Video Smart Helmet Market Overview and Analysis:

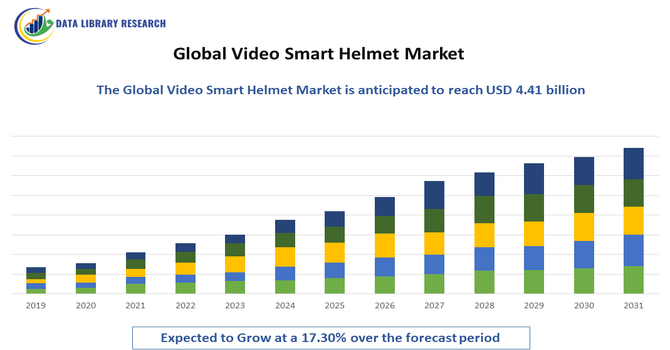

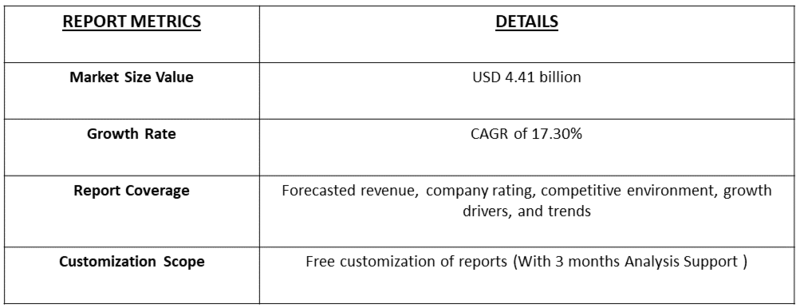

- The Global Smart Helmet Market, valued at approximately USD 1.05 billion in 2025, is projected to reach around USD 4.41 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of about 17.30% over the forecast period, 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Video Smart Helmet Market is witnessing significant growth, driven primarily by the increasing adoption of advanced wearable technologies in industrial, construction, and public safety sectors. Organisations are leveraging video smart helmets to enhance worker safety, improve operational efficiency, and enable real-time monitoring and communication in hazardous environments. The growing need for remote assistance, hands-free video streaming, and augmented reality (AR) integration for training, maintenance, and inspection tasks is fueling market demand.

Video Smart Helmet Market Latest Trends:

The Global Video Smart Helmet Market is seeing a strong push toward integration of AR/AI and IoT connectivity: helmets are no longer mere protective gear but evolving into fully connected wearable workstations. Many new models are incorporating heads up displays (HUDs), augmented reality overlays, real time hazard detection, environmental sensing, and cloud-linked analytics — enabling improved situational awareness, hands-free communication, and smarter safety management on worksites.

Another major trend is the rise of industrial and enterprise adoption, especially in sectors such as construction, manufacturing, mining, oil & gas, and public safety/emergency services. Firms are increasing investments in smart helmets as part of broader workplace safety and digital transformation strategies, driven by stricter safety regulations and the need for remote monitoring, compliance, and operational efficiency.

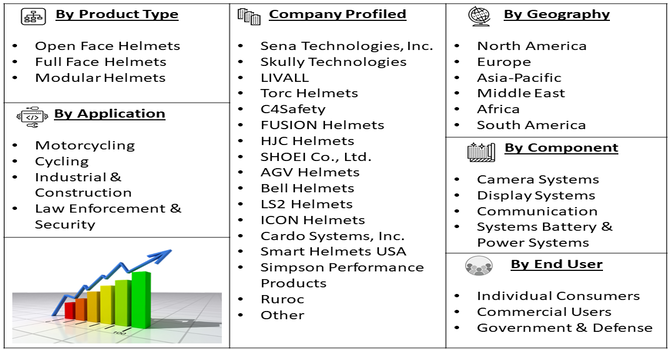

Segmentation: Global Video Smart Helmet Market is segmented By Type (Open Face Helmets, Full Face Helmets, Modular Helmets), Component/Feature (Camera Systems, Display Systems, Communication Systems, Battery & Power Systems), Application (Motorcycling, Cycling, Industrial & Construction, Law Enforcement & Security), Connectivity Technology (Bluetooth, Wi-Fi, 4G/5G), By End-User (Individual Consumers, Commercial Users, Government & Defense), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Demand for Rider Safety and Accident Prevention

The primary drivers of the video smart helmet market is the increasing emphasis on rider safety across motorcycling, cycling, and industrial applications. Traditional helmets provide only passive protection during accidents, whereas video smart helmets integrate real-time monitoring features such as cameras, sensors, and GPS systems. These features allow riders to record journeys, monitor road conditions, and even alert emergency services in case of accidents. Government regulations in several regions, including Europe and North America, are also encouraging the use of smart helmets to reduce fatalities and injuries among two-wheeler riders. The rising awareness of road safety among consumers is pushing manufacturers to innovate helmets with advanced safety features, which, in turn, drives market growth.

