Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Overview and Analysis

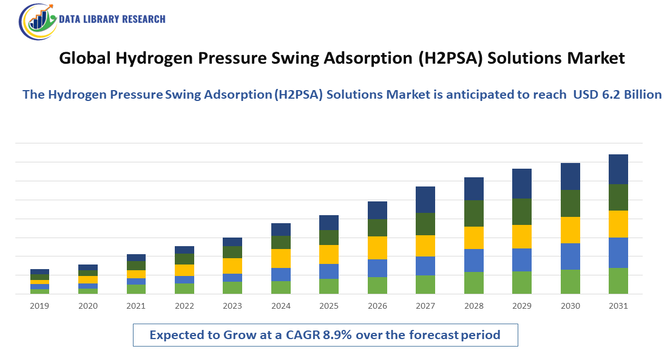

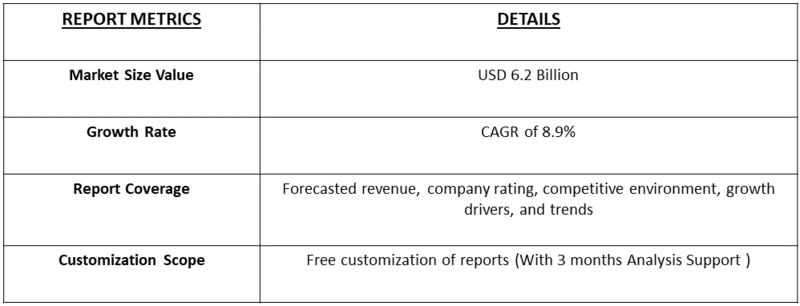

- The Global Hydrogen Pressure Swing Adsorption (PSA) Solutions Market size was valued at USD 1.8 Billion in 2025 and is projected to reach USD 6.2 Billion by 2032, growing with a CAGR of 8.9% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Hydrogen Pressure Swing Adsorption (PSA) Solutions Market is witnessing strong growth, driven primarily by the accelerating global push toward clean hydrogen production and decarbonization across industrial sectors. As governments and industries shift toward low-carbon energy systems, PSA systems are increasingly deployed for high-purity hydrogen generation in refineries, ammonia plants, methanol units, and emerging green-hydrogen facilities. Rising investments in green and blue hydrogen projects, expansion of hydrogen fueling infrastructure, and growing industrial gas demand are further boosting adoption. PSA technology continues to benefit from its high efficiency, low operational cost, scalability, and reliability for bulk hydrogen purification, making it a preferred option over alternative separation technologies in large-scale hydrogen facilities.

Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Latest Trends

The Global Hydrogen Pressure Swing Adsorption (PSA) Solutions market is experiencing rapid technological and strategic advancements as clean-hydrogen demand accelerates worldwide. A key trend is the rising integration of PSA units into large-scale green and blue hydrogen projects, where consistent high-purity output is essential for fuel-cell applications, ammonia production, and chemical industries. Manufacturers are increasingly focusing on advanced adsorbent materials, hybrid PSA-VPSA configurations, and automation-driven control systems to enhance energy efficiency, reduce operational costs, and improve recovery rates. Modular and scalable PSA systems are also gaining adoption, enabling flexible deployment across centralized hydrogen plants as well as distributed hydrogen fueling and industrial sites.

