Sodium Naphthalene Sulphonate Formaldehyde Market Overview and Analysis:

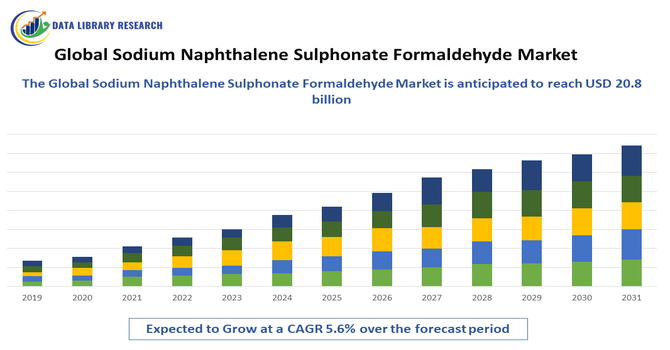

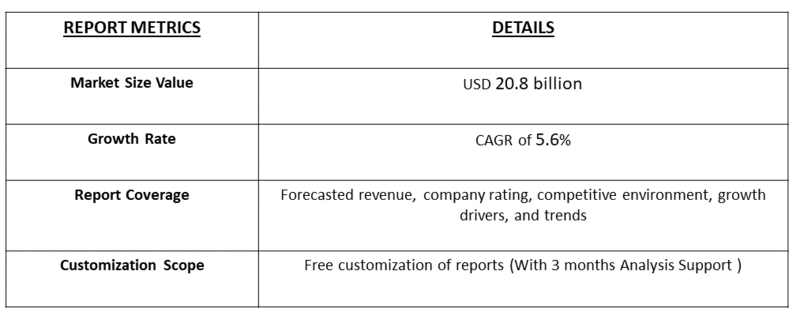

The global sodium naphthalene sulphonate formaldehyde market was valued at USD 2.9 billion in 2025 and is projected to reach USD 3.84 billion by 2032, growing with a CAGR of 4.03%.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Sodium Naphthalene Sulphonate Formaldehyde (SNSF) is a high-range water-reducing chemical admixture widely used in the construction industry, especially in concrete and cement formulations. It is produced by condensing naphthalene sulfonic acid with formaldehyde and then neutralizing it with sodium hydroxide. SNSF works as a dispersant, breaking down cement particle clumps to improve fluidity without adding extra water. This enhances the workability, strength, and durability of concrete while reducing water content. It is commonly used in ready-mix concrete, precast products, and high-performance construction projects, helping achieve higher early strength and better surface finishes while lowering costs and improving construction efficiency.

Sodium Naphthalene Sulphonate Formaldehyde Market Latest Trends:

The sodium naphthalene sulphonate formaldehyde (SNSF) market is experiencing steady growth, driven by rising demand for high-performance concrete in infrastructure, commercial, and residential construction projects. Rapid urbanization, especially in emerging economies, is boosting the need for water-reducing admixtures to enhance concrete strength and durability. There is also a growing shift toward cost-effective admixtures that improve workability while reducing water and cement usage. Additionally, increased investments in smart cities, transportation networks, and industrial facilities are fueling consumption. Technological advancements in construction chemicals and stricter quality standards are further encouraging the adoption of SNSF, strengthening its market presence globally.

Segmentation:

The Sodium Naphthalene Sulphonate Formaldehyde (SNSF) segmented by Type (High, Medium, Low Sulfonate Content), Application (Concrete Admixtures—Superplasticizers and Plasticizers; Cement Dispersion Aids; Concrete Repair Blends; Ready-Mix Additives), End-User Industry (Construction, Commercial, Residential, Infrastructure; Ready-Mix Suppliers; Precast Manufacturers; Cement Producers), Grade (Standard; High-Purity/Reinforced; Specialty Grades), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Robust Growth in the Global Construction Industry

The global construction industry's steady expansion is a significant growth driver for the SNSF market. As urbanization accelerates and developing economies invest heavily in infrastructure development, including roads, bridges, dams, and commercial buildings, the demand for concrete, a primary application for SNSF, surges. SNSF acts as a highly effective water reducer and dispersant in concrete, enabling the production of high-strength, durable, and workable concrete mixes. This enhanced performance is crucial for meeting the stringent requirements of modern construction projects. The continued need for efficient construction processes and materials that improve concrete quality directly translates into increased consumption of SNSF.

