Medicine Compounding Robot Market Overview and Analysis:

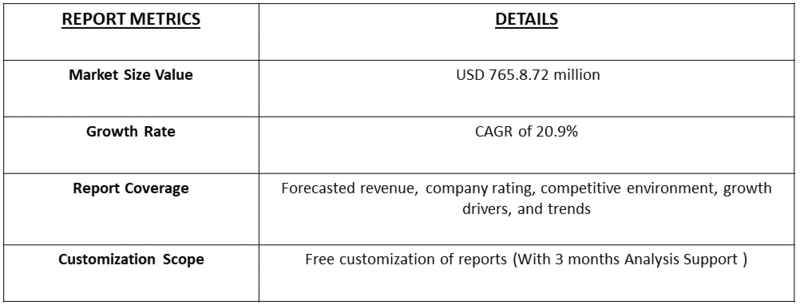

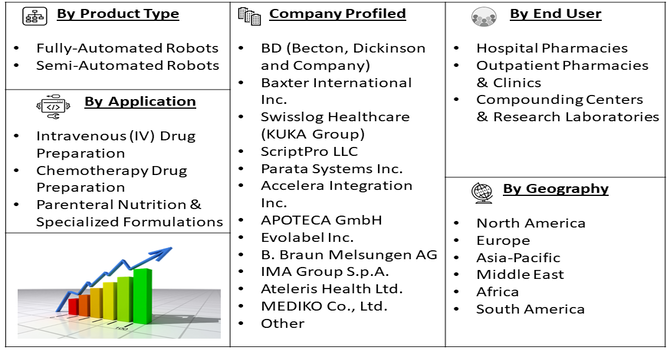

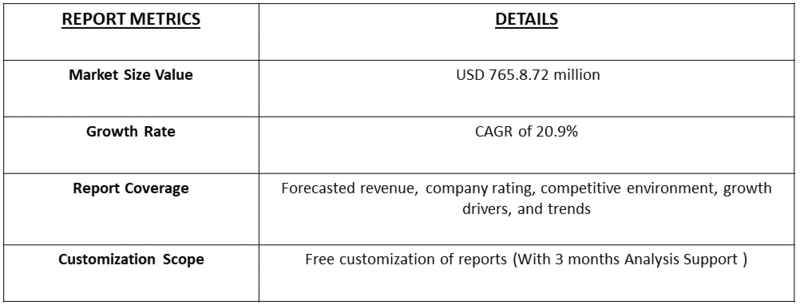

- The Global Medicine Compounding Robot Market is projected to reach about USD 765.8.72 million by 2032, from USD 217 million in 2025. The market is forecast to surge with an impressive CAGR of around 20.9% over the forecast period (2025–2032).

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Medicine Compounding Robot Market is witnessing significant growth, primarily driven by the increasing demand for automation in pharmaceutical compounding to enhance accuracy, efficiency, and patient safety. With the rising prevalence of chronic diseases and the growing need for personalized medicine, hospitals and compounding pharmacies are adopting robotic systems to minimize human error and contamination risks in drug preparation. Additionally, stringent regulatory requirements for sterile and precise compounding, particularly in oncology and parenteral nutrition, are accelerating the deployment of robotic solutions.

Medicine Compounding Robot Market Latest Trends:

The global Medicine Compounding Robot market is witnessing a range of compelling trends that are reshaping how hospitals and pharmacies prepare medications. Firstly, there is growing adoption of AI and machine-learning-enabled robotic systems, which allow real-time error detection, predictive maintenance and enhanced dosing accuracy during compounding operations. Secondly, vendors are developing compact, modular robotic platforms, tailored for smaller pharmacies and specialty clinics with limited space, enabling wider deployment beyond large hospital pharmacies.

