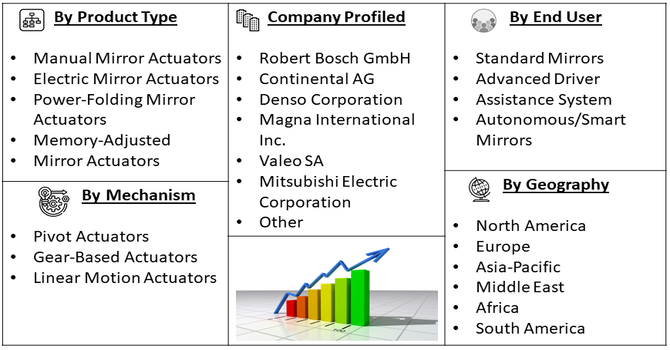

Segmentation: Global Automotive Mirror Actuator Market is segmented By Type (Manual Mirror Actuators, Electric Mirror Actuators, Power-Folding Mirror Actuators, and Memory-Adjusted Mirror Actuators), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), Mechanism (Pivot Actuators, Gear-Based Actuators, and Linear Motion Actuators), End-Use Feature (Standard Mirrors, Advanced Driver Assistance System, and Autonomous/Smart Mirrors), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Focus on Vehicle Safety and Regulatory Compliance

The major drivers for the Global Automotive Mirror Actuator Market is the increasing emphasis on road safety, supported by strict government regulations mandating the inclusion of advanced visibility and safety-enhancing components in vehicles.

Automotive mirror actuators enable power adjustment, folding, and precise positioning of mirrors, which is essential for reducing blind spots and improving driver visibility. For instance, in April 2025, the launch of Hyundai’s all-new NEXO FCEV had strengthened the Automotive Mirror Actuator sector by reinforcing the need for advanced, reliable components in next-generation zero-emission vehicles. Its emphasis on safety, efficiency, and cutting-edge technology had encouraged automakers to adopt high-precision actuators that support enhanced visibility features. At the same time, NEXO’s compliance with strict environmental and safety standards had pushed suppliers to develop actuator systems that met rising regulatory expectations and vehicle safety requirements.

- Rising Adoption of Electric and Autonomous Vehicles

The shift toward electrification and vehicle automation is another significant growth driver, as next-generation electric and autonomous vehicles increasingly replace traditional manual mirror systems with advanced electronic mirror actuators and digital camera-based side mirrors.

EV manufacturers prioritize lightweight, compact, and energy-efficient actuators to optimize vehicle aerodynamics and extend driving range, which boosts demand for miniaturized and high-performance actuator technologies. For instance, March 2025, TATA.ev’s launch of its EV portfolio in Mauritius had supported growth in the Automotive Mirror Actuator market by increasing demand for reliable, electronically integrated components suited to advanced EV platforms. With models like the Tiago.ev, Punch.ev, and Nexon.ev offering high-voltage architectures and strong safety features, automakers had prioritized smarter, more durable actuators. This expansion also reflected the rising global adoption of electric and autonomous vehicles, further accelerating innovation and integration in mirror actuator technologies.

Market Restraints:

- High Cost of Advanced Mirror Actuator Systems

The increasing integration of electronic, memory, and smart actuator technologies—such as power-folding mirrors, camera-based systems, and ADAS-enabled actuators—raises the overall cost of vehicles. This cost factor is particularly challenging in emerging markets, where price sensitivity is high and mid-range or budget vehicles dominate. Consumers and OEMs may hesitate to adopt high-end actuator systems due to the added manufacturing, maintenance, and replacement costs, which can restrain large-scale penetration in cost-sensitive segments.

Socio Economic Impact on Automotive Mirror Actuator Market

The Global Automotive Mirror Actuator Market has a noticeable socioeconomic impact because it helps drive safety, jobs, and industrial growth around the world. As cars become smarter and more advanced, the need for better mirror actuators increases, which encourages companies to invest in new technology and hire skilled workers. This growth also benefits related industries like electronics and plastics, creating more opportunities in both developed and developing countries. Better mirror systems contribute to road safety, which can reduce accident-related costs for society. At the same time, the industry brings new manufacturing activity to emerging regions, helping strengthen local economies. However, as technology becomes more automated, some traditional jobs may change or decline, pushing the workforce toward more specialized, tech-focused roles.

Segmental Analysis

- Electric mirror actuators segment is expected to witness highest growth over the forecast period

Electric mirror actuators are witnessing significant growth due to their ability to provide precise, motorized adjustment of side and rearview mirrors. These actuators enhance driver convenience by allowing remote adjustment, power folding, and integration with memory settings. The rising adoption of ADAS and safety-oriented features, such as blind-spot detection, further fuels demand for electric actuators. Their compatibility with modern electronic systems makes them a preferred choice in both mid-range and premium passenger vehicles, contributing significantly to market value.

- Passenger Cars segment is expected to witness highest growth over the forecast period

Passenger cars account for the largest share in the automotive mirror actuator market. Increasing consumer demand for comfort, convenience, and safety features, including power-folding, heated, and memory-adjusted mirrors, is driving growth in this segment. Moreover, the proliferation of electric and hybrid passenger vehicles, which often incorporate advanced electronic mirror systems, further strengthens market adoption. OEMs are progressively integrating smart mirror actuators as standard features, particularly in mid-to-high-end passenger vehicles.

- Gear-Based Actuators segment is expected to witness highest growth over the forecast period

Gear-based actuators dominate the market due to their reliability, compact design, and cost-effectiveness. These actuators provide smooth and accurate mirror movement, which is essential for precise positioning in powered and memory-adjustable mirrors. They are widely used across passenger cars and light commercial vehicles, making them a key contributor to market value. Additionally, gear-based actuators can be easily integrated with electric motors and electronic control systems, supporting advanced functionalities like auto-folding and ADAS compatibility.

- Advanced Driver Assistance System (ADAS) Mirrors segment is expected to witness highest growth over the forecast period

ADAS-enabled mirrors are increasingly being adopted to enhance vehicle safety and reduce accidents. These mirrors integrate sensors, cameras, and actuators to assist with lane changes, blind-spot detection, and parking. The growth of autonomous and semi-autonomous vehicles is accelerating the deployment of ADAS mirrors, driving demand for reliable and responsive actuators. This segment contributes significantly to market growth as OEMs prioritize safety and regulatory compliance across global markets.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth in the Global Automotive Mirror Actuator Market over the forecast period, driven by a combination of technological advancements, regulatory initiatives, and increasing consumer demand for enhanced vehicle safety and convenience features.

The region has a mature automotive industry, with the United States and Canada serving as major hubs for vehicle manufacturing, research, and development. For instance, July 2025, BMW i Ventures’ investment in Estes Energy Solutions had supported the North American Automotive Mirror Actuator market by accelerating EV adoption through improved battery technology and local manufacturing. As Estes advanced its flexible battery platform, demand grew for EVs equipped with integrated, sensor-ready components. This shift had increased the need for durable, electronically compatible mirror actuators suited to autonomous-focused vehicle designs across the region.

Automotive manufacturers in North America are increasingly integrating advanced mirror actuator systems into both passenger and commercial vehicles, including power-folding, memory-adjusted, heated, and electronically controlled mirrors. These systems not only enhance driver comfort but also play a critical role in improving vehicle safety by reducing blind spots, assisting in lane changes, and supporting collision avoidance technologies.

To Learn More About This Report - Request a Free Sample Copy

Automotive Mirror Actuator Market Competitive Landscape:

The global automotive mirror actuator market is highly competitive, comprising a mix of large Tier 1 suppliers, specialized actuator manufacturers, and automotive systems integrators. Companies in this space are investing heavily in R&D to develop more energy-efficient, compact, and integrated actuators—capable of supporting advanced features like power-folding, memory positioning, and ADAS compatibility. To maintain their competitive edge, manufacturers are also focusing on improving the reliability and durability of their actuator assemblies, reducing noise and vibration, and optimizing them for integration with electronic control units and software-based mirror control systems. Cost pressures in emerging markets, coupled with the rising demand for premium features in developed markets, are pushing companies to balance innovation with scalability.

Key Players:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Magna International Inc.

- Valeo SA

- Gentex Corporation

- Ficosa International S.A.

