Disposable Virus Sampling Kits Market Overview and Analysis

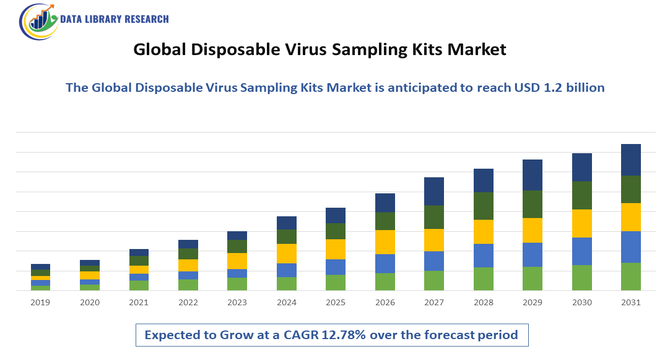

The Global Disposable Virus Sampling Kits Market is currently valued at USD 476.23 Million in 2025 and is expected to reach USD 1.2 Billion by 2033. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.78% between 2025 and 2032, driven by advancements in collection methods and preparedness for future outbreaks.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Disposable Virus Sampling Kits Market is experiencing steady growth, driven by the rising demand for efficient and reliable diagnostic solutions in infectious disease management. The growing prevalence of viral outbreaks, including seasonal influenza, respiratory infections, and emerging pathogens, has heightened the need for safe, accurate, and convenient sample collection tools. Increased investments in healthcare infrastructure, rising awareness about early disease detection, and widespread adoption of point-of-care testing further support market expansion. Moreover, government initiatives to strengthen pandemic preparedness, coupled with advancements in biotechnology and molecular diagnostics, are fueling adoption.

Disposable Virus Sampling Kits Market Latest Trends

Disposable virus sampling kits are being reimagined with integration of digital technologies—like embedding QR codes or RFID tags—for sample tracking and chain-of-custody, which improves traceability and reduces handling errors. There’s also a growing push toward point-of-care and self-collection kits: kits designed for at-home sample collection or collection in decentralized settings that reduce reliance on centralized labs. Material innovation is important too—advanced swab materials and new transport media that preserve viral integrity better, sometimes with inactivation built-in, are being developed to increase safety for handlers and improve diagnostic accuracy. Finally, sustainability is emerging as a factor, with manufacturers exploring biodegradable or less environmentally harmful materials, and better packaging/designs to reduce waste.

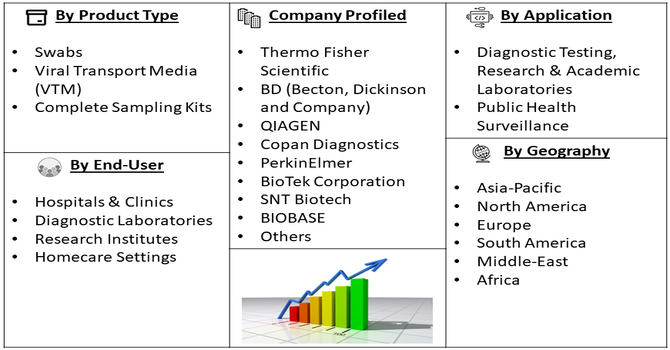

Segmentation: Global Disposable Virus Sampling Kits Market is segmented By Product Type (Swabs, Viral Transport Media (VTM), Complete Sampling Kits), By Application (Diagnostic Testing, Research & Academic Laboratories, Public Health Surveillance), By End-User (Hospitals & Clinics, Diagnostic Laboratories, Research Institutes, Homecare Settings), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of Viral Infections and Outbreak Preparedness

The increasing global burden of viral diseases such as influenza, RSV, and emerging pathogens, coupled with the continued need for pandemic preparedness post-COVID-19, is driving demand for reliable and safe disposable virus sampling kits. Governments and healthcare systems are stockpiling diagnostic tools to ensure rapid response, further boosting market adoption.

The escalating global burden of viral diseases—such as influenza, respiratory syncytial virus (RSV), and emerging pathogens—coupled with the ongoing imperative for pandemic preparedness in the aftermath of COVID-19, is significantly driving the demand for reliable and safe disposable virus sampling kits. Governments and healthcare systems worldwide are proactively stockpiling diagnostic tools to ensure rapid response capabilities, thereby further boosting market adoption. This strategic approach aims to enhance diagnostic infrastructure, enabling swift detection and containment of infectious diseases, thereby safeguarding public health and mitigating the economic impact of potential outbreaks.

- Expansion of Diagnostic Testing and Research Infrastructure

Growing investments in diagnostic laboratories, point-of-care testing, and molecular biology research are fueling the demand for efficient virus sampling solutions. The rise in public health initiatives, clinical trials, and surveillance programs across both developed and emerging economies enhances the need for standardized disposable kits that ensure sample integrity and reduce contamination risks.

Market Restraints:

- High Cost of Advanced Sampling Kits and Testing Infrastructure

The primary challenges is the high cost of advanced sampling kits and testing infrastructure, which limits accessibility in low- and middle-income countries where healthcare budgets are constrained. Additionally, regulatory hurdles and compliance requirements across different regions can delay product approvals and market entry, reducing the speed of adoption. Another restraint is the increased competition from alternative sampling and diagnostic technologies, such as non-invasive testing methods and rapid antigen-based solutions, which may reduce reliance on traditional virus sampling kits. Furthermore, supply chain disruptions and shortages of critical raw materials, as seen during the COVID-19 pandemic, can impact manufacturing consistency and timely availability of these kits, thereby affecting global demand.

Socio Economic Impact on Disposable Virus Sampling Kits Market

The global disposable virus sampling kits market has major socio economic implications: by enabling rapid, reliable, and scalable sampling especially during outbreaks like COVID 19, these kits improve disease surveillance, reduce transmission, and lessen the burden on health systems. They also stimulate economic activity by driving demand across manufacturing, logistics, and regulatory sectors, creating jobs and supporting SMEs in diagnostics supply chains. However, high costs, supply chain disruptions, and regulatory barriers can limit access in low and middle income countries, exacerbating health inequities. Investment in local production, lower cost innovation, and streamlined regulation can help ensure broader access, thus enhancing public health resilience while providing economic opportunities in underserved regions.

Segmental Analysis

- Swabs segment is expected to witness highest growth over the forecast period

The Swabs segment under product type remains one of the most critical components of the disposable virus sampling kits market, as they are the primary medium for collecting nasopharyngeal, oropharyngeal, and other clinical specimens. Their affordability, ease of use, and wide adoption in both hospital and diagnostic settings make them indispensable. Additionally, continuous advancements in swab materials, such as flocked and foam swabs, are further enhancing sample collection efficiency and accuracy.

Advancements in swab materials, such as flocked and foam swabs, have further enhanced sample collection efficiency and accuracy. Flocked swabs, with their perpendicular nylon fibers, increase sample uptake and enable superior elution of collected material, making them ideal for diagnostic applications like molecular and microbiological testing.

- Public Health Surveillance segment is expected to witness highest growth over the forecast period

Public Health Surveillance is emerging as a vital segment, driven by increasing government-led programs for early detection and containment of viral outbreaks. This segment’s growth is supported by the rising emphasis on large-scale community testing during pandemics like COVID-19, as well as ongoing surveillance for influenza, RSV, and other infectious diseases. Public health agencies increasingly rely on reliable, disposable sampling kits to ensure quick and safe collection of specimens for epidemiological monitoring.

- Diagnostic Laboratories segment is expected to witness highest growth over the forecast period

Diagnostic Laboratories play a central role in the global market, as they process high volumes of patient samples daily and require standardized, high-quality sampling kits to maintain testing accuracy. The growing demand for PCR-based testing, coupled with expanded laboratory networks in both developed and developing regions, has made diagnostic labs one of the largest consumers of virus sampling kits. Their dependency on validated kits ensures a consistent demand even beyond pandemic-driven testing surges.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period in the Global Disposable Virus Sampling Kits Market, primarily due to its well-established healthcare infrastructure, strong presence of leading diagnostic laboratories, and high adoption of advanced testing methods. The region’s growth is further fueled by continuous government funding for public health initiatives, preparedness for pandemic and epidemic threats, and large-scale investments in R&D activities by both public and private sectors. Additionally, the increasing prevalence of viral infections, robust regulatory support for diagnostic testing, and the presence of major manufacturers driving product innovations contribute to North America’s leadership in this market.

