Radiation Hardened Electronics For the Aerospace Market: Overview and Analysis

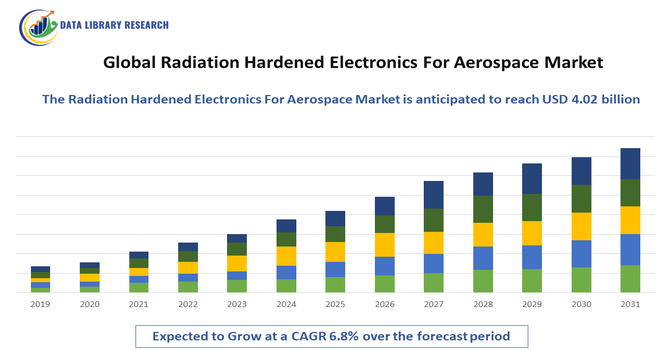

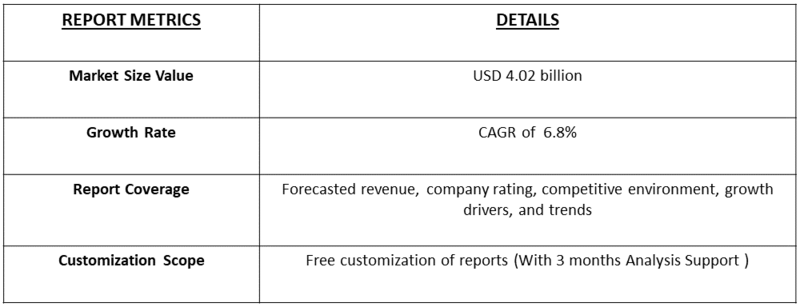

- The Global Radiation Hardened Electronics for Aerospace Market size was estimated at USD 2.07 billion in 2025 and is projected to reach USD 4.02 billion by 2032. Growing with a CAGR of 6.8% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Radiation Hardened Electronics for Aerospace Market is witnessing significant growth, driven primarily by the increasing demand for reliable and durable electronic components capable of withstanding extreme space and high-radiation environments. The expansion of satellite deployments, including communication, navigation, and Earth observation satellites, has fueled the need for advanced radiation-hardened semiconductors and integrated circuits to ensure mission-critical operations.

Additionally, rising investments in space exploration programs by government agencies and private aerospace companies are accelerating the adoption of these resilient electronics. The growing trend of miniaturization and the integration of advanced technologies in spacecraft and defense systems further supports market growth. Moreover, the increasing need for high-reliability components in unmanned aerial vehicles (UAVs), space probes, and deep-space missions is reinforcing the adoption of radiation-hardened electronics, positioning the market for sustained expansion over the forecast period.

Radiation Hardened Electronics For Aerospace Market Latest Trends

The Global Radiation Hardened Electronics for Aerospace Market is witnessing several notable trends shaping its growth trajectory. There is a strong push towards miniaturization and SWaP (Size, Weight, and Power) optimization, driven by the rise of small satellites, CubeSats, and commercial constellations, which require compact, lightweight, and energy-efficient components. Alongside this, the adoption of Commercial-Off-The-Shelf (COTS) and radiation-tolerant solutions is increasing, enabling cost-effective deployment in less demanding aerospace applications without compromising reliability. Advanced semiconductor materials, such as silicon-on-insulator (SOI) and gallium nitride (GaN), along with radiation-hardening by design (RHBD) techniques, are being integrated to enhance device resilience and performance. High-speed communication and data processing capabilities are becoming essential, supporting the growing need for high-throughput satellite networks and autonomous spacecraft operations.

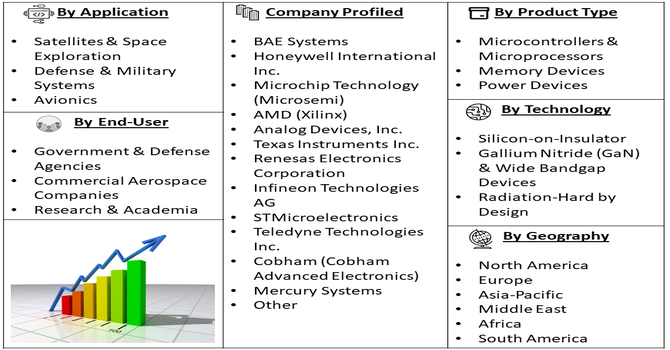

Segmentation: Global Radiation Hardened Electronics For Aerospace Market is segmented By Component Type (Microcontrollers & Microprocessors, Memory Devices, Power Devices, Analog & Mixed-Signal Devices), Technology (Silicon-on-Insulator, Gallium Nitride (GaN) & Wide Bandgap Devices, Radiation-Hard by Design, Radiation-Hard by Process), Application (Satellites & Space Exploration, Defense & Military Systems, Avionics), End-User (Government & Defense Agencies, Commercial Aerospace Companies, Research & Academia), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Satellite Deployments and Space Exploration Programs

