Balcony Construction Market Overview and Analysis:

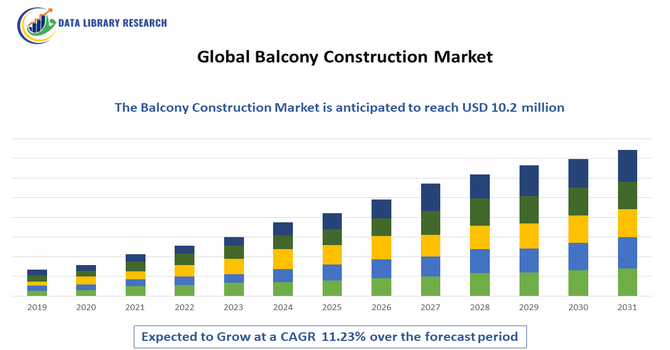

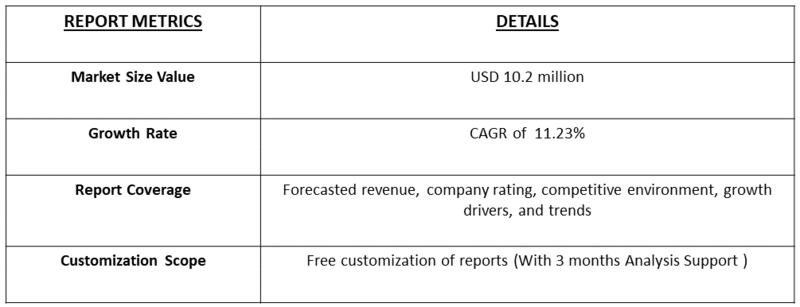

The global Balcony Construction market was valued at USD 6.2 million in 2025 and is anticipated to reach USD 10.2 million by 2032, witnessing a CAGR of 11.23% during 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Rapid urbanization and expanding residential and commercial construction activity worldwide are the primary engines driving growth in the global balcony construction market, as developers and homeowners increasingly prioritize usable outdoor space for leisure, ventilation and aesthetic value. Rising disposable incomes and changing lifestyle preferences — including demand for private outdoor zones, work-from-home–friendly terraces, and enhanced curb appeal — are boosting new-build and renovation projects. Technological and material innovations (lightweight composites, engineered timber, corrosion-resistant metals, and prefabricated modular systems) are lowering installation time and lifecycle costs, encouraging wider adoption across mid- and high-rise developments.

Balcony Construction Market Latest Trends

The global balcony construction market is witnessing several emerging trends driven by design innovation, sustainability, and advancing construction technologies. There is a strong shift toward eco-friendly materials such as recycled metals, engineered timber, and high-performance glass, aligning with green building standards and energy-efficient construction practices. Modular and prefabricated balcony systems are rapidly gaining traction because they reduce installation time, minimize labor costs, and ensure consistent quality, making them especially attractive for large-scale residential and commercial projects.

Segmentation: Global Balcony Construction Market is segmented by Material Type (Steel, Aluminum, Glass, and Wood), Construction Type (New Construction, Renovation/Retrofit), End User (Residential Sector, Commercial Sector), Design Type (Cantilevered Balconies, Hung and Stacked Balconies, Prefabricated/Modular Balconies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rapid Urbanization and Growing Demand for High-Density Residential Construction

The strongest drivers of the global balcony construction market is the rapid pace of urbanization, which is accelerating the development of high-density residential buildings such as apartments, condominiums, and mixed-use structures. As land availability declines in major cities, vertical construction becomes the default solution, and balconies play a crucial role in enhancing liveability within compact homes. For instance, the Economic Times, in 2025, reported that by 2036, India's urban areas were expected to drive 75% of the country’s GDP, highlighting the urgency of solving major challenges like infrastructure gaps and housing shortages. The push toward adopting these IVC principles for rapid urbanization and growing demand for high-density residential construction had a significant impact on the Balcony Construction Market. As planning shifted toward grid-based, organized layouts and climate-conscious building, developers favored prefabricated balcony systems that simplified installation in dense settings.

