Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Overview and Analysis:

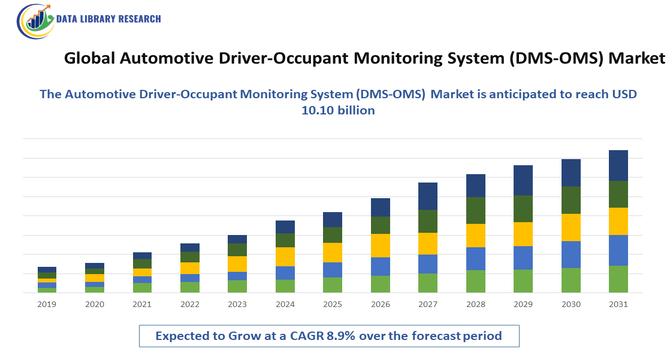

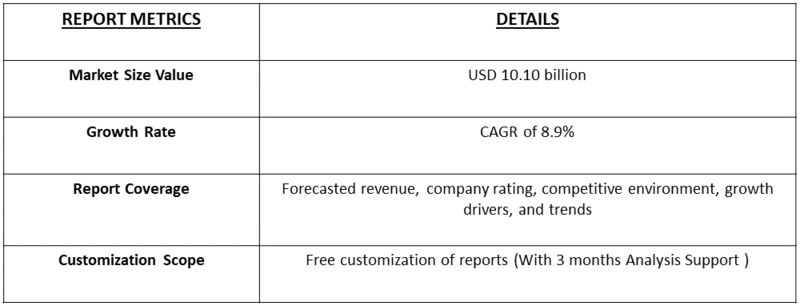

The Global Automotive Driver–Occupant Monitoring System (DMS–OMS) Market size was estimated at USD 3.87 billion in 2025 and is projected to reach USD 10.10 billion by 2032, growing with a CAGR of 8.9% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Automotive Driver–Occupant Monitoring System (DMS–OMS) Market refers to technologies used in vehicles to monitor the driver’s alertness, attention, and behavior, as well as the presence, posture, and safety of passengers. These systems use cameras, sensors, and AI to detect drowsiness, distraction, seatbelt use, and child presence.

The Global Automotive Driver–Occupant Monitoring System (DMS–OMS) Market is growing rapidly due to stricter global safety regulations, increasing integration of ADAS features, and rising concerns about distracted and drowsy driving. Governments are mandating driver monitoring in new vehicles to reduce road accidents, especially with the spread of semi-autonomous driving.

Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Latest Trends

The Automotive Driver–Occupant Monitoring System market is witnessing strong trends driven by AI-powered in-cabin sensing, higher-resolution infrared cameras, and multi-modal monitoring that combines eye tracking, head position, heart-rate sensing, and posture detection. Automakers are increasingly integrating DMS–OMS into advanced safety suites to comply with Euro NCAP and upcoming global mandates. There is also a shift toward combining monitoring features with comfort functions, such as personalized settings and health detection, making in-cabin intelligence a key differentiator in new vehicles.

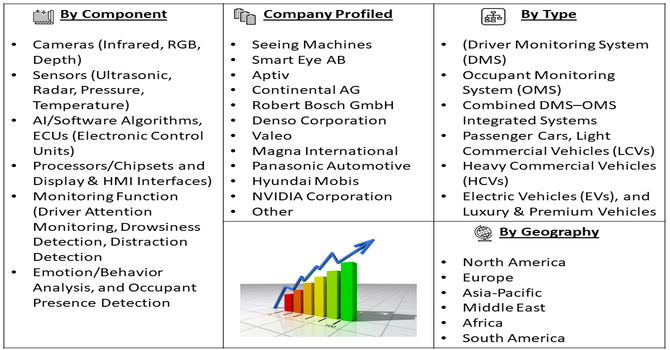

Segmentation: The Automotive Driver–Occupant Monitoring System market is segmented by System Type (Driver Monitoring System (DMS), Occupant Monitoring System (OMS) and Combined DMS–OMS Integrated Systems), Component (Cameras (Infrared, RGB, Depth), Sensors (Ultrasonic, Radar, Pressure, Temperature), AI/Software Algorithms, ECUs (Electronic Control Units), Processors/Chipsets and Display & HMI Interfaces), Monitoring Function (Driver Attention Monitoring, Drowsiness Detection, Distraction Detection, Emotion/Behavior Analysis, and Occupant Presence Detection), Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), and Luxury & Premium Vehicles), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Strict Regulatory Mandates and Safety Rating Requirements

The primary driver for the DMS-OMS market is the introduction and enforcement of increasingly strict global automotive safety regulations and rating protocols. Organizations such as the European New Car Assessment Programme (Euro NCAP) and the U.S. National Highway Traffic Safety Administration (NHTSA) are integrating mandatory requirements for Driver Monitoring Systems (DMS) to detect and warn against driver distraction and drowsiness. For instance, Euro NCAP includes points for the inclusion and effectiveness of DMS, compelling OEMs to implement these systems to achieve top safety ratings, which are crucial for marketability. This regulatory push transforms DMS from a premium feature into a standard, indispensable safety component across all vehicle segments.

