Organ Preservation and Perfusion Solution Market Overview and Analysis

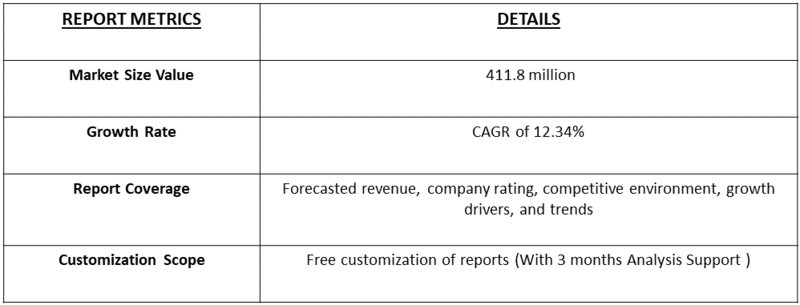

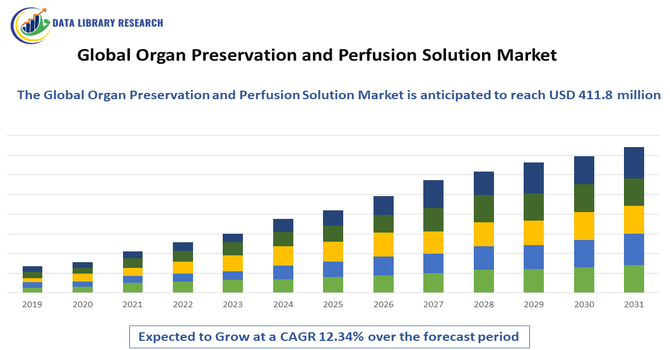

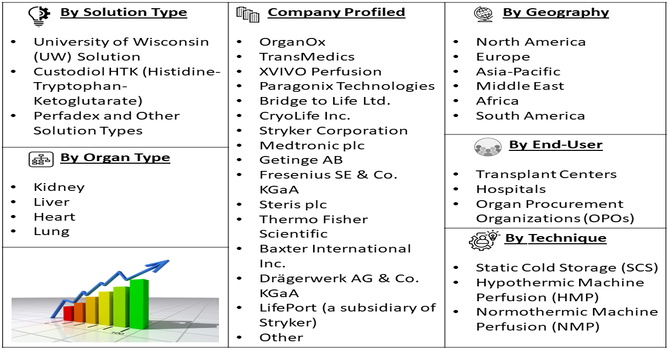

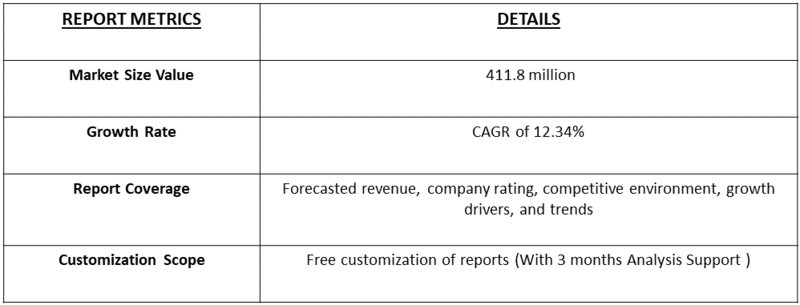

- The Global Organ Preservation and Perfusion Solution Market size was estimated at USD 273.0 million in 2025 and is projected to reach USD 411.8 million by 2032, growing at a CAGR of 12.34% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Organ Preservation and Perfusion Solution Market refers to the industry focused on products and technologies that maintain organ viability outside the body for transplantation. These solutions, including cold storage and machine perfusion systems, enhance preservation, reduce ischemic damage, and improve transplant outcomes. Rising organ transplantation demand and technological advancements are driving growth in this market globally.

Organ Preservation and Perfusion Solution Market Latest Trends

The Global Organ Preservation and Perfusion Solution Market is witnessing rapid growth due to increasing organ transplantation procedures worldwide and rising incidences of organ failure. Advancements in machine perfusion technologies, such as normothermic and hypothermic perfusion systems, are improving organ viability and transplant success rates. There is a growing focus on personalized preservation solutions tailored to specific organ types, including kidneys, livers, hearts, and lungs. Integration with real-time monitoring, AI-based predictive analytics, and improved biocompatible solutions is enhancing preservation outcomes. Increasing awareness among healthcare providers, coupled with supportive regulatory frameworks, is further driving the adoption of organ preservation and perfusion solutions globally.

