Oxygen-enriched Membrane Oxygen Generator Market Overview and Analysis

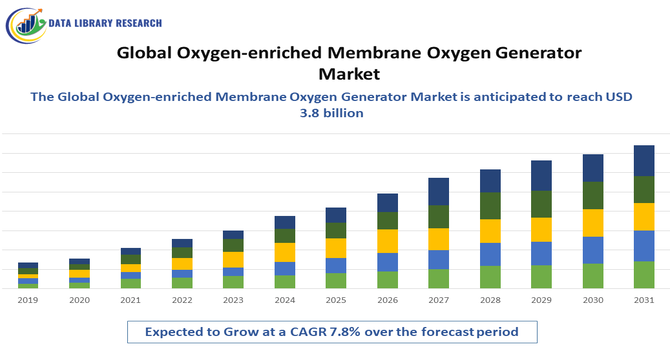

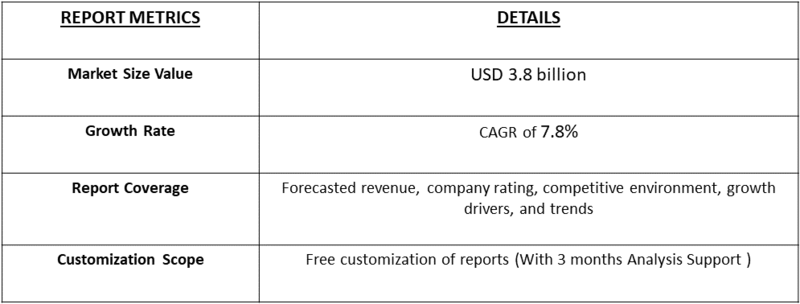

- The Global Oxygen-enriched Membrane Oxygen Generator (OMOG) market is experiencing significant growth, is currently valued at USD 1.07 billion in the year 2025, projected to reach approximately USD 3.8 billion by 2032 and growing with a CAGR of around 7.8% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The global oxygen-enriched membrane oxygen generator market focuses on systems that use advanced membrane technology to separate and concentrate oxygen from air, providing a reliable, energy-efficient solution for medical, industrial, and environmental applications worldwide. The growth of the global oxygen-enriched membrane oxygen generator market is driven by increasing demand for efficient oxygen generation in healthcare, industrial, and environmental applications. Rising cases of respiratory diseases, expanding use in wastewater treatment, and growing adoption in manufacturing and chemical industries are fueling market expansion. These systems offer advantages such as compact design, low maintenance, and energy efficiency compared to traditional oxygen production methods.

Oxygen-enriched Membrane Oxygen Generator Market Latest Trends

The global oxygen-enriched membrane oxygen generator market is witnessing strong growth, driven by advancements in membrane technology, increasing automation, and the rising preference for on-site oxygen generation solutions. Manufacturers are focusing on developing compact, energy-efficient, and high-purity systems suitable for diverse applications, including healthcare, chemical processing, food packaging, and environmental management. Strategic collaborations, R&D investments, and integration of smart monitoring and IoT-based control systems are emerging as key trends to enhance operational efficiency and reliability. Additionally, the growing emphasis on sustainable, low-carbon industrial processes and the expansion of healthcare infrastructure in developing regions are further shaping the market’s evolution toward more scalable and eco-friendly oxygen generation technologies.

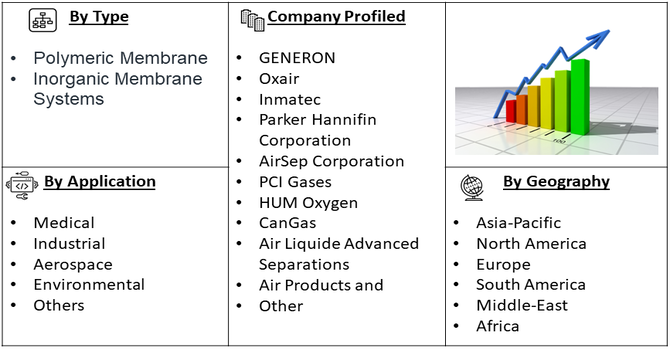

Segmentation: The Global Oxygen-Enriched Membrane Oxygen Generator Market is segmented By Type (Polymeric Membrane and Inorganic Membrane Systems), Application (Medical, Industrial, Aerospace, Environmental, and Others) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Demand in Healthcare and Medical Applications

The growing need for reliable oxygen supply in healthcare facilities is a major driver for the global oxygen-enriched membrane oxygen generator market. Hospitals, clinics, and emergency care centers are increasingly adopting on-site membrane oxygen generators to ensure a consistent and high-purity oxygen supply for critical care, respiratory therapy, and surgical procedures. The COVID-19 pandemic further highlighted the importance of localized oxygen generation systems to reduce dependence on external suppliers. These systems offer significant advantages such as compact design, low maintenance, and cost-effective operation compared to traditional cryogenic or pressure swing adsorption systems. Moreover, increasing investments in healthcare infrastructure, especially in developing regions, continue to accelerate the adoption of oxygen-enriched membrane generators globally.