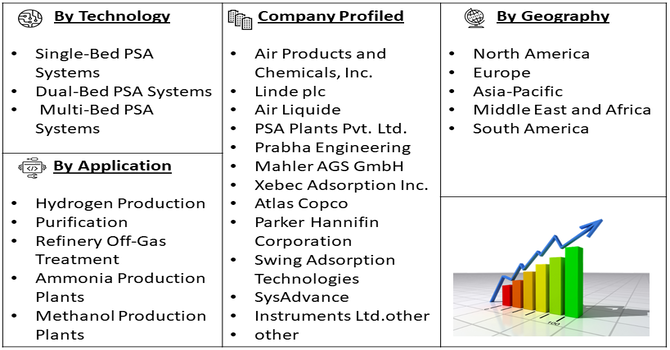

Segmentation: Global Hydrogen Pressure Swing Absorption Solutions Market is segmented By Technology (Single-Bed PSA Systems, Dual-Bed PSA Systems, Multi-Bed PSA Systems), By Application (Hydrogen Production & Purification, Refinery Off-Gas Treatment, Ammonia Production Plants, Methanol Production Plants), By End-Use Industry (Oil & Gas, Chemical & Petrochemical, Power & Energy, Steel & Metallurgy, Electronics & Semiconductor), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Global Shift Toward Clean Hydrogen Production

A major driver for the Global Hydrogen Pressure Swing Adsorption Solutions Market is the accelerated transition toward clean and low-carbon hydrogen across industrial and energy sectors. Governments and corporations worldwide are investing heavily in green and blue hydrogen infrastructure to support decarbonization goals, carbon-neutral industrial operations, and hydrogen-based mobility. PSA technology is preferred for hydrogen purification due to its high purity levels, operational flexibility, and cost-effectiveness compared to cryogenic separation or membrane technologies. As green hydrogen electrolyzer capacity expands and blue hydrogen plants integrate CO₂-capture, PSA systems are increasingly being deployed for efficient and scalable purification—boosting market demand.

- Increasing Hydrogen Use in Refineries, Petrochemicals, and Industrial Processes

Rising hydrogen consumption in oil refineries, ammonia and methanol production, steel manufacturing, and semiconductor fabrication also drives PSA system adoption. These industries require continuous high-purity hydrogen streams for desulfurization, hydrogenation, syngas processing, and fuel-cell applications. PSA units are widely used in steam methane reforming (SMR), gasification, and industrial off-gas recovery systems to ensure reliable supply of ultra-pure hydrogen. With global refinery modernization, expansion of petrochemical complexes, and emerging hydrogen-powered industrial applications, the demand for PSA-based hydrogen purification solutions continues to accelerate.

Market Restraints:

- High Initial Capital and Operational Costs Associated with PSA System Installation

The growth of the Global Hydrogen Pressure Swing Adsorption Solutions Market is constrained by the high initial capital and operational costs associated with PSA system installation, adsorbent material handling, and ongoing maintenance. These costs can be significant, especially for small and medium-scale hydrogen producers and emerging hydrogen refueling networks, where budget limitations often delay system adoption. Additionally, energy-intensive operation and efficiency limitations in fluctuating input gas compositions pose technological challenges, as PSA performance can decline when feed gas quality varies, requiring supplemental purification steps or hybrid systems. Furthermore, competition from alternative hydrogen purification technologies, such as membrane separation and cryogenic distillation, is increasing—particularly in applications demanding lower energy consumption or compact system design.

Socio-Economic Impact on Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market

The global Hydrogen Pressure Swing Adsorption (H2PSA) solutions market has significant socioeconomic impacts, driven by the growing adoption of hydrogen as a clean energy source across industries such as transportation, power generation, and industrial manufacturing. By enabling efficient hydrogen purification and storage, H2PSA technologies support the transition to low-carbon economies, reduce greenhouse gas emissions, and enhance energy security. The market fosters job creation in engineering, research, and manufacturing sectors while stimulating investment in advanced energy infrastructure. Additionally, it encourages technological innovation in fuel cells, renewable energy integration, and industrial gas applications. However, high capital costs and infrastructure challenges can limit access in developing regions. Overall, the H2PSA market contributes to sustainable industrial growth, green energy adoption, and global economic modernization.

Segmental Analysis

- Multi-Bed PSA Systems segment is expected to witness the highest growth over the forecast period

Multi-bed PSA systems dominate the market and are expected to expand significantly due to their superior purification efficiency, ability to handle large-scale hydrogen separation, and continuous operation capabilities. These systems are preferred in industrial hydrogen plants and refinery applications because they maintain high hydrogen recovery rates and purity levels, making them ideal for high-volume production environments.