Segmentation: The Global Organ Preservation and Perfusion Solution Market is segmented by Solution Type (University of Wisconsin (UW) Solution, Custodiol HTK (Histidine-Tryptophan-Ketoglutarate), Perfadex and Other Solution Types), Preservation Technique (Static Cold Storage (SCS), Hypothermic Machine Perfusion (HMP) and Normothermic Machine Perfusion (NMP)), Organ Type (Kidney, Liver, Heart, Lung and Others), End-User (Transplant Centers, Hospitals and Organ Procurement Organizations (OPOs)), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Organ Transplant Procedures

The Global Organ Preservation and Perfusion Solution Market is driven by the rising number of organ transplant procedures worldwide. The growing prevalence of organ failure, chronic diseases, and lifestyle-related conditions is increasing the demand for kidneys, livers, hearts, and lungs. For instance, in India, the Ministry of Health and Family Welfare in 2025 reported that in 2024, India achieved a record milestone with more than 18,900 organ transplants in a single year, a remarkable increase from fewer than 5,000 transplants in 2013, reflecting significant growth in awareness, infrastructure, and organ donation initiatives nationwide.

Advanced preservation and perfusion solutions improve organ viability, extend storage time, and reduce rejection rates, ensuring higher transplant success. Hospitals and transplant centers are investing in machine perfusion systems, cold storage solutions, and real-time monitoring technologies. This growing clinical need for effective organ preservation directly fuels market expansion, particularly in North America and Europe.

- Technological Advancements in Preservation Solutions

Technological innovations are a major driver in the organ preservation and perfusion market. Development of normothermic and hypothermic perfusion systems, AI-driven monitoring, and biocompatible preservation solutions has improved transplant outcomes and reduced organ discard rates. Real-time organ quality assessment and organ-specific preservation protocols enhance efficiency and clinical decision-making.

In February 2025, Vivalyx, an organ vitality technology startup, received up to €8.5M from the EIC Accelerator to advance its innovative organ revitalization technology. This funding accelerated technological advancements in preservation solutions by enabling development of cutting-edge methods to enhance donor organ viability, improve transplant outcomes, and support next-generation organ preservation techniques. These innovations attract healthcare providers seeking reliable, standardized, and high-performance solutions. Continuous R&D and collaborations between biotech firms, medical device manufacturers, and hospitals accelerate market growth. As a result, advanced technologies play a crucial role in expanding adoption and driving the global organ preservation and perfusion market.

Market Restraints:

- High Cost of Preservation and Perfusion Systems

The high cost of organ preservation and perfusion systems restrains market growth, especially in emerging economies. Advanced machine perfusion devices, monitoring tools, and specialized preservation solutions require significant capital investment and maintenance. Small and medium healthcare facilities may find adoption financially challenging. Additionally, the need for trained personnel to operate these sophisticated systems adds to operational costs. High equipment costs can limit accessibility for hospitals and transplant centers with constrained budgets, slowing widespread adoption. These financial barriers restrict market penetration, particularly in low-income regions, despite the growing demand for effective organ preservation and perfusion solutions.

Socioeconomic Impact on Organ Preservation and Perfusion Solution Market

Organ preservation and perfusion solutions have a significant socioeconomic impact by increasing the success rates of transplants and improving patient outcomes. Enhanced preservation technologies reduce organ discard rates, saving healthcare costs and optimizing resource utilization. These solutions support equitable organ distribution and access, particularly in regions with high demand for transplants. Improved transplant outcomes contribute to longer patient survival, better quality of life, and reduced long-term treatment costs. Additionally, the industry fosters employment opportunities in medical device manufacturing, research, and healthcare services. Overall, organ preservation and perfusion solutions positively impact public health, economic efficiency, and the sustainability of transplant programs worldwide.

Segmental Analysis:

- Custodiol HTK (Histidine-Tryptophan-Ketoglutarate) segment is expected to witness the highest growth over the forecast period

The Custodiol HTK segment is expected to witness the highest growth due to its widespread use in organ preservation, particularly for kidneys, livers, and hearts. HTK solution minimizes cellular injury during ischemia, maintains electrolyte balance, and enhances organ viability for transplantation. Its compatibility with multiple organ types and ease of use make it a preferred choice for transplant centers globally. Increasing organ transplant procedures and the growing need for reliable cold storage solutions are driving adoption. Additionally, hospitals and research institutions are investing in high-quality preservation solutions like Custodiol HTK to improve transplant outcomes, ensuring continued market expansion.

