Restaurant Prepared Dishes Market Overview and Analysis

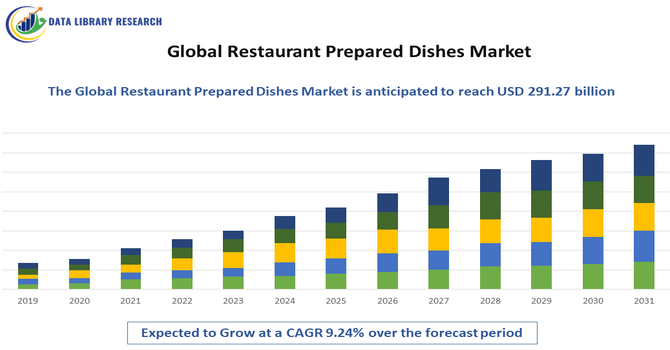

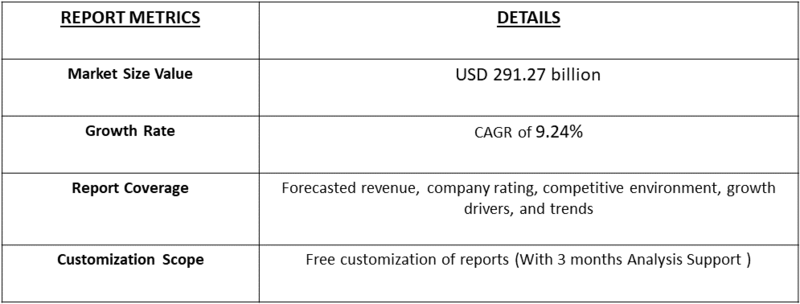

- The Global Restaurant Prepared Dishes Market size is projected to grow from USD 189.71 billion in 2025 to USD 291.27 billion by 2032, a CAGR of 9.24% during the forecast period 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Restaurant Prepared Dishes Market is witnessing steady growth driven by evolving consumer lifestyles, increasing urbanization, and a growing preference for convenience-based food options. With busy work schedules and changing eating habits, consumers are increasingly turning to ready-to-eat or ready-to-serve restaurant-style meals that offer both convenience and high-quality taste. The rise of online food delivery platforms, cloud kitchens, and quick-service restaurants (QSRs) has significantly expanded access to prepared dishes, enhancing market reach. Moreover, technological innovations in food packaging and preservation have extended product shelf life, making prepared dishes more accessible and appealing to a wider demographic. Health-conscious consumers are also driving demand for nutritionally balanced, organic, and plant-based meal options, prompting manufacturers to diversify offerings.

Restaurant Prepared Dishes Market Latest Trends

The global restaurant-prepared dishes market is experiencing several dynamic trends reshaping the way companies develop, market and distribute their offerings. One major trend is the growing demand for plant-based and health-focused meals consumers increasingly expect restaurant-quality prepared dishes that also cater to dietary preferences like vegan, vegetarian, gluten-free or low-carb. Another key shift is the expansion of international and fusion cuisines within the ready/meal-service category: consumers are seeking global flavors, and prepared dishes are evolving accordingly, which means restaurant-style items for takeaway or delivery are now offering more adventurous, premium and culturally diverse menus.

Segmentation: Global Restaurant Prepared Dishes Market is segmented By Type (Ready-to-Eat Meals, Frozen Prepared Dishes, Chilled Prepared Dishes, and Shelf-Stable Meals), Cuisine (Continental, Asian, American, Mediterranean), Distribution Channel (Online Delivery Platforms, Quick Service Restaurants (QSRs), Full-Service Restaurants, and Supermarkets/Convenience), End-User (Households, Corporate/Institutional Consumers, and Hospitality Industry), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Convenience and Ready-to-Eat Meals

One of the primary drivers of the Global Restaurant Prepared Dishes Market is the growing consumer demand for convenience-oriented food options. With fast-paced lifestyles, urbanization, and increasing participation of women in the workforce, consumers are seeking quick, ready-to-eat solutions that save both time and effort while maintaining restaurant-quality taste. Prepared dishes—whether chilled, frozen, or freshly packaged—offer a hassle-free alternative to cooking, especially for urban dwellers and young professionals.

Moreover, the availability of these meals through multiple channels, including online delivery platforms, supermarkets, and restaurant takeaways, has made them more accessible than ever. For instance, in Febraury 2024, Celebrity interior designer Gauri Khan launched her first restaurant, Torii, a progressive Asian dining concept blending diverse global influences. Partnering with restaurateur Abhayraj Kohli and entrepreneur Tanaaz Bhatia, she transformed Torii into an immersive culinary and design experience featuring a creative menu and innovative bar program. This venture marked Gauri’s entry into hospitality after designing several restaurants. The launch positively impacted the global Restaurant Prepared Dishes Market by inspiring premium dining trends, promoting experiential gastronomy, and driving innovation in contemporary Asian cuisine presentation.