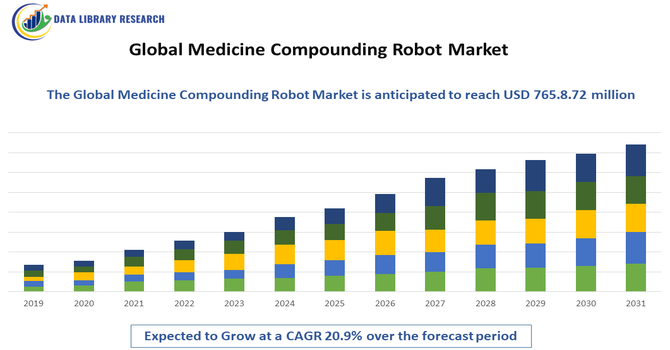

Segmentation: Global Medicine Compounding Robot Market is segmented By Product Type (Fully-Automated Robots, Semi-Automated Robots), End User (Hospital Pharmacies, Outpatient Pharmacies & Clinics, Compounding Centers & Research Laboratories), Application (Intravenous (IV) Drug Preparation, Chemotherapy Drug Preparation, Parenteral Nutrition & Specialized Formulations), Compounding Type (Non-Hazardous Compounding, Hazardous Compounding), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Precision and Safety in Drug Preparation

One of the key drivers for the Global Medicine Compounding Robot Market is the increasing emphasis on accuracy, sterility, and safety in medication preparation. Traditional manual compounding methods are prone to human error, which can lead to incorrect dosages, contamination, or cross-mixing of drugs—particularly critical in chemotherapy and intravenous (IV) formulations.

Medicine compounding robots eliminate these risks by delivering precise measurements under sterile environments, ensuring high-quality and consistent outputs. Growing concerns over medication errors and the enforcement of stringent regulatory standards by agencies such as the U.S. FDA and the European Medicines Agency (EMA) are pushing healthcare facilities to adopt automated compounding systems for both hazardous and non-hazardous preparations.

- Labor Shortages and the Push for Healthcare Automation

Another major growth driver is the increasing shortage of skilled pharmacy technicians and compounding staff, particularly in hospitals and clinical laboratories. As healthcare systems face higher workloads and workforce constraints, automation offers a sustainable solution to maintain productivity and compliance. Medicine compounding robots significantly reduce manual intervention, allowing pharmacists to focus on clinical and patient-care activities.

Additionally, the growing integration of artificial intelligence (AI), machine vision, and data analytics in robotic systems enhances operational efficiency, enabling real-time monitoring, error detection, and traceability. This technological progress, coupled with rising labor costs and the need for 24/7 operations, continues to accelerate the adoption of robotic compounding solutions across global healthcare facilities.

Market Restraints

- High Initial Investment and Maintenance Cost

The primary restraints is the high initial investment and maintenance cost associated with installing and operating compounding robots. These systems require significant capital for procurement, integration, and staff training, making them less accessible to small and mid-sized hospitals or pharmacies with limited budgets. Additionally, the ongoing expenses related to calibration, software updates, and compliance validation can further strain financial resources.

Socio Economic Impact on Medicine Compounding Robot Market

The global medicine compounding robot market has had a significant socioeconomic impact by improving the safety, accuracy, and efficiency of drug preparation in hospitals and pharmacies. These robots reduced human errors, ensured precise dosages, and lowered the risk of contamination, protecting patients’ health. The market also created skilled jobs in robotics, engineering, and healthcare, while encouraging innovation in automated pharmaceutical solutions. By streamlining workflows, reducing costs, and enhancing patient outcomes, the market strengthened healthcare systems worldwide and increased public trust in safe and reliable medication delivery.

Segmental Analysis:

- Fully-Automated Robots segment is expected to witness highest growth over the forecast period

The fully-automated robot segment dominates the Global Medicine Compounding Robot Market and is expected to continue its strong growth trajectory over the forecast period. These systems handle the complete compounding process autonomously—from measuring and mixing ingredients to labeling and dispensing—under sterile conditions. Their ability to minimize human intervention, reduce contamination risk, and deliver consistent, error-free preparations makes them the preferred choice for large hospital pharmacies and oncology centers. Increasing regulatory scrutiny around sterile compounding practices, especially in high-risk drug preparation like parenteral nutrition and chemotherapy, is further fueling demand for fully automated robotic systems.