- Increasing Demand for High-Performance Concrete

The drive for superior concrete performance in demanding construction applications is a key factor propelling the SNSF market. High-performance concrete (HPC) offers enhanced strength, durability, resistance to chemical attack, and reduced permeability compared to conventional concrete. SNSF plays a pivotal role in achieving these properties by significantly reducing the water-cement ratio without compromising workability, leading to denser and stronger concrete. This is particularly important for projects exposed to harsh environmental conditions or requiring exceptional load-bearing capabilities. As industries and governments prioritize long-lasting and resilient infrastructure, the adoption of HPC, and consequently SNSF, is set to grow substantially.

Market Restraints:

- Fluctuating Raw Material Prices and Environmental Concerns

A major restraint impacting the SNSF market is the volatility in raw material prices, specifically naphthalene and formaldehyde. These price fluctuations, influenced by crude oil prices and supply-demand dynamics, directly affect the production costs of SNSF, making it challenging for manufacturers to maintain stable pricing and profit margins. Furthermore, increasing environmental awareness and stringent regulations concerning formaldehyde emissions are creating pressure on manufacturers. While SNSF is generally considered less hazardous than pure formaldehyde, concerns about its production processes and potential environmental impact can lead to market hesitancy and a push towards the development and adoption of alternative, greener superplasticizers.

Social Economic Impact On Sodium Naphthalene Sulphonate Formaldehyde Market

The sodium naphthalene sulphonate formaldehyde (SNSF) market has a notable socio-economic impact as it supports large-scale infrastructure and construction projects, generating employment, boosting industrial growth, and improving urban development worldwide. By enhancing concrete quality and reducing material costs, it contributes to more sustainable and cost-efficient construction. Before COVID-19, rapid urbanization and infrastructure investments drove steady demand, while during the pandemic, lockdowns and supply chain disruptions temporarily slowed construction activity. Post-COVID, renewed infrastructure spending, government stimulus packages, and resumed construction projects have accelerated market recovery, further strengthening SNSF’s role in supporting economic development and industrial expansion.

Segmental Analysis

- Medium Sulfonate Content Segment is Expected to Witness Significant Growth Over the Forecast Period

The medium sulfonate content segment within the SNSF market is poised for significant growth. This particular type of SNSF strikes an optimal balance between water reduction capabilities and slump retention in concrete. It offers enhanced performance compared to lower sulfonate content products, providing superior early strength development and improved overall concrete quality, while often being more cost-effective than high sulfonate content variants. This makes it an attractive option for a broad range of construction applications, from general structural concrete to precast elements, where a reliable and efficient admixture is paramount. As construction projects demand improved concrete properties without excessive cost, this balanced performance profile will drive its adoption.

- Concrete Repair Blends Segment is Expected to Witness Significant Growth Over the Forecast Period

The concrete repair blends segment is poised for substantial growth, driven by the increasing global need for rehabilitating and maintaining aging infrastructure, such as bridges, roads, and historical buildings. SNSF-based admixtures are crucial in these specialized repair mortars and concretes, as they improve bond strength, reduce shrinkage, and enhance durability—key requirements for long-lasting repairs. Rising government investments in infrastructure refurbishment and the growing emphasis on extending the lifecycle of existing structures will be the primary catalysts propelling this high-value segment forward.

- Construction Segment is Expected to Witness Significant Growth Over the Forecast Period

The construction segment, as the primary end-user, is expected to witness continued significant growth throughout the forecast period. This demand is fueled by massive global investments in new infrastructure, residential complexes, and commercial spaces, particularly within rapidly urbanizing emerging economies. SNSF is indispensable in modern construction for producing high-performance, durable, and sustainable concrete that meets evolving engineering standards. The relentless pace of global development, coupled with the need for advanced materials that improve efficiency and structural integrity, ensures the construction industry remains the dominant and fastest-growing driver for SNSF consumption.