The rising number of satellite launches for communication, navigation, Earth observation, and deep-space missions is driving the demand for radiation-hardened electronics. These components ensure reliable performance in harsh space environments where exposure to cosmic radiation, solar flares, and high-energy particles can damage conventional electronics. The expansion of government-led space exploration programs and private commercial satellite ventures further accelerates this demand. Additionally, advancements in miniaturization and increased integration of radiation-hardened electronics are enabling more compact, energy-efficient, and multifunctional spacecraft systems. This trend supports cost-effective satellite missions and enhances the capabilities of defense, research, and commercial space applications. As global reliance on satellite-based services grows—ranging from telecommunications and GPS to climate monitoring and disaster management—the importance of reliable rad-hard electronics intensifies, making them a critical enabler of both technological progress and economic growth in the aerospace sector.

- Growing Need for High-Reliability Aerospace and Defense Systems

Aerospace vehicles, defense platforms, unmanned aerial vehicles (UAVs), and military satellites require electronics that can operate reliably under extreme conditions, including high radiation levels and temperature fluctuations. The need to prevent system failures in mission-critical applications is pushing manufacturers to adopt advanced radiation-hardened components, thereby driving market growth. Moreover, the increasing investment in space defense and strategic aerospace programs by governments worldwide is fueling innovation in radiation-hardened electronics. Collaborations between defense contractors, semiconductor manufacturers, and research institutions are accelerating the development of next-generation components with higher resilience, lower power consumption, and enhanced processing capabilities.

Market Restraints

- High Cost of Radiation-Hardened Components

One major challenge is the high cost of radiation-hardened components, which are significantly more expensive than standard electronics due to specialized materials, fabrication processes, and rigorous testing requirements. This cost factor limits adoption, especially in small satellite projects or commercial aerospace ventures with tight budgets. Another restraint is the long and complex development and qualification process, as rad-hard components must undergo extensive radiation testing and certification to ensure reliability in extreme environments. This not only increases time-to-market but also requires substantial investment in R&D and specialized manufacturing infrastructure. Additionally, technological complexity and limited supply chain capabilities for advanced rad-hard materials, such as silicon-on-insulator (SOI) and gallium nitride (GaN), can constrain production scalability, affecting market growth.

Socio Economic Impact on Radiation Hardened Electronics For Aerospace Market

The global radiation hardened electronics market for aerospace has profound socioeconomic implications. It underpins the robustness of space systems and defense infrastructure, driving high skilled employment, innovation, and large-scale R&D investments. Growth in satellite deployments and space exploration—fueled by both government agencies and private players—boosts demand for rad hard components, contributing to technological sovereignty and national security. Yet the high costs and specialized manufacturing needed limit access to a few major players, reinforcing economic disparities. Over time, broader adoption may lower costs, democratizing space access and supporting global infrastructure development.

Segmental Analysis:

- Microcontrollers & Microprocessors segment is expected to witness the highest growth over the forecast period

The microcontrollers and microprocessors segment is expected to dominate the component type category due to the growing demand for high-performance computing in spacecraft, satellites, and defense systems. These components are critical for managing onboard operations, communication protocols, and autonomous decision-making in harsh radiation environments. The shift toward smaller satellites and advanced UAVs further drives the need for compact, energy-efficient, and radiation-hardened processors capable of performing complex computations reliably. This segment holds significant market value as mission-critical applications increasingly depend on robust processing capabilities.

- Silicon-on-Insulator segment is expected to witness the highest growth over the forecast period

The Silicon-on-Insulator (SOI) technology segment is projected to witness substantial growth owing to its inherent radiation tolerance and high-performance characteristics. SOI-based devices minimize leakage currents and improve overall device reliability under high-radiation conditions, making them ideal for aerospace and defense applications. This technology is widely used in rad-hard microprocessors, memory devices, and mixed-signal ICs, and its adoption is accelerating with the increasing number of satellite missions and long-duration space exploration programs.

- Satellites & Space Exploration segment is expected to witness the highest growth over the forecast period

The satellites and space exploration segment is the fastest-growing application area in the market. The surge in satellite constellations for communication, navigation, and Earth observation, coupled with deep-space exploration initiatives, drives demand for reliable rad-hard electronics. These components protect sensitive instruments and onboard systems from cosmic radiation, solar flares, and high-energy particles. The trend of miniaturized satellites, such as CubeSats and small LEO constellations, further reinforces growth in this segment.

- Government & Defense Agencies segment is expected to witness the highest growth over the forecast period

The government and defense agencies segment represents the largest end-user category, as military and space programs heavily rely on high-reliability electronics capable of operating under extreme conditions. Defense satellites, missile guidance systems, radar platforms, and strategic UAVs require radiation-hardened electronics to ensure mission success. Government-funded space exploration projects and defense modernization initiatives continue to drive significant investments, sustaining high demand in this segment.