- Increased Focus on Aesthetic Appeal, Safety, and Material Innovation

Another major growth driver is the rising emphasis on design aesthetics, structural safety, and advanced construction materials. Consumers and developers are demanding balcony systems that enhance the architectural appeal of buildings while ensuring long-term durability and compliance with stricter building codes. Innovations such as frameless glass railings, powder-coated aluminum structures, corrosion-resistant steel, fire-safe composite materials, and prefabricated balcony modules are transforming the market. These solutions not only improve safety—through enhanced load-bearing capacities, non-combustible designs, and certified railing systems—but also reduce maintenance requirements and extend lifecycle performance.

Market Restraints:

- High installation and Material Costs

High installation and material costs remain a significant barrier, particularly for projects requiring premium materials such as tempered glass, stainless steel, or advanced composite systems that comply with strict safety standards. For developers working on cost-sensitive residential projects, the added expense of balcony structures often leads to design compromises or complete omission. Additionally, stringent building codes, fire safety regulations, and structural compliance requirements increase the complexity of balcony design and approval processes, resulting in longer project timelines and higher engineering costs. Climate-related challenges—such as corrosion in coastal areas, water leakage, and long-term weathering—further elevate maintenance costs, discouraging adoption in certain environments.

Socio-Economic Impact on Balcony Construction Market

The global balcony construction market boosted economies and improved quality of life in important ways. As cities grew denser, balconies provided valuable outdoor space that enhanced mental well being and increased property value. Their design also helped buildings use less energy by offering passive cooling and natural shading. The industry created jobs in construction and design, supported sustainable building practices, and offered a more affordable way for people to access livable, green urban homes — all contributing to long-term social and economic well being.

Segmental Analysis:

- Aluminum segment is expected to witness highest growth over the forecast period

Aluminum is one of the most rapidly expanding material segments in the global balcony construction market due to its lightweight nature, excellent corrosion resistance, and suitability for modern architectural aesthetics. Its ease of fabrication, long lifespan, and low maintenance requirements make it a preferred material for both structural framing and railing systems. Aluminum balconies also support advanced design trends such as slim profiles, powder-coated finishes, and integration with glass panels. Additionally, aluminum’s recyclability aligns with green building standards, further driving its adoption across residential and commercial construction projects.

- New Construction segment is expected to witness highest growth over the forecast period

New construction dominates the market as global urbanization accelerates and high-rise residential buildings become increasingly common. Developers are incorporating balconies into new structures to enhance property value, meet buyer preferences for outdoor space, and align with modern architectural designs. Rising investments in multi-family housing, luxury apartments, and mixed-use buildings are contributing to the strong growth of this segment. The integration of innovative balcony systems—such as prefabricated modules and energy-efficient glazed balconies—further strengthens demand within the new construction category.

- Residential Sector segment is expected to witness highest growth over the forecast period

The residential sector leads the global balcony construction market, driven by the rising demand for apartments and condominiums equipped with private outdoor spaces. Balconies are increasingly viewed as essential features that enhance comfort, ventilation, natural light, and living quality—especially in dense urban environments. Post-pandemic lifestyle changes, including work-from-home arrangements and interest in home gardening, have further elevated balcony demand. Developers prioritize balcony installations to attract buyers, increase unit value, and differentiate residential projects in competitive markets.

- Prefabricated/Modular Balconies segment is expected to witness the highest growth over the forecast period

Prefabricated or modular balconies are experiencing significant growth as they offer faster installation, reduced labor dependency, and consistent manufacturing quality. These systems are produced off-site and installed as complete units, making them ideal for large-scale construction projects. Prefabricated balconies also improve safety by reducing on-site work at height and minimizing structural errors. Their adaptability, cost efficiency, and ability to meet strict building codes make them highly attractive for modern residential and commercial developments.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period, supported by robust residential and commercial construction activity, rising urban redevelopment initiatives, and the strong preference for modern outdoor living spaces in both new-build and renovation projects. Growing adoption of high-quality materials, stricter safety regulations, and increasing use of prefabricated balcony systems further propel market expansion across the region. Additionally, lifestyle trends emphasizing outdoor leisure, home improvement, and enhanced property aesthetics are driving developers and homeowners to integrate innovative balcony designs, solidifying North America’s position as the fastest-growing regional market.

To Learn More About This Report - Request a Free Sample Copy

Balcony Construction Market Competitive Landscape:

The competitive landscape of the global balcony construction market is characterized by a mix of specialized facade and balcony solution providers, as well as large multi-national construction firms that also operate in balcony systems. Key players are investing in R&D to develop modular balcony systems, lightweight and sustainable materials, and prefabricated solutions, while also seeking strategic partnerships, regional expansion, and acquisitions to strengthen their market position.

