Inkjet Printing Thin-Film Transistor Market Overview and Analysis

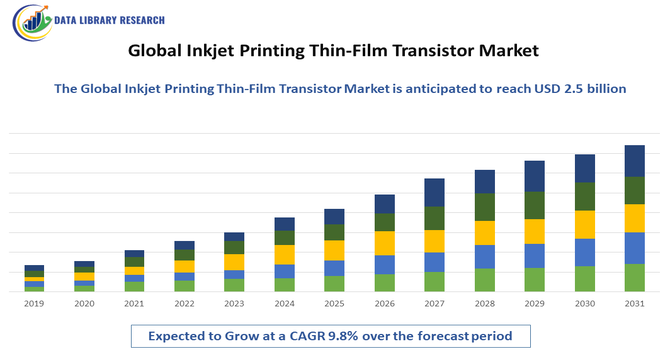

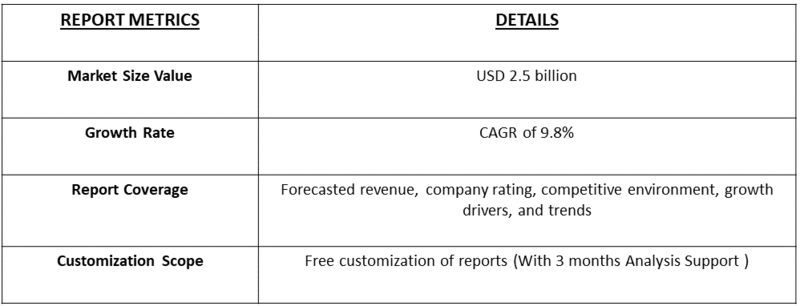

- The Global Inkjet Printing Thin-Film Transistor (TFT) Market was valued at around USD 156.9 million in 2025 to reach USD 2.5 billion by 2032 and beyond, at a strong CAGR of 9.8% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Inkjet Printing Thin-Film Transistor (TFT) Market is witnessing significant growth, driven by the rising demand for flexible, lightweight, and cost-effective display technologies in consumer electronics, wearable devices, and next-generation displays such as OLED and AMOLED screens. The adoption of inkjet-printed TFTs is fueled by their advantages over traditional silicon-based TFTs, including low-temperature processing, reduced material wastage, and scalability for large-area applications.

Inkjet Printing Thin-Film Transistor Market Latest Trends

The Global Inkjet Printing Thin-Film Transistor (TFT) Market is being shaped by the rapid adoption of flexible and large-area displays, particularly in consumer electronics, wearables, and smart packaging. Manufacturers are increasingly focusing on high-resolution, energy-efficient, and low-temperature inkjet printing techniques to produce TFTs on plastic, glass, and other flexible substrates, enabling lightweight and bendable electronic devices. There is a growing trend toward integrating advanced conductive and semiconductive inks, including organic and metal-oxide formulations, which enhance device performance and durability. Additionally, the convergence of inkjet-printed TFTs with emerging applications such as OLED and micro-LED displays, IoT devices, and smart sensors is driving innovation, while collaborative R&D initiatives between material suppliers, printing technology developers, and display manufacturers are accelerating commercialization and market penetration globally.

Segmentation: Global Inkjet Printing Thin-Film Transistor Market is segmented By Material Type (Organic Semiconductor-Based TFTs, Metal Oxide Semiconductor-Based TFTs, Hybrid Semiconductor TFTs), Application (Flexible Displays, OLED & AMOLED Displays, Wearable Electronics), Substrate Type (Plastic Substrates, Glass Substrates, Metal Foil Substrates), End User (Consumer Electronics Manufacturers, Display Panel Manufacturers, Wearable Device Manufacturers, IoT and Smart Sensor Device Makers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Flexible and Large-Area Displays

The growing adoption of flexible, lightweight, and large-area display technologies is a major driver for the inkjet printing TFT market. Traditional silicon-based TFTs face limitations in terms of flexibility and cost when applied to bendable or large-area substrates. Inkjet-printed TFTs, on the other hand, enable low-temperature processing on plastic or flexible substrates, reducing material waste and manufacturing costs. For instance, since the second half of 2022, Chinese display makers have significantly reduced the prices of flexible AMOLED panels. since This has led to major smartphone OEMs to upgrade mid-range smartphone screens, which traditionally use rigid AMLED and LTPS TFT LCD panels, to flexible AMOLEDs.

This makes them highly suitable for next-generation OLED, AMOLED, and micro-LED displays used in smartphones, foldable tablets, wearable devices, and large-area signage. The increasing consumer preference for innovative, slim, and bendable electronics is accelerating adoption, driving the demand for scalable, efficient, and cost-effective inkjet-printed TFT solutions globally.