- Standard Segment is Expected to Witness Significant Growth Over the Forecast Period

The standard SNSF product segment is forecast to see significant growth due to its widespread applicability and cost-effectiveness for routine construction needs. It serves as the workhorse admixture for a vast majority of general concrete applications, including slabs, beams, and pre-cast elements, where extreme high-range water reduction is not required. Its reliable performance, established supply chain, and affordability make it the default choice for bulk construction projects, especially in developing regions where the construction industry is scaling up and adopting chemical admixtures on a larger scale for the first time.

- Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region is unequivocally expected to be the fastest-growing market for SNSF, driven by unprecedented levels of construction and infrastructure development. China and India are the primary engines of this growth, with massive government initiatives like China's Belt and Road Initiative and India's push for smart cities and affordable housing.

The region's rapid urbanization, growing population, and increasing investments in transportation and energy infrastructure create immense, sustained demand for concrete admixtures, positioning Asia Pacific as the dominant and most dynamic regional market for the foreseeable future.

To Learn More About This Report - Request a Free Sample Copy

Sodium Naphthalene Sulphonate Formaldehyde Market Competitive Landscape:

The sodium naphthalene sulphonate formaldehyde market is characterized by a highly competitive landscape, with the presence of both global and regional players. The market is dominated by a few large multinational companies, such as BASF SE, Sika AG, Arkema Group, and Mapei S.p.A., which have a strong global footprint and offer a wide range of sodium naphthalene sulphonate formaldehyde-based products for various applications, including concrete admixtures, dispersants, and industrial coatings. These leading players focus on expanding their product portfolios, investing in research and development to develop innovative formulations, and strengthening their distribution networks to maintain their market share. Additionally, regional players, particularly in developing economies, are also gaining traction by offering cost-effective and customized solutions to cater to the specific needs of local customers. The competitive landscape is further intensified by the entry of new players, mergers and acquisitions, and strategic collaborations among industry participants to capitalize on the growing demand for sodium naphthalene sulphonate formaldehyde-based products across diverse end-use industries.

The 10 major players in the Sodium Naphthalene Sulphonate Formaldehyde (SNSF) market are:

- Shandong Wanshan Chemical Co., Ltd. (China)

- Wuhan Xinyingda Chemicals Co., Ltd. (China)

- Huntsman International LLC (USA)

- MUHU Construction Materials Co., Ltd. (China)

- Chemsons Industrial Corporation (India)

- Sure Chemical Co., Ltd. Shijiazhuang (China)

- Kao Corporation (Taiwan)

- Kashyap Industries (India)

- Viswaat Chemicals Limited (India)

- Kingsun Chemical (China)

Recent Developments:

- In March 2025, Vinati Organics Limited, reported that rising demand for stronger, longer-lasting, and more efficient concrete, the construction industry is increasingly adopting SNF-based admixtures. Sodium naphthalene sulfonate formaldehyde (SNF) improves concrete’s workability, strength, and durability while reducing water and cement usage. These performance benefits are driving its integration into modern infrastructure and high-performance projects. As more builders prioritize quality, cost efficiency, and sustainability, the growing reliance on SNF admixtures is expected to significantly boost the global SNF market’s growth in the coming years.

- In December 2022, research published by scientist of Department of Materials Science and Engineering, University of Sheffield, in the Journal of Colloid and Interface Science reported that ow different alkali and alkaline earth cations (Na⁺, K⁺, Ca²⁺, Mg²⁺) and pH affected the interaction of sodium naphthalene sulfonate formaldehyde polymer (SNSFP) with metakaolin particles in systems relevant to alkali-activated and blended Portland cements. Using zeta potential, adsorption tests, and FTIR spectroscopy, researchers found that SNSFP dispersed metakaolin most effectively in Ca²⁺-modified NaOH systems at 5 wt.%, with Ca²⁺ enhancing dispersion in NaOH mixtures and Mg²⁺ in KOH mixtures. This stable dispersion in highly alkaline environments showed that SNSFP could significantly improve the fluidity and stability of metakaolin-based cements. These findings highlighted its ability to enhance advanced cement systems, which is expected to boost demand and drive growth of the global SNSF market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The main growth drivers for the Sodium Naphthalene Sulphonate Formaldehyde market include rapid urbanization and infrastructure development, especially in emerging economies like China and India, which increase demand for concrete admixtures. Additionally, the growing focus on green and sustainable construction practices that reduce environmental impact drives market expansion.

