High-End Botanical Herbal Skin Care Market Overview and Analysis:

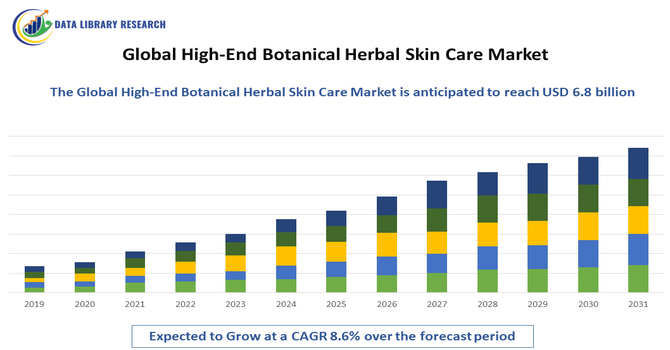

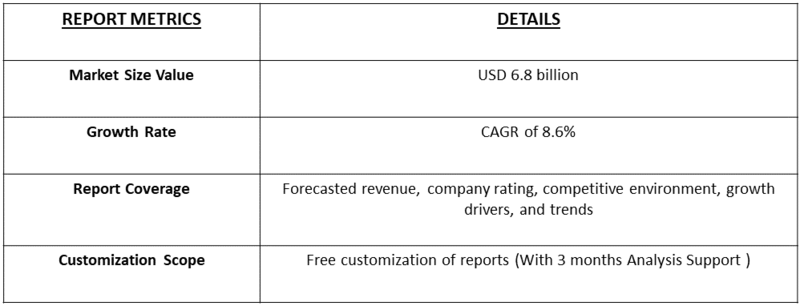

- The Market size was valued at USD 2.8 billion in 2025 and is projected to reach USD 6.8 billion by 2032, growing with a CAGR of 8.6% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global High-End Botanical Herbal Skin Care Market includes luxury skincare products made from plant-based ingredients like herbs, flowers, and natural extracts. These products avoid harsh chemicals and appeal to consumers seeking clean, eco-friendly beauty. The market grows as people prioritize natural wellness, premium formulations, and sustainable beauty routines worldwide.

The growth in the global high-end botanical herbal skin care market is driven by rising consumer demand for natural, chemical-free beauty products, increasing awareness of the benefits of plant-based ingredients, and a broader shift toward wellness-focused lifestyles. Premiumization trends, higher disposable incomes, and growing preference for sustainable, eco-friendly formulations further boost the market, while innovations in botanical extraction and product customization enhance appeal and expand the customer base.

High-End Botanical Herbal Skin Care Market Latest Trends

The high-end botanical herbal skin care market is driven by strong demand for clean, natural, and plant-based beauty solutions. Consumers increasingly prioritize transparency, ethically sourced ingredients, and eco-friendly packaging, pushing brands to adopt sustainable and traceable supply chains. Minimal-ingredient formulas, bio-fermented botanicals, and skin-barrier-focused products are rising trends.

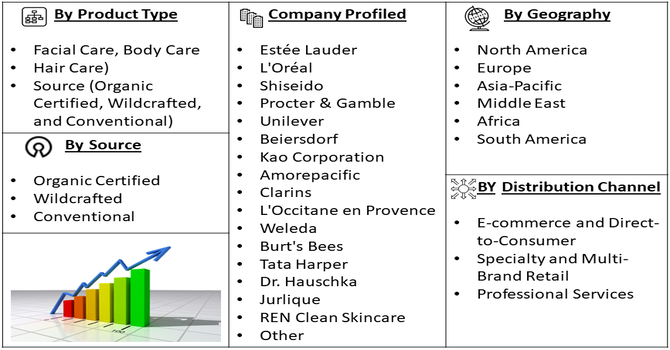

Segmentation: The Global High-End Botanical Herbal Skin Care Market is segmented by Product Type (Facial Care, Body Care, and Hair Care), Source (Organic Certified, Wildcrafted, and Conventional), Distribution Channel (E-commerce and Direct-to-Consumer, Specialty and Multi-Brand Retail and Professional Services), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Use of Paraben and Chemical Based Products

The biggest reason this market is growing is that customers are scared of putting synthetic chemicals on their skin. They're reading labels and getting smart about ingredients like parabens or harsh preservatives, largely thanks to social media and wellness trends. They are demanding what's called 'clean beauty'—meaning natural, organic, and ethically sourced. When high-end brands can clearly show where their plant ingredients come from and prove they are sustainable, people are happy to pay extra. It’s all about trust and feeling good about the ethical choices behind their luxurious purchase.

