Ultrasonic Homogenizer Machine Market Overview and Analysis

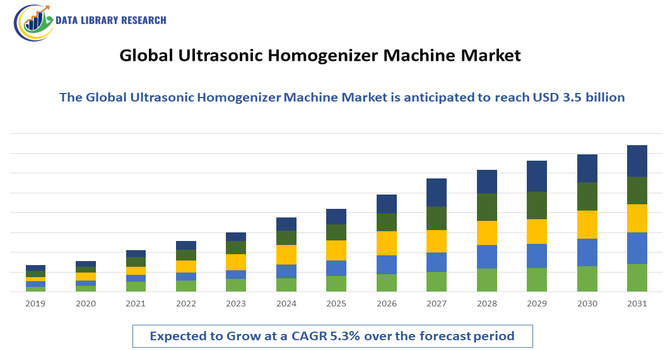

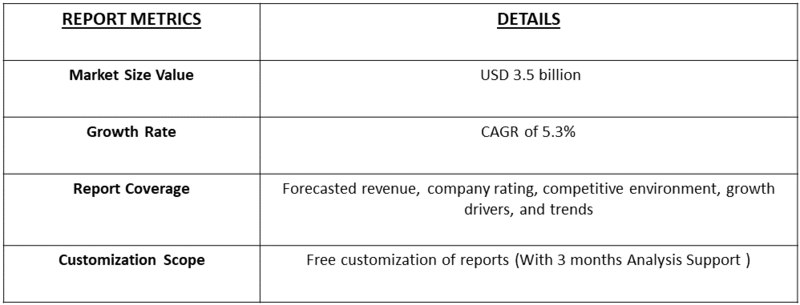

- The Global Ultrasonic Homogenizer Machine Market size was estimated at USD 1.62 billion in 2025 and is projected to grow at a CAGR of 5.3% from 2025 to 2032, reaching USD 9.2% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Ultrasonic Homogenizer Machine Market is experiencing robust growth, driven by rising demand for efficient and precise homogenization, emulsification, and particle size reduction across multiple industries. Increasing investment in pharmaceutical and biotechnology research is a key driver, as ultrasonic homogenizers are essential for applications such as cell disruption, drug formulation, and nanoparticle production. This demand is further bolstered by the expansion of the food and beverage sector, where ultrasonic homogenization enhances product quality, texture, and stability, meeting stringent industry standards. Additionally, technological advancements — such as improved energy efficiency, digital controls, and compact laboratory-friendly designs — are broadening adoption in both industrial and research environments.

Ultrasonic Homogenizer Machine Market Latest Trends

The Global Ultrasonic Homogenizer Machine Market is evolving with several notable trends that reflect increasing technological sophistication and broader application reach. One prominent trend is the miniaturization of homogenizer systems, particularly desktop and compact models, which are gaining traction in laboratory, biotech, and research settings due to their convenience, precision, and efficiency for small scale processing. This shift toward smaller, more efficient devices is complemented by automation and digital integration, with many new models featuring programmable controls, real time monitoring, and data logging capabilities that improve reproducibility and workflow efficiency. There is also a strong emphasis on energy efficient and eco friendly designs, aligning with industry sustainability goals while reducing operational costs.

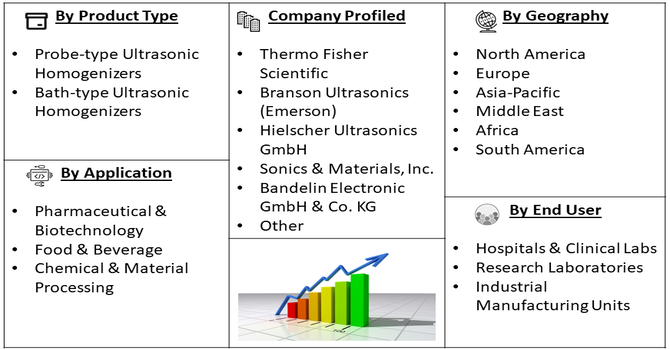

Segmentation: Global Ultrasonic Homogenizer Machine Market is segmented By Type (Probe-type Ultrasonic Homogenizers, Bath-type Ultrasonic Homogenizers), Application (Pharmaceutical & Biotechnology, Food & Beverage, Chemical & Material Processing), Frequency (Low Frequency (20–40 kHz), Medium Frequency (40–80 kHz), High Frequency (Above 80 kHz), End User (Hospitals & Clinical Labs, Research Laboratories, Industrial Manufacturing Units), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Demand in Pharmaceutical and Biotechnology Applications

A primary driver of the ultrasonic homogenizer machine market is the rising demand from the pharmaceutical and biotechnology sectors. Ultrasonic homogenizers are essential for processes such as cell disruption, protein extraction, nanoparticle formulation, and drug delivery development. As pharmaceutical research intensifies—particularly in biopharmaceuticals, vaccines, and personalized medicine—there is a growing need for precise, efficient, and reproducible homogenization technologies. Ultrasonic homogenizers offer superior performance over traditional mechanical methods, enabling faster processing, better consistency, and reduced contamination risks. The expanding global focus on advanced drug development and regenerative medicine significantly fuels market growth.

