Acoustic Vehicle Alerting System (AVAS) for the Electric Vehicle Market Overview and Analysis

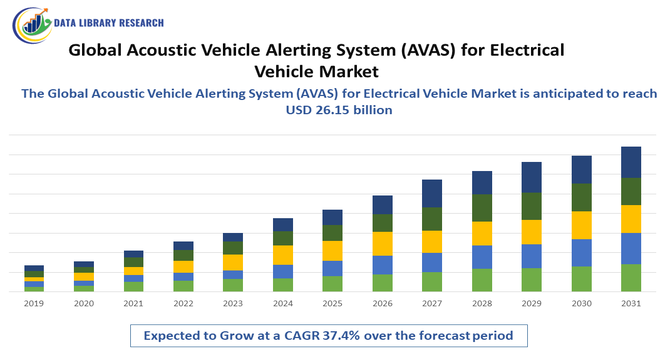

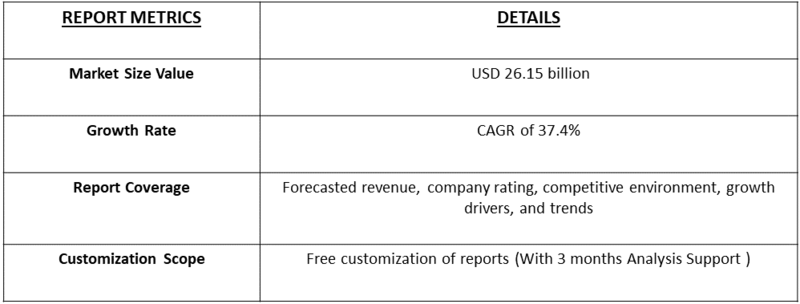

- The Global Acoustic Vehicle Alerting System (AVAS) for Electric Vehicle Market size is projected to grow from USD 3.76 billion in 2026 to USD 26.15 billion by 2033, growing at a CAGR of 37.4% from 2026-2033.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Acoustic Vehicle Alerting System (AVAS) for Electric Vehicle Market focuses on the design, production, and deployment of sound-generating systems that alert pedestrians and cyclists to the presence of otherwise quiet electric and hybrid vehicles. AVAS enhances road safety by producing artificial engine sounds at low speeds or in sensitive areas. Technological advancements, such as customizable sounds and integration with vehicle control systems, along with government mandates, are boosting demand for AVAS across passenger cars, buses, and commercial EVs globally.

Acoustic Vehicle Alerting System (AVAS) for the Electric Vehicle Market: Latest Trends

The Global Acoustic Vehicle Alerting System (AVAS) market is growing rapidly alongside the surge in electric vehicle (EV) adoption. Regulatory mandates in regions like Europe, North America, and Asia-Pacific require AVAS implementation for pedestrian safety, especially at low speeds. Innovations focus on customizable, directional, and adaptive sound systems that improve urban safety while minimizing noise pollution. Integration with vehicle electronics and advanced driver-assistance systems (ADAS) is increasingly common.

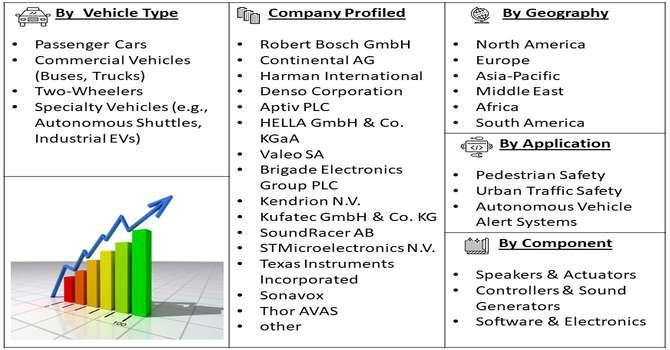

Segmentation: The Global Acoustic Vehicle Alerting System (AVAS) market is segmented by Vehicle Type (Passenger Cars, Commercial Vehicles (Buses, Trucks), Two-Wheelers, Specialty Vehicles (e.g., Autonomous Shuttles, Industrial EVs)), System Type (External AVAS (outside the vehicle for pedestrians) and Internal AVAS (inside the vehicle for driver/passenger alerts)), Sound Type (Engine Simulation Sounds, Warning/Alert Tones, and Custom/Signature Sounds), Component (Speakers & Actuators, Controllers & Sound Generators and Software & Electronics), Application (Pedestrian Safety, Urban Traffic Safety and Autonomous Vehicle Alert Systems), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Regulatory Mandates for Pedestrian Safety