- Rapid Advancements in Sensor Technology and AI Integration

Technological evolution, particularly in high-resolution infrared cameras, advanced image processing, and deep learning algorithms, is accelerating the adoption of DMS and OMS. Modern systems can reliably track complex behaviors—such as micro-sleep events, emotional state, or occupant size—even under challenging conditions like low light or when the driver is wearing sunglasses. The integration of Artificial Intelligence allows the systems to learn individual driver behavior and distinguish between genuine distraction and normal activities, significantly reducing false alerts. This accuracy enhancement expands the system's utility beyond basic safety to enable personalized climate control, infotainment settings, and robust preparation for Level 3 (Conditional Automation) and higher autonomous driving features.

Market Restraints

- High System Cost and Consumer Data Privacy Concerns

A significant constraint on the market is the relatively high cost associated with integrating the full spectrum of DMS and OMS components, including specialized cameras, complex processing units, and sophisticated software licenses. This cost barrier is particularly prohibitive for manufacturers operating in the budget and mid-range vehicle segments, limiting mass-market penetration. Furthermore, consumer apprehension regarding data privacy poses a critical challenge. Since DMS/OMS continuously monitors and processes biometric data (eye movement, head position, and potentially facial recognition), users have raised concerns about how this sensitive, real-time information is stored, transmitted, and utilized by manufacturers, necessitating stringent data protection compliance and trust-building measures.

Socio-Economic Impact on Automotive Driver-Occupant Monitoring System (DMS-OMS) Market

This market has a significant socioeconomic impact by enhancing road safety, reducing accidents caused by distraction or fatigue, and improving overall public health. Widespread adoption helps lower societal costs associated with collisions, healthcare expenses, insurance claims, and lost productivity. It also supports job creation in AI development, sensor manufacturing, and automotive engineering. As safety improves, communities benefit from safer transportation systems, while consumers gain confidence in semi-autonomous vehicles, accelerating smart mobility adoption.

Segmental Analysis:

- Driver Monitoring System (DMS) segment is expected to witness highest growth over the forecast period

The Driver Monitoring System (DMS) segment is expected to see the highest growth as global road safety regulations tighten and mandates for in-cabin monitoring increase. Governments in Europe, the U.S., and Asia are requiring DMS in new vehicles to reduce distracted and drowsy driving accidents. Automakers are rapidly integrating AI-powered eye tracking, head-position detection, and fatigue alerts as standard features. Rising adoption of Level 2 and Level 2+ autonomous vehicles is further accelerating demand, as these vehicles require continuous driver supervision. Increasing consumer awareness about safety and insurance benefits also boosts the expansion of the DMS segment.

- Cameras (Infrared, RGB, Depth) segment is expected to witness highest growth over the forecast period

The Cameras segment—especially infrared, RGB, and depth-sensing cameras—is expected to dominate growth due to their critical role in accurate in-cabin monitoring. Infrared cameras enable reliable performance in low light, while RGB and depth cameras enhance facial recognition, posture tracking, and multi-occupant analysis. As vehicles adopt multi-modal sensing for enhanced safety and comfort, camera-based systems are becoming the preferred choice for automakers. Their integration with AI algorithms improves precision in detecting distraction, fatigue, and passenger presence. Increasing localization of camera manufacturing and advancements in miniaturization and thermal efficiency also support strong growth across this segment during the forecast period.

- Driver Attention Monitoring segment is expected to witness highest growth over the forecast period

The Driver Attention Monitoring segment is projected to grow the fastest as distracted driving continues to be one of the leading causes of global road accidents. Governments and rating agencies such as Euro NCAP now require real-time attention monitoring for vehicle safety scoring. Automakers are integrating advanced analytics to track eye gaze, blink rate, micro-expressions, and head orientation to predict fatigue or distraction. The rise of semi-autonomous driving further increases the need for continuous driver engagement monitoring. As consumers prioritize safety and insurers offer incentives for vehicles equipped with attention-monitoring systems, demand for this segment will continue to accelerate.

- Heavy Commercial Vehicles (HCVs) segment is expected to witness highest growth over the forecast period

The Heavy Commercial Vehicles (HCVs) segment is expected to witness strong growth due to the high risk associated with long driving hours, fatigue, and heavy-duty operations. Commercial fleets are increasingly adopting DMS–OMS technologies to improve driver safety, reduce accidents, and minimize operational downtime. Strict government regulations for fleet safety compliance and pressure to lower insurance costs are driving widespread adoption. Logistics, mining, construction, and long-haul trucking companies are investing in real-time monitoring systems to enhance efficiency and protect valuable cargo. As fleet digitalization rises and telematics integrates with DMS, HCVs will remain a key growth contributor.