- Rising Industrial Applications and Energy Efficiency

Another key growth driver for the oxygen-enriched membrane oxygen generator market is the rising use of oxygen-enriched air in industrial processes. Industries such as chemical manufacturing, metallurgy, wastewater treatment, and glass production are increasingly adopting membrane-based systems for improved combustion efficiency, reduced emissions, and enhanced process control. These generators offer energy-efficient oxygen separation with lower operational costs and reduced carbon footprints compared to conventional technologies. The growing focus on sustainability and environmental compliance is encouraging industries to transition toward membrane-based oxygen systems. Additionally, continuous advancements in membrane materials and design have enhanced permeability and selectivity, improving overall system efficiency and extending operational life, thereby driving widespread industrial adoption.

Market Restraints:

- High Initial Investment and Technical Limitations

Despite their advantages, the high initial setup cost of oxygen-enriched membrane systems remains a key restraint for market growth. The technology requires advanced materials and precision engineering, leading to higher manufacturing and installation costs compared to traditional oxygen supply methods. Small and medium enterprises, particularly in cost-sensitive regions, may find the upfront investment challenging. Furthermore, membrane-based systems can face limitations in achieving extremely high oxygen purity levels, restricting their use in certain high-grade industrial or medical applications that demand ultra-pure oxygen. Membrane degradation over time and the need for periodic replacement also add to maintenance costs, posing challenges for long-term affordability and large-scale adoption in price-conscious markets

Socio economic Impact on Oxygen-enriched Membrane Oxygen Generator Market

The global oxygen-enriched membrane oxygen generator market has a significant socioeconomic impact by improving access to affordable and reliable oxygen supply across medical, industrial, and environmental sectors. In healthcare, these systems enhance emergency preparedness, particularly in remote and developing regions, by ensuring continuous oxygen availability for critical care and respiratory treatments. Industrially, they promote energy efficiency, reduce carbon emissions, and lower production costs, supporting sustainable economic growth. The expansion of local manufacturing and installation services also creates employment opportunities and drives technological skill development. Furthermore, by reducing dependency on transported oxygen cylinders, these systems contribute to cost savings, operational safety, and greater self-sufficiency, aligning with global efforts toward sustainability, healthcare resilience, and industrial modernization.

Segmental Analysis:

- Polymeric Membrane segment is expected to witness highest growth over the forecast period

The polymeric membrane segment is expected to witness the highest growth over the forecast period due to its superior flexibility, cost-effectiveness, and scalability in oxygen separation applications. These membranes offer excellent permeability, stability, and durability, making them ideal for continuous oxygen generation in both medical and industrial environments. Their lightweight design and easy integration into compact systems further enhance their appeal in portable and on-site oxygen generation units. Ongoing advancements in polymer chemistry and nanocomposite materials are improving oxygen selectivity and lifespan, driving widespread adoption across healthcare, manufacturing, and environmental sectors seeking efficient and sustainable oxygen enrichment technologies.

- Medical segment is expected to witness highest growth over the forecast period

The medical segment is projected to experience the highest growth during the forecast period, driven by increasing global demand for high-purity oxygen in hospitals, clinics, and home healthcare. Rising incidences of respiratory disorders, an aging population, and growing healthcare infrastructure investments have accelerated the adoption of oxygen-enriched membrane generators in medical applications. These systems provide a stable and cost-efficient on-site oxygen source, reducing reliance on cylinder supply chains. Furthermore, technological improvements in membrane efficiency and compact designs have enabled faster oxygen delivery, particularly beneficial during medical emergencies and pandemic situations, solidifying the segment’s leadership in market expansion.

- North America region is expected to witness highest growth over the forecast period

North America is expected to witness the highest growth in the global oxygen-enriched membrane oxygen generator market due to strong healthcare infrastructure, increasing investments in advanced medical technologies, and growing industrial demand for energy-efficient oxygen systems. The region’s focus on sustainability, coupled with stringent environmental regulations, has driven industries to adopt cleaner and more efficient oxygen generation methods. Additionally, the presence of major market players, robust R&D activities, and high awareness of on-site oxygen generation benefits contribute to regional dominance. Expanding healthcare facilities and technological advancements in membrane materials further strengthen North America’s position as a key growth hub for this market.