Q2. What are the main restraining factors for this market?

The key restraining factors are stringent environmental regulations related to formaldehyde emissions and the potential substitution by newer, eco-friendly dispersants. Price volatility of raw materials and challenges in meeting sustainability compliance also restrict market growth.

Q3. Which segment is expected to witness high growth?

The Asia Pacific region segment is expected to witness high growth due to booming construction activities, industrialization, and urbanization in countries such as China and India, which drive large-scale demand for Sodium Naphthalene Sulphonate Formaldehyde products.

Q4. Which country is the largest player?

China is the largest player in the sodium naphthalene sulphonate formaldehyde market, owing to the country's robust construction industry and the presence of several regional players.

List of Figures

Figure 1: Global Sodium Naphthalene Sulphonate Formaldehyde Market Revenue Breakdown (USD Billion, %) by Region, 2023 & 2030

Figure 2: Global Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 1, 2023 & 2030

Figure 3: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 4: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 5: Global Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 2, 2023 & 2030

Figure 6: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 7: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 8: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 9: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 10: Global Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 3, 2023 & 2030

Figure 11: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 12: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 13: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 14: Global Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 15: Global Sodium Naphthalene Sulphonate Formaldehyde Market Value (USD Billion), by Region, 2023 & 2030

Figure 16: North America Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 1, 2023 & 2030

Figure 17: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 18: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 19: North America Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 2, 2023 & 2030

Figure 20: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 21: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 22: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 23: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 24: North America Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 3, 2023 & 2030

Figure 25: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 26: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 27: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 28: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 29: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by U.S., 2018-2030

Figure 30: North America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Canada, 2018-2030

Figure 31: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 1, 2023 & 2030

Figure 32: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 33: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 34: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 2, 2023 & 2030

Figure 35: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 36: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 37: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 38: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 39: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 3, 2023 & 2030

Figure 40: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 41: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 42: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 43: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 44: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Brazil, 2018-2030

Figure 45: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Mexico, 2018-2030

Figure 46: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Rest of Latin America, 2018-2030

Figure 47: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 1, 2023 & 2030

Figure 48: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 49: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 50: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 2, 2023 & 2030

Figure 51: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 52: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 53: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 54: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 55: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 3, 2023 & 2030

Figure 56: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 57: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 58: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 59: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 60: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by U.K., 2018-2030

Figure 61: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Germany, 2018-2030

Figure 62: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by France, 2018-2030

Figure 63: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Italy, 2018-2030

Figure 64: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Spain, 2018-2030

Figure 65: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Russia, 2018-2030

Figure 66: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Rest of Europe, 2018-2030

Figure 67: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 1, 2023 & 2030

Figure 68: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 69: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 70: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 2, 2023 & 2030

Figure 71: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 72: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 73: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 74: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 75: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 3, 2023 & 2030

Figure 76: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 77: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 78: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 79: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 80: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by China, 2018-2030

Figure 81: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by India, 2018-2030

Figure 82: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Japan, 2018-2030

Figure 83: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Australia, 2018-2030

Figure 84: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Southeast Asia, 2018-2030

Figure 85: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2030

Figure 86: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 1, 2023 & 2030

Figure 87: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 88: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 89: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 2, 2023 & 2030

Figure 90: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 91: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 92: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 93: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 94: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Value Share (%), By Segment 3, 2023 & 2030

Figure 95: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 96: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 97: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 98: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Others, 2018-2030

Figure 99: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by GCC, 2018-2030

Figure 100: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by South Africa, 2018-2030

Figure 101: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2030

List of Tables

Table 1: Global Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 2: Global Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 3: Global Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 4: Global Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Region, 2018-2030

Table 5: North America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 6: North America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 7: North America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 8: North America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 9: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 10: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 11: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 12: Europe Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 13: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 14: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 15: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 16: Latin America Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 17: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 18: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 19: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 20: Asia Pacific Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 21: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 22: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 23: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 24: Middle East & Africa Sodium Naphthalene Sulphonate Formaldehyde Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model