Key Player:

- Aluplex

- Schüco International

- Technal (part of Hydro)

- Kawneer (Alcoa/Arconic)

- Sapa Building Systems (now Hydro Building Systems)

- REYNAERS Aluminium

- Q-railing

- Balco Group

- Etem (Aluminum Systems)

- Hueck System GmbH

- Faraone

- CristalRoc

- Permasteelisa Group

- Handler (Glass & Metal)

- YKK AP America

- Alpolic (Mitsubishi Chemical)

- ASSA ABLOY Entrance Systems

- Alumetal

- Alumil

- Kawaguchi Metal Works

Recent Development

- In October 2025, Balcony partnered with Chainlink and integrated its Runtime Environment (CRE) into Balcony’s Keystone platform, giving them the rights to bring over USD 240 billion in government sourced property data on chain. CRE let Balcony stream verified parcel data securely and transparently, laying a foundation for compliant, programmable real estate tokens. This integration unlocked liquidity, made property markets more accessible, and increased trust in the tokenized real estate space.

- In November 2024, TECNALIA designed the first prefabricated modular balcony for existing homes, which could be installed easily and quickly. It was built to let homeowners add renewable power systems, efficient ventilation, and a smart energy manager. The new balcony significantly improved comfort and habitability while complying with the Spanish Technical Building Code and the Basque Government’s regulations.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the global trend toward high-rise and apartment living, where balconies are essential for private outdoor space and lifestyle appeal. Growth is also fueled by stringent building safety codes requiring regular maintenance, repair, and replacement of aging structures. Furthermore, increasing consumer desire for enhanced aesthetics and property value leads to demand for modern, customized, and larger balcony designs.

Q2. What are the main restraining factors for this market?

A key constraint is the high material and labor cost associated with custom balcony construction, especially for complex designs or materials like glass and high-grade aluminum. The market also faces lengthy regulatory approval processes and restrictive zoning laws in dense urban areas. Furthermore, safety concerns and structural integrity risks related to older, deteriorating balconies can lead to costly and time-consuming mandatory repair orders.

Q3. Which segment is expected to witness high growth?

The Renovation and Refurbishment Segment is projected to witness the highest growth. This is driven by the massive need to repair or replace balconies on the large volume of existing multi-family residential buildings built decades ago. Concerns over structural safety, alongside the desire to modernize facades and enhance tenant appeal, ensure constant, non-discretionary demand for upgrading and weather-proofing existing balcony structures and railings.

Q4. Who are the top major players for this market?

The market is highly fragmented, featuring local fabricators and regional construction firms, but is led by specialized manufacturers of prefabricated balcony and railing systems. Top major players include Trex Company (decking/railings), Oldcastle BuildingEnvelope, and various regional steel and aluminum fabricators. Competition focuses on offering durable, low-maintenance materials and providing efficient, prefabricated installation systems that save time on site.

Q5. Which country is the largest player?

China is the largest country player, overwhelmingly driven by its unprecedented rate of urbanization and the massive scale of its high-rise residential construction boom. China's construction volume far surpasses any other nation, ensuring constant, large-scale demand for new balcony installations. While Western markets lead in premium materials, China's sheer volume of new multi-story residential and commercial projects makes it the dominant revenue driver.

List of Figures

Figure 1: Global Balcony Construction Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Balcony Construction Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Balcony Construction Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Balcony Construction Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Balcony Construction Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Balcony Construction Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Balcony Construction Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Balcony Construction Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Balcony Construction Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Balcony Construction Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Balcony Construction Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Balcony Construction Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Balcony Construction Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Balcony Construction Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Balcony Construction Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Balcony Construction Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Balcony Construction Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Balcony Construction Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Balcony Construction Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Balcony Construction Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Balcony Construction Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Balcony Construction Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Balcony Construction Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Balcony Construction Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Balcony Construction Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Balcony Construction Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Balcony Construction Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Balcony Construction Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Balcony Construction Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Balcony Construction Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Balcony Construction Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Balcony Construction Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Balcony Construction Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Balcony Construction Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Balcony Construction Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Balcony Construction Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Balcony Construction Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Balcony Construction Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Balcony Construction Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Balcony Construction Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Balcony Construction Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Balcony Construction Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Balcony Construction Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model