Dual Pinion Assist EPS (DPEPS) Market Overview and Analysis:

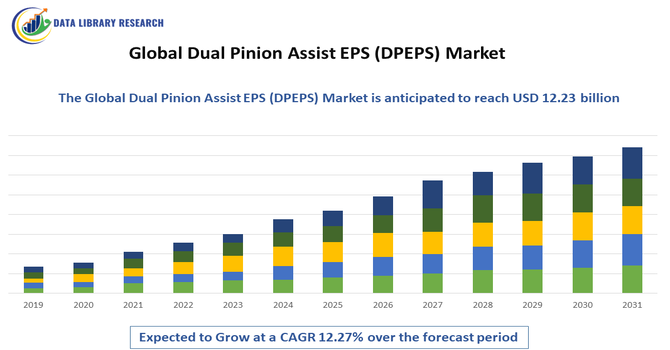

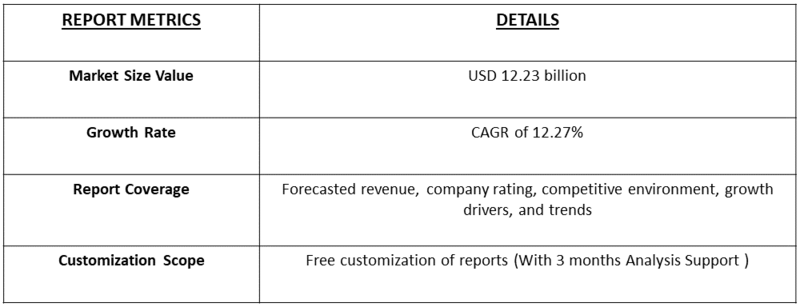

- The Global Dual Pinion Assist Electric Power Steering (DPEPS) Market size was valued at USD 3.8 billion in 2025 and is projected to reach USD 12.23 billion by 2032, growing with a CAGR of 12.27% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Dual Pinion Assist Electric Power Steering (DPEPS) Market refers to the worldwide industry focused on electric steering systems that use two pinions one for the driver’s input and one for motor assistance to provide smoother, more precise vehicle steering. This market covers the design, production, and sale of these advanced steering systems, which are increasingly used in modern cars for better handling, improved safety features, and compatibility with driver-assistance and autonomous-driving technologies.

The growth in the Global Dual Pinion Assist EPS (DPEPS) Market is driven by rising demand for advanced driver-assistance systems (ADAS), the shift toward electric and hybrid vehicles that require efficient, lightweight steering solutions, and growing consumer preference for enhanced driving comfort and precision.

Dual Pinion Assist EPS (DPEPS) Market Latest Trends:

The Global Dual Pinion Assist EPS (DPEPS) Market is shaped by growing integration of steering systems with advanced driver-assistance features, enabling higher precision and smoother automated control. Automakers are increasingly adopting steer-by-wire and software-defined steering technologies, pushing suppliers to innovate in motor efficiency, sensor accuracy, and control algorithms. Lightweight components and higher energy efficiency remain core design priorities, especially as electric vehicle production accelerates.

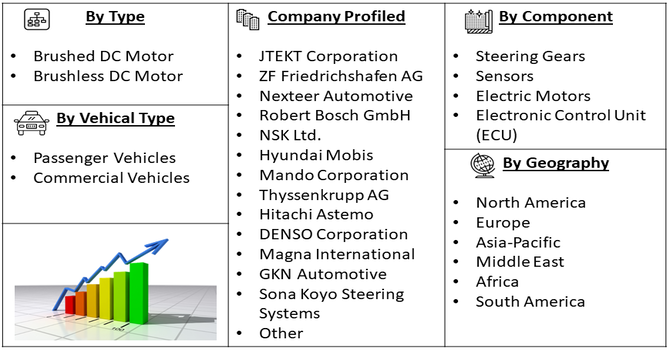

Segmentation: The Global Dual Pinion Assist EPS (DPEPS) Market is segmented by Type (Brushed DC Motor and Brushless DC Motor), Vehicle Type (Passenger Vehicles and Commercial Vehicles), Component (Steering Gears, Sensors, Electric Motors, and Electronic Control Unit (ECU)), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Adoption of ADAS and Autonomous Technologies

The major driver of the Global Dual Pinion Assist EPS (DPEPS) Market is the rapid adoption of advanced driver-assistance systems (ADAS) and the growing shift toward autonomous vehicles. DPEPS technology offers precise steering control, fast response, and seamless integration with sensors and electronic control units, making it ideal for lane-keeping, automated parking, and highway pilot systems.

