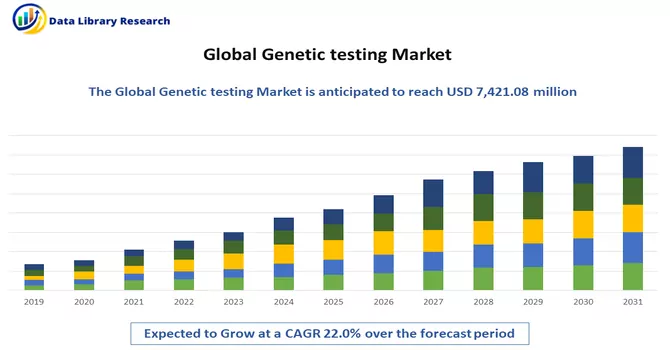

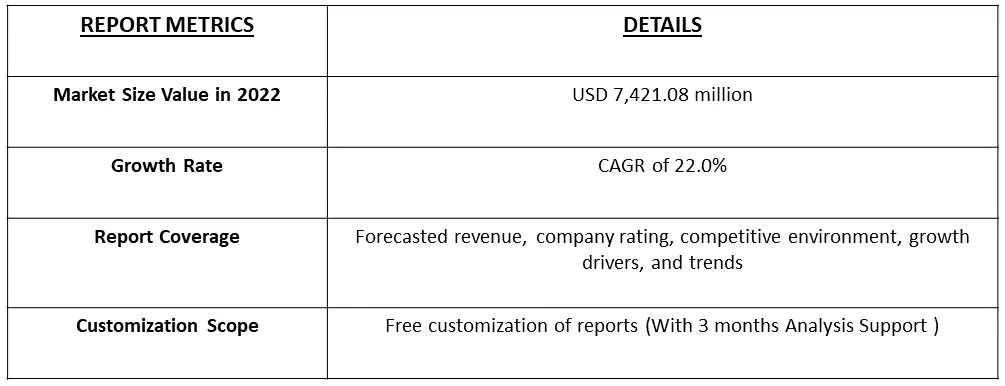

The global genetic testing market, which reached a value of USD 7,421.08 million in 2022, is poised for substantial growth with an expected compound annual growth rate (CAGR) of 22.0% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

This growth is being significantly driven by various factors, including the increasing awareness of newborn screening and the rising prevalence of genetic disorders. For instance, the United States has made significant strides in newborn screening programs, with assessments for over 60 diseases. The American Association for Clinical Chemistry highlights the nation's commitment to these initiatives. Furthermore, in the U.S., the Recommended Uniform Screening Panel (RUSP) plays a pivotal role by mandating the screening of specific genetic diseases. This decision is based on comprehensive data related to disease prevalence and incidence, collected over time.

DNA testing can detect changes in an individual's genes, chromosomes, or proteins. A sample of blood, hair, skin, tissues, or amniotic fluid is taken for genetic testing. The test may be able to either confirm or rule out whether or not a person has a genetic problem. It may also aid in determining the likelihood of getting or passing on a genetic condition.