- Integration of Advanced Technologies for Enhanced User Experience

The integration of cutting-edge technologies, including augmented reality (AR), artificial intelligence (AI), Bluetooth connectivity, and voice-assisted commands, is significantly fueling market growth. Video smart helmets are now capable of offering live navigation, real-time traffic updates, hands-free communication, and even monitoring environmental conditions like speed, weather, and potential hazards. Such technological advancements are appealing not only to motorcyclists and cyclists but also to industrial workers, security personnel, and adventure sports enthusiasts. This trend of combining safety with convenience and enhanced user experience is leading to higher adoption rates, attracting both individual consumers and commercial users to invest in video smart helmets.

Market Restraints:

- High Cost of Smart Helmets

Video smart helmets are significantly more expensive than conventional helmets due to the integration of advanced technologies such as cameras, sensors, AR displays, and connectivity features. This high price point limits adoption, particularly in price-sensitive regions and among individual consumers who may not perceive the added value compared to traditional helmets. The cost of maintenance and replacement of components such as batteries and cameras further adds to the overall expense, restraining market growth.

Socioeconomic Impact on the Video Smart Helmet Market

The global video smart helmet market is creating meaningful socioeconomic benefits by improving safety, efficiency, and connectivity across industries such as construction, mining, manufacturing, and public safety. These helmets help protect workers while providing real-time video communication, allowing supervisors to monitor tasks remotely and reduce accidents. This leads to lower medical costs, fewer workplace disruptions, and higher productivity. The market also supports job creation in technology development, training, and equipment maintenance. By enabling smarter inspections, faster decision-making, and better documentation, video smart helmets help companies save time and resources. Overall, the market enhances worker safety, strengthens operational efficiency, and contributes to economic growth worldwide.

Segmental Analysis:

- Full face helmets segment is expected to witness the highest growth over the forecast period

Full face helmets are expected to dominate the market due to their superior protection and ability to integrate multiple smart features like cameras, AR displays, and communication systems. Riders prefer full face helmets for high-speed motorcycling, as they offer complete coverage, enhanced safety, and a better platform for mounting video recording and navigation devices. The growing popularity of sports and adventure motorcycling is further boosting demand for this segment.

- Camera Systems segment is expected to witness the highest growth over the forecast period

Camera systems are a critical component driving the adoption of video smart helmets. They enable users to record rides, capture evidence in case of accidents, and share experiences on social media platforms. The demand for high-resolution cameras with wide-angle views and image stabilization is increasing, especially among motorcyclists and cyclists, which fuels growth in this segment.

- Motorcycling segment is expected to witness the highest growth over the forecast period

Motorcycling represents the largest application segment due to the high number of two-wheeler users globally. Riders are increasingly adopting video smart helmets to improve safety, navigation, and connectivity while on the road. Features like real-time GPS tracking, accident alerts, and dashcam recording are particularly appealing for both recreational and daily commuters, making motorcycling a key driver of market growth.

- Bluetooth segment is expected to witness the highest growth over the forecast period

Bluetooth-enabled helmets are widely adopted due to their ability to support hands-free communication, music streaming, and smartphone integration. Riders prefer Bluetooth connectivity for its ease of use, reliability, and low power consumption, which allows seamless interaction with smartphones and other smart devices. This technology is expected to witness sustained growth, especially in urban areas where connectivity needs are high.

- Individual Consumers segment is expected to witness the highest growth over the forecast period

Individual consumers form the largest end-user segment, driven by the growing awareness of road safety and desire for technologically advanced helmets. Enthusiasts, daily commuters, and adventure riders are investing in smart helmets to combine protection with convenience, connectivity, and entertainment features, which is propelling the adoption of personal smart helmet devices.

- North America segment is expected to witness highest growth over the forecast period

North America is expected to witness significant growth in the video smart helmet market, supported by high disposable income, advanced technological infrastructure, and a strong culture of motorcycle and adventure sports. Government regulations promoting road safety and increasing consumer awareness about accident prevention further contribute to market expansion in the region.