To Learn More About This Report - Request a Free Sample Copy

Oxygen-enriched Membrane Oxygen Generator Market Competitive Landscape

The competitive landscape of the global oxygen-enriched membrane oxygen generator market is characterized by a mix of established players and emerging innovators focusing on technological advancements and efficiency improvements. Key companies compete through product innovation, material enhancement, and strategic partnerships to expand their global presence. Leading players are investing in R&D to develop membranes with higher permeability, selectivity, and durability while reducing energy consumption and operational costs. The market also witnesses collaborations between manufacturers and healthcare providers to design compact, cost-effective on-site oxygen generation systems. Furthermore, regional manufacturers in Asia-Pacific and Europe are gaining traction by offering localized, affordable solutions, intensifying competition in both medical and industrial segments worldwide.

The 20 major players for above market are:

- GENERON

- Oxair

- Inmatec

- Parker Hannifin Corporation

- AirSep Corporation

- PCI Gases

- HUM Oxygen

- CanGas

- Air Liquide Advanced Separations

- Air Products and Chemicals, Inc.

- MVS Engineering (OXYMED)

- BODA Gas Technology

- GRASYS JSC

- Guochu Technology (Xiamen) Co., Ltd.

- INOX Air Products

- Maximator GmbH

- INCOTEC GmbH

- Medo Products Inc.

- Stirling Cryogenics

- Genrich Membranes Pvt. Ltd.

Recent Development

- In May 2025, an article published by Asia-Pacific Journal of Chemical Engineering reported that Oxygen is vital for preventing and treating acute altitude sickness and for emergency rescue. On-site oxygen generation provides timely supply using various methods such as cryogenic distillation, pressure swing adsorption, membrane separation, and water electrolysis. Understanding these technologies and their advancements helps improve efficiency and develop oxygen generation systems suited for diverse environmental and medical conditions.

- In July 2025, an article published by researchers of State Key Laboratory of Heavy Oil Processing, College of Chemical Engineering, China University of Petroleum (East China), reported that oxygen is vital for treating acute altitude sickness and emergencies, requiring reliable on-site generation. Methods like membrane separation, PSA, and electrolysis have advanced, while innovations such as COF-enhanced PEM fuel cells improve oxygen transport and efficiency. These developments drive more effective, portable oxygen generation solutions globally.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary drivers are the increasing global prevalence of chronic respiratory diseases, such as COPD and asthma, which necessitate continuous oxygen therapy. Furthermore, the rising global elderly population, who require both hospital and home-based medical oxygen, significantly boosts demand. Technological advancements that result in more energy-efficient, reliable, and portable membrane oxygen generators, along with growing investments in healthcare infrastructure in emerging economies, are key accelerators for market expansion.

Q2. What are the main restraining factors for this market?

A major restraint is the technical limitation of membrane technology itself, as it typically produces oxygen at a lower purity (60-80%) compared to cryogenic or high-end PSA methods, which is often insufficient for critical medical or high-purity industrial applications. Additionally, the high capital expenditure for specialized membranes and the dependence on a stable, reliable power supply for continuous operation, particularly in remote or underdeveloped areas, pose significant implementation challenges.

Q3. Which segment is expected to witness high growth?

While the Healthcare/Medical Sector currently holds the largest share due to widespread oxygen therapy demand, the Environmental Remediation and Energy & Power Generation segments are expected to witness high growth rates. This is driven by the use of oxygen-enriched air in clean combustion technologies to improve energy efficiency and reduce carbon emissions, as well as its application in wastewater treatment plants for enhanced aeration processes and improved water quality.

Q4. Who are the top major players for this market?

The oxygen generator market, which includes membrane technology, is dominated by large industrial gas and medical equipment providers. Top major players include Linde plc, Air Liquide S.A., Air Products and Chemicals, Inc., and Atlas Copco. These companies leverage their global presence and engineering expertise to offer advanced on-site generation systems, including membrane and Pressure Swing Adsorption (PSA) technologies, for large-scale medical, industrial, and specialized applications.

Q5. Which country is the largest player?

North America, primarily driven by the United States, currently holds the largest market share by revenue for oxygen-enriched membranes. This dominance is due to the region's highly established healthcare sector, significant R&D in gas separation technologies, and high expenditure on both medical oxygen equipment and advanced industrial processes. However, the Asia-Pacific region is projected to register the fastest growth due to rapid industrialization and improving healthcare infrastructure.

List of Figures

Figure 1: Global Oxygen-enriched Membrane Oxygen Generator Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Oxygen-enriched Membrane Oxygen Generator Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Oxygen-enriched Membrane Oxygen Generator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model