- Growing Adoption in Food, Beverage, and Cosmetic Industries

Another major driver is the increasing application of ultrasonic homogenizers in the food, beverage, and cosmetic industries. In food and beverage processing, ultrasonic homogenization enhances emulsion stability, texture, flavor retention, and shelf life. Similarly, in cosmetics, it improves the dispersion of active ingredients and uniformity of creams, lotions, and gels. Rising consumer demand for high-quality, stable, and premium products encourages manufacturers to adopt ultrasonic homogenization technologies. The combination of efficiency, precision, and energy-saving operation makes these machines highly attractive for industrial processing, further propelling market expansion globally.

Market Restraints:

- High Initial Cost and Maintenance Requirements

The major restraints for the ultrasonic homogenizer machine market is the high capital investment required for advanced systems, particularly probe-type homogenizers with digital controls and high-frequency capabilities. Small-scale laboratories and emerging-market manufacturers may find it difficult to afford these machines, limiting adoption. Additionally, ultrasonic homogenizers require regular maintenance, calibration, and periodic replacement of probes and transducers to ensure consistent performance. These ongoing costs, combined with the initial investment, can act as a barrier for smaller organizations, restricting widespread deployment across price-sensitive markets.

Socioeconomic Impact on Ultrasonic Homogenizer Machine Market

The Ultrasonic Homogenizer Machine Market has notable socioeconomic impacts by advancing research, industrial, and medical applications across pharmaceuticals, biotechnology, food processing, and materials science. These machines improve product quality, enhance efficiency, and reduce processing time, contributing to cost savings and higher productivity in laboratories and manufacturing units. Market growth stimulates employment in engineering, research, and manufacturing sectors while promoting technological innovation and skill development. Additionally, the widespread adoption of ultrasonic homogenizers supports healthcare improvements through faster drug formulation and diagnostic processes. However, high equipment costs may limit access for smaller enterprises, highlighting the need for affordable solutions to ensure broader socioeconomic benefits.

Segmental Analysis:

- Probe-type Ultrasonic Homogenizers segment is expected to witness the highest growth over the forecast period

Probe-type ultrasonic homogenizers dominate the market due to their high efficiency, precise control, and versatility in laboratory and industrial applications. They are widely used for cell disruption, emulsification, and nanoparticle synthesis, offering faster processing and better reproducibility compared to bath-type systems, contributing significantly to market value in USD million.

- Pharmaceutical & Biotechnology segment is expected to witness the highest growth over the forecast period

The pharmaceutical and biotechnology sector is a key application segment, driven by the need for drug formulation, protein extraction, vaccine development, and nanomedicine research. The demand for accurate and reproducible homogenization in research and manufacturing processes fuels growth in this segment.

- Low Frequency (20–40 kHz) segment is expected to witness the highest growth over the forecast period

Low-frequency ultrasonic homogenizers are widely adopted for industrial and laboratory applications requiring efficient mixing, emulsification, and cell disruption. Their strong cavitation effects and energy efficiency make them suitable for large-scale and routine processing, enhancing market share.

- Research Laboratories segment is expected to witness the highest growth over the forecast period

Research laboratories represent a significant end-user segment, leveraging ultrasonic homogenizers for biotechnology, pharmaceutical, and material science studies. The precision, speed, and reproducibility offered by these machines are critical for experimental accuracy, supporting consistent market growth.

The industrial sector also significantly contributes to the Ultrasonic Homogenizer Machine Market, applying these devices in food processing, cosmetics, and chemical manufacturing. Their ability to ensure uniform mixing, particle size reduction, and emulsification enhances product quality and operational efficiency. Growing industrial adoption, combined with rising demand for high-performance, scalable solutions, further propels market growth globally.

- North America region is expected to witness the highest growth over the forecast period

North America region is expected to witness the highest growth over the forecast period, driven by strong demand for advanced ultrasonic homogenizer machines across pharmaceutical, biotechnology, and food processing sectors. The region benefits from high adoption of cutting-edge laboratory equipment, extensive R&D activities, and a well-established industrial infrastructure. Increasing focus on precision medicine, vaccine development, and nanotechnology research further fuels market expansion. Additionally, technological advancements such as energy-efficient, digitally controlled, and compact ultrasonic homogenizers are being rapidly adopted in North American research laboratories and industrial facilities, reinforcing the region’s position as the fastest-growing market globally.

