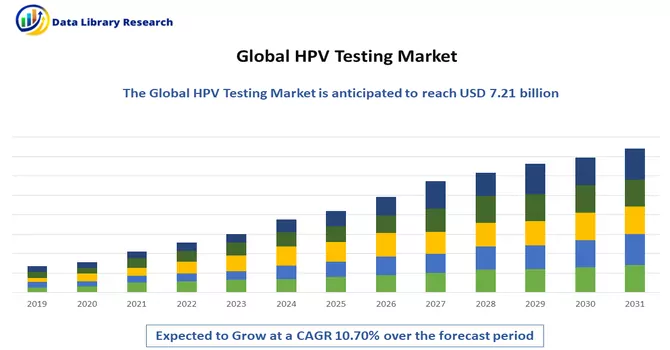

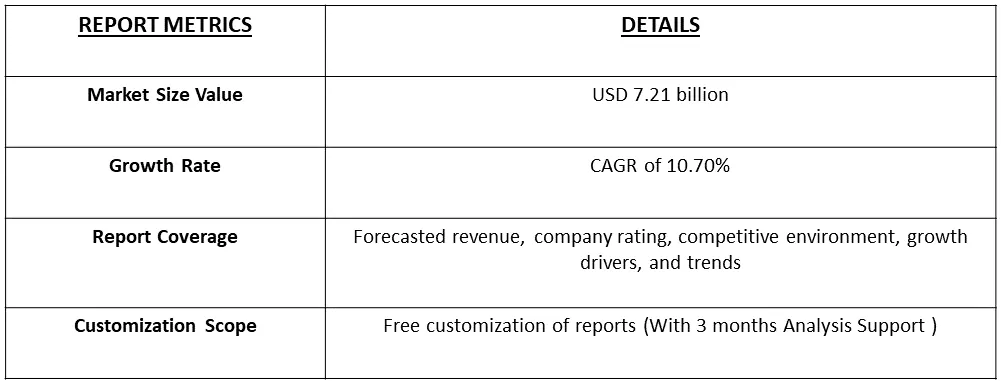

The Global HPV Testing and Pap Test Market size is estimated at USD 7.21 billion in 2023 and is expected to register a CAGR of 10.70% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

HPuman Papillomavirus (HPV) testing and the Pap test, or Papanicolaou test, are integral components of cervical cancer screening. The HPV test is conducted to identify the presence of high-risk HPV types, commonly associated with cervical cancer, by analyzing cervical cell samples collected during routine examinations. Typically recommended for women over 30, a positive result prompts further evaluation. On the other hand, the Pap test is aimed at detecting abnormal changes in cervical cells that could lead to cancer, involving the microscopic examination of cell samples. Recommended for women aged 21 to 65, abnormal results trigger additional tests or procedures. Combining both tests enhances the screening process, providing a comprehensive assessment of cervical cancer risk and facilitating early detection and intervention. Individual screening schedules should be discussed with healthcare providers, considering factors such as age and medical history.

The market is propelled by several key factors, including the escalating global incidence of cervical cancer, a rising prevalence of cervical cancer screening initiatives, and the advent of cutting-edge technologies in the field. The growth of the market is closely tied to the expanding numbers of cervical cancer cases observed worldwide, underscoring the pressing need for effective diagnostic solutions. Furthermore, the proliferation of cervical cancer screening programs on a global scale reflects a heightened emphasis on preventive healthcare measures. The introduction of advanced technologies has played a pivotal role, contributing to enhanced precision and efficiency in the diagnostic process. This convergence of factors underscores the dynamic nature of the market, with an increasing focus on innovation and accessibility in the fight against cervical cancer.