Also, the technological innovations in packaging, such as vacuum sealing and modified atmosphere packaging, have further enhanced product freshness and shelf life, reinforcing consumer trust and boosting market growth.

- Expansion of Online Food Delivery Platforms and Cloud Kitchens

The digital transformation of the food industry has revolutionized how consumers access restaurant-prepared dishes, allowing them to enjoy gourmet and diverse meals from the comfort of their homes. Platforms like Uber Eats, DoorDash, Zomato, and Swiggy have expanded the reach of restaurants and meal providers to a wider audience. Cloud kitchens restaurants that operate solely for online orders have also surged, enabling faster, cost-effective, and scalable delivery of prepared dishes. The convenience of real-time tracking, contactless delivery, and customizable menu options further enhance consumer satisfaction. This digital-driven ecosystem continues to reshape the restaurant landscape, fueling strong growth in the global restaurant prepared dishes market.

Market Restraints:

- High Cost Associated with Production, Storage, And Logistics

One of the major challenges is the high cost associated with production, storage, and logistics, especially for perishable and freshly prepared meals that require advanced cold chain management. Additionally, health and nutrition concerns among consumers—particularly regarding preservatives, sodium content, and artificial additives—pose a barrier to mass adoption. The market also contends with intense competition from both local eateries and packaged food brands, pressuring pricing and profit margins. Furthermore, fluctuations in raw material costs and supply chain disruptions can impact consistency and quality, while regulatory compliance and food safety standards vary across regions, increasing operational complexity. These factors collectively restrain the market’s full growth potential despite rising consumer demand for convenience-based dining solutions.

Socio Economic Impact on Restaurant Prepared Dishes Market

The socioeconomic impact of the Global Restaurant Prepared Dishes Market is extensive, shaping employment, consumer behavior, and urban economies worldwide. As demand for convenient, high-quality meals grows, the market has generated millions of jobs across food production, logistics, retail, and technology sectors. It supports small and large businesses alike, stimulating local agriculture and food supply chains. The expansion of quick-service and automated dining concepts has improved operational efficiency while influencing lifestyle trends, particularly in urban areas where time-saving food options are essential. Additionally, the industry drives innovation in sustainable packaging, plant-based meals, and digital ordering platforms. Thus, the market contributes significantly to economic growth, social well-being, and the modernization of global food consumption patterns.

Segmental Analysis:

- Ready-to-Eat Meals segment is expected to witness highest growth over the forecast period

The Ready-to-Eat Meals segment dominates the market and is expected to witness robust growth over the forecast period. This is primarily driven by the increasing demand for quick, convenient, and time-efficient meal options among working professionals and urban consumers. Ready-to-eat dishes offer the advantage of minimal preparation time while maintaining restaurant-level taste and quality. Advancements in packaging and preservation technologies, such as vacuum sealing and modified atmosphere packaging, have further enhanced product freshness and shelf life, contributing to their growing popularity.

- Online Delivery Platforms segment is expected to witness highest growth over the forecast period

The Online Delivery Platforms segment is growing at the fastest rate, driven by the widespread use of mobile apps and online ordering systems. The convenience of home delivery, real-time tracking, multiple payment options, and exclusive discounts have encouraged more consumers to choose restaurant-prepared dishes through online platforms. The rise of cloud kitchens and aggregator apps like Uber Eats, DoorDash, Zomato, and Swiggy has also accelerated this shift toward digital meal consumption.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period in the Global Restaurant Prepared Dishes Market, driven by the strong presence of established restaurant chains, evolving consumer preferences, and the rapid expansion of online food delivery services. Busy lifestyles and high disposable incomes have fueled the demand for convenient, ready-to-eat restaurant-style meals among working professionals and urban households.

Moreover, the region’s growing emphasis on premium, health-conscious, and clean-label food options is pushing restaurants to innovate with organic, low-sodium, and plant-based prepared dishes. Technological advancements in packaging and cold chain logistics further ensure product quality and freshness during delivery. For instance, in October 2025, Wonder, a New York City-based food hall venture, opened two new D.C.-area locations in Fairfax County, with launched in Franconia announced the grand openings featured restaurant samples and giveaways. The Franconia site, formerly Genghis Grill, offered over a dozen eateries, while the Reston location hosted even more options. This expansion positively impacted the global Restaurant Prepared Dishes Market by promoting culinary diversity, enhancing consumer convenience, and stimulating competition in the multi-brand dining experience segment.

To Learn More About This Report - Request a Free Sample Copy

Restaurant Prepared Dishes Market Competitive Landscape

The competitive landscape of the Global Restaurant Prepared Dishes Market is highly fragmented, with major players competing through product innovation, quality, and convenience. Key companies focus on expanding their product portfolios, improving delivery efficiency, and adopting digital ordering platforms to strengthen market presence. Strategic partnerships, menu diversification, and sustainable packaging are also central to gaining a competitive edge. The market features a mix of global food manufacturers, restaurant chains, and online delivery platforms, all striving to meet growing consumer demand for convenient, high-quality, and health-oriented prepared meals.

Key Players:

- Nestlé

- Kraft Heinz

- Conagra Brands

- Tyson Foods

- Sysco Corporation

- US Foods

- Compass Group

- Sodexo

- Aramark

- McDonald’s

- Yum! Brands

- Starbucks Corporation

- Subway Global S.A.

- Domino’s Pizza, Inc.

- Chipotle Mexican Grill

- DoorDash, Inc.

- Uber Eats

- Grubhub Inc.

- Blue Apron Holdings, Inc.

- HelloFresh SE

Recent Development

- In September 2025, Chipotle Mexican Grill (NYSE: CMG) announced a joint venture with SPC Group, a leading South Korea-based food company, to expand into Asia for the first time. The partnership aimed to open Chipotle restaurants in South Korea and Singapore by 2026. This move marked a major step in Chipotle’s global growth strategy. The expansion positively impacted the global Restaurant Prepared Dishes Market by increasing international competition, diversifying culinary offerings, and driving demand for high-quality, convenient, and freshly prepared meals in rapidly growing Asian markets.

- In April 2025, ABB Robotics introduced BurgerBots, a groundbreaking automated restaurant concept in Los Gatos, California, designed to prepare perfectly cooked, made-to-order burgers with consistency and efficiency. The kitchen utilized ABB’s IRB 360 FlexPicker® and YuMi® collaborative robots to assemble meals, manage inventory, and enhance customer service. This innovation positively impacted the global Restaurant Prepared Dishes Market by advancing automation, improving operational efficiency, reducing labor costs, and setting new standards for quality and speed in food preparation.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth driving factors for this market?

The market is primarily fueled by rapid urbanization and busy consumer lifestyles, increasing the demand for time-saving and convenient ready-to-eat and ready-to-heat meals. The proliferation of online food delivery platforms (like DoorDash and Uber Eats) and the expansion of Quick-Service Restaurants (QSRs) and cloud kitchens significantly enhance product accessibility. Furthermore, continuous innovation in food preservation and packaging technologies (like HPP and smart packaging) extends shelf life while maintaining taste and nutritional value.

Q2. What are the main restraining factors for this market?

Key restraining factors include persistent consumer health concerns regarding the presence of preservatives, additives, and high sodium content in many prepared meals, which affects purchasing decisions. The market also faces intense competition from freshly cooked, homemade meals and premium meal kits, compelling manufacturers to maintain high quality and competitive pricing. Additionally, maintaining consistent food quality and taste across long supply chains and various packaging formats remains a major logistical and technical challenge.

Q3. Which segment is expected to witness high growth?

The Chilled Ready Meals segment is expected to witness high growth, particularly in urban areas and developed markets like Europe. Consumers perceive chilled meals as fresher and healthier alternatives compared to frozen or shelf-stable options, due to fewer preservatives and a shorter time from kitchen to consumption. The online distribution channel is also projected to grow the fastest, driven by the convenience of e-commerce platforms and personalized subscription services offering tailored meal plans.

Q4. Who are the top major players for this market?

The market is led by major multinational food corporations and specialized meal providers. Top players include global food giants like Nestlé S.A., General Mills, The Kraft Heinz Company, and Conagra Brands Inc., which offer extensive ready-meal portfolios through their well-known sub-brands. Specialist players in the premium or meal kit space, such as HelloFresh SE and Marley Spoon, are also key competitors, driving innovation in delivery, customization, and healthier meal options.

Q5. Which country is the largest player?

North America, particularly the United States, is the largest market player by revenue share. This dominance is driven by high per-capita consumer spending, the busy, fast-paced lifestyles of the population, and the maturity of the retail and online food distribution infrastructure. Europe, led by the UK and Germany, also holds a significant share. However, the Asia Pacific region is generally projected to be the fastest-growing market due to rapid urbanization, rising disposable incomes, and the strong cultural acceptance of convenience foods.

List of Figures

Figure 1: Global Restaurant Prepared Dishes Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Restaurant Prepared Dishes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Restaurant Prepared Dishes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Restaurant Prepared Dishes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Restaurant Prepared Dishes Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Restaurant Prepared Dishes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Restaurant Prepared Dishes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Restaurant Prepared Dishes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Restaurant Prepared Dishes Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Restaurant Prepared Dishes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Restaurant Prepared Dishes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Restaurant Prepared Dishes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Restaurant Prepared Dishes Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Restaurant Prepared Dishes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Restaurant Prepared Dishes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Restaurant Prepared Dishes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Restaurant Prepared Dishes Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Restaurant Prepared Dishes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Restaurant Prepared Dishes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Restaurant Prepared Dishes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Restaurant Prepared Dishes Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Restaurant Prepared Dishes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Restaurant Prepared Dishes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Restaurant Prepared Dishes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Restaurant Prepared Dishes Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Restaurant Prepared Dishes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model