To Learn More About This Report - Request a Free Sample Copy

Disposable Virus Sampling Kits Market Competitive Landscape

The Global Disposable Virus Sampling Kits Market is characterized by a diverse and competitive landscape, with numerous companies involved in the development, manufacturing, and distribution of virus sampling kits. These kits are essential for the collection, transport, and storage of viral specimens, ensuring accurate and timely diagnostic testing.

Key players in this market include:

- Thermo Fisher Scientific

- BD (Becton, Dickinson and Company)

- QIAGEN

- Copan Diagnostics

- PerkinElmer

- BioTek Corporation

- SNT Biotech

- BIOBASE

- Jiangsu Kangjian Medical

- Trinity Biotech

- Titan Biotech Ltd.

- Medico Technology Co., Ltd.

- Zhejiang Langhua Pharmaceutical Co., Ltd.

- Shenzhen Dakewe Bio-engineering Co., Ltd.

- Singuway Biotech Inc.

- BioSci

- Langhua Pharmaceutical

- Beroni Group

- Yocon Biology Technology Company

- BGI Group

Recent News:

- In July 2022, YIZUMI, Chinese manufacturer of injection molding machines, has developed an integrated solution specifically for producing disposable virus sampling tubes used in nucleic acid testing. These tubes are critical consumables for collecting and storing throat or nasal swab samples during COVID 19 and other virus testing. Key features include clean, durable tubes (with smooth, burr free caps/nozzles), ability to withstand extreme sterilization temperatures (121 °C) and freezing (−80 °C), tight spiral seals, and precise wall tolerances. By combining high production capacity, lower energy consumption, and improved product quality, YIZUMI’s solution aims to reduce costs, alleviate supply shortages, and strengthen the supply chain for testing consumables.

- In June 2021, Gujarat based medical device firm Meril has secured approval from the Indian Council of Medical Research (ICMR) for its self use rapid antigen test kit, CoviFind, enabling at home screening for Covid 19. The indigenously developed test is designed to detect SARS CoV 2 in infectious individuals—including symptomatic persons and immediate contacts—and delivers results within just 15 minutes. Importantly, no special refrigeration or storage conditions are required, simplifying distribution and use across diverse settings.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth driving factors for this market?

The market is primarily driven by the rising global prevalence of viral diseases and the continuous emergence of newer, highly transmissible pathogens, necessitating widespread diagnostic testing. The demand for accurate and rapid diagnostics is crucial for effective public health responses and disease control, compelling governments and healthcare providers to stockpile and utilize disposable kits. Furthermore, increased global blood donation initiatives require enhanced viral screening using reliable collection kits to ensure blood supply safety. The market also benefits from substantial government funding and regulatory approvals for new, advanced detection tests, which subsequently boost the adoption and usage of these essential disposable sampling tools globally.

Q2. What are the main restraining factors for this market?

A significant restraining factor is the high cost associated with advanced disposable virus sampling kits, which can limit accessibility for smaller clinics, research institutions, and laboratories in developing economies with limited healthcare budgets. Furthermore, despite increased production capabilities, the market faces persistent supply chain bottlenecks and potential shortages of critical components, such as high-quality swabs and specific viral transport media (VTM). Trade barriers, export restrictions, and rising transportation costs can also disrupt the global supply flow, particularly impacting developing countries that heavily rely on imported kits, consequently hindering widespread testing efforts and market expansion.

Q3. Which segment is expected to witness high growth?

