Microalbumin Control Market Overview and Analysis

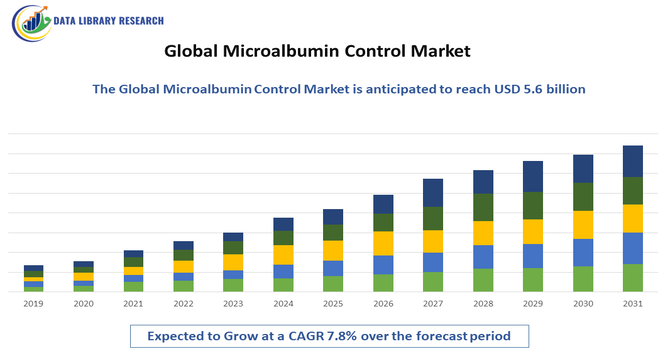

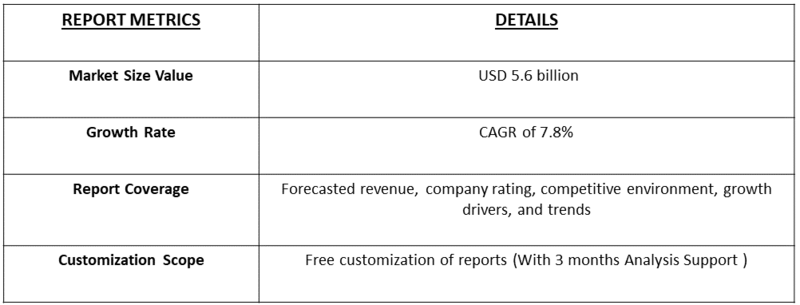

- The Global Microalbumin Control market is an estimated market size around USD 1.98 billion in 2025, projected to grow significantly, reaching USD 5.6 billion by 2032, reported to register a CAGR of 7.8% from 2025-2032. The Global Microalbumin Control Market refers to the industry producing and supplying standardized control materials used in laboratory testing to measure microalbumin levels in urine or blood. These controls ensure accuracy, reliability, and consistency in diagnostic tests, supporting early detection and monitoring of kidney disease, diabetes, and related health conditions worldwide.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The growth of the Global Microalbumin Control Market is driven by rising prevalence of diabetes and chronic kidney disease, increasing demand for early detection and monitoring of renal complications, growing adoption of automated laboratory testing, stringent regulatory requirements for accurate diagnostics, and expanding awareness of preventive healthcare, which collectively boost demand for reliable microalbumin control materials.

Microalbumin Control Market Latest Trends

The Global Microalbumin Control Market has witnessed trends toward automation, standardization, and high-precision diagnostic solutions. Laboratories increasingly prefer standardized control materials to ensure accurate and reproducible microalbumin testing. Rising integration of microalbumin testing into routine health screenings, alongside the development of multiplex assays and point-of-care testing, is shaping market growth. Technological advancements such as improved assay sensitivity, digital monitoring, and compatibility with automated analyzers are enabling faster and more reliable results.

Segmentation: The Microalbumin Control Market is segmented by Product Type (Level 1 Control (Normal/Low) and Level 2 Control (Abnormal/High)), Application (Disease Diagnosis & Monitoring, Research & Development (R&D), and Other Laboratory Uses), End-User (Hospitals & Clinic Laboratories, Independent Diagnostic Laboratories, Point-of-Care (POC) Testing Centers and Research & Academic Institutes), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of Diabetes and Kidney Disorders

The primary driver of the global microalbumin control market is the increasing prevalence of diabetes and chronic kidney disease worldwide. For instance, in 2025, GAVI Alliance, reported that, between 2005 and 2015 alone, chronic kidney disease of unknown aetiology was estimated to have affected 34000 people. Similarly, in 2025, National Kidney Foundation, reported that, diabetes is the most common cause of kidney disease. Diabetes and hypertension cause or contribute to 2 of 3 new cases of kidney failure.

Early detection of microalbuminuria is critical for monitoring renal health and preventing complications, which drives laboratories and healthcare facilities to adopt standardized microalbumin control materials. Growing awareness of preventive healthcare, routine screenings, and government initiatives for diabetes and kidney disease management further supports market growth. As the number of patients requiring frequent monitoring rises, the demand for reliable, accurate, and reproducible control materials strengthens, expanding adoption across diagnostic laboratories and healthcare institutions globally.

- Technological Advancements and Automated Testing

Another key driver is the rising adoption of automation and high-precision diagnostic technologies in clinical laboratories. Modern microalbumin control materials are designed for compatibility with automated analyzers, offering reproducible results and reducing human error. Integration of digital monitoring, multiplex testing, and high-sensitivity assays has improved testing efficiency and reliability, encouraging laboratories to invest in quality control products.