Recent advancements in automation and digital monitoring have further strengthened the adoption of multi-bed PSA systems. Integration of smart sensors, real-time data analytics, and predictive maintenance technologies has enhanced operational efficiency, reduced downtime, and lowered operational costs. Additionally, growing demand for green hydrogen in power generation, transportation, and chemical industries has driven investments in multi-bed PSA systems, positioning them as a critical component in sustainable hydrogen production and supporting the global shift toward low-carbon energy solutions.

- Chemical & Petrochemical Industry segment is expected to witness the highest growth over the forecast period

The chemical & petrochemical sector remains the primary end-use segment, benefiting from high hydrogen demand in ammonia, methanol, and specialty chemical manufacturing. PSA systems are widely used in this industry for cost-efficient purification and recovery of hydrogen from process gas streams, supporting energy optimization and low-carbon production goals.

The refining industry also represents a significant end-use segment for PSA systems, leveraging their high hydrogen recovery and purity capabilities for hydrocracking, desulfurization, and other hydrogen-intensive processes. As refineries increasingly focus on efficiency and emissions reduction, PSA technology helps optimize hydrogen utilization, lower operational costs, and comply with stringent environmental regulations. Moreover, growing global demand for cleaner fuels and sustainable refinery operations is expected to drive further adoption of PSA systems, reinforcing their critical role in modern industrial hydrogen management.

- Asia-Pacific (APAC) region is expected to witness the highest growth over the forecast period

The Asia Pacific region is expected to witness the highest growth over the forecast period in the Global Hydrogen Pressure Swing Absorption (PSA) Solutions Market, driven by accelerating investments in clean hydrogen infrastructure, strong government support for decarbonization initiatives, and expansion of hydrogen production facilities across China and Japan.

Rising adoption of hydrogen in fuel-cell mobility, industrial decarbonization, and power generation applications is further propelling PSA technology deployment, particularly as industries seek high-purity hydrogen for refinery modernization, chemical manufacturing, and emerging green hydrogen projects. For instance, in October 2024, Engineers India Limited (EIL) and Hindustan Petroleum Corporation Ltd. (HPCL) signed a Memorandum of Agreement (MoA) to commercialize HPCL’s H2 PSA technology, with EIL as the technology and engineering partner. The agreement included scale-up, design, and preparation of Basic Engineering & Design for various H2 PSA applications such as HGU-PSA and CCR-PSA. This collaboration strengthened the global Hydrogen Pressure Swing Adsorption (H2PSA) market by promoting advanced, scalable purification solutions, fostering innovation, and expanding hydrogen purification capabilities in industrial applications worldwide.

Additionally, significant funding programs, pilot hydrogen hubs, and advancements in carbon-neutral energy systems solidify APAC’s position as a key growth engine for PSA-based hydrogen purification solutions.

To Learn More About This Report - Request a Free Sample Copy

Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Competitive Landscape

The Global Hydrogen Pressure Swing Absorption (PSA) Solutions Market is highly competitive, characterized by the presence of established industrial gas companies, technology providers, and engineering solution firms. Market participants are focusing on technological advancements, expanding hydrogen purification capacities, and forming strategic collaborations to capitalize on the accelerating hydrogen economy. Investments in green hydrogen production, modular PSA systems, and long-term supply contracts are key strategies driving competition as companies aim to enhance purification efficiency, reduce operating costs, and scale production to support global clean energy targets.

Key Players:

- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide

- PSA Plants Pvt. Ltd.

- Prabha Engineering

- Mahler AGS GmbH

- Xebec Adsorption Inc.

- Atlas Copco

- Parker Hannifin Corporation

- Swing Adsorption Technologies

- SysAdvance

- Inmatec GaseTechnologie

- Oxair Gas Systems

- Peak Scientific Instruments Ltd.