The Home Test segment and the Viral Transport Media (VTM) product type are both poised for significant growth. The home test segment is forecast to expand rapidly as manufacturers focus on patient convenience and safety, offering self-collection kits that reduce the risk of virus transmission in clinical settings. This shift is supported by high consumer acceptance and the move toward decentralized healthcare. Additionally, the VTM segment, which ensures the integrity and viability of the collected viral sample during transport to the lab, remains a key growth area. Technological advancements in VTM formulations are continuously improving sample preservation and compatibility with diverse molecular assays.

Q4. Who are the top major players for this market?

The market is dominated by major multinational corporations with extensive research, manufacturing, and distribution capabilities, particularly those specializing in life sciences and diagnostics. Key players include Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), COPAN Diagnostics Inc., and F. Hoffmann-La Roche Ltd. These companies offer comprehensive solutions, from collection swabs and proprietary viral transport media to integrated diagnostic platforms. Their market leadership is reinforced by strategic initiatives such as scaling up production, securing government contracts during viral outbreaks, and engaging in mergers and acquisitions to continuously expand their product portfolios and geographical reach across both developed and emerging markets.

Q5. Which country is the largest player?

The United States is the largest and most dominant country player within the Global Disposable Virus Sampling Kits Market, primarily driving the market revenue in the North American region. This leading position is attributable to several key factors, including its robust and advanced healthcare infrastructure, high healthcare expenditure, and the presence of numerous top-tier biopharmaceutical and clinical research organizations. The U.S. also sees early and extensive adoption of cutting-edge diagnostic technologies and benefits from significant federal funding and regulatory support for infectious disease testing and personalized medicine initiatives, ensuring its sustained market dominance throughout the forecast period.

List of Figures

Figure 1: Global Disposable Virus Sampling Kits Market Revenue Breakdown (USD Billion, %) by Region, 2023 & 2029

Figure 2: Global Disposable Virus Sampling Kits Market Value Share (%), By Segment 1, 2023 & 2029

Figure 3: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Disposable Virus Sampling Kits Market Value Share (%), By Segment 2, 2023 & 2029

Figure 6: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Disposable Virus Sampling Kits Market Value Share (%), By Segment 3, 2023 & 2029

Figure 11: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Disposable Virus Sampling Kits Market Value (USD Billion), by Region, 2023 & 2029

Figure 16: North America Disposable Virus Sampling Kits Market Value Share (%), By Segment 1, 2023 & 2029

Figure 17: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Disposable Virus Sampling Kits Market Value Share (%), By Segment 2, 2023 & 2029

Figure 20: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Disposable Virus Sampling Kits Market Value Share (%), By Segment 3, 2023 & 2029

Figure 25: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Disposable Virus Sampling Kits Market Value Share (%), By Segment 1, 2023 & 2029

Figure 32: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Disposable Virus Sampling Kits Market Value Share (%), By Segment 2, 2023 & 2029

Figure 35: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Disposable Virus Sampling Kits Market Value Share (%), By Segment 3, 2023 & 2029

Figure 40: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Disposable Virus Sampling Kits Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Disposable Virus Sampling Kits Market Value Share (%), By Segment 1, 2023 & 2029

Figure 48: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Disposable Virus Sampling Kits Market Value Share (%), By Segment 2, 2023 & 2029

Figure 51: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Disposable Virus Sampling Kits Market Value Share (%), By Segment 3, 2023 & 2029

Figure 56: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Disposable Virus Sampling Kits Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Disposable Virus Sampling Kits Market Value Share (%), By Segment 1, 2023 & 2029

Figure 68: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Disposable Virus Sampling Kits Market Value Share (%), By Segment 2, 2023 & 2029

Figure 71: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Disposable Virus Sampling Kits Market Value Share (%), By Segment 3, 2023 & 2029

Figure 76: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Disposable Virus Sampling Kits Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Disposable Virus Sampling Kits Market Value Share (%), By Segment 1, 2023 & 2029

Figure 87: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Disposable Virus Sampling Kits Market Value Share (%), By Segment 2, 2023 & 2029

Figure 90: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Disposable Virus Sampling Kits Market Value Share (%), By Segment 3, 2023 & 2029

Figure 95: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Disposable Virus Sampling Kits Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Disposable Virus Sampling Kits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model