In October 2025, Mobileye announced it had signed an MoU with VVDN Technologies to localize and supply its ADAS technologies to Indian automakers, combining Mobileye’s global expertise with VVDN’s local engineering and manufacturing capabilities. This collaboration strengthened ADAS adoption in India and indirectly supported growth in the DPEPS market by boosting demand for advanced, automation-ready steering systems. As, automakers enhance vehicle intelligence and safety features, demand for steering systems capable of supporting high-level automation increases significantly. This technological evolution compels manufacturers to integrate DPEPS into new vehicle platforms, accelerating market expansion and strengthening its role in next-generation mobility solutions.

- Growth of Electric and Hybrid Vehicles

The accelerating production of electric and hybrid vehicles is another key driver of the DPEPS market. These vehicles require highly efficient, lightweight steering systems to maximize battery range and reduce energy losses, making traditional hydraulic steering unsuitable. For instance, in December 2024, Honda Motor Co., Ltd. held a press briefing to showcase its hybrid-electric vehicle (HEV) strategy and updates to its original 2-motor e:HEV system. The company also revealed next-generation technologies for future HEVs, supporting the growth of electric and hybrid vehicles and driving demand for DPEPS in advanced, energy-efficient steering systems.

DPEPS aligns perfectly with EV requirements by offering lower power consumption, improved precision, and compatibility with advanced control software. As EV manufacturers expand model lineups and integrate more digital vehicle architectures, the need for DPEPS systems will continue to grow, supporting performance, safety, and sustainability targets across the automotive sector.

Market Restraints:

- High System Cost and Integration Complexity

The one restraint for the DPEPS market is the high cost and technical complexity associated with developing and integrating these systems. DPEPS requires advanced sensors, control units, redundant safety mechanisms, and precise mechanical components, which increase manufacturing expenses compared to conventional steering systems. Smaller automakers or those focused on low-cost vehicles may struggle to absorb these costs, slowing adoption in price-sensitive markets.

Socio Economic Impact on Dual Pinion Assist EPS (DPEPS) Market

The expansion of the DPEPS market contributes positively to economic growth by stimulating demand for skilled labor in electronics, software engineering, and precision manufacturing. It supports the broader transition to sustainable mobility by enabling fuel-efficient and low-emission vehicles, aligning with global environmental goals. Improved steering safety and reliability reduce accident risks, offering substantial social benefits. However, rising technological complexity may increase vehicle costs, influencing affordability in some regions. The shift toward automated and electric mobility driven by DPEPS demand also encourages infrastructure upgrades and innovation ecosystems, creating new business opportunities while requiring workforce reskilling to match evolving industry needs.

Segmental Analysis:

- Brushless DC Motor segment is expected to witness the highest growth over the forecast period

The Brushless DC (BLDC) motor segment is expected to experience the highest growth in the Global DPEPS Market due to its superior efficiency, durability, and precise torque control. BLDC motors generate less heat, offer smoother operation, and require minimal maintenance compared to brushed alternatives, making them ideal for modern electric steering systems. Their ability to support rapid response times and consistent performance aligns with the increasing integration of ADAS and autonomous features in vehicles. As automakers focus on improving energy efficiency and reducing overall vehicle weight, the demand for BLDC motors in DPEPS applications is projected to rise rapidly.

- Commercial Vehicles segment is expected to witness the highest growth over the forecast period

The commercial vehicle segment is anticipated to witness the fastest growth owing to rising adoption of advanced steering technologies in trucks, buses, and delivery fleets. Commercial vehicles increasingly require enhanced maneuverability, stability, and reduced driver fatigue—capabilities well supported by DPEPS systems.

The growth of e-commerce and logistics industries is also driving demand for reliable, fuel-efficient commercial vehicles equipped with modern electronic steering. Additionally, regulatory emphasis on safety and emission reduction is pushing fleet operators to adopt advanced electric steering solutions. As electrification of commercial vehicles accelerates globally, DPEPS penetration is expected to expand significantly within this segment.

- Electronic Control Unit (ECU) segment is expected to witness the highest growth over the forecast period

The Electronic Control Unit (ECU) segment is expected to grow rapidly as modern steering systems rely heavily on advanced software, sensors, and real-time data processing. In DPEPS applications, ECUs manage motor torque, steering assistance levels, and integration with ADAS features, making them central to performance and safety. Increasing demand for software-defined vehicles and enhanced electronic architecture drives the need for more powerful and intelligent ECUs. Automakers are also prioritizing cybersecurity, redundancy, and diagnostic capabilities, further propelling ECU advancements. As vehicles become more connected and autonomous-ready, the ECU segment will play an essential role in enabling next-generation steering systems.

