Customized Luxury Stays Tour Packages Market Overview and Analysis:

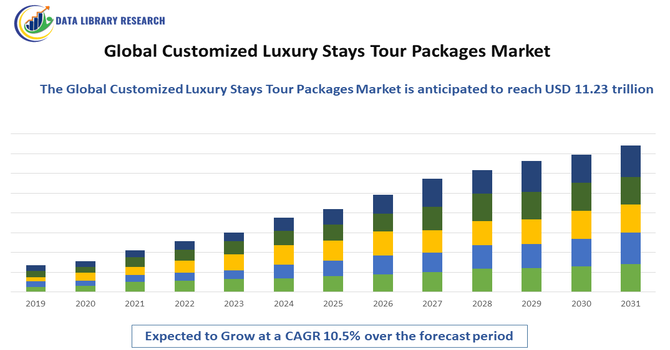

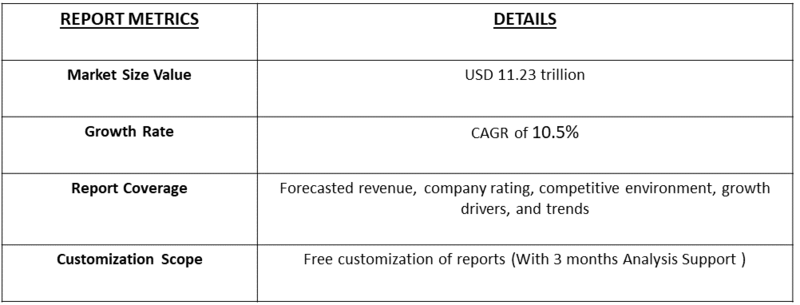

- The Global Customized Luxury Stays Tour Packages Market size was valued at USD 2.12 trillion in 2025, and the market is projected to reach USD 11.23 trillion in 2032, growing with a CAGR of 10.5% during the forecast period of 2025–2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Customized Luxury Stays Tour Packages Market is witnessing strong growth, driven by the rising preference for highly personalized and immersive travel experiences among affluent consumers. High-net-worth individuals increasingly seek bespoke hospitality offerings that combine premium accommodation with curated beverage experiences such as wine, champagne, whiskey, and craft cocktail tastings. Growth in experiential luxury tourism, coupled with increasing disposable incomes and evolving lifestyle aspirations, is fueling demand for customized stay packages tailored to individual tastes and occasions.

Customized Luxury Stays Tour Packages Market Latest Trends:

The Global Customized Luxury Stays Tour Packages Market is being reshaped by evolving consumer preferences and innovative hospitality offerings. A major trend is the rise of hyper-personalization, where luxury properties tailor Tour experiences—such as wine, craft spirits, and rare vintage tastings—based on guest profiles, taste preferences, and special occasions. Digital concierge services and AI-enabled recommendation engines are enhancing this customization, making it easier for travelers to design bespoke beverage experiences before arrival. Another trend is the integration of experiential luxury travel, where Tour packages are combined with immersive activities like guided vineyard tours, mixology masterclasses, and curated culinary pairings.

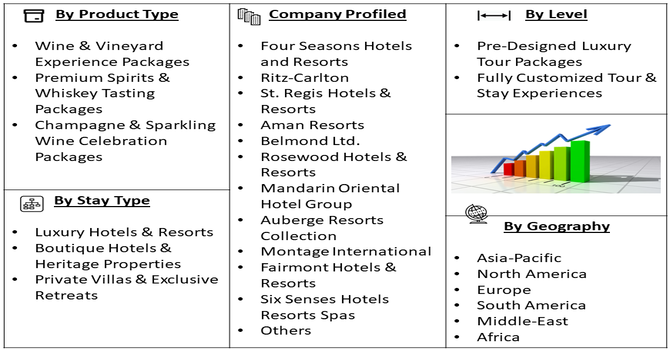

Segmentation: Global Customized Luxury Stays Tour Packages Market is segmented By Package Type (Wine & Vineyard Experience Packages, Premium Spirits & Whiskey Tasting Packages, Champagne & Sparkling Wine Celebration Packages), Stay Type (Luxury Hotels & Resorts, Boutique Hotels & Heritage Properties, Private Villas & Exclusive Retreats), Customization Level (Pre-Designed Luxury Tour Packages, Fully Customized Tour & Stay Experiences), Occasion Type (Leisure & Experiential Travel, Honeymoons & Romantic Getaways, Corporate Retreats & Executive Stays), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Experiential and Personalized Luxury Travel

A key driver of the Global Customized Luxury Stays Tour Packages Market is the growing preference among affluent travelers for experiential and highly personalized hospitality offerings. High-net-worth individuals increasingly seek unique, immersive experiences that go beyond standard luxury accommodations, combining premium stays with curated beverage journeys such as wine tastings, rare spirit samplings, and bespoke cocktail experiences. Customized Tour packages allow guests to tailor their stay according to personal tastes, cultural preferences, and special occasions, enhancing emotional engagement and perceived value. This shift toward experience-driven luxury travel is encouraging hotels and resorts to innovate and expand customized Tour offerings, significantly driving market growth.

