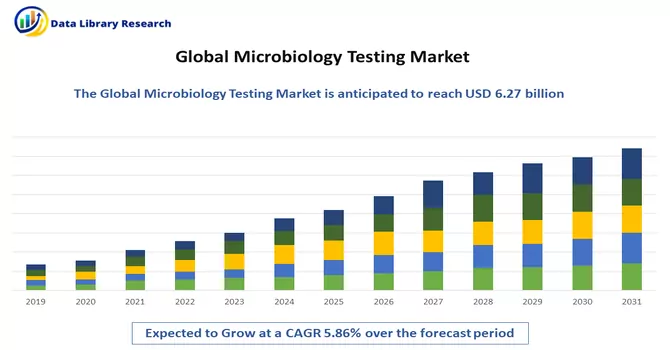

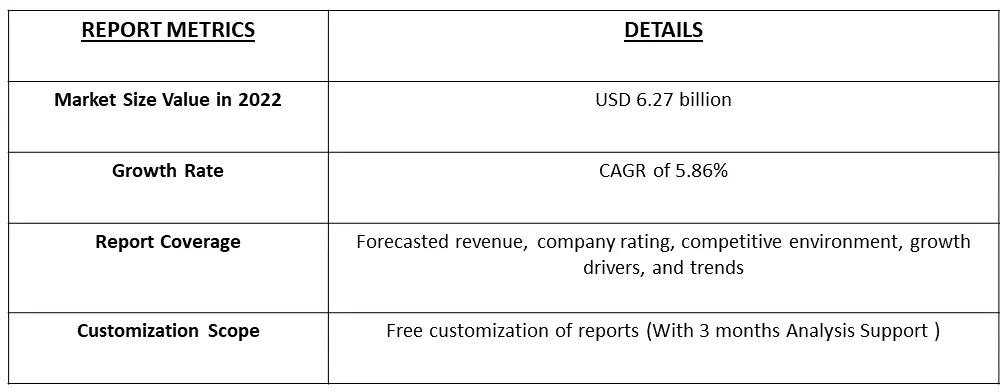

The Microbiology Testing Market is currently valued at USD 6.27 billion in the year 2022 and is expected to register a CAGR of 5.86% over the forecast period 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Microbial testing is an analytical technique that is utilized to determine the number of microorganisms in food, beverages, biological samples, and environmental samples. The microbial testing technique employs chemical, biological, biochemical, or molecular methods to identify and quantify the microbes. It is one of the important processes carried out in the medical, healthcare, and food industries for the prevention of future product damage.

The propelling factors for the growth of the microbiology testing market include technological advancements in microbiology testing, rising incidences of infectious diseases, growing healthcare expenditure, and rising private-public funding for research on infectious diseases.

The new microbiological testing techniques including matrix-assisted laser desorption/ionization time-of-flight mass spectrometry (MALDI-TOF-MS), next-generation sequencing (NGS), and automated polymerase chain reaction (PCR), are emerging as valuable diagnostic methods. These techniques aim to improve the speed and accuracy of diagnosis.

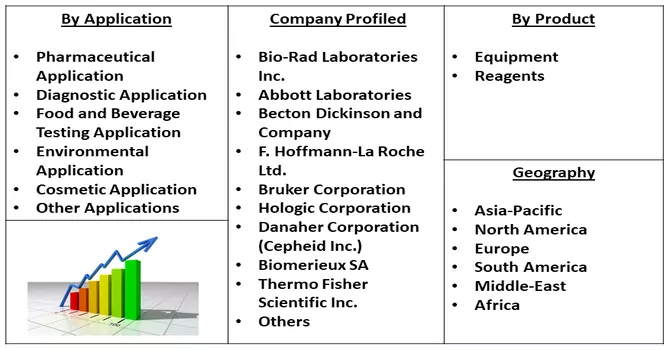

Segmentation:

The Microbiology Testing Market is Segmented

By Application :

By Product :

Geography :

The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Technological Advancements in Microbiology Testing

The new product launches by major players in the market are positively affecting the growth of the segment. For instance, in July 2021, Bruker launched new microbiology products and workflows for microbial identification and infection control. It includes products such as MBT Lipid Xtract kit which expands the research capabilities even beyond rapid microbial identification.

Rising Burden of Infectious Diseases and Outbreak of Epidemics

The increasing prevalence of infectious diseases in society has emerged as a major growth factor for the therapeutic system as well. For instance, an article published by BMC Infectious Disease reported that the nationwide overall prevalence of all infectious disease syndromes was 71.8 per 10,000 population between 2009 and 2017. The average number of all infectious disease syndromes was 14,519 (range 5229 to 55,132) per year. Similarly, another article published by National Centre for Biotechnology Information in January 2023, reported that infectious diseases remain one of the leading causes of morbidity and mortality around the world accounting for more than 52 million (33%) annual deaths worldwide. Half of the world's population remains at risk of emerging and re-emerging infectious diseases. The recent figures indicate an estimated 14 million global deaths in children less than 5 years of age, 70% of which resulted from vaccine-preventable diseases and 99% reported in developing countries. Thus, such instances show that a high number of infectious diseases are constantly propelling the demand for microbiological testing thereby fuelling the studied market growth.

