PXI Remote Control Module Market Overview and Analysis

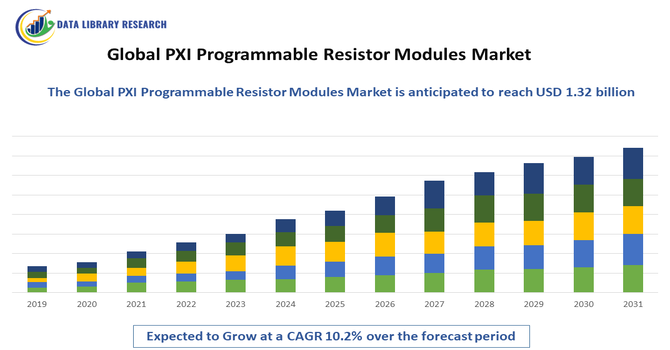

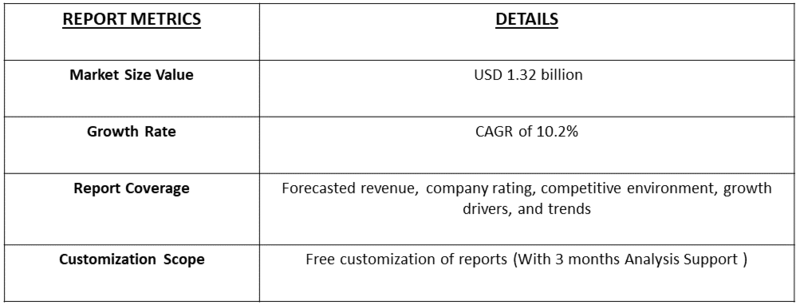

- The global PXI Remote Control Module market size was valued at approximately USD 350 million in 2023 and is projected to grow to around USD 650 million by 2032, growing with a CAGR of 10.12% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global PXI Remote Control Module Market refers to the worldwide industry for modules that enable remote communication between PXI chassis and host computers. These modules support high-speed data transfer, system control, and automated testing across sectors such as electronics, automotive, aerospace, and telecommunications.

Growth in the Global PXI Remote Control Module Market is driven by rising adoption of automated test systems, expanding semiconductor and electronics production, and increasing need for high-speed data acquisition and analysis. Demand for modular, scalable instrumentation in aerospace, automotive, and telecom industries, along with advancements in 5G, IoT, and complex electronic designs, further accelerates the market’s expansion.

PXI Remote Control Module Market Latest Trends

The Global PXI Remote Control Module Market is experiencing strong technological evolution driven by demand for flexible, modular, and high-performance test automation systems. Key trends include the integration of higher-bandwidth interfaces such as Thunderbolt and PCIe for faster data processing, along with growing adoption of remote and cloud-connected testing. The rise of 5G infrastructure, complex semiconductor architectures, and advanced driver-assistance systems is prompting organizations to upgrade to more efficient PXI-based solutions.

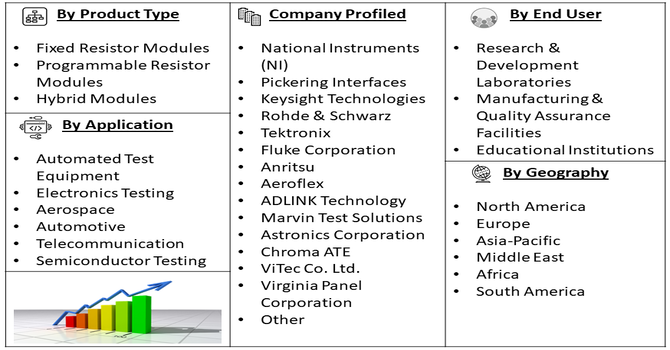

Segmentation: The PXI Remote Control Module Market is segmented by Type (PCIe-based PXI Remote Control Module, Thunderbolt/USB-based PXI Remote Control Modules, Ethernet-based PXI Remote Control , Modules, and MXI-Express Remote Control Modules), Application (Automated Test Equipment (ATE), Data Acquisition Systems, Semiconductor Testing, RF & Microwave Testing, High-Speed Digital Testing and Research & Development Laboratories), Connectivity (PCI Express, Thunderbolt, USB, Ethernet, and Optical Links), End Users (Electronics & Semiconductor, Automotive & Transportation, Aerospace & Defense, Telecommunications & Networking, Industrial Automation, and Healthcare & Medical Devices), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Expansion of Automated Test and Measurement Systems

The key drivers for the PXI Remote Control Module Market is the rapid expansion of automated test and measurement systems across industries such as semiconductor manufacturing, aerospace, automotive, and telecommunications. As electronic devices become increasingly complex, organizations require faster, more accurate, and scalable testing platforms. PXI remote control modules enable high-speed data transfer, streamlined system integration, and flexible remote access, improving testing efficiency and reducing operational downtime. The shift toward modular instrumentation, combined with rising demand for real-time analysis and improved throughput, continues to boost adoption. This trend is especially prominent in R&D labs and high-volume production environments.