- Expansion of Luxury Hospitality and Premium Beverage Collaborations

The increasing collaboration between luxury hotels, resorts, and premium beverage brands is another major driver of market growth. Strategic partnerships with renowned wineries, distilleries, and champagne houses enable hospitality providers to offer exclusive, high-end Tour experiences that cannot be easily replicated. These collaborations enhance brand prestige, attract affluent clientele, and create differentiated offerings in a competitive luxury travel market. Additionally, growing investments in luxury tourism infrastructure, particularly in emerging destinations, are expanding the availability of customized Tour packages. This convergence of luxury accommodation and premium beverage experiences continues to strengthen demand and market expansion globally.

Market Restraints:

- High Cost Structure and Limited Affordability

The major restraints in the Global Customized Luxury Stays Tour Packages Market is the high cost associated with delivering bespoke luxury experiences. These packages often involve premium accommodations, rare or high-end alcoholic beverages, expert sommeliers or mixologists, and personalized concierge services, significantly increasing operational expenses. As a result, pricing remains accessible primarily to high-net-worth individuals, limiting the overall customer base. Economic slowdowns, inflation, or reduced discretionary spending among affluent travelers can further impact demand. This high cost structure restricts mass-market penetration and makes the market vulnerable to fluctuations in luxury travel spending patterns.

Socioeconomic Impact on Customized Luxury Stays Tour Packages Market

The Global Customized Luxury Stays Tour Packages Market created meaningful socioeconomic impacts by stimulating high-value tourism, premium hospitality employment, and localized supply chains. Personalized stay packages encouraged spending on boutique accommodations, culinary artisans, wellness providers, and cultural experiences, benefiting local economies. The market supported skilled jobs in hospitality design, digital marketing, and experience curation while attracting affluent travelers to emerging destinations. However, benefits were uneven, often favoring high-income regions and travelers. When aligned with sustainability and community partnerships, customized luxury stays promoted cultural preservation, responsible tourism, and inclusive economic growth, reinforcing experiential travel as a driver of modern luxury consumption worldwide.

Segmental Analysis:

- Wine & Vineyard Experience Packages segment is expected to witness the highest growth over the forecast period

Wine & Vineyard Experience Packages represent a prominent segment in the Global Customized Luxury Stays Tour Packages Market, driven by the growing popularity of wine tourism and experiential travel. These packages typically combine luxury accommodations with private vineyard tours, exclusive wine tastings, cellar experiences, and curated food pairings led by sommeliers. Affluent travelers are increasingly drawn to destinations offering authentic, region-specific wine experiences that blend leisure, education, and indulgence. The segment benefits from strong demand in established wine regions and emerging vineyard destinations, where luxury resorts collaborate with premium wineries to deliver bespoke experiences. As wine appreciation becomes closely linked with lifestyle travel, this segment continues to contribute significantly to overall market value.

- Luxury Hotels & Resorts segment is expected to witness the highest growth over the forecast period

Luxury Hotels & Resorts dominate the stay type segment due to their extensive infrastructure, brand reputation, and ability to deliver high-end, customized experiences at scale. These establishments offer sophisticated amenities, professional concierge services, and access to premium beverage collections, making them ideal for hosting customized Tour packages. Their global presence enables consistent service quality across regions, attracting high-net-worth travelers seeking reliability and exclusivity. Additionally, luxury resorts often partner with renowned beverage brands and employ expert sommeliers or mixologists to elevate guest experiences. Continuous investments in experiential offerings and personalization technologies further strengthen the role of luxury hotels and resorts as key revenue generators in this market.

- Fully Customized Tour & Stay Experiences segment is expected to witness the highest growth over the forecast period

Fully Customized Tour & Stay Experiences are witnessing strong demand as affluent travelers increasingly prioritize personalization and exclusivity. This segment allows guests to tailor every aspect of their stay, including beverage selection, tasting formats, dining pairings, and event settings. High-net-worth individuals value the ability to design unique experiences aligned with personal preferences, cultural tastes, or special occasions. Advances in digital concierge services and data-driven personalization tools enable hospitality providers to deliver seamless, bespoke offerings. Although these experiences command premium pricing, their high perceived value and emotional appeal drive strong adoption, making this segment a key contributor to market growth and profitability.

- Leisure & Experiential Travel segment is expected to witness the highest growth over the forecast period

Leisure & Experiential Travel represents a leading occasion type segment, supported by the shift toward experience-led luxury tourism. Travelers increasingly seek meaningful, immersive stays that combine relaxation with curated activities such as beverage tastings, culinary experiences, and cultural exploration. Customized Tour packages enhance leisure travel by adding an element of exclusivity and indulgence, appealing to affluent tourists looking for memorable experiences. This segment benefits from rising global travel, longer luxury stays, and growing interest in destination-based experiences. As leisure travelers prioritize quality over quantity, demand for tailored luxury stays with personalized Tour experiences continues to rise, strengthening this segment’s market position.