- Hospital Pharmacies segment is expected to witness highest growth over the forecast period

The hospital pharmacy segment holds the largest market share, driven by the growing need for safe and efficient medication compounding in inpatient and outpatient care. Hospitals frequently deal with complex and high-risk formulations, such as intravenous drugs and chemotherapeutics, where precision and sterility are critical. The adoption of compounding robots helps hospitals enhance workflow efficiency, meet USP <797> and <800> standards, and minimize occupational exposure to hazardous drugs. Additionally, the rising prevalence of chronic diseases and increasing patient loads in hospitals have accelerated the integration of robotic compounding systems to streamline pharmacy operations.

- Chemotherapy Drug Preparation segment is expected to witness highest growth over the forecast period

The chemotherapy drug preparation segment represents a key area of growth within the market, owing to the heightened need for safety and accuracy in handling cytotoxic drugs. Manual compounding of chemotherapy medications poses serious health risks to pharmacists and technicians due to potential exposure. Medicine compounding robots ensure exact dosing, traceability, and closed-system drug transfer, significantly enhancing both patient safety and staff protection. With the global increase in cancer cases and expansion of oncology care facilities, demand for robotic compounding in chemotherapy applications is projected to rise steadily.

- Hazardous Compounding segment is expected to witness highest growth over the forecast period

The hazardous compounding segment is expected to see robust growth as healthcare institutions prioritize automation to mitigate occupational risks. Handling of hazardous drugs, including chemotherapy and antiviral agents, requires strict adherence to safety protocols. Robotic compounding systems provide a sterile, enclosed environment that eliminates direct human contact with toxic substances while maintaining precision in formulation. Increasing regulatory emphasis on worker safety and sterile environments is a major factor driving adoption in this category.

- North America segment is expected to witness highest growth over the forecast period

The North America region is projected to dominate the Global Medicine Compounding Robot Market over the forecast period, owing to advanced healthcare infrastructure, high adoption of healthcare automation, and strong regulatory compliance culture. The U.S., in particular, has been at the forefront of integrating compounding robots in hospital and oncology pharmacies to enhance accuracy and meet USP standards. Growing investments in healthcare automation, coupled with labor shortages in the pharmacy sector, are further accelerating market expansion across the region.

Moreover, North America maintained a leading position in the global medicine compounding robot market due to its advanced healthcare infrastructure, widespread adoption of automation, and stringent regulatory standards. The U.S. spearheaded integration of compounding robots in hospitals and oncology pharmacies to improve accuracy and comply with USP guidelines. Increasing investments in automation technologies and addressing workforce shortages further accelerated market growth, reinforcing North America’s dominance in driving innovation and adoption in the medicine compounding robot sector.

To Learn More About This Report - Request a Free Sample Copy

Medicine Compounding Robot Market Competitive Landscape:

The competitive landscape in the global medicine compounding robot market is characterized by a growing number of players developing robotic systems for hospital pharmacies, outpatient clinics and centralized compounding centers. Companies compete on automation capabilities, integration with pharmacy information systems (PIS) and electronic health records (EHR), precision dosing, closed-system safety for hazardous drug handling, modularity, maintenance service contracts and geographic service networks. Strategic partnerships with healthcare institutions, oncology centers and pharmaceutical companies are common, as is expansion into emerging markets via distributor networks.

Key Player:

- BD (Becton, Dickinson and Company)

- Baxter International Inc.

- Swisslog Healthcare (KUKA Group)

- ScriptPro LLC

- Parata Systems Inc.

- Accelera Integration Inc.

- APOTECA GmbH

- Evolabel Inc.

- B. Braun Melsungen AG

- IMA Group S.p.A.

- Ateleris Health Ltd.

- Capsa Healthcare (Capsa Solutions)

- Elia Medical Generation (CMF & Robotique)

- Hutchison Technologies Inc.

- MEDIKO Co., Ltd.