Restraints :

Laboratory Reimbursement Issues and High Cost of Microbiology Instruments

Healthcare laboratory reimbursement describes the payment received by a healthcare provider, hospital, diagnostic facility, or another healthcare facility for providing a medical service. Fee-for-service (FFS) is the most common reimbursement method. Sometimes the labs don’t provide the proper reimbursement and this may be difficult for the users. The microbiology lab instruments are quite expensive, as a result, the cost of diagnostic testing increases significantly, thereby making it difficult for users in developing countries to access these instruments. For instance, as per latest data published by Labster in October 2022, reported that the cost for a Next-Generation Sequencer (NGS) ranges around USD 20,000, Polymerase Chain Reaction (PCR) System ranges around USD 90,000, Mass Spectrometry ranges around USD 5,000, Fluorescence-automated Cell Sorting (FACS) Machine ranges around USD 100,000 and High-Performance Liquid Chromatography Unit ranges around USD 15,000. Thus, instances are impeding the growth of the studied market.

The COVID-19 impacted the growth of the studied market. Molecular methods, such as RT-qPCR and isothermal amplification, are the gold standard for SARS-CoV-2 diagnosis, thus it is important to understand how these tests may be utilized in different settings. Thus, the demand for microbiological testing increased to a greater extent during the pandemic, thereby contributing to the studied market’s growth. For instance, an article published by the National Institute of Library in October 2021, reported that RT-qPCR testing rates increased by 154% in October 2020, compared to the previous year. In the current scenario, it is estimated that since the COVID-19 cases decreased, the demand for microbiology testing decreased significantly, compared to the beginning of the pandemic. However, due to the presence of other infectious diseases, the market is expected to witness growth over the forecast period.

Segmental Analysis:

Diagnostic Application Segment is Expected to Witness Significant growth Over the Forecast Period

The purpose of diagnostic microbiology is to confirm the suspicion of infectious disease and to identify the etiologic agent, often by bacterial or fungal culture or virus isolation. Routine diagnostic tests include microscopic examination, culture, and biochemical tests, serological tests including agglutination and ELISA, and genetic tests. More advanced diagnostic methods are emerging, focused on speed, accuracy, and cost-effectiveness.

The advancements in microbiology testing are expected to contribute to the growth of the studied market. For instance, in October 2022, Gold Standard Diagnostics launched a new GSD Absorbance 96 ELISA Reader. GSD Absorbance 96 is a new category of plate readers with the mission to simplify the workflow in the laboratory. The small size of the reader, in combination with the unique open design, leads to an entirely new user experience. The footprint of the GSD Absorbance 96 is almost as small as the microplate itself, thereby fitting into every lab, saving valuable bench space, and providing unprecedented flexibility. Thus, such developments are expected to fuel the growth of the studied market.

The Reagents Products Segment is Expected to Witness High Growth Over the Forecast Period

A reagent is any organic or inorganic substance that can be added to a mixture to trigger a chain of chemical reactions. It's also used to test for the presence of other substances in a solution. This makes certain types of reagents very useful as testing tools in experiments. In April 2023, at the 33rd European Congress of Clinical Microbiology & Infectious Diseases announced its latest innovations for user-friendly, best-in-class diagnostic solutions for routine clinical microbiology and infection diagnostics laboratories. Thus, such developments are fueling the growth of the studied segment.

North America Region is Expected to Witness Significant Growth Over the Forecast Period.

The factors that are driving the market growth in the North American region include better healthcare infrastructure, the rising burden of infectious diseases and outbreaks of epidemics, technological advancements in microbiology testing, and the presence of key market players in the region. he rising prevalence of infectious diseases in the region is also boosting the market growth. For instance, according to the data published by the CDC in June 2022, it is estimated that in the most recent five years, approximately 14,000 to 25,000 cases of invasive group A strep disease occurred each year in the United States. Furthermore, as per the report published by the Centers for Disease Control and Prevention in April 2022, around 677,769 cases of gonorrhea were reported in 2020. Gonorrhea also emerged as the second most common noticeable sexually transmitted infection in the United States. Hence, the increasing prevalence of infectious diseases is expected to enhance the market growth.

The market players are adopting various strategies such as product launches, developments, acquisitions, collaborations, partnerships, and expansions to increase market share. For instance, in March 2022 Bureau Veritas launched a microbiology laboratory that will offer rapid pathogen testing for E.coli, Listeria, Salmonellas, yeast, and Mold in Canada. Such establishment of the facilities is expected to increase the accessibility of testing and thus expected to propel the growth of the market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The microbiology testing market is moderately competitive in nature. The companies have witnessed new product launches, mergers and acquisitions, partnerships, joint ventures, and strategies adopted by the major players to gain a competitive advantage. The companies are also introducing advanced microbiological automated systems that have high throughput and are less time-consuming. Some of the key players include:

Key Players :

Recent Developments:

1. November 2022: IDEXX acquired Tecta-PDS, an innovative Canadian company that has introduced automation to water microbiology testing for parameters including E. coli and total coliforms. The acquisition helped IDEXX to expand its range of water microbiology testing options for both laboratory-based and in-field testing.

2. November 2022: Archer Daniels Midland (ADM) opened a new microbiology laboratory at its ADM Specialty Manufacturing facility in Decatur, Illinois. The project doubled the site’s microbiology laboratory footprint and expanded the location’s testing capabilities.

Q1. What is the current Microbiology Testing Market size?

The Microbiology Testing Market is currently valued at USD 6.27 billion.

Q2. What is the Growth Rate of the Microbiology Testing Market?

Microbiology Testing Market is expected to register a CAGR of 5.86% over the forecast period.

Q3. What are the factors on which the Microbiology Testing Market research is based on?

By Application, By Product & Geography are the factors on which the Microbiology Testing Market research is based on

Q4. Which region has the largest share of the Microbiology Testing market? What are the largest region's market size and growth rate??

North America was the largest region in the in 2022. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model