- PCI Gases

- Universal Industrial Plants

- Wuxi Zhongrui Air Separation Equipment

- Hengda Gas Separation Plant

- H2 PSA Systems Pvt. Ltd.

- Denver Instrument Company

Recent Development

- In March 2025, HD Korea Shipbuilding and Offshore Engineering (HD KSOE), HD Hydrogen, and DNV signed a Joint Industry Project (JIP) agreement to develop and validate Pressure Swing Adsorption (PSA) technology for carbon capture in Solid Oxide Fuel Cells (SOFC). This collaboration advanced research in efficient hydrogen purification and carbon mitigation technologies. The initiative positively impacted the global Hydrogen Pressure Swing Adsorption (H2PSA) solutions market by accelerating innovation, improving system reliability, and promoting the adoption of H2PSA solutions in clean energy applications, including fuel cells and industrial decarbonization efforts.

- In June 2023, Hindustan Petroleum Corporation Limited (HPCL) announced that its HP Green R&D Centre in Bengaluru successfully completed the indigenization of Hydrogen Pressure Swing Adsorption (H2PSA) technology, including the adsorbent system, PLC programming, and plant design. This achievement positioned HPCL to offer end-to-end H2PSA solutions to the industry. The development positively impacted the global H2PSA solutions market by promoting technology localization, reducing reliance on imports, enhancing cost-efficiency, and encouraging wider adoption of hydrogen purification systems in energy, industrial, and transportation applications worldwide.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth driving factors for this market?

The market is intensely driven by the global push toward decarbonization and the massive investment in the hydrogen economy, particularly for fuel cell applications and low-carbon energy transition goals. H2PSA is essential because it produces the ultra-high-purity hydrogen (up to 99.9999%) required by fuel cells and the semiconductor industry. Its low operating cost, relative simplicity, and industrial maturity make it the preferred technology for recovering and purifying hydrogen from various sources, including off-gases from traditional refining and green hydrogen production.

Q2. What are the main restraining factors for this market?

Major constraints include the high initial capital investment and maintenance costs associated with building and operating H2PSA plants, which particularly challenge small and mid-scale enterprises. Furthermore, while the process is efficient, it faces technological limitations related to the high cost and slow development of new adsorbent materials needed to enhance hydrogen recovery rates and further improve selectivity against impurities. Competition from alternative purification technologies like membrane separation and cryogenic distillation also acts as a restraint.

Q3. Which segment is expected to witness high growth?

The Mobility/Fuel Cell application segment is expected to witness the highest growth. This is directly linked to the surging global adoption of hydrogen fuel cell vehicles (FCEVs) and the build-out of associated refueling infrastructure, which demands extremely pure hydrogen to protect the sensitive fuel cells. By gas source, feed gas from off-gases/waste gases is also a key growth area, driven by industrial decarbonization efforts to efficiently capture and purify valuable hydrogen by-products from chemical plants and refineries.

Q4. Who are the top major players for this market?

The H2PSA market is dominated by a few global industrial gas and engineering giants with extensive experience in gas separation technologies. Top major players include Honeywell UOP, Linde plc, Air Products and Chemicals, Inc., and Air Liquide. These companies possess the proprietary adsorbent technology, specialized engineering expertise, and established global footprints necessary to design, build, and maintain large-scale, high-reliability PSA units required for major industrial and energy transition projects worldwide.

Q5. Which country is the largest player?

Asia Pacific (APAC) is the dominant market region, primarily led by China, in terms of overall consumption and manufacturing activity. This is driven by the massive scale of chemical processing, petroleum refining, and rapidly expanding electronics and semiconductor industries—all high-purity hydrogen consumers. However, Europe is also a major market due to its ambitious regulatory push towards a hydrogen economy and large-scale green hydrogen projects, while the United States (North America) remains a key player due to its large refining capacity and established technology base.

List of Figures

Figure 1: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Hydrogen Pressure Swing Adsorption (H2PSA) Solutions Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model