- Asia-Pacific Region segment is expected to witness the highest growth over the forecast period

The Asia-Pacific region is projected to witness the highest growth in the DPEPS market, driven by its expanding automotive production base, strong demand for passenger and commercial vehicles, and rapid adoption of electric mobility. Countries such as China, Japan, South Korea, and India are investing heavily in EV manufacturing, automotive electronics, and intelligent transportation systems. For instance, Toyota Motor Corporation announced it had launched sales of its all-new Alphard and Vellfire Plug-in Hybrid Electric Vehicle (PHEV) six-seater models in Japan in January 2025, along with improved gasoline and HEV versions on January 7, 2025. This strengthened EV and hybrid adoption, boosting DPEPS demand in the Asia-Pacific region.

Rising urbanization and improving road safety regulations are also accelerating adoption of advanced steering technologies. Additionally, the presence of major EPS and component manufacturers in the region enhances supply chain efficiency. With supportive government policies and growing consumer preference for technologically advanced vehicles, Asia-Pacific will remain a dominant growth hub.

To Learn More About This Report - Request a Free Sample Copy

Dual Pinion Assist EPS (DPEPS) Market Competitive Landscape:

The competitive landscape of the Global DPEPS Market is dominated by established automotive steering system manufacturers and emerging tech-driven suppliers focused on intelligent vehicle systems. Companies compete primarily on innovation, offering advanced motor control, enhanced fail-safe mechanisms, and seamless ADAS integration. Strategic collaborations, joint ventures, and long-term contracts with automakers are common as OEMs seek reliable, scalable solutions for electric and autonomous platforms. New entrants leveraging software-centric steering technologies are intensifying competition, pushing traditional suppliers to modernize their portfolios and invest heavily in research and development.

The major players for above market:

- JTEKT Corporation

- ZF Friedrichshafen AG

- Nexteer Automotive

- Robert Bosch GmbH

- NSK Ltd.

- Hyundai Mobis

- Mando Corporation

- Thyssenkrupp AG

- Hitachi Astemo

- DENSO Corporation

- Magna International

- GKN Automotive

- Sona Koyo Steering Systems

- China Automotive Systems

- Showa Corporation

- Valeo SA

- Mitsubishi Electric Corporation

- BorgWarner Inc.

- Continental AG

- Delphi Technologies

Recent Development

- In August 2024, Nexteer Automotive announced its Modular Pinion-Assist Electric Power Steering system, expanding its cost-efficient, modular EPS lineup to include both Single-Pinion and Dual-Pinion configurations. The launch broadened the company’s ability to deliver flexible, high-performance steering solutions tailored to various vehicle platforms and automaker requirements.

- In December 2023, Nexteer Automotive announced it had reached a global production milestone of 100 million electric power steering (EPS) systems, a technology that enhanced fuel efficiency, safety, and performance. The company reaffirmed its position as a global EPS leader, having supplied advanced steering solutions to more than 60 customers worldwide.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is driven by increasing demand for high-precision steering needed by Advanced Driver-Assistance Systems (ADAS) and autonomous driving. The rapid global adoption of Electric Vehicles (EVs) is also a major driver, as DPEPS provides better efficiency and lightweight design for EVs.

Q2. What are the main restraining factors for this market?

Key restraints include the high initial cost of DPEPS hardware compared to simpler systems, which limits adoption in budget vehicles. Integration complexity into existing vehicle platforms and growing concerns over cybersecurity risks also slow market expansion.

Q3. Which segment is expected to witness high growth?

The Electronic Control Unit (ECU) segment is poised for the highest growth due to the escalating demand for smart, high-precision steering. As ADAS features like lane-keep assist and full autonomy become standard, the ECU must handle complex software and massive amounts of sensor data. This necessity for more powerful, sophisticated, and safety-critical electronic control units drives rapid segment expansion and high-value revenue growth.

Q4. Who are the top major players for this market?

The market is dominated by established Tier 1 automotive suppliers and technology specialists. Major players include JTEKT Corporation, Nexteer Automotive Group, ZF Friedrichshafen AG, NSK Ltd., and Robert Bosch GmbH, who focus on software-integrated, high-performance solutions.

Q5. Which country is the largest player?

The Asia-Pacific region holds the largest overall market share, primarily due to the vast vehicle manufacturing volumes in China. China is the single largest country market, benefiting from its large EV installed base and strong government backing for intelligent vehicle technologies.

List of Figures

Figure 1: Global Dual Pinion Assist EPS (DPEPS) Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Dual Pinion Assist EPS (DPEPS) Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Dual Pinion Assist EPS (DPEPS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model