- Advancements in Printable Materials and Inkjet Printing Technologies

Technological innovations in conductive and semiconductive inks, including organic and metal-oxide formulations, are significantly boosting the performance and reliability of inkjet-printed TFTs. These advancements enable higher resolution, better electrical performance, and longer device lifetimes, making the technology more competitive with conventional TFT fabrication methods. In addition, improvements in inkjet printing hardware and precision deposition techniques allow for scalable, high-throughput manufacturing of TFTs on various substrates. Collaborative R&D efforts between material suppliers, display manufacturers, and printing technology developers are further enhancing process efficiency and product quality, fueling market growth across consumer electronics, IoT devices, and wearable applications.

Market Restraints:

- High Initial Investment and Production Costs

Although inkjet-printed TFTs offer cost advantages over conventional silicon-based fabrication in the long run, the initial investment in advanced inkjet printing equipment, precision deposition systems, and high-quality conductive/semiconductive inks remains significant. Small and mid-sized manufacturers, particularly in emerging markets, often find it challenging to justify these upfront costs. Additionally, the need for controlled environments to ensure uniform deposition and defect-free TFTs further increases operational expenses, slowing adoption in price-sensitive regions.

Socioeconomic Impact on Inkjet Printing Thin-Film Transistor Market

The Global Inkjet Printing Thin-Film Transistor (TFT) Market has created notable socioeconomic impacts worldwide. By enabling low-cost, scalable production of advanced displays and flexible electronics, the technology has supported growth in consumer electronics, healthcare devices, and industrial applications. This expansion has boosted manufacturing employment, encouraged high-tech skills development, and attracted investments into semiconductor and display industries. In emerging economies, inkjet-printed TFTs have lowered barriers to entry for smaller manufacturers, promoting innovation and competitiveness. Consumers have benefited from more affordable, energy-efficient devices such as e-readers, wearables, and IoT products. However, the rapid pace of technological change has also required workforce retraining and capital upgrades, pushing companies to adapt quickly to remain competitive in the global market.

Segmental Analysis:

- Metal Oxide Semiconductor-Based TFTs segment is expected to witness the highest growth over the forecast period

Metal oxide semiconductor-based TFTs are gaining prominence due to their higher carrier mobility, better electrical stability, and improved performance compared to organic semiconductor TFTs. These characteristics make them suitable for high-resolution displays, wearable electronics, and applications requiring consistent long-term operation. The segment benefits from ongoing research into advanced oxide formulations that enhance transparency and flexibility while maintaining reliable electronic properties.

- Flexible Displays segment is expected to witness the highest growth over the forecast period

Flexible displays are a major application driver for inkjet-printed TFTs, as consumers increasingly demand bendable, foldable, and lightweight electronic devices. Inkjet printing enables low-temperature fabrication on plastic or flexible substrates, reducing production costs and material wastage. This application is particularly significant in smartphones, tablets, and foldable OLED/AMOLED panels, where traditional silicon-based TFTs cannot provide the necessary flexibility.

- Plastic Substrates segment is expected to witness the highest growth over the forecast period

Plastic substrates are widely used for inkjet-printed TFTs due to their lightweight, bendable nature, and compatibility with low-temperature processing. They allow manufacturers to produce flexible and rollable electronic devices while maintaining mechanical durability. The use of plastic substrates also enables large-area fabrication, making them ideal for next-generation wearable electronics, flexible displays, and smart packaging solutions.

- Consumer Electronics Manufacturers segment is expected to witness the highest growth over the forecast period

Consumer electronics manufacturers are the primary adopters of inkjet-printed TFT technology because of the growing demand for flexible smartphones, tablets, wearable devices, and smart displays. These manufacturers leverage inkjet-printed TFTs to reduce manufacturing costs, enhance product design flexibility, and improve energy efficiency, while also catering to consumer expectations for innovative and aesthetically appealing devices.

- Asia-pacific region is expected to witness the highest growth over the forecast period

The Asia-Pacific region was expected to experience the fastest growth in the Global Inkjet Printing Thin-Film Transistor Market due to strong manufacturing capabilities, expanding electronics production, and increasing investments in advanced display technologies. Countries such as China, South Korea, Japan, and Taiwan had continued to lead in semiconductor and display panel development, creating high demand for efficient, cost-effective printing methods.