- Europe Region is expected to witness highest growth over the forecast period

Europe is expected to lead market growth due to strong regulatory support, advanced automotive R&D capabilities, and early implementation of in-cabin safety mandates. Euro NCAP has made driver monitoring a key requirement for safety ratings, prompting automakers to rapidly adopt DMS–OMS technologies across new models. Europe’s focus on autonomous driving, coupled with government initiatives promoting safer mobility, further accelerates adoption. The region also hosts major technology suppliers specializing in AI, sensor systems, and automotive electronics, strengthening innovation. With consumer preference shifting toward high-safety vehicles and premium brands integrating advanced monitoring by default, Europe will remain the fastest-growing market.

To Learn More About This Report - Request a Free Sample Copy

Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Competitive Landscape

The competitive landscape is intense, with major automotive suppliers, tech firms, and AI startups investing heavily in DMS–OMS innovation. Leading companies compete through advanced algorithms, low-light camera performance, and integrated sensor platforms. Traditional Tier-1 suppliers partner with automakers to build embedded systems, while newer companies focus on software-only AI models. Competition is also shaped by regulatory pressures, forcing manufacturers to deliver compliant, cost-effective, and reliable systems. As vehicles become smarter, DMS–OMS has become a core battleground for in-cabin safety technology leadership.

The major players for above market are:

- Seeing Machines

- Smart Eye AB

- Aptiv

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Valeo

- Magna International

- Panasonic Automotive

- Hyundai Mobis

- NVIDIA Corporation

- Tobii AB

- OmniVision Technologies

- Pioneer Corporation

- STMicroelectronics

- Texas Instruments

- Qualcomm Technologies

- Renesas Electronics

- ZF Friedrichshafen AG

- Huawei Technologies Co., Ltd.

Recent Development

- In October 2025, OMNIVISION introduced the OX05C, the automotive industry's first 5-megapixel BSI global-shutter HDR sensor designed for in-cabin driver and occupant monitoring systems. As part of its Nyxel® NIR technology family, the sensor delivered superior low-light performance and high imaging accuracy. OMNIVISION showcased its advanced capabilities at AutoSens Europe 2025 in Barcelona, strengthening innovation in next-generation DMS and OMS applications and setting a new benchmark for in-cabin sensing technology.

- In July 2024, Valeo, a global provider in automotive technology, and Seeing Machines, a pioneer in AI-powered operator monitoring systems, announced a strategic collaboration to strengthen their presence in the driver and occupant monitoring systems market. The partnership combined Valeo’s expertise in automotive systems with Seeing Machines’ advanced computer-vision capabilities, enabling the development of safer, more intelligent in-cabin monitoring solutions and reinforcing both companies’ competitiveness in the rapidly growing DMS and OMS sectors.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary growth driver is the push for greater vehicle safety through strict government regulations, such as Europe's General Safety Regulation (GSR 2), which mandates these systems in new cars. This regulatory environment combines with rapid improvements in sensor technology and AI-powered computer vision. These factors enhance system accuracy in detecting driver distraction and fatigue, which in turn fuels adoption by car manufacturers and increases consumer demand for advanced safety features.

Q2. What are the main restraining factors for this market?

The high initial cost of integrating complex camera and sensor hardware, along with the sophisticated software, presents a significant hurdle for widespread adoption, particularly in budget-sensitive vehicle segments. Furthermore, concerns regarding data privacy and security are major restraining factors. Drivers worry about how personal in-cabin data, such as facial recognition and behavior patterns, is collected, stored, and used by car makers and system providers.

Q3. Which segment is expected to witness high growth?

The fastest growing segment is the integration of DMS and OMS into a single, unified in-cabin monitoring system. Automakers are increasingly moving towards these combined solutions to offer comprehensive safety features efficiently, including child presence detection and personalized in-cabin settings. The hardware segment, specifically for advanced sensors like high-resolution cameras, is also projected to see rapid growth due to increasing deployment volume.

Q4. Who are the top major players for this market?

The DMS-OMS market is highly competitive, dominated by major Tier 1 automotive suppliers and technology firms. The top key players include well-known companies like Robert Bosch GmbH, Continental AG, Denso Corporation, and Aptiv. Other significant contributors are companies specializing in software and AI algorithms for in-cabin sensing, such as Smart Eye and Magna International, which continue to drive innovative system designs.

Q5. Which country is the largest player?

The European market, driven by the European Union (EU) and its stringent General Safety Regulation (GSR), currently holds the largest share in the DMS-OMS market by revenue. However, the Asia-Pacific region, particularly China, is expected to become the fastest-growing market globally due to its massive automotive production volume and strong governmental support for intelligent, safer vehicle technologies.

List of Figures

Figure 1: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Automotive Driver-Occupant Monitoring System (DMS-OMS) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model