- Growing Demand of Ayurvedic Products

Modern shoppers don't just want a nice-smelling cream; they want high-performance products that actually fix wrinkles and age spots, but they want them to be plant-based. They are seeking out advanced formulas that combine ancient wisdom—like remedies from Ayurvedic or Chinese medicine—with modern, breakthrough lab technology.

In June 2025, Kiabi entered the beauty sector by launching a 215-square-foot cosmetics corner in its pilot store in Lezennes, France, following its home décor expansion the previous year. Featuring third-party brands, including organic and skincare products, the move enhanced premium botanical product visibility and supported growth in the global high-end botanical herbal skincare market. When a brand can prove its unique botanical extract works as well as, or better than, traditional synthetic ingredients, it captures a huge part of this high-end market. It’s the perfect blend of high-tech results and natural purity.

Market Restraints:

- Expensive Cost of Plant Ingredients

The main issue holding the market back is the sheer difficulty and high cost of securing those top-tier plant materials. Unlike cheap lab-made chemicals, rare herbs are sensitive to weather, seasons, and farming practices, leading to unstable supply. Finding pure, certified organic ingredients and putting them through rigorous testing costs a fortune. Because of these huge sourcing and testing expenses, the final product price has to be very high. This inevitably puts a ceiling on how many people can afford the products, slowing down the potential for wider, mass-market growth.

Socioeconomic Impact on High-End Botanical Herbal Skin Care Market

This market positively influences rural and agricultural economies by increasing global demand for herbs, flowers, and medicinal plants. Communities involved in natural ingredient cultivation benefit from stable income and sustainable farming initiatives. Rising disposable incomes, especially in emerging countries, support increased spending on premium natural skincare. The industry also fuels job creation across farming, research, formulation, packaging, marketing, and e-commerce. Its shift toward ethical and sustainable practices encourages environmental conservation and responsible sourcing, reinforcing wellness-driven consumer lifestyles globally.

Segmental Analysis:

- Body Care segment is expected to witness the highest growth over the forecast period

The body care segment is projected to record the highest growth as consumers increasingly adopt full-body wellness routines that extend beyond facial skincare. Demand is rising for premium botanical formulations in body lotions, oils, scrubs, and creams that emphasize natural hydration, skin barrier repair, and sensorial experiences. Brands are capitalizing on this shift by introducing plant-derived actives, aromatherapeutic blends, and spa-inspired treatments. Premiumization, coupled with growing interest in self-care rituals and year-round skin maintenance, is driving robust expansion. Additionally, improved product texture technologies and targeted solutions for concerns such as dryness and sensitivity are strengthening consumer uptake.

- E-commerce and Direct-to-Consumer segment is expected to witness the highest growth over the forecast period

E-commerce and direct-to-consumer channels are expected to experience the strongest growth as digital purchasing becomes central to premium beauty consumption. High-end botanical skincare brands leverage online platforms for personalized recommendations, ingredient transparency, and convenient replenishment. The rise of social commerce, influencer-driven discovery, and subscription models further accelerates conversion and retention. Consumers increasingly trust D2C brands for authenticity and sustainability commitments, while online sales allow companies to reduce retail overhead, enhance margins, and rapidly scale globally. Advanced fulfillment logistics, virtual try-ons, and data-driven customer engagement strategies are reinforcing e-commerce as the most dynamic distribution channel.

- Organic Certified segment is expected to witness highest growth over the forecast period

The organic certified segment is poised for the highest growth as consumers prioritize safety, purity, and verifiable ingredient standards in botanical skincare. Certification provides a strong competitive advantage by assuring buyers that products meet rigorous environmental and health criteria. Growth is further propelled by rising concerns about synthetic chemicals, allergies, and long-term skin health. Luxury brands are expanding portfolios with certified organic formulations that feature traceable sourcing, clean labeling, and sustainable cultivation practices. Regulatory support and increasing global awareness of eco-friendly beauty also contribute to segment acceleration, positioning certified organic products as a premium benchmark within the market.

- Asia-Pacific Region segment is expected to witness the highest growth over the forecast period

The Asia-Pacific region is expected to witness the fastest growth, supported by rising disposable incomes, rapid urbanization, and strong cultural affinity for herbal and natural beauty traditions. Markets such as China, South Korea, Japan, and Southeast Asia are driving demand for high-end botanical skincare with premium ingredients and science-backed formulations. For instance, in June 2025, Hyphen’s star-powered skincare brand crossed Rs 100 crore in sales, marking a significant milestone. The achievement highlighted strong consumer demand for premium, celebrity-endorsed botanical products and boosted market confidence, driving growth, investment, and competition in the Asia-Pacific high-end botanical herbal skincare sector.