Rising adoption of flexible displays, wearables, and next-generation consumer electronics further supported market expansion. Governments in the region also promoted innovation through funding and industrial policies, encouraging companies to scale inkjet-printed TFT technologies. With a large consumer base and rapid technological adoption, Asia-Pacific had become the key growth engine for the industry. For instance, in December 2024, The Indian Institute of Technology Madras (IIT Madras) inaugurated the AMOLED Research Centre (ARC), a National Centre of Excellence focused on advancing next-generation AMOLED displays for smartphones, tablets, wearables, and other devices. Funded by MeitY, DRDO, and Tata Sons, the centre aims to bolster India’s display manufacturing capabilities. Equipped with a state-of-the-art cleanroom and advanced fabrication and characterization tools, ARC brings together multidisciplinary researchers to drive innovation. This initiative was expected to accelerate the development and adoption of AMOLED and OLED displays, strengthening the Asia-Pacific inkjet-printed TFT market by fostering local production, enhancing technological capabilities, and boosting regional competitiveness in next-generation display technologies.

Thus, such factors together are driving the growth of above market in this region.

To Learn More About This Report - Request a Free Sample Copy

Inkjet Printing Thin-Film Transistor Market Competitive Landscape

The competitive landscape for the Global Inkjet Printing Thin Film Transistor (TFT) Market is dynamic and characterized by both large, diversified display panel and electronics manufacturers — which leverage scale, established supply chains and deep R&D budgets — and more specialized firms focusing on inkjet printing technologies, materials, and flexible electronics innovations. Key competitive levers include the ability to deliver high mobility, stable oxide or organic TFT backplanes; to scale inkjet printing processes to large-area, flexible substrates; to integrate TFT solutions with next gen displays (OLED, micro-LED, e paper); and to form strategic partnerships for supply chain integration (inks, substrates, display assembly).

The major players for this market are:

- Samsung Electronics

- LG Display

- BOE Technology Group

- Innolux Corporation

- AU Optronics

- TCL CSOT

- Sharp Corporation

- Japan Display Inc.

- E Ink Holdings

- Universal Display Corporation

- Dai Nippon Printing Co., Ltd.

- Fujifilm Dimatix, Inc.

- Kateeva, Inc.

- Merck KGaA

- DuPont de Nemours, Inc.

- Tianma Microelectronics Co., Ltd.

- Visionox Technology Inc.

- Sony Corporation

- FlexEnable Ltd.

- Nanosys, Inc.

Recent Development

- In December 2025, onsemi and Innoscience signed a memorandum of understanding to fast-track the deployment of GaN power devices, initially targeting 40–200V offerings, with sampling expected in the first half of 2026. By combining onsemi’s expertise in integrated systems with Innoscience’s 8-inch GaN technology, the partnership aimed to advance products across industrial, automotive, telecom, consumer, and AI sectors. This collaboration indirectly strengthened the global inkjet-printed TFT market by increasing demand for high-performance, energy-efficient electronic components.

- In April 2025, The Indian government approved the Semicon India Programme with a total outlay of INR 76,000 crore to develop the country’s semiconductor and display ecosystem. The scheme had provided up to 50% fiscal support for setting up CMOS, display, compound semiconductor fabs, and ATMP/OSAT facilities, along with design and deployment-linked incentives. This initiative had strengthened the Asia-Pacific inkjet-printed TFT market by boosting local display manufacturing and technology adoption.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The biggest drivers are the rapidly increasing demand for flexible and wearable electronics. Inkjet printing allows manufacturers to produce these complex, large-area Thin-Film Transistor (TFT) arrays cheaply and efficiently, reducing material waste compared to older fabrication methods. This is essential for the future of foldable phones and new display technologies.

Q2. What are the main restraining factors for this market?

The market is held back by the high initial investment cost needed for the specialized inkjet printing equipment. Furthermore, achieving the extremely high resolution and uniformity required for top-tier displays remains a technical challenge. Quality control and ensuring the stability of the functional ink materials can also slow adoption.

Q3. Which segment is expected to witness high growth

?

The Display Manufacturing segment, particularly for advanced screens, is expected to see the highest growth. Inkjet printing is revolutionizing the production of large-size and flexible OLED displays. It offers a precise, non-contact method to deposit organic materials, making it indispensable for next-generation, high-resolution screens in smart devices and televisions.

Q4. Who are the top major players for this market?

The major players include established electronics and printing companies that provide both the necessary equipment and the display technology. Key companies in this specialized area are Panasonic Corporation, Seiko Epson Corporation, Kateeva Inc., and Konica Minolta. These firms focus heavily on advancing the proprietary printhead and ink chemistry technologies.

Q5. Which country is the largest player?

Asia-Pacific currently dominates the Inkjet TFT market, primarily due to the region's massive concentration of display and semiconductor manufacturing hubs in countries like South Korea, China, and Japan. These countries possess the strong R&D infrastructure and high-volume production capabilities necessary for advanced display technology adoption.

List of Figures

Figure 1: Global Inkjet Printing Thin-Film Transistor Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Inkjet Printing Thin-Film Transistor Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Inkjet Printing Thin-Film Transistor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model