In January 2025, Prantae Solutions’ seed funding enabled the development of advanced point-of-care diagnostics for conditions like CKD and preeclampsia. This innovation accelerated technological advancements and automated testing in clinical laboratories, driving demand for reliable microalbumin control materials and positively influencing the growth of the global microalbumin control market. The shift toward standardized, automated workflows in diagnostic testing, combined with increased emphasis on laboratory accreditation and compliance with international standards, has significantly boosted the demand for microalbumin control materials across hospitals, research centers, and commercial diagnostic laboratories globally.

Market Restraints:

- High Cost and Limited Awareness in Emerging Regions

A major restraint is the high cost of advanced microalbumin control materials and limited awareness of their importance in emerging markets. Small clinics and laboratories may find the investment in standardized controls prohibitive, leading to continued reliance on manual or less precise testing methods. Additionally, insufficient knowledge about the benefits of using high-quality control materials for accurate microalbumin testing slows adoption in regions with underdeveloped healthcare infrastructure. Regulatory differences, lack of trained personnel, and budget constraints further restrict market penetration.

Socioeconomic Impact on Microalbumin Control Market

The market has a significant socioeconomic impact by supporting early diagnosis and monitoring of kidney disease and diabetes, which reduces healthcare costs and improves patient outcomes. Reliable microalbumin control materials ensure laboratory accuracy, minimizing misdiagnoses and unnecessary treatments. Early detection of renal and metabolic disorders improves workforce productivity and reduces the economic burden on healthcare systems. By promoting preventive healthcare and standardized laboratory practices, the market contributes to public health improvements. It also supports the growth of diagnostic laboratories, employment in clinical diagnostics, and investment in healthcare infrastructure, thereby having a positive ripple effect on socioeconomic development globally.

Segmental Analysis:

- Level 1 Control (Normal/Low) segment is expected to witness highest growth over the forecast period

The Level 1 Control (Normal/Low) segment is expected to witness the highest growth over the forecast period as it is critical for routine laboratory calibration and quality assurance. These controls help laboratories validate assay accuracy for healthy or near-normal microalbumin levels, ensuring reliable detection of early-stage kidney disease. Increasing routine screenings for diabetes and renal complications, along with growing adoption of automated analyzers, has driven demand for Level 1 controls. Their affordability, widespread applicability, and essential role in maintaining laboratory standards make this segment the fastest-growing in the global microalbumin control market.

- Disease Diagnosis & Monitoring segment is expected to witness highest growth over the forecast period

The disease diagnosis and monitoring segment is projected to witness the highest growth due to the rising prevalence of diabetes, hypertension, and chronic kidney disease. Microalbumin testing is crucial for early detection, disease progression monitoring, and therapeutic management. Healthcare providers are increasingly adopting standardized control materials to ensure test accuracy and regulatory compliance. The integration of automated analyzers and point-of-care testing has further expanded the use of microalbumin controls for ongoing patient monitoring. As awareness of preventive healthcare grows, the demand for reliable disease diagnosis and monitoring tools continues to drive market expansion globally.

- Point-of-Care (POC) Testing Centers segment is expected to witness highest growth over the forecast period

Point-of-care (POC) testing centers are expected to witness the highest growth as they offer rapid, convenient, and accessible microalbumin testing outside traditional laboratories. Rising demand for early kidney disease detection and home-based monitoring has prompted healthcare providers to implement standardized microalbumin controls in POC settings. These controls ensure test reliability and accuracy, critical for clinical decision-making. The adoption of compact, automated analyzers and portable testing devices has accelerated POC utilization. As patient awareness and government initiatives supporting decentralized healthcare increase, the segment’s contribution to the global microalbumin control market is expected to grow significantly over the forecast period.

- North America region is expected to witness highest growth over the forecast period

North America is expected to record the highest growth in the global microalbumin control market due to well-established healthcare infrastructure, high prevalence of diabetes and kidney disorders, and widespread adoption of advanced diagnostic technologies. Strong regulatory frameworks, routine health screenings, and increasing focus on preventive care drive the use of standardized microalbumin control materials.

The presence of key market players and continuous technological innovation, including automated analyzers and high-sensitivity assays, further fuels regional growth. For instance, in July 2022, Healthy.io’s Minuteful Kidney test, cleared by the FDA, introduced the first digital home kidney testing solution, enabling early detection of chronic kidney disease. This innovation increased awareness and demand for reliable microalbumin testing in North America, driving adoption of standardized microalbumin control materials in laboratories and point-of-care settings to support accurate, early-stage kidney disease diagnosis and monitoring.