- Normothermic Machine Perfusion (NMP) segment is expected to witness the highest growth over the forecast period

The Normothermic Machine Perfusion (NMP) segment is projected to witness significant growth as it allows organs to be preserved at physiological temperatures with continuous perfusion of oxygenated blood or nutrient solutions. NMP enhances organ viability, reduces ischemic injury, and enables real-time functional assessment before transplantation. Rising adoption in heart, liver, and kidney transplants, coupled with technological advancements in portable and automated NMP systems, drives market growth. Clinicians prefer NMP for its ability to extend preservation times and improve post-transplant outcomes. Increased R&D investments and regulatory approvals are further accelerating adoption, making NMP a key growth segment in the organ preservation market.

- Heart segment is expected to witness the highest growth over the forecast period

The Heart segment is expected to witness the highest growth due to increasing prevalence of cardiovascular diseases and the rising number of heart transplants globally. Heart preservation is critical, given the organ’s high sensitivity to ischemic damage. Advanced perfusion technologies, including normothermic and hypothermic machine perfusion, and solutions like Custodiol HTK, improve viability, reduce complications, and extend storage times. Growth in cardiac transplant centers, government support for organ donation programs, and technological advancements in monitoring and perfusion systems are driving demand. The segment benefits from higher reimbursement rates and clinical adoption, making it a leading contributor to the organ preservation market.

- North American Region is expected to witness the highest growth over the forecast period

North America is expected to witness the highest growth in the Organ Preservation and Perfusion Solution Market due to advanced healthcare infrastructure, high organ transplant rates, and favorable reimbursement policies. The region has widespread adoption of cold storage solutions and normothermic perfusion systems for heart, kidney, and liver transplants. For instance, in October 2025, Bridge to Life, Ltd. received FDA 510(k) clearance for its Belzer UW and MPS organ preservation solutions, including expanded labeling for Belzer MPS UW Machine Perfusion Solution covering all abdominal organs. This achievement supported North America’s increasing organ transplant procedures and boosted the organ preservation and perfusion market by enhancing multi-organ preservation and improving transplant outcomes.

Strong presence of key market players, ongoing R&D, and technological innovations further support growth. For instance, in July 2025, Researchers at Vanderbilt University Medical Center developed the REUP method for recovering hearts from deceased donors after circulatory death, using cold oxygenated preservation without reanimation. This innovation supported North America’s rising organ transplant procedures and advanced the organ preservation and perfusion market by providing a cost-effective, ethical, and efficient solution for heart preservation.

Thus, the increasing awareness of organ donation, supportive regulatory frameworks, and rising investment in transplant centers contribute to North America’s established healthcare ecosystem and demand for advanced preservation solutions position it as the leading regional market globally.

To Learn More About This Report - Request a Free Sample Copy

Organ Preservation and Perfusion Solution Market Competitive Landscape:

The Global Organ Preservation and Perfusion Solution Market is highly competitive, featuring established medical device manufacturers, biotech firms, and specialized solution providers. Key players focus on product innovation, advanced perfusion systems, and partnerships with transplant centers to expand market reach. Companies are investing in research and development to improve organ-specific solutions, incorporate real-time monitoring, and enhance perfusion efficiency. Competitive strategies also include mergers, acquisitions, and collaborations to strengthen technological capabilities and global presence. Differentiation through performance, reliability, regulatory compliance, and cost-effectiveness is critical. Market leaders continue to invest in innovation and customer support to maintain dominance in the growing organ preservation and perfusion industry.

The major players for the above market are:

- OrganOx

- TransMedics

- XVIVO Perfusion

- Paragonix Technologies

- Bridge to Life Ltd.

- CryoLife Inc.

- Stryker Corporation

- Medtronic plc

- Getinge AB

- Fresenius SE & Co. KGaA

- Steris plc

- Thermo Fisher Scientific

- Baxter International Inc.

- Drägerwerk AG & Co. KGaA

- LifePort (a subsidiary of Stryker)

- Organ Recovery Systems

- Spectrum Medical

- Organtec Ltd.

- Nihon Kohden Corporation

- Merck KGaA

Recent Development

- In August 2025, Terumo Corporation acquired OrganOx for approximately USD 1.5 billion, entering the organ transplantation sector. This strategic move enhanced the Global Organ Preservation and Perfusion Solution Market by combining Terumo’s medical device expertise with OrganOx’s NMP technology, improving organ utilization, supporting marginal donor organs, and advancing transplant outcomes globally.

- In January 2025, Paragonix Technologies completed the world’s first-in-human cases using its FDA-cleared KidneyVault Portable Renal Perfusion System, successfully transporting four donor kidneys to separate institutions within 24 hours. This milestone boosted the Global Organ Preservation and Perfusion Solