BSM Units Market Overview and Analysis:

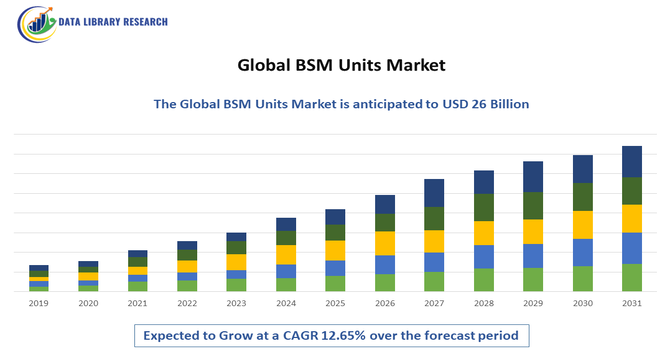

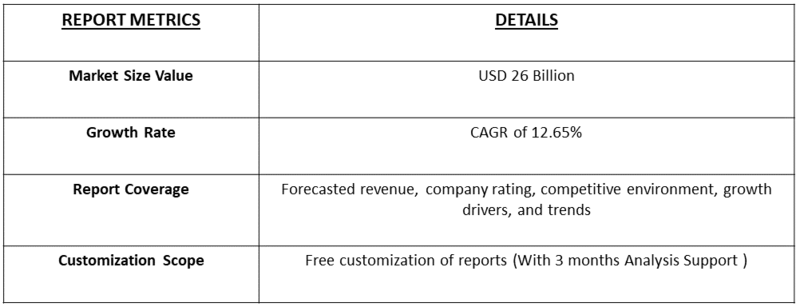

- The market is projected to reach USD 26 Billion in 2025 to USD 85 billion by 2035, expanding at a robust CAGR of 12.65%, from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Blind Spot Monitoring (BSM) Units Market is experiencing strong growth, driven primarily by the increasing focus on vehicle safety, rising road accident rates, and regulatory pressure pushing the adoption of advanced driver assistance systems (ADAS). Growing consumer awareness of vehicle safety features and the shift toward smart mobility solutions are accelerating the integration of BSM units, particularly in mid-range and entry-level passenger vehicles, where such technologies were previously limited. The expansion of electric and autonomous vehicle production further strengthens market demand, as BSM units are essential components within automated safety architectures.

BSM Units Market Latest Trends:

The Global Chronic Pain Topical Analgesics Market is being shaped by several key trends that reflect shifts in consumer behaviour, technological advancement, and distribution strategies. A major trend is the growing demand for non-opioid and localized pain-relief options—topical gels, patches, and creams are increasingly preferred because they target specific areas, avoid systemic side-effects, and align with the “safer pain-management” narrative. Innovations in drug-delivery and formulation, such as hydrogel carriers, nano-emulsions, transdermal patches, and penetrating agents, are enhancing product performance and user experience.

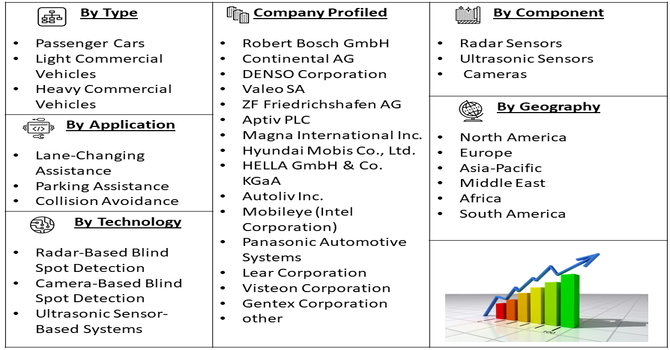

Segmentation: Global BSM Units Market is segmented By Component (Radar Sensors, Ultrasonic Sensors, Cameras), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Technology (Radar-Based Blind Spot Detection, Camera-Based Blind Spot Detection, Ultrasonic Sensor-Based Systems), Application (Lane-Changing Assistance, Parking Assistance, Collision Avoidance), End User (Private Vehicle Owners, Fleet and Transportation Operators, Government and Defense Mobility), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Regulatory Mandates for Vehicle Safety Systems

The strongest drivers of the Global BSM Units Market is the increasing number of government regulations and safety mandates targeting advanced driver assistance systems (ADAS) to reduce road accidents.

Regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA), the European Commission, and New Car Assessment Programs (NCAPs) are pushing automakers to integrate blind spot detection and similar safety technologies as standard rather than optional features. For instance, in May 2023, Porsche’s partnership with Mobileye to integrate the SuperVision driver assistance system advanced hands-off driving, lane changing, collision avoidance, and blind spot detection, indirectly boosting the global BSM units market by increasing demand for precise body surface mapping and sensor integration in luxury vehicles. As these mandates expand globally, automakers are accelerating large-scale adoption of BSM units in both ICE and electric vehicles to ensure regulatory compliance and improve safety ratings, driving significant market growth.

- Growing Consumer Demand for Enhanced Safety and Driver Assistance Technologies

Increasing awareness among consumers about road safety, rising vehicle ownership, and a heightened focus on preventing collision-related injuries have dramatically boosted the demand for vehicles equipped with BSM systems. Blind spot monitoring technology plays a critical role in preventing lane-changing accidents, collisions with motorcycles, and side-impact crashes—scenarios increasingly common in dense traffic environments.

As buying preferences shift toward vehicles offering smarter safety features, even mid-range and compact models now incorporate BSM units, which were once restricted to premium vehicles. For instance, in February 2023, Tata Motors’ launch of the Harrier and Safari dark editions with ADAS features, including blind spot detection and emergency braking, contributed to growth in the global BSM units market by driving adoption of advanced safety and monitoring systems in compact SUVs.

Market Restraints:

- High Cost Associated with Advanced Sensing Modules, Radar Systems

The primary challenges is the high cost associated with advanced sensing modules, radar systems, and integration with existing vehicle electronics, which makes these systems less accessible in entry-level and budget vehicle segments, especially in price-sensitive emerging markets. Additionally, complex calibration and maintenance requirements, particularly after repairs or sensor misalignment due to accidents or weather conditions, can increase ownership and service costs, reducing consumer willingness to invest in such technologies.

Socio Economic Impact on BSM Units Market

The BSM (Body Surface Mapping) units market has a notable socioeconomic impact by improving healthcare efficiency and patient outcomes. These advanced diagnostic tools help doctors monitor and analyze skin and neurological conditions more accurately, reducing misdiagnoses and unnecessary treatments. This leads to faster recovery, lower healthcare costs, and less strain on medical facilities. As BSM technology becomes more accessible, it supports early intervention and preventive care, improving quality of life for patients. Additionally, the market creates jobs in manufacturing, research, and clinical services, stimulating economic growth. Thus, BSM units contribute to healthier communities while easing financial and societal burdens associated with chronic health conditions.

Segmental Analysis:

- Radar Sensors segment is expected to witness highest growth over the forecast period

Radar sensors dominate the component segment due to their high accuracy, long-range detection capabilities, and ability to perform reliably in low-visibility conditions such as rain, fog, and darkness. Their essential role in enabling real-time object tracking and safety alerts makes radar the preferred technology for OEM-installed blind spot monitoring systems, especially in modern ADAS-integrated vehicles.

- Passenger Cars segment is expected to witness highest growth over the forecast period

Passenger cars represent the largest segment due to rising consumer demand for safety features, growing middle-class vehicle ownership, and increasing integration of ADAS in mass-market and compact models. With automakers increasingly positioning BSM units as a safety standard rather than a premium add-on, adoption continues to grow rapidly in both conventional and electric passenger vehicles.

- Based Blind Spot Detection segment is expected to witness highest growth over the forecast period

Radar-based blind spot detection leads the technology segment, backed by its superior detection accuracy, wide operational range, and capability to support real-time analysis of surrounding vehicle movement. As automotive platforms evolve toward semi-autonomous driving systems, radar-based BSM technology is becoming foundational to advanced safety and perception systems.

- Lane-Changing Assistance segment is expected to witness highest growth over the forecast period

Lane-changing assistance is the dominant application category as blind spot monitoring plays a critical role in reducing collisions caused by driver visibility limitations and unsafe lane transitions. Increasing traffic density, multilane highway infrastructure, and safety-focused driving features continue to boost demand for BSM systems within this application area.

- Private Vehicle Owners segment is expected to witness highest growth over the forecast period

Private vehicle owners constitute the largest end-user segment due to rising personal vehicle purchases and growing preference for driver-assistance technologies that enhance safety and convenience. The adoption of aftermarket retrofitting kits and the availability of budget-friendly BSM upgrades further support strong penetration in this category.

- Asia-Pacific segment is expected to witness highest growth over the forecast period

The Asia-Pacific segment is expected to witness the highest growth in the global BSM (Body Surface Mapping) units market over the forecast period due to rising healthcare investments, increasing awareness of advanced diagnostic technologies, and a growing prevalence of chronic diseases in the region.

Countries such as China, India, and Japan are rapidly expanding their healthcare infrastructure, driving demand for innovative diagnostic tools like BSM units. For instance, in January 2023, NXP’s 28-nanometer RFCMOS radar-on-chip for ADAS and autonomous driving enabled enhanced safety applications like automatic emergency braking and blind spot detection, supporting the global BSM units market by facilitating integration of high-precision sensor technologies in next-generation vehicles.

Additionally, government initiatives promoting early detection and preventive healthcare, along with the rising number of hospitals and specialized clinics, are further fueling market adoption. Increasing patient awareness and affordability of medical technologies in urban and semi-urban areas are also contributing to strong regional growth.

To Learn More About This Report - Request a Free Sample Copy

BSM Units Market Competitive Landscape:

The competitive landscape for Blind Spot Monitoring (BSM) units is led by major automotive Tier-1 suppliers, sensor and semiconductor manufacturers, and specialist ADAS technology firms competing on sensor performance, sensor fusion, system integration, cost, and OEM partnerships.

Key Players:

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Valeo SA

- ZF Friedrichshafen AG

- Aptiv PLC

- Magna International Inc.

- Hyundai Mobis Co., Ltd.

- HELLA GmbH & Co. KGaA

- Autoliv Inc.

- Mobileye (Intel Corporation)

- Panasonic Automotive Systems

- Lear Corporation

- Visteon Corporation

- Gentex Corporation

- Sensata Technologies

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- Veoneer, Inc.

Recent Development:

- In May 2025, AUMOVIO celebrated producing 200 million radar sensors, reflecting its leading position in automotive safety technology and accelerating advanced driver assistance systems (ADAS) development. This rapid technological progress and growing demand for vehicle safety features indirectly influenced the global BSM units market by driving innovation in body surface mapping and sensor integration. Additionally, EUR 1.5 billion in series orders from vehicle manufacturers signaled strong market growth, with production planned for 2026 and 2027.

- In April 2025, Hyundai Motor introduced the all-new NEXO at the Seoul Mobility Show 2025, showcasing advancements in hydrogen mobility and mid-size SUV design. With improved powertrain efficiency, towing capability, and enhanced interior comfort, the vehicle demonstrated the integration of advanced automotive technologies. This innovation indirectly influenced the global BSM units market by increasing demand for body surface mapping and sensor systems, as automakers incorporated more sophisticated safety, performance, and monitoring features in next-generation fuel cell electric vehicles.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary drivers are increasingly strict government safety regulations across major regions, which mandate the inclusion of Advanced Driver Assistance Systems (ADAS). This is complemented by strong consumer demand for enhanced safety features in both passenger cars and commercial vehicles. Furthermore, the global rise in vehicle production and preference for connected and semi-autonomous vehicles boosts adoption.

Q2. What are the main restraining factors for this market?

The market is mainly restrained by the high initial cost and complexity of integrating BSM systems, which can limit their inclusion in lower-end vehicle models. Additionally, the performance of the radar and camera sensors can be negatively impacted by severe weather conditions, such as heavy rain or snow, leading to reduced efficiency and reliability.

Q3. Which segment is expected to witness high growth?

The Passenger Car segment currently holds the largest share and continues to drive growth due to high consumer adoption rates and widespread integration by OEMs. However, the Commercial Vehicle segment, including heavy-duty trucks, is expected to witness lucrative growth due to specific government mandates focused on improving the safety of large vehicles.

Q4. Who are the top major players for this market?

The BSM market is dominated by large automotive technology and component suppliers. The top major players include Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, and Magna International Inc. These companies focus on continuous innovation in radar and sensor technology to enhance system accuracy and integration.

Q5. Which country is the largest player?

The Asia-Pacific region, led by countries like China and Japan, currently holds the largest market share due to its massive vehicle production volume and rapid adoption of ADAS technologies. However, Europe and North America also represent significant markets, driven by stringent regulatory frameworks and high consumer spending on safety features.

List of Figures

Figure 1: Global BSM Units Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global BSM Units Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global BSM Units Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global BSM Units Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global BSM Units Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America BSM Units Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America BSM Units Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America BSM Units Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America BSM Units Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America BSM Units Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America BSM Units Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America BSM Units Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America BSM Units Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America BSM Units Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America BSM Units Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America BSM Units Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe BSM Units Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe BSM Units Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe BSM Units Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe BSM Units Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe BSM Units Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe BSM Units Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe BSM Units Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe BSM Units Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe BSM Units Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe BSM Units Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific BSM Units Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific BSM Units Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific BSM Units Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific BSM Units Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific BSM Units Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific BSM Units Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific BSM Units Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific BSM Units Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific BSM Units Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa BSM Units Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa BSM Units Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa BSM Units Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa BSM Units Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa BSM Units Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa BSM Units Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa BSM Units Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa BSM Units Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global BSM Units Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global BSM Units Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global BSM Units Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global BSM Units Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America BSM Units Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America BSM Units Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America BSM Units Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America BSM Units Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe BSM Units Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe BSM Units Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe BSM Units Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe BSM Units Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America BSM Units Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America BSM Units Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America BSM Units Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America BSM Units Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific BSM Units Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific BSM Units Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific BSM Units Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific BSM Units Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa BSM Units Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa BSM Units Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa BSM Units Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa BSM Units Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model