Furthermore, the rising awareness among healthcare providers and patients regarding early kidney disease detection has strengthened the market, making North America the fastest-growing region for microalbumin control solutions. For instance, in November 2025, the Canada Kidney Foundation, reported that, the rising CKD mortality in Canada and the Kidney Foundation’s development of a national framework heightened awareness among healthcare providers and patients about early kidney disease detection. This increased focus on timely diagnosis and intervention boosted demand for standardized microalbumin control materials, positively impacting the global microalbumin control market.

Thus, all such factors are together are contributing this market’s growth in this region.

To Learn More About This Report - Request a Free Sample Copy

Microalbumin Control Market Competitive Landscape

The competitive landscape of the Global Microalbumin Control Market is moderately fragmented, with key players focusing on product quality, reliability, and regulatory compliance. Leading companies invest in research and development to introduce high-precision, easy-to-use control materials compatible with automated analyzers. Strategic partnerships, mergers, and regional expansions are common to strengthen distribution and market presence. Competitive differentiation is achieved through product innovation, global certifications, and superior technical support. Emerging players target niche segments, such as point-of-care testing and specialty assays. Overall, competition encourages continuous improvement in accuracy, consistency, and technological advancement, benefiting laboratories and driving the overall growth of the market.

The major players for this market are:

- Roche Diagnostics

- Siemens Healthineers

- Abbott Laboratories

- Thermo Fisher Scientific

- Bio Rad Laboratories

- Danaher Corporation (via Beckman Coulter)

- Sysmex Corporation

- Randox Laboratories

- ARKRAY, Inc.

- Nova Biomedical

- Ortho Clinical Diagnostics

- DiaSorin

- Fortress Diagnostics

- Quantimetrix

- DIALAB GmbH

- Kamiya Biomedical

- Joinstar Biomedical Technology Co.

- Boditech Med Inc.

- EKF Diagnostics

- ACON Laboratories, Inc.

Recent Development

- In March 2024, King Chulalongkorn Memorial Hospital, Thailand, launched the Microalbuminuria Rapid Test, developed by Chulalongkorn University researchers. The accurate, easy-to-use self-screening test for kidney damage demonstrated Thailand’s innovation in diagnostics, highlighting growing demand for reliable microalbumin control materials and positively influencing the global microalbumin control market.

- In November 2023, Carolina Liquid Chemistries Corp.’s partnership with Kamiya Biomedical to secure CLIA moderate complexity classification for the K-ASSAY Microalbumin reagent enhanced accessibility on the Medica EasyRA analyzer. This collaboration improved reagent availability in the U.S., reinforced confidence in standardized testing, and positively influenced the global microalbumin control market by promoting wider adoption of reliable, compliant microalbumin testing solutions.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The biggest driver is the rapidly rising global number of people suffering from chronic diseases like diabetes and hypertension. Since microalbuminuria is an early warning sign of kidney damage in these patients, the growing need for routine monitoring and early detection testing fuels the demand for high-quality control materials.

Q2. What are the main restraining factors for this market?

A key challenge is the high cost of advanced diagnostic equipment and the associated control solutions, which limits adoption in developing or resource-constrained countries. Another restraint is ensuring standardization and accuracy across different types of testing platforms and reagent kits, which affects reliability.

Q3. Which segment is expected to witness high growth?

The segment related to Point-of-Care (POC) Testing is expected to show high growth. This involves portable microalbumin control kits used outside central laboratories, such as in doctor's offices or for home testing. This trend makes monitoring quicker and more accessible for chronic disease management.

Q4. Who are the top major players for this market?

The market is led by major players in the in-vitro diagnostics (IVD) and laboratory control sectors. Key companies often include large names like Bio-Rad Laboratories, Quantimetrix, and Randox Laboratories, as they specialize in manufacturing quality control solutions for clinical laboratory testing.

Q5. Which country is the largest player?

North America, particularly the United States, holds the largest market share. This dominance is due to its advanced healthcare infrastructure, high prevalence of diabetes and obesity, and widespread adoption of stringent quality control practices in clinical laboratories and hospitals.

List of Figures

Figure 1: Global Microalbumin Control Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Microalbumin Control Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Microalbumin Control Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Microalbumin Control Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Microalbumin Control Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Microalbumin Control Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Microalbumin Control Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Microalbumin Control Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Microalbumin Control Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Microalbumin Control Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Microalbumin Control Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Microalbumin Control Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Microalbumin Control Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Microalbumin Control Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Microalbumin Control Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Microalbumin Control Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Microalbumin Control Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Microalbumin Control Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Microalbumin Control Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Microalbumin Control Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Microalbumin Control Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Microalbumin Control Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Microalbumin Control Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Microalbumin Control Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Microalbumin Control Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Microalbumin Control Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Microalbumin Control Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Microalbumin Control Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Microalbumin Control Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Microalbumin Control Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Microalbumin Control Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Microalbumin Control Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Microalbumin Control Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Microalbumin Control Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Microalbumin Control Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Microalbumin Control Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Microalbumin Control Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Microalbumin Control Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Microalbumin Control Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Microalbumin Control Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Microalbumin Control Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model