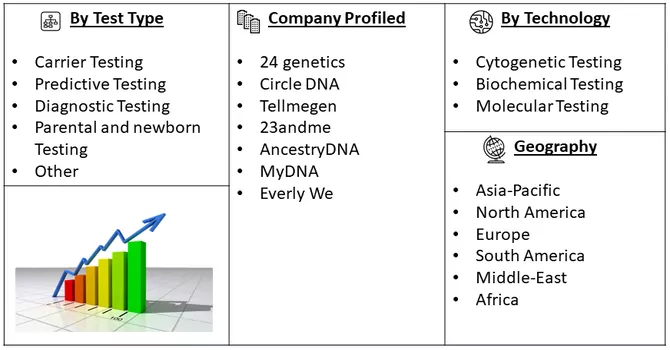

Segmentation: The global genetic testing market is segmented by Test Type (Carrier Testing, Predictive Testing, Diagnostic Testing, Parental and newborn Testing, and Other Types), Technology (Cytogenetic Testing, Biochemical Testing, and Molecular Testing), and by Geography (North America, Europe, Asia-pacific, South America, and Middle East and Africa). The report offers market size and forecasts in value (USD Million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Predictive genetic testing is a form of testing that examines inherited gene alterations that may increase a person's risk of developing specific types of cancer. An individual who has a longstanding family history of certain forms of cancer can get tested to see if they have a mutation in their genes that raises their risk. If they do have a hereditary mutation, they may want to have screening tests to detect cancer early, or they may want to make efforts to reduce their risk. Testing for mutations in the BRCA1 and BRCA2 genes (which in turn are known to raise the risk of breast cancer and other malignancies) in people who have multiple family members who suffered from breast cancer serves as an example. Family members of someone who has an inherited gene mutation that puts them at risk of cancer can undergo genetic testing to know whether they need screening tests to detect cancer early or if they ought to implement precautions to reduce their risk.

Drivers:

Increasing Prevalence of Genetic Disorders and Cancer

The rising prevalence of genetic disorders is driving up demand for genetic testing. According to the NCBI, cystic fibrosis (CF) is less commonly reported in the Asian community due to under-diagnosis and the absence of centralized CF patient registries. Clinical research on Asian CF individuals has revealed an advanced stage of the disease. In this population, the range of cystic fibrosis transmembrane conductance regulator (CFTR) variations is highly diverse. On about 3,700 Asian CF chromosomes, 166 variations have been found. As a result, increasing occurrences of cystic fibrosis (CF) will drive up demand for genetic testing.

According to estimates, there will be 2.3 million new cases of breast cancer identified and 685,000 deaths from the disease worldwide in 2020, making it the most common cancer and the fifth greatest cause of death for women worldwide. In low- and middle-income nations, the incidence and mortality are increasing quickly and disproportionately. China ranked first globally in terms of new cases and deaths in 2020, accounting for almost 18.4% of all new cases and 17.1% of all deaths worldwide. Healthcare systems in developing nations are under a heavy burden due to the high incidence and mortality rates. Thus, the medical practitioners in the area strongly advise and carry out genetic testing, routine clinical breast examinations, mammograms, and monthly self-exams of the breasts. Thus, it is necessary to evaluate current breast cancer screening procedures in terms of both costs and health outcomes due to rising incidence, significant illness, and economic burden.

Increasing Demand for Personalized Medicine

Personalized medicine employs an individual's genetic makeup to guide decisions about illness prevention, diagnosis, and therapy. Knowing a patient's genetic profile may assist doctors in choosing the right medication or treatment and administering it correctly. The Human Genome Project data is being used to enhance personalized medicine. As per NCBI findings, Southeast Asia has made strides in the adoption of personalized medicine, particularly in Singapore and Thailand. A pharmacogenomics research network has been established in the region. However, rules and programs for personalized medicine (PM) vary greatly. Recent developments in molecular biology have enabled personalized medicine (PM), which is the customization of medical care or prevention to the unique characteristics of each patient. Omic's scientific research has expanded the understanding of the links among genes, proteins, and disease, enabling additional tools for PM and prompting a shift in medical practice.

Restraints

High Cost of Genetic Testing

The high cost of genetic testing presents a significant obstacle to the widespread adoption of these valuable services. Addressing this challenge is essential to ensure that genetic testing is accessible to all individuals, regardless of their socioeconomic status. Reducing costs, increasing insurance coverage, and promoting transparency in pricing are crucial steps to remove this barrier and maximize the benefits of genetic testing in improving healthcare outcomes and personalized medicine. Thus, this may slow down the growth of the studied market.

The COVID-19 pandemic has expanded the role of genetic testing in various aspects, from susceptibility and treatment to vaccine development and virus tracking. This interdisciplinary approach, combining genetics and infectious disease research, has the potential to enhance our understanding of the virus and improve our ability to combat it effectively. However, it also raises important ethical and privacy considerations that need to be addressed as genetic testing plays a more prominent role in the context of the pandemic.

Segmental Analysis :

Predictive Testing is Expected to Witness Significant growth Over the Forecast Period

Predictive testing is a specialized form of genetic testing that focuses on identifying an individual's risk of developing a specific genetic condition, often before any symptoms manifest. This proactive approach to genetic testing is valuable for disease prevention, early intervention, and personalized healthcare. Predictive testing plays a crucial role in genetic testing by allowing individuals to proactively assess their risk of developing specific genetic conditions. It offers opportunities for early intervention, personalized healthcare, and informed decision-making regarding lifestyle and family planning. Thus, the region is expected to witness significant growth over the forecast period.

Molecular Testing is Expected to Witness Significant growth Over the Forecast Period

Molecular testing, also known as molecular diagnostics or genetic testing, refers to a broad range of laboratory techniques used to analyze biological markers in an individual's genetic material (such as DNA, RNA, or proteins) to gain insights into various aspects of their health, including the presence or absence of genetic mutations, predisposition to diseases, infectious diseases, and the effectiveness of specific treatments. Molecular testing plays a crucial role in various fields, including clinical medicine, oncology, infectious diseases, pharmacogenomics, and genetic counseling. It has revolutionized healthcare by providing valuable insights into the underlying genetic factors contributing to diseases, leading to more personalized and targeted medical treatments and interventions. Thus, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The demand for genetic testing in the region, particularly in the segments of personalized healthcare and identification for predisposition of various diseases, has been further fueled by the rising expenditure on preventive measures coupled with the increasing awareness among the Indian population regarding early diagnosis. Additionally, location and technological knowledge can significantly help genetic testing organizations be better organized, plan ahead, respond more swiftly, and conduct end-to-end operations effectively and efficiently.

The genetic testing industry is more likely to improve and expand in the future because of increasing technology advancements. The expansion of the regional market is being fueled by the increasing trend of collaborations between major players for product launches and innovation. For Example, In 2023, the major Chinese player, BGI Genomics, and the University of Pécs (UP) in Hungary reached an agreement to establish a collaborative laboratory. This is part of a collaboration agreement signed by BGI Group, BGI Genomics' parent firm, and the University. The combined lab is expected to begin official functioning in 2023. This world-class facility will speed the development of genetic sequencing and clinical diagnostic services, while also bolstering BGI Genomics and the UP's dominance in genomics, bioinformatics, reproductive wellness, and precision medicine in Central and Eastern Europe. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Some prominent players in the global genetic testing market include:

Recent Developments:

1) In August 2023, Thermo Fisher Scientific Inc., announced that it had acquired CorEvitas, LLC from Audax Private Equity for USD 912.5 million. CorEvitas is a leading provider of regulatory-grade, real-world evidence for approved medical treatments and therapies. The acquisition of CorEvitas, LLC helps Thermo Fisher expand its clinical research business with real-world evidence solutions that help in improving decision-making along with the time and cost of drug development.

2) In January 2020, ARCHIMED Life announced a strategic alliance with Amides Holding GmbH to expand and provide better access to special diagnostic services for genetic, biochemical, and biomarker testing.

Q1. What was the Genetic testing Market size in 2022?

As per Data Library Research The global genetic testing market, reached a value of USD 7,421.08 million in 2022.

Q2. At what CAGR is the Genetic testing Market market projected to grow within the forecast period?

Genetic testing Market is poised for substantial growth with an expected CAGR of 22.0% over the forecast period.

Q3. What are the factors driving the Genetic testing Market?

Key factors that are driving the growth include the Increasing Prevalence of Genetic Disorders and Cancer and Increasing Demand for Personalized Medicine.

Q4. What Impact did COVID-19 have on the Genetic testing Market?

The COVID-19 pandemic has expanded the role of genetic testing in various aspects, from susceptibility and treatment to vaccine development and virus tracking. For detailed insights request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model