Expanding e-commerce infrastructure, growing beauty consciousness among younger consumers, and regional leadership in skincare innovation further fuel momentum. For instance, in September 2025, Nykaa introduced two Korean haircare brands, Mise En Scène and RYO, to the Indian market, marking the 10th anniversary of its partnership with Amorepacific. The launch expanded Nykaa’s K-beauty portfolio and strengthened consumer access to herbal and premium formulations, boosting growth and visibility in the Asia-Pacific high-end botanical herbal skincare and haircare market.

International brands are increasing investments and partnerships in APAC, while local botanical companies gain prominence through unique indigenous plant extracts. Overall, APAC’s scale and sophistication make it the most dynamic growth hub.

To Learn More About This Report - Request a Free Sample Copy

High-End Botanical Herbal Skin Care Market Competitive Landscape

The competitive landscape is fragmented, with luxury heritage brands, clean-beauty startups, and niche botanical formulators all vying for differentiation. Companies compete through ingredient purity, organic certifications, sustainable packaging, and unique botanical blends. Many invest in research to enhance product efficacy while maintaining natural integrity. Social media, influencer partnerships, and direct-to-consumer platforms heavily shape brand visibility and customer loyalty. Smaller boutique brands often excel through authenticity and craftsmanship, while large corporations leverage scale, advanced R&D, and global distribution to maintain a competitive advantage.

The major players for this market are:

- Estée Lauder

- L'Oréal

- Shiseido

- Procter & Gamble

- Unilever

- Beiersdorf

- Kao Corporation

- Amorepacific

- Clarins

- L'Occitane en Provence

- Weleda

- Burt's Bees

- Tata Harper

- Dr. Hauschka

- Herbivore Botanicals

- Jurlique

- REN Clean Skincare

- Aveda

- Melvita

- Madara Cosmetics

Recent Development

- In July 2025, Chantecaille, the luxury botanical skincare and cosmetics brand announced its long-awaited entry into the India market through a partnership with Luxasia, Asia’s leading luxury beauty distributor. The move broadened the brand’s global footprint, strengthened premium botanical beauty visibility, and intensified competition, positively influencing growth and consumer adoption within the global high-end botanical herbal skincare market.

- In April 2025, Kora Organics entered into a partnership with Nykaa, making its beauty products exclusively available on the platform. Its India range included cleansers, serums, oils, and exfoliating treatments. The launch broadened access to premium botanical skincare and strengthened growth momentum in the global high-end botanical herbal skincare market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The growth is primarily driven by rising consumer awareness of the negative effects of synthetic chemicals, causing a shift toward natural, clean-label products. Consumers are also seeking highly effective, premium anti-aging solutions using verified plant-based ingredients. The popularity of ethical sourcing, sustainability, and vegan certification further boosts demand for high-end herbal offerings.

Q2. What are the main restraining factors for this market?

The biggest challenges are the high production costs and supply chain inconsistencies associated with sourcing rare and high-quality botanical raw materials. Additionally, the premium price point of these products can deter some consumers, and there is often consumer skepticism regarding the scientifically proven efficacy of herbal ingredients versus conventional laboratory-made compounds.

Q3. Which segment is expected to witness high growth?

The premium segment is forecast to see high growth, specifically within the e-commerce distribution channel. Online platforms offer convenience, allow brands to share ingredient transparency stories, and are critical for reaching high-spending, digitally-aware consumers who seek specialized and luxurious skincare products from niche and international brands.

Q4. Who are the top major players for this market?

The market is led by major established beauty conglomerates and specialized luxury brands. Key players include Shiseido, L'Oréal (with its premium botanical lines), The Estée Lauder Companies, and Amorepacific. These companies invest heavily in research to validate their herbal extracts and maintain significant control over global distribution networks.

Q5. Which country is the largest player?

The Asia-Pacific region, particularly countries like China, Japan, and South Korea, accounts for the largest market share. This dominance is due to a long-standing cultural appreciation for traditional herbal remedies, high disposable incomes, and strong consumer focus on intensive daily skincare routines that prioritize natural and advanced botanical extracts.

List of Figures

Figure 1: Global High-End Botanical Herbal Skin Care Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global High-End Botanical Herbal Skin Care Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa High-End Botanical Herbal Skin Care Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa High-End Botanical Herbal Skin Care Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa High-End Botanical Herbal Skin Care Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model