To Learn More About This Report - Request a Free Sample Copy

Ultrasonic Homogenizer Machine Market Competitive Landscape:

The Global Ultrasonic Homogenizer Machine Market is characterized by intense competition among established mechanical and ultrasonic equipment manufacturers, laboratory instrument suppliers, and specialized biotech solution providers. Key players are focused on innovation, product quality, and expanding their geographic footprint to meet increasing demand from pharmaceutical, biotechnology, food processing, and research sectors. Innovations such as digital controls, enhanced energy efficiency, automation, and improved probe technologies are shaping competitive dynamics, as vendors seek to differentiate through performance and reliability. Strategic collaborations, mergers, and distribution partnerships are also common as companies strive to enhance market penetration and respond to evolving customer needs worldwide.

Key Players:

- Thermo Fisher Scientific

- Branson Ultrasonics (Emerson)

- Hielscher Ultrasonics GmbH

- Sonics & Materials, Inc.

- Bandelin Electronic GmbH & Co. KG

- Qsonica LLC

- Scilogex LLC

- UP100H (Dr. Hielscher product line)

- LABSONIC (Sartorius/Stedim)

- BioEquip, Inc.

- IKA Works, Inc.

- Benchmark Scientific

- Cole-Parmer (Antylia Scientific)

- EpiGeneSys

- Misonix, Inc.

- Sartorius AG

- RESONET ZeroRez (Ultrasonics division)

- Daihan Scientific Co., Ltd.

- Heal Force Bio Medical Electronics Co., Ltd.

- Shanghai Xiangyi Ultrasonic Instrument Co., Ltd.

Recent News

- In April 2025, a research published by Food and Bioprocess Technology, reported that Recent research demonstrated that nanoemulsions of mangosteen pericarp extract, stabilized with pea protein isolate and soluble soybean polysaccharide, retain antioxidant activity and stability better than unencapsulated extracts. Preparation using combined high-speed homogeniser, ultrasonic processor, and microfluidiser (HSH-USP-MF) highlights the critical role of ultrasonic homogenisation, driving demand for high-performance ultrasonic homogeniser machines in functional food and nutraceutical development globally.

- In 2025, a research published by Shape Memory and Superelasticity, reported that how varying carbon content in additively manufactured Fe-32Mn-6Si-5Cr-0.5Nb-xC alloys affects mechanical and functional properties, using laser powder bed fusion and in situ nanoparticle re-alloying. Ultrasonic homogenisation played a key role in nanoparticle dispersion, enabling precise alloy composition. Such applications drive demand for high-performance ultrasonic homogeniser machines in advanced materials research and additive manufacturing globally.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because industries like pharmaceuticals and food processing require extremely fine particle sizes to improve product stability and shelf life. The rise of nanotechnology, which relies on ultrasonic waves for dispersing nanomaterials, is a major driver. Additionally, a global shift toward energy-efficient, chemical-free manufacturing makes these machines a popular choice for eco-friendly extraction.

Q2. What are the main restraining factors for this market?

Growth is limited by the high initial cost of high-power ultrasonic equipment, which can be difficult for smaller laboratories or startups to afford. Maintenance can also be complex, requiring specialized parts like titanium probes that wear down over time. Furthermore, the loud noise produced during operation often requires expensive sound-dampening enclosures to meet workplace safety standards.

Q3. Which segment is expected to witness high growth?

The Pharmaceutical and Biotechnology segment is expected to see the highest growth. These machines are essential for creating vaccines, breaking down cell walls for protein extraction, and formulating complex drug delivery systems like nanoemulsions. As the world invests more in advanced medical research and personalized medicine, the demand for precision ultrasonic homogenization is surging rapidly.

Q4. Who are the top major players for this market?

The market is led by specialized scientific equipment manufacturers. Key global players include Hielscher Ultrasonics, Sonics & Materials, Inc., Branson (Emerson), Qsonica, and Bandelin Electronic. These companies are respected for developing durable, high-amplitude systems that can be used for both small-scale laboratory research and large-scale industrial production lines.

Q5. Which country is the largest player?

The United States is currently the largest player in the ultrasonic homogenizer market. It leads because of its massive pharmaceutical industry and heavy investment in biotechnology and nanotechnology research. The U.S. also has a well-established network of food science laboratories that use ultrasonic technology to develop "clean-label" products without using artificial chemical stabilizers.

List of Figures

Figure 1: Global Ultrasonic Homogenizer Machine Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Ultrasonic Homogenizer Machine Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Ultrasonic Homogenizer Machine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Ultrasonic Homogenizer Machine Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Ultrasonic Homogenizer Machine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model