- Growth of 5G, IoT, and Advanced RF Technologies

Another significant growth driver is the global rollout of advanced communication technologies such as 5G, IoT, and high-frequency RF systems, which require precise validation and continuous performance monitoring. PXI remote control modules support the high bandwidth, low-latency connections crucial for testing these sophisticated devices. Their ability to reliably interface with PXI chassis over long distances, while maintaining signal integrity and synchronization, makes them indispensable for telecom operators, network equipment manufacturers, and research institutions.

Market Restraints:

- High Cost and Integration Complexity

Despite strong growth potential, the PXI Remote Control Module Market faces a key restraint: the high initial investment required for PXI-based test systems. The cost of PXI chassis, modules, software licenses, and compatible accessories can be prohibitive for small and medium-sized enterprises, particularly those with limited testing budgets. Additionally, integrating PXI solutions into existing test environments may require specialized technical expertise, increasing training and deployment costs.

Socioeconomic Impact on PXI Remote Control Module Market

The PXI Remote Control Module Market contributes significantly to socioeconomic development by enabling industries to accelerate innovation, improve product quality, and reduce testing costs. Its role in advancing semiconductor production, telecom infrastructure, and automotive safety technologies enhances global competitiveness and supports job creation in engineering, manufacturing, and research sectors. Adoption of PXI-based remote testing improves operational efficiency, reduces downtime, and fosters sustainable practices by optimizing resource use. This indirectly boosts economic growth, technological self-reliance, and workforce skill development.

Segmental Analysis:

- Thunderbolt/USB-based PXI Remote Control Modules segment is expected to witness the highest growth over the forecast period

The rapid expansion of the Thunderbolt and USB segments is fueled by the need for faster, more efficient data transfer between PXI systems and external controllers, particularly laptops and modern workstations. These interfaces offer significantly higher bandwidth than traditional methods, allowing test engineers to quickly process massive amounts of data generated during complex, high-channel-count testing. This flexibility is critical for engineers who require portable and convenient remote control setups, moving PXI systems out of dedicated labs and into flexible production environments or field testing sites, making advanced PXI performance accessible without proprietary hardware.

- Automated Test Equipment (ATE) segment is expected to witness the highest growth over the forecast period

Growth in the ATE segment is directly linked to the global push for higher manufacturing quality, lower production costs, and increased throughput. PXI remote control modules are essential in ATE systems because they enable centralized control over large, distributed test cells. This automation minimizes human error, ensures test repeatability, and supports round-the-clock operations. As the complexity of devices—from consumer electronics to industrial sensors—rises, companies rely on ATE platforms to manage rigorous, multi-site testing protocols efficiently, driving demand for robust remote connectivity.

- Telecommunications & Networking segment is expected to witness the highest growth over the forecast period

The telecom segment's high growth is driven by the massive global deployment of 5G and ongoing developments toward 6G technology. Testing complex RF and microwave components requires systems with extremely high performance and channel density, which PXI excels at providing. Remote control modules allow test teams to manage these complex, expensive setups across different geographical locations, facilitating collaborative testing and deployment. This remote capability is vital for verifying signal integrity and component performance in rapidly evolving wireless communication standards.

- North America region is expected to witness the highest growth over the forecast period

North America's continued market leadership and high growth are underpinned by substantial R&D investments in high-tech industries, particularly aerospace and defense, and the presence of major technology innovators. Government spending on modernizing defense and security systems requires rigorous, high-channel PXI testing.

Furthermore, the region's strong ecosystem of established PXI vendors and systems integrators ensures rapid technology adoption and customization, continually pushing the demand for high-performance, remotely managed PXI solutions. For instance, in 2025, Kratos Defense & Security Solutions relocated its Jerusalem Microwave Electronics Division to a new 60,000 sq. ft. facility within the Gav Yam high-tech complex, including 20,000 sq. ft. of clean-room space for precision assembly, testing, and production of qualified microwave assemblies and subsystems.The expansion enhances Kratos’ production and testing capabilities, indirectly supporting North America’s PXI Remote Control Module market. Increased high-precision microwave assembly and testing capacity drives demand for advanced PXI-based modular test solutions, fostering adoption in defense and aerospace sectors. This move strengthens regional supply chains, accelerates innovation, and boosts the market for high-performance PXI testing infrastructure.