- Swisslog Pharmacy Automation (part of KUKA)

- Phaedrus Systems (PharmacyAutomation.com)

- Hospi Depot Automation S.r.l.

- VarioTrack Systems (Pharmacy Automation)

- SHL Group Ltd.

Recent Development

- In May 2025, CurifyLabs, a Finnish healthtech company, raised EUR 6.7 million to modernize and automate the production of compounded medications, enhancing safety and personalization for patients. Led by Springvest and supported by a EUR 1 million deep tech loan from Business Finland, the funding enabled CurifyLabs to scale operations and serve high-volume customers. This investment advanced technological adoption and strengthened growth in the global medicine compounding robot market.

- In October 2025, Ballad Health in Johnson City, Tennessee, added three Omnicell IVX Station compounding robots to its central fill pharmacy at Bristol Regional Medical Center, joining three Omnicell XR2 dispensing robots introduced in early 2024. The robots automated IV preparation, reduced manual tasks, and minimized medication errors, dispensing nearly 9 million doses without mistakes. Their deployment highlighted the efficiency and reliability of automation, driving adoption and growth in the global medicine compounding robot market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

A primary driver is the critical need to enhance patient safety by minimizing human errors, such as dosage mistakes and contamination, inherent in manual compounding processes. Additionally, stringent healthcare regulations, particularly in North America and Europe, mandate highly sterile preparation environments. The rising complexity and demand for personalized medicine, including chemotherapy drugs and total parenteral nutrition (TPN), further necessitate the precision and accuracy that robotic automation provides.

Q2. What are the main restraining factors for this market?

The most significant restraint is the extremely high initial capital cost associated with purchasing, installing, and integrating these complex robotic systems into existing hospital pharmacies. This initial investment creates a substantial barrier to entry, especially for smaller hospitals and healthcare facilities. Furthermore, the specialized nature of the technology requires technical expertise, leading to high maintenance costs and a need for extensive staff training.

Q3. Which segment is expected to witness high growth?

The Hospital application segment is anticipated to witness the highest growth. Hospitals handle the largest volume and greatest complexity of compounded medications, especially intravenous (IV) solutions and antineoplastic (chemotherapy) drugs. Driven by increasing patient admissions, strict safety protocols, and the push for greater efficiency in central hospital pharmacies, these institutions are the primary adopters of high-throughput compounding robots.

Q4. Who are the top major players for this market?

Key players dominating the market include Omnicell, Inc., ARxIUM, and Baxter International Inc. These companies focus on developing fully automated, aseptic solutions, particularly for IV and hazardous drug compounding. Their competitive edge comes from strong technological integration, offering comprehensive pharmacy automation ecosystems that not only compound medicines but also manage inventory and ensure regulatory compliance.

Q5. Which country is the largest player?

The United States (in the North American region) is the largest country in this market. This dominance is due to its advanced healthcare infrastructure, high healthcare expenditure, and a highly regulated environment that places a strong emphasis on reducing medication errors and ensuring patient safety. Large hospital networks continuously invest in automation to meet high clinical standards and manage increasing patient volumes efficiently.

List of Figures

Figure 1: Global Medicine Compounding Robot Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Medicine Compounding Robot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Medicine Compounding Robot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Medicine Compounding Robot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Medicine Compounding Robot Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Medicine Compounding Robot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Medicine Compounding Robot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Medicine Compounding Robot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Medicine Compounding Robot Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Medicine Compounding Robot Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Medicine Compounding Robot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Medicine Compounding Robot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Medicine Compounding Robot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Medicine Compounding Robot Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Medicine Compounding Robot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Medicine Compounding Robot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Medicine Compounding Robot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Medicine Compounding Robot Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Medicine Compounding Robot Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Medicine Compounding Robot Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Medicine Compounding Robot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Medicine Compounding Robot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Medicine Compounding Robot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Medicine Compounding Robot Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Medicine Compounding Robot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Medicine Compounding Robot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Medicine Compounding Robot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Medicine Compounding Robot Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Medicine Compounding Robot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model