- North America region is expected to witness the highest growth over the forecast period

The North America region is expected to witness the highest growth in the Global Radiation Hardened Electronics for Aerospace Market over the forecast period. This growth is primarily driven by substantial investments in space exploration, satellite programs, and defense modernization initiatives led by government agencies such as NASA and the U.S. Department of Defense. The presence of major aerospace and defense companies, advanced research and development infrastructure, and early adoption of cutting-edge radiation-hardened technologies further reinforce the region’s market dominance. Additionally, the increasing deployment of commercial satellites and the expansion of private space ventures in North America are boosting demand for reliable, high-performance radiation-hardened components, positioning the region for sustained growth throughout the forecast period.

To Learn More About This Report - Request a Free Sample Copy

Radiation Hardened Electronics For Aerospace Market Competitive Landscape

The competitive landscape is dominated by a mix of large aerospace/defense primes and specialized semiconductor and subsystem suppliers. Demand is driven by increased space programs (deep-space and proliferated LEO constellations), defense modernization, and the need for higher-reliability parts for harsh/nuclear environments, so vendors compete on radiation-hard process IP, qualified foundry access, hermetic packaging, supply-chain traceability, and system-level integration. Market activity includes strategic M&A, foundry/packaging partnerships, and targeted product portfolios (rad-hard ASICs, FPGAs, power devices, memory, and mixed-signal ICs) to serve both ultra-high-reliability and cost-sensitive radiation-tolerant segments.

Key Players:

- BAE Systems

- Honeywell International Inc.

- Microchip Technology (Microsemi)

- AMD (Xilinx)

- Analog Devices, Inc.

- Texas Instruments Inc.

- Renesas Electronics Corporation

- Infineon Technologies AG

- STMicroelectronics

- Teledyne Technologies Inc.

- Cobham (Cobham Advanced Electronics)

- Data Device Corporation (DDC)

- 3D-Plus

- Aitech Defense Systems (AiTech)

- Crane Aerospace & Electronics

- Mercury Systems

- Boeing (Aerospace electronics divisions)

- Raytheon Technologies

- L3Harris Technologies

- Northrop Grumman.

Recent Development

- In March 2025, Infineon Technologies launched its first P-channel power MOSFET, offering a more cost-effective alternative to the traditional hermetic packaging typically used in radiation-hardened devices, while allowing for higher-volume manufacturing similar to conventional components.

- In November 2023, Infineon Technologies AG revealed the expansion of its radiation-hardened asynchronous static RAM lineup, now featuring built-in Error Correction Code (ECC) memory, designed for space applications and other extreme environments.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the rapid proliferation of Low Earth Orbit (LEO) satellite constellations for global internet, imaging, and communication services. These mega-constellations require thousands of reliable, radiation-tolerant electronic components to function correctly in the harsh space environment. Additionally, increasing government spending on defense and space exploration missions (like lunar and deep space probes) necessitates the use of robust electronics that can withstand total ionizing dose (TID) effects and single-event upsets (SEUs), driving continuous demand and technological advancement.

Q2. What are the main restraining factors for this market?

The major restraint is the extremely high cost and time required for design, testing, and certification of radiation-hardened components. Developing these specialized electronics involves expensive materials and rigorous testing in particle accelerators, which significantly inflates manufacturing costs compared to commercial-off-the-shelf (COTS) parts. Furthermore, the market faces challenges from limited production volume and the technological gap where these components often lag behind COTS components in terms of processing power and speed due to the constraints of the hardening process.

Q3. Which segment is expected to witness high growth?

The Space-Grade COTS (Commercial Off-The-Shelf) Segment is expected to witness high growth. Traditionally, space programs used fully customized, expensive radiation-hardened (Rad-Hard) components. However, to meet the cost and volume demands of LEO constellations, there is a strong shift toward using enhanced COTS components. These parts are standard commercial chips that receive minimal radiation-tolerance modifications and extensive screening. This approach offers a better balance of performance, affordability, and acceptable radiation resistance for short-to-medium lifespan satellites, accelerating market growth significantly.

Q4. Who are the top major players for this market?

The market is dominated by major semiconductor and aerospace technology providers with the specialized facilities required for radiation testing. Top major players include Microchip Technology Inc. (via its Microsemi acquisition), BAE Systems, Texas Instruments Inc., and Teledyne Technologies Incorporated. These companies compete by offering a comprehensive portfolio of components, including microprocessors, power management chips, and memory solutions, and by investing heavily in R&D to make radiation-tolerant chips smaller, faster, and more energy-efficient for the next generation of spacecraft.

Q5. Which country is the largest player?

The United States is the largest country player in the Global Radiation Hardened Electronics for Aerospace Market. This leadership position is driven by its massive government and private spending on space programs, including both NASA missions and major commercial ventures like SpaceX and Blue Origin. The presence of the world's largest aerospace and defense contractors, coupled with a robust ecosystem of specialized semiconductor manufacturers and testing facilities, ensures the U.S. remains the primary source of innovation and the largest consumer of these high-reliability components.

List of Figures

Figure 1: Global Radiation Hardened Electronics For Aerospace Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Radiation Hardened Electronics For Aerospace Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Radiation Hardened Electronics For Aerospace Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model