- Mitsubishi Electric Corporation

- ZF Friedrichshafen AG

- Honda Lock Manufacturing Co.

- Murakami Corporation

- Hella GmbH & Co. KGaA

- Tokai Rika Co., Ltd.

- Samvardhana Motherson International Ltd.

- Ichikoh Industries, Ltd.

- SL Corporation

- MEKRA Lang GmbH & Co. KG

- Johnson Electric Holdings Ltd.

- OECHSLER AG

- EM Kunststofftechnik GmbH

Recent Development

- In September 2025, Continental’s AUMOVIO 3D head-up display had reduced the Global Automotive Mirror Actuator Market’s relevance by replacing traditional mirror-based projection systems with compact, advanced digital displays. By cutting installation space by up to 50% and offering more realistic AR visuals, it shifted industry interest toward integrated visualization technologies over mechanical actuators, lowering demand for some actuator components and pushing manufacturers to invest more in sensor-driven display innovations.

- In January 2025, collaboration between Qualcomm Technologies and Alps Alpine had influenced the Global Automotive Mirror Actuator Market by accelerating the shift toward digitally enhanced, AI-driven cabin systems. By integrating the latest Snapdragon Cockpit platform to power personalized and intelligent in-cabin experiences, automakers increasingly prioritized advanced display and sensor solutions over traditional mechanical components. This trend had reduced reliance on some mirror actuator technologies while pushing suppliers to adapt, innovate, and align their products with next-generation digital cockpit architectures.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary growth drivers are the increasing focus on vehicle safety and the proliferation of Advanced Driver Assistance Systems (ADAS). Actuators are vital for automating mirror adjustments and enabling features like blind-spot detection and automatic folding, which are now standard or highly desired. Additionally, the increasing global production and adoption of electric vehicles (EVs) are boosting demand for these high-tech components.

Q2. What are the main restraining factors for this market?

The key restraint is the high cost associated with integrating complex, automated mirror systems, such as power-folding and smart mirrors, into vehicles. These sophisticated features often increase overall vehicle manufacturing costs. Furthermore, the varying and often stringent safety regulations set by different governing bodies worldwide create compliance challenges and increased development hurdles for manufacturers.

Q3. Which segment is expected to witness high growth?

The passenger cars segment is anticipated to experience the highest growth rate. This is largely due to the sheer volume of passenger vehicle production globally compared to commercial vehicles. Consumers in this segment increasingly expect advanced convenience and safety features, such as powered adjustment and auto-dimming functionality, directly driving up the demand for mirror actuators.

Q4. Who are the top major players for this market?

The market is dominated by global Tier 1 automotive suppliers. The top major players include Magna International Inc., Gentex Corporation, Samvardhana Motherson Reflectec (SMR), and Ficosa International S.A. These companies invest heavily in research and development to integrate complex electronics, such as electrochromic and camera systems, into the mirror assemblies they supply to car manufacturers.

Q5. Which country is the largest player?

United States, in North America is projected to see significant growth in the Global Automotive Mirror Actuator Market, driven by increasing adoption of electric and autonomous vehicles, stringent safety regulations, and advanced automotive technology integration. Strong investments in smart cockpit systems and sensor-based components have further accelerated demand for high-precision, electronically controlled mirror actuators.

List of Figures

Figure 1: Global Automotive Mirror Actuator Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Automotive Mirror Actuator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Automotive Mirror Actuator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Automotive Mirror Actuator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Automotive Mirror Actuator Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Automotive Mirror Actuator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Automotive Mirror Actuator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Automotive Mirror Actuator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Automotive Mirror Actuator Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Automotive Mirror Actuator Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Automotive Mirror Actuator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Automotive Mirror Actuator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Automotive Mirror Actuator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Automotive Mirror Actuator Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Automotive Mirror Actuator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Automotive Mirror Actuator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Automotive Mirror Actuator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Automotive Mirror Actuator Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Automotive Mirror Actuator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Automotive Mirror Actuator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Automotive Mirror Actuator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Automotive Mirror Actuator Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Automotive Mirror Actuator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Automotive Mirror Actuator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Automotive Mirror Actuator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Automotive Mirror Actuator Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Automotive Mirror Actuator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model