Thus, such factors together are fueling the growth of this market over the forecast period.

To Learn More About This Report - Request a Free Sample Copy

PXI Remote Control Module Market Competitive Landscape

The competitive landscape of the PXI Remote Control Module Market is characterized by a mix of established instrumentation manufacturers and emerging technology providers. Major players focus on continuous innovation in interface speed, reliability, and module density to differentiate their offerings. Companies invest heavily in R&D to expand product portfolios tailored to semiconductor testing, RF applications, and automated test equipment. Strategic collaborations, acquisitions, and partnerships with system integrators are common to strengthen market presence.

The major players for this market are:

- National Instruments (NI)

- Keysight Technologies

- Tektronix

- Pickering Interfaces

- ADLINK Technology

- Marvin Test Solutions

- Chroma ATE Inc.

- Astronics Corporation

- Rohde & Schwarz

- Viavi Solutions

- VTI Instruments

- LitePoint Corporation

- Giga-tronics Incorporated

- ZTEC Instruments

- Advantest Corporation

- Teradyne, Inc.

- Yokogawa Electric Corporation

- Cobham Advanced Electronic Solutions

- Fortive Corporation

- Bustec Ltd.

Recent Development

- In November 2025, Pickering Interfaces has launched the 60-107-001, a compact 12-slot LXI/USB modular chassis—the highest PXI slot density in 2U. It supports PXI and PXIe modules and can be controlled via USB or Ethernet (LXI), removing the need for a dedicated PXI controller, offering a cost-effective solution for modular test and measurement

- In October 2025, Pickering Interfaces introduced new compact single-slot PXI and PXIe FIU switch modules, models 40-205 and 42-205, using MEMS technology. Designed for two-wire serial interface fault insertion, they simulated common faults in high-speed communication protocols, supporting advanced MultiGBASE-T1 testing and enhancing modular test capabilities for electronics and networking applications. These modules strengthened the PXI Remote Control Module market by expanding testing capabilities for high-speed communications, driving demand for modular, scalable, and cost-effective PXI solutions in telecom, automotive, and electronics industries, thereby supporting market growth and adoption of advanced fault-insertion testing technologies.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is driven by the huge increase in industrial automation and the need for high-speed, flexible testing systems. PXI Remote Control Modules allow engineers to manage complex, modular test setups from a distance, improving efficiency and reducing the need for constant human interaction in manufacturing and development environments like aerospace and automotive.

Q2. What are the main restraining factors for this market?

The biggest obstacle is the high initial cost required to purchase and implement a comprehensive PXI-based testing infrastructure. This large capital outlay can deter smaller enterprises. Additionally, operating and maintaining these advanced, complex modular systems requires personnel with specialized technical training.

Q3. Which segment is expected to witness high growth?

The Telecommunications & Networking segment is expected to witness the highest growth over the forecast period due to the rapid deployment of 5G networks, increasing demand for high-speed data transmission, and the need for rigorous testing of network equipment. PXI remote control modules enable efficient, reliable validation and monitoring, driving adoption.

Q4. Who are the top major players for this market?

Key global players dominate the PXI modular instrument ecosystem, often offering the remote control modules as part of their larger PXI chassis and software solutions. These top companies include National Instruments (NI), Keysight Technologies, and Pickering Interfaces.

Q5. Which country is the largest player?

The United States holds the largest market share in the PXI Remote Control Module market. This dominance stems from the country's strong technological base, heavy expenditure on defense and aerospace R&D, and the established presence of numerous major PXI solution providers.

List of Figures

Figure 1: Global PXI Remote Control Module Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global PXI Remote Control Module Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global PXI Remote Control Module Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global PXI Remote Control Module Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global PXI Remote Control Module Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America PXI Remote Control Module Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America PXI Remote Control Module Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America PXI Remote Control Module Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America PXI Remote Control Module Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America PXI Remote Control Module Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America PXI Remote Control Module Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America PXI Remote Control Module Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America PXI Remote Control Module Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America PXI Remote Control Module Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe PXI Remote Control Module Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe PXI Remote Control Module Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe PXI Remote Control Module Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe PXI Remote Control Module Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe PXI Remote Control Module Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe PXI Remote Control Module Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe PXI Remote Control Module Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe PXI Remote Control Module Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe PXI Remote Control Module Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe PXI Remote Control Module Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific PXI Remote Control Module Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific PXI Remote Control Module Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific PXI Remote Control Module Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific PXI Remote Control Module Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa PXI Remote Control Module Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa PXI Remote Control Module Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa PXI Remote Control Module Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa PXI Remote Control Module Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa PXI Remote Control Module Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model