Additionally, North America’s industrial and construction sectors are increasingly adopting video smart helmets for enhanced worker safety and operational efficiency. Integration of features like real-time communication, augmented reality, and wearable cameras supports remote supervision and training, reducing workplace accidents. These trends, combined with strong investments in smart safety technologies, are driving robust growth in the region’s video smart helmet market.

To Learn More About This Report - Request a Free Sample Copy

Video Smart Helmet Market Competitive Landscape:

The Global Video Smart Helmet Market is highly competitive, characterized by the presence of numerous established players and emerging startups focusing on innovation, technology integration, and user experience. Companies are investing in research and development to offer helmets with advanced features such as high-resolution cameras, augmented reality displays, connectivity solutions, and enhanced safety functionalities. Strategic collaborations, mergers, and partnerships are also shaping the market, as manufacturers aim to expand their product portfolios and strengthen their global presence. The competition is further intensified by the increasing demand for technologically advanced helmets across motorcycling, cycling, industrial, and law enforcement applications, pushing companies to differentiate themselves through innovative designs, superior performance, and enhanced consumer engagement.

Key players in the market include:

- Sena Technologies, Inc.

- Skully Technologies

- LIVALL

- Torc Helmets

- C4Safety

- FUSION Helmets

- HJC Helmets

- SHOEI Co., Ltd.

- AGV Helmets

- Bell Helmets

- LS2 Helmets

- ICON Helmets

- Cardo Systems, Inc.

- Smart Helmets USA

- Simpson Performance Products

- Ruroc

- GAMMA Helmets

- CrossHelmet

- Bosch Mobility Solutions

- Huawei Technologies

Recent Development

- In June 2025, The Jarsh WorkAlive smart safety helmet introduced advanced technology into PPE, enhancing safety, operational oversight, and workforce efficiency. Equipped with an HD camera, GPS, and real-time monitoring, it improved protection and streamlined operations across construction sites, oil rigs, and remote industrial facilities, setting a new standard for smart safety helmets.

- In January 2025, Proxgy, supported by investors including Ajinkya Rahane, Nikhil Kamath, and Suniel Shetty, launched the Hat+ Band and ProHat Band after its Series A funding. These devices upgraded standard industrial helmets into advanced AC and smart helmets, enhancing worker safety, comfort, and connectivity in challenging industrial environments worldwide.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is primarily propelled by increasing global concerns over safety, especially given the rise in road accidents and two-wheeler sales. Stringent government safety regulations across industries like construction and manufacturing also mandate advanced protective gear. The integration of high-tech features like navigation, communication, and real-time tracking further boosts consumer adoption.

Q2. What are the main restraining factors for this market?

The biggest obstacle is the relatively high production cost of these advanced helmets compared to standard ones. Since they incorporate complex components like integrated video cameras, communication systems, and heads-up displays, the final product price can be expensive, which limits affordability and widespread adoption, particularly in developing countries.

Q3. Which segment is expected to witness high growth?

The Full-Face Helmet segment is expected to maintain dominance and witness high growth due to its superior protective properties and integration of maximum features.

Q4. Who are the top major players for this market?

Key companies in this market include specialized tech firms and protective gear manufacturers. Some of the top players are Sena Technologies, Inc., Forcite Helmet Systems Pty Ltd., Livall Tech Co., Ltd., and DAQRI. These companies compete by focusing on research and development to enhance features like communication and crash detection.

Q5. Which country is the largest player?

North America, primarily the United States, holds the largest market share globally. This dominance is attributed to a high level of consumer awareness, the rapid adoption of emerging wearable technologies, and strong, well-enforced industrial and road safety standards that encourage investment in premium, smart protective equipment.

List of Figures

Figure 1: Global Video Smart Helmet Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Video Smart Helmet Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Video Smart Helmet Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Video Smart Helmet Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Video Smart Helmet Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Video Smart Helmet Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Video Smart Helmet Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Video Smart Helmet Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Video Smart Helmet Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Video Smart Helmet Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Video Smart Helmet Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Video Smart Helmet Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Video Smart Helmet Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Video Smart Helmet Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Video Smart Helmet Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Video Smart Helmet Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Video Smart Helmet Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Video Smart Helmet Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Video Smart Helmet Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Video Smart Helmet Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Video Smart Helmet Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Video Smart Helmet Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Video Smart Helmet Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Video Smart Helmet Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Video Smart Helmet Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Video Smart Helmet Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Video Smart Helmet Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Video Smart Helmet Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Video Smart Helmet Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Video Smart Helmet Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Video Smart Helmet Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Video Smart Helmet Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Video Smart Helmet Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Video Smart Helmet Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Video Smart Helmet Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Video Smart Helmet Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Video Smart Helmet Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Video Smart Helmet Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Video Smart Helmet Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Video Smart Helmet Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model