- North America region is expected to witness the highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period, driven by the strong presence of luxury hotels and resorts, high disposable incomes, and a well-established culture of experiential luxury travel. Affluent travelers in the region increasingly seek personalized stay packages that combine premium accommodations with curated beverage experiences such as wine tastings, craft spirits, and champagne celebrations.

In July 2025, TripMasters, a long-established leader in customizable travel, continued to offer flexible multi-city vacation planning, allowing travelers to personalize itineraries with up to 12 destinations and extended stays tailored to individual schedules, interests, and travel styles. This flexibility strengthened North America’s Customized Luxury Stays Tour Packages Market by reinforcing demand for highly personalized, multi-destination luxury travel experiences.

The growing popularity of destination getaways, corporate retreats, and experiential gifting further supports market expansion. Additionally, advanced digital booking platforms, concierge services, and strategic collaborations between hospitality providers and premium beverage brands are enhancing service customization and accessibility, positioning North America as a high-growth region in the global market.

To Learn More About This Report - Request a Free Sample Copy

Customized Luxury Stays Tour Packages Market Competitive Landscape:

The competitive landscape of the Global Customized Luxury Stays Tour Packages Market is characterized by a diverse mix of luxury hotel chains, boutique resorts, high-end travel experience curators, and premium beverage partners that together create bespoke hospitality offerings. Key players differentiate themselves through personalized service portfolios, exclusive partnerships with renowned wineries and distilleries, and digital concierge platforms that enhance guest engagement. Strategic focus on experiential travel, curated Tour experiences, and integrated stay packages are central to gaining market share. Many companies are investing in luxury amenities, signature tasting events, and customized itinerary design to attract affluent travelers seeking unique and memorable stays. Collaboration with regional artisans and global beverage brands further strengthens brand positioning and creates high-value offerings in a competitive and evolving market.

The major players for this market are:

- Four Seasons Hotels and Resorts

- Ritz-Carlton

- St. Regis Hotels & Resorts

- Aman Resorts

- Belmond Ltd.

- Rosewood Hotels & Resorts

- Mandarin Oriental Hotel Group

- Auberge Resorts Collection

- Montage International

- Fairmont Hotels & Resorts

- Six Senses Hotels Resorts Spas

- Banyan Tree Holdings

- Waldorf Astoria Hotels & Resorts

- The Luxury Collection (Marriott)

- Relais & Châteaux

- Shangri-La Hotels and Resorts

- Soneva

- Dorchester Collection

- The Leading Hotels of the World

- Peninsula Hotels

Recent Developments

- In December 2025, Fern Holidays International emerged as a dynamic entrant in the travel and hospitality sector, offering personalized domestic and international holiday solutions. The company focused on customized itineraries, seamless bookings, and premium services for diverse traveler segments. By moving beyond standard tour packages, it emphasized experience-led, customer-centric travel designed around individual preferences, budgets, and travel purposes, quickly gaining recognition within India’s tourism industry.

- In September 2025, InterContinental, within IHG Hotels & Resorts’ luxury and lifestyle portfolio, introduced the Doors Unlocked 2025 collection—curated, bookable packages granting guests privileged access to renowned global cultural events, including fashion weeks, design fairs, and film festivals across six major cities. The initiative elevated the Global Customized Luxury Stays Tour Packages Market by strengthening demand for exclusive, event-driven, and experience-focused luxury travel offerings.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because high-net-worth travelers now prioritize unique, "once-in-a-lifetime" experiences over standard hotel stays. Social media influence drives the demand for "Instagrammable" and exclusive locations. Additionally, the rise of remote work among the wealthy allows for longer, "work-from-anywhere" stays that require personalized services and high-end amenities.

Q2. What are the main restraining factors for this market?

Growth is limited by the high cost of providing bespoke services, which makes these packages exclusive to a very small group of people. Global political instability and fluctuating currency values can also disrupt travel plans. Furthermore, a shortage of highly trained staff capable of delivering "white-glove" service remains a challenge.

Q3. Which segment is expected to witness high growth?

The Private Villa and Estate Stays segment is expected to see the highest growth. Travelers are increasingly seeking privacy, safety, and seclusion away from crowded resorts. These packages often include private chefs, dedicated concierges, and customized itineraries, appealing to families and small groups looking for a secure, ultra-luxury environment.

Q4. Who are the top major players for this market?

The market is led by world-renowned luxury travel agencies and hospitality groups. Key players include Abercrombie & Kent, Aman Resorts, Belmond (LVMH), Four Seasons Hotels and Resorts, and Inspiring Travel Company. These organizations dominate by offering exclusive access to hidden locations and providing highly personalized, end-to-end travel management.

Q5. Which country is the largest player?

The United States is the largest player in the customized luxury stays market. This is due to its high number of billionaire and millionaire households with significant disposable income. American travelers are the leading spenders on premium international tours, driving the global demand for bespoke, high-end travel experiences and services.

List of Figures

Figure 1: Global Customized Luxury Stays Tour Packages Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Customized Luxury Stays Tour Packages Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Customized Luxury Stays Tour Packages Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Customized Luxury Stays Tour Packages Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Customized Luxury Stays Tour Packages Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model