The primary drivers of the Global AVAS market is the growing implementation of safety regulations requiring electric and hybrid vehicles to emit audible sounds at low speeds. Governments in regions such as Europe, North America, and Asia-Pacific have mandated AVAS installation to reduce accidents involving pedestrians and cyclists. Compliance with these laws ensures that automakers avoid penalties and improve vehicle safety ratings. This regulatory push drives widespread adoption across passenger cars, commercial vehicles, and two-wheelers. As EV sales rise globally, mandatory AVAS implementation continues to expand, creating sustained demand for reliable, high-quality alerting systems.

- Rapid Adoption of Electric Vehicles

The increasing global adoption of electric vehicles is another major driver of the AVAS market. EVs are inherently quieter than internal combustion engine vehicles, creating a heightened need for artificial acoustic warning systems to ensure pedestrian safety.

Rising awareness of road safety, coupled with government incentives promoting EV purchases, has accelerated the shift toward electric mobility. For instance, in 2025, The approval of Phase-II of the FAME Scheme in India ,with Rs. 10,000 crore funding, significantly boosted electric vehicle adoption in India. By incentivizing e-buses, e-3 wheelers, e-4 wheelers, and e-2 wheelers, the scheme accelerated EV demand, supported large-scale deployment, and encouraged manufacturers and consumers to transition toward sustainable, low-emission transportation across the country.

As EV production grows across passenger, commercial, and specialty vehicles, manufacturers are integrating AVAS as a standard feature. Technological advancements, including customizable, directional, and energy-efficient sound systems, further support market growth by offering safer and more sophisticated solutions for emerging electric mobility trends.

Market Restraints:

- High Implementation and Integration Costs

The key restraint for the AVAS market is the high cost of implementation and integration into vehicles. Designing, producing, and installing AVAS components—including speakers, sound generators, and software—adds to overall vehicle production expenses. Smaller automakers and cost-sensitive segments may delay adoption due to limited budgets. Integration with existing vehicle electronics and compliance with regional sound regulations can further complicate deployment. Additionally, research and development costs for advanced, customizable, or directional systems may restrict smaller suppliers from entering the market. These financial challenges can slow adoption in emerging regions, despite regulatory requirements and the growing EV base globally.

Socioeconomic Impact on Acoustic Vehicle Alerting System (AVAS) for the Electric Vehicle Market

AVAS technology significantly improves pedestrian and cyclist safety, particularly in urban areas, reducing accidents caused by silent electric vehicles. By enabling safer mobility, AVAS contributes to enhanced public health and urban livability. The market also creates economic opportunities, including manufacturing jobs, R&D employment, and service sectors related to installation and maintenance. Wider adoption of AVAS aligns with regulatory compliance, reducing liability costs for automakers. Moreover, the technology supports social inclusion by protecting visually impaired and vulnerable populations. Overall, AVAS adoption fosters safer, more sustainable transportation ecosystems while stimulating economic growth through innovation and industrial activity.

Segmental Analysis:

- Specialty Vehicles (e.g., Autonomous Shuttles, Industrial EVs) segment is expected to witness highest growth over the forecast period

The specialty vehicles segment, including autonomous shuttles and industrial EVs, is expected to witness the highest growth over the forecast period. These vehicles operate in pedestrian-heavy or industrial environments where safety is critical, making AVAS integration essential. Rising investments in autonomous mobility, logistics, and smart factory solutions drive demand for reliable alert systems. Governments and private operators prioritize compliance with safety regulations, further accelerating adoption. Additionally, technological advancements in compact, energy-efficient AVAS solutions enable installation in smaller or unconventional vehicles. As autonomous and specialized EV applications expand globally, AVAS becomes increasingly critical for safe operations, fueling market growth in this segment.