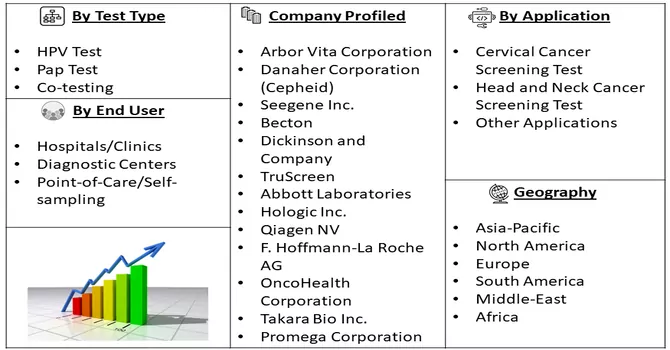

Market Segmentation: HPV Testing Market is segmented by Test Type (HPV Test, Pap Test, and Co-testing), Application (Cervical Cancer Screening Test, Head and Neck Cancer Screening Test, and Other Applications), End User (Hospitals/Clinics, Diagnostic Centers, and Point-of-Care/Self-sampling), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The market provides the value (in USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

The HPV testing market has been witnessing notable trends, including a surge in awareness and education about the correlation between human papillomavirus (HPV) and cervical cancer, leading to an increased demand for screening. Technological advancements, particularly in molecular testing methods like nucleic acid amplification tests (NAATs), have improved the accuracy of HPV detection. Integrating HPV testing with Pap smear (co-testing) has become a common practice among healthcare providers to enhance the sensitivity of cervical cancer screening. Additionally, the emergence of point-of-care testing options and global initiatives for cervical cancer prevention, including vaccination and screening programs, contribute to the evolving landscape. Market consolidation through mergers, acquisitions, and strategic partnerships reflects the industry's efforts to strengthen product portfolios and expand market presence. It's crucial to note that market trends may have evolved, and for the latest information, consulting recent industry reports and news sources is recommended.

Market Drivers:

Increasing Number of Cervical Cancer Cases and Screening Programs

In 2020, over half a million women were diagnosed with cervical cancer, resulting in approximately 342,000 deaths, as reported by the World Health Organization (WHO). To address this global health challenge, the WHO's endorsed strategy for cervical cancer elimination, passed by the World Health Assembly in 2020, aims to achieve regular screening for 70% of women worldwide using high-performance tests and ensure that 90% of those requiring treatment receive appropriate interventions. In the United States alone, the American Cancer Society estimates that 14,110 new cases of invasive cervical cancer were diagnosed in 2022.

This escalating global incidence of cervical cancer underscores the increasing demand for HPV testing and Pap tests, driving market growth. The surge in cervical cancer cases has prompted a greater need for effective screening programs. Recognizing deficiencies in traditional cervical screening methods, alternative paradigms, particularly those involving the detection of the human papillomavirus (HPV), have gained significance. Companies like Qiagen NV are contributing to this paradigm shift with technologically advanced tests, such as the Capture 2 test, designed to detect the presence of 13 high-risk HPV types in cervical samples. These developments collectively contribute to the dynamic growth of the market, reflecting the intersection of technological advancements and the urgent need for more effective cervical cancer screening solutions.

Introduction to Advanced Technologies

The introduction of advanced technologies has significantly transformed the landscape of HPV testing, enhancing precision, sensitivity, and efficiency in the detection of human papillomavirus (HPV) infections. Nucleic acid amplification tests (NAATs) have emerged as a cornerstone in HPV testing, allowing for the amplification and identification of specific HPV DNA sequences with high sensitivity. Polymerase chain reaction (PCR) and real-time PCR techniques enable the detection of even low levels of viral DNA, providing valuable insights into the presence of high-risk HPV types. Additionally, next-generation sequencing (NGS) technologies have facilitated the identification of a broader spectrum of HPV genotypes, contributing to a more comprehensive understanding of viral diversity. Automation and robotic technologies have streamlined laboratory workflows, reducing turnaround times and enhancing overall testing efficiency. Furthermore, the integration of molecular technologies with cytology, as seen in liquid-based cytology and molecular cytology assays, has strengthened the accuracy of HPV testing and its correlation with cellular abnormalities. These technological advancements not only improve the diagnostic accuracy of HPV testing but also contribute to the development of point-of-care testing solutions and self-sampling methodologies, expanding accessibility and convenience. As the field continues to evolve, ongoing research and development endeavours aim to further refine and innovate HPV testing technologies, reinforcing their role in early detection and prevention strategies for cervical cancer.

Marker Restraints:

Changes in Regulatory Guidelines for Cervical Cancer Screening

Changes in regulatory guidelines for cervical cancer screening have the potential to impede the growth of the HPV testing market. Regulatory bodies play a crucial role in defining the standards and requirements for diagnostic tests, ensuring their safety and efficacy. Any alterations or updates in these regulations can introduce challenges for manufacturers and stakeholders in the HPV testing market. Strict regulatory scrutiny may result in prolonged approval processes, requiring comprehensive clinical data and evidence of test reliability before new products can enter the market. Additionally, changes in screening recommendations or guidelines may impact the frequency and population targeted for HPV testing, affecting the market dynamics. Adaptation to evolving regulatory frameworks and the incorporation of new guidelines may necessitate adjustments in testing protocols, potentially causing delays in market growth. As the regulatory landscape continues to evolve, industry players must stay agile and proactively address compliance requirements to navigate potential obstacles and sustain the momentum of the HPV testing market. Thus, such factors may slow the growth of the studied market.

The market underwent a profound transformation in the wake of the COVID-19 pandemic, with far-reaching consequences. The imposition of lockdowns and the suspension of international trade by numerous countries had a cascading effect, leading to a downturn in various healthcare services, including the diagnosis of different medical conditions. Throughout 2020, as the global COVID-19 crisis intensified, elective medical procedures, notably cancer screenings, experienced widespread postponements to redirect resources towards urgent healthcare demands and mitigate the risk of COVID-19 transmission. Consequently, there was a substantial decline in cancer screening activities during this period. Despite these challenges, national healthcare bodies and international healthcare systems remained steadfast in their commitment to prioritize cancer care and uphold rigorous standards in diagnosis and treatment. This underscored the resilience of healthcare priorities even in the face of unprecedented challenges posed by the pandemic, emphasizing the enduring importance of maintaining quality healthcare services.

Segmental Analysis:

HPV Test Segment is Expected To witness Significant Growth Over the Forecast Period

HPV testing is a crucial diagnostic procedure integral to women's health, primarily focused on identifying the presence of human papillomavirus (HPV), a common sexually transmitted infection linked to cervical cancer. Typically performed during routine gynecological examinations, the test involves collecting cervical cells, often in conjunction with a Pap smear. The analysis of these cells, particularly the detection of HPV DNA, helps determine the risk of developing cervical cancer. Advances in diagnostic technologies, such as nucleic acid amplification tests (NAATs), have enhanced the precision of HPV testing, enabling the differentiation between high-risk and low-risk HPV types. Integrated into cervical cancer screening programs, HPV testing, when combined with Pap testing (co-testing), enhances overall sensitivity, offering a comprehensive risk. Thus, the segment is expected to witness significant growth over the forecast period. Often integrated into cervical cancer screening programs, HPV testing, especially when combined with Pap testing, enhances the overall sensitivity, providing a comprehensive risk assessment and prompting further evaluation if necessary. Positive HPV results serve as an early indicator, guiding healthcare professionals in tailored patient care strategies and emphasizing the significance of regular screening in preventing and detecting cervical cancer.

Cervical Cancer Screening Test Segment is Expected To witness Significant Growth Over the Forecast Period

Cervical cancer screening tests are pivotal tools in women's healthcare aimed at detecting early signs of cervical abnormalities and preventing the progression to cervical cancer. The two primary screening methods are the Pap test (Papanicolaou test) and HPV testing, often conducted in conjunction for comprehensive assessment. The Pap test involves collecting cells from the cervix, which are then examined under a microscope to identify any abnormal changes. Human Papillomavirus (HPV) testing, on the other hand, detects the presence of high-risk HPV types associated with cervical cancer by analyzing cervical cell samples. Co-testing, which combines both the Pap test and HPV testing, enhances sensitivity and accuracy. These screening approaches are crucial for identifying precancerous or cancerous conditions early, allowing for timely intervention and prevention. Regular screenings, typically starting at age 21, help in the early detection of cervical abnormalities, enabling healthcare providers to provide timely and effective interventions, including further diagnostic procedures or treatment. Advances in technology and a growing emphasis on preventive healthcare contribute to the evolving landscape of cervical cancer screening, emphasizing the importance of routine screenings in women's health.

Point-of-Care/Self-sampling Segment is Expected To witness Significant Growth Over the Forecast Period

Point-of-care (POC) and self-sampling approaches for HPV testing represent innovative strategies that enhance accessibility and convenience in cervical cancer screening. Point-of-care HPV testing allows for real-time results at the location of patient care, reducing the turnaround time and enabling immediate intervention when needed. This approach is particularly valuable in resource-limited settings, improving the efficiency of screening programs. On the other hand, self-sampling involves individuals collecting their own vaginal or cervical samples in a private setting, offering a convenient alternative to traditional clinician-administered tests. In June 2022, Roche launched an HPV self-sampling solution, allowing patients to collect samples for HPV screening at home. Similarly, in May 2021, Becton, Dickinson, and Company obtained CE marking for the industry's first self-collection claim for HPV screening. These advancements in POC and self-sampling not only empower individuals to take an active role in their healthcare but also address barriers to traditional screening, such as lack of access or privacy concerns. The integration of such approaches into cervical cancer screening programs holds promise for increasing screening rates and ultimately contributing to the early detection and prevention of cervical cancer. However, ongoing research and careful implementation are essential to ensure the reliability and effectiveness of POC and self-sampling methods in diverse healthcare settings. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected To witness Significant Growth Over the Forecast Period

The North American market commands a prominent position in the field, driven by a high incidence of cervical cancer and a growing number of screening procedures. However, the COVID-19 pandemic temporarily halted HPV testing and Pap screening, significantly impacting market growth. As health systems gradually resume preventive care visits, there is an expected resurgence in clinic-based cervical cancer screening. Despite a decline in death rates over the last four decades, cervical cancer remains a leading cause of mortality among women in the United States, with approximately 4,280 reported deaths in 2022. Although there is currently no FDA-approved HPV test for men, the market for diagnostic HPV testing and Pap screening is buoyed by the approval of the Cobas test for primary cervical cancer screening for women aged 25 and older, along with ongoing research introducing new tests to enhance the evaluation of HPV-positive women. The increasing demand for cancer screening tests, including Pap and HPV tests, is poised to drive market growth, supported by favourable government policies like the National Breast and Cervical Cancer Early Detection Program (NBCCEDP) in the United States, which plays a crucial role in advancing early detection initiatives and is expected to fuel market expansion in the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Prominent industry players are strategically emphasizing a combination of organic and inorganic approaches to fortify their positions in the HPV testing and Pap test market. This strategic mix includes product approvals and licenses, entering agreements, fostering collaborations and partnerships, undertaking expansions, and engaging in strategic acquisitions. By pursuing both organic growth through internal developments and inorganic growth through external collaborations and acquisitions, these key players aim to enhance their market presence and capitalize on emerging opportunities. Notably, gaining approvals from regulatory authorities for the introduction of new products is deemed pivotal, as it not only ensures compliance but also provides companies with a distinctive competitive edge. This multifaceted strategy underscores the industry's commitment to innovation, regulatory adherence, and collaborative efforts to sustain growth and leadership in the dynamic landscape of HPV testing and Pap tests. Some of the key market players are:

Recent Development:

1) In June 2022, Roche unveiled a groundbreaking human papillomavirus (HPV) self-sampling solution, now available in countries that adhere to the CE mark standards. This innovative solution empowers patients to independently collect vaginal samples for HPV screening in the privacy of their homes. The collected samples, clinically validated, are then analyzed using the Roche Cobas HPV test, leveraging Roche's molecular instrument technology.

2) In May 2021, Becton, Dickinson, and Company announced a significant development with the CE marking of the industry's first self-collection claim for HPV screening under the IVD directive 98/79/EC. This pioneering claim enables laboratories and facilities to process self-collected samples utilizing a BD diluent tube. The samples are then tested using the BD Onclarity HPV Assay, compatible with both the BD Viper LT and the BD COR System. These advancements mark a notable shift in HPV screening approaches, offering individuals greater convenience and privacy while maintaining the accuracy and reliability of the diagnostic process.

Q1. What was the HPV Testing Market size in 2023?

As per Data Library Research the HPV Testing Market size is estimated at USD 7.21 billion in 2023.

Q2. What is the Growth Rate of the HPV Testing Market ?

HPV Testing Market is expected to register a CAGR of 10.70% during the forecast period.

Q3. Who are the key players in HPV Testing Market?

Some key players operating in the market include

Q4. What are the factors driving the HPV Testing Market?

Key factors that are driving the growth include the Increasing Number of Cervical Cancer Cases and Screening Programs and Introduction to Advanced Technologies.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model