- External AVAS (outside the vehicle for pedestrians) segment is expected to witness highest growth over the forecast period

The external AVAS segment is projected to experience the highest growth, driven by the need to alert pedestrians, cyclists, and other road users to silent electric and hybrid vehicles. Regulatory mandates in Europe, North America, and Asia require audible alerts at low speeds, particularly below 20 km/h. External AVAS systems provide clear, directional, and adaptive warning sounds to enhance urban traffic safety. With rising EV adoption and increasing pedestrian traffic in cities, automakers are focusing on high-quality external acoustic solutions. Technological developments in customizable and energy-efficient external speakers further stimulate adoption and market expansion.

- Custom/Signature Sounds segment is expected to witness highest growth over the forecast period

The custom or signature sounds segment is expected to witness the highest growth as automakers differentiate EV models through distinctive acoustic identities. Beyond safety compliance, manufacturers aim to enhance brand recognition and customer experience by integrating unique vehicle sounds. Technological advancements in sound modulation, directional speakers, and software-controlled tones allow precise, customizable alerts that meet regulatory standards while maintaining aesthetic appeal. Growing consumer preference for personalized features and the rise of premium EV models drive demand. Additionally, regulatory flexibility in certain regions encourages innovative sound designs, making custom or signature AVAS systems a fast-growing segment within the electric vehicle safety market.

- Software & Electronics segment is expected to witness highest growth over the forecast period

The software and electronics segment of the AVAS market is projected to witness the highest growth, driven by the increasing complexity of modern electric and autonomous vehicles. AVAS software enables adaptive sound control, integration with vehicle sensors, and compliance with regional regulations. Advanced electronics, including sound generators, controllers, and signal processors, enhance system reliability and efficiency. With EVs and autonomous vehicles requiring precise, context-aware alerts, manufacturers are investing in software-driven, programmable AVAS solutions. The integration of AI, cloud connectivity, and data-driven sound adaptation further boosts adoption. This trend makes software and electronics critical for the evolution and growth of the AVAS market.

- Autonomous Vehicle Alert Systems segment is expected to witness highest growth over the forecast period

The autonomous vehicle alert systems segment is expected to witness the highest growth over the forecast period, fueled by increasing deployment of self-driving vehicles in urban, commercial, and industrial settings. AVAS integration is essential to ensure pedestrian and cyclist safety when vehicles operate quietly. AI-enabled systems provide adaptive, directional alerts that adjust to speed, environment, and proximity, improving overall traffic safety. Government regulations and urban mobility guidelines are also driving widespread adoption. Additionally, growing investments in autonomous shuttle programs, last-mile delivery EVs, and industrial robotics require sophisticated alert systems, positioning autonomous vehicle alert systems as a key growth driver in the AVAS market.

- Asia-Pacific Region is expected to witness highest growth over the forecast period

The Asia-Pacific region is anticipated to witness the highest growth in the AVAS market over the forecast period due to rapid adoption of electric vehicles, expanding urban populations, and stringent pedestrian safety regulations.

Countries like China, Japan, India, and South Korea are investing heavily in EV infrastructure, autonomous vehicle initiatives, and smart city projects, increasing demand for AVAS. For instance, in December 2025, Mitsubishi Heavy Industries’ demonstration of autonomous buses with vehicle-infrastructure integration in Shimotsuke City, Japan, highlighted the increasing deployment of autonomous EVs in Asia-Pacific. The project emphasized the need for Acoustic Vehicle Alerting Systems (AVAS) to ensure pedestrian and cyclist safety in urban and public transport environments. This initiative accelerated AVAS adoption across the region, driving demand for advanced, regulatory-compliant alerting solutions in electric and autonomous vehicle fleets.

Rising industrial and commercial EV fleets further accelerate adoption. Regional regulatory mandates, government incentives, and growing public awareness of road safety contribute to market expansion. Additionally, the presence of key AVAS manufacturers and suppliers in the region supports localized production, distribution, and technological innovation, driving rapid growth.

To Learn More About This Report - Request a Free Sample Copy

Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Competitive Landscape

The AVAS market is competitive, featuring a mix of established automotive component suppliers, specialized acoustic technology firms, and emerging startups. Key players differentiate through sound quality, energy efficiency, integration capabilities, and compliance with regional safety standards. Companies invest heavily in R&D to develop customizable, directional, and adaptive sound solutions compatible with various EV platforms. Strategic partnerships with automakers, collaborations with electronics and software firms, and global distribution networks strengthen market positions. Pricing, after-sales service, and technological innovation are crucial for market leadership. The presence of strict regulatory requirements ensures continuous demand, motivating players to expand their offerings and technological expertise worldwide.

The major players for above market are:

- Robert Bosch GmbH

- Continental AG

- Harman International

- Denso Corporation

- Aptiv PLC

- HELLA GmbH & Co. KGaA

- Valeo SA

- Brigade Electronics Group PLC

- Kendrion N.V.

- Kufatec GmbH & Co. KG

- SoundRacer AB

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Sonavox

- Thor AVAS

- Nissan Motor Co., Ltd.

- Honda Motor Co., Ltd.

- Toyota Motor Corporation

- Tesla, Inc.

- BMW AG

Recent Development

- In January 2026, Lyft’s partnership with BENTELER Mobility to deploy autonomous shuttles in US urban areas increased the demand for Acoustic Vehicle Alerting Systems (AVAS). As quiet EV shuttles operated in airports and city centers, AVAS integration became essential to ensure pedestrian and cyclist safety, boosting adoption of reliable, adaptive alerting solutions in the autonomous and electric vehicle market.

- In October 2025, BorgWarner’s supply of advanced lithium NMC battery systems for HOLON autonomous shuttles highlighted the growing adoption of fully electric, autonomous vehicles. This development increased the need for Acoustic Vehicle Alerting Systems (AVAS) to ensure pedestrian and cyclist safety in quiet EVs. As autonomous urban shuttles expanded in North America, demand for reliable, high-performance AVAS solutions rose, driving market growth and encouraging innovation in adaptive, software-integrated alert systems.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

Strict government regulations mandating artificial noise for quiet electric vehicles are the primary drivers. Safety concerns for pedestrians, cyclists, and the visually impaired have led to legislation like the EU’s Type-Approval requirements and similar US NHTSA standards. The rapid global transition from internal combustion engines to electric mobility further accelerates adoption.

Q2. What are the main restraining factors for this market?

High development costs associated with sophisticated sound-shaping technology and specialized waterproof speaker hardware can restrain market growth. Additionally, varying regional regulations regarding specific frequency ranges and sound levels create complexities for global manufacturers. Some consumers also perceive artificial sounds as noise pollution, leading to resistance in certain luxury vehicle segments.

Q3. Which segment is expected to witness high growth?

The Autonomous Vehicle Alert Systems segment is expected to witness the highest growth, driven by rising adoption of self-driving vehicles, advanced safety regulations, and increasing demand for pedestrian and urban traffic protection. Advancements in AI and sensor technologies are enabling precise, adaptive acoustic alerts for autonomous vehicles. Additionally, global regulatory mandates are encouraging manufacturers to integrate AVAS as standard safety features in autonomous fleets.

Q4. Who are the top major players for this market?

Leading players include Tier-1 automotive suppliers such as Brigade Electronics, HELLA GmbH & Co. KGaA, Harman International, and Bosch. Other significant contributors are Continental AG, Denso Corporation, and Kendrion. These companies dominate through advanced R&D in digital signal processing and integrated pedestrian alert systems for global automotive OEMs.

Q5. Which country is the largest player?

China is currently the largest player in the AVAS market. This dominance is fueled by China being the world’s largest producer and consumer of electric vehicles. Strong domestic manufacturing capabilities, coupled with aggressive government subsidies for New Energy Vehicles (NEVs) and early implementation of safety standards, have solidified its market leadership.

List of Figures

Figure 1: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Acoustic Vehicle Alerting System (AVAS) for Electrical Vehicle Market Revenue (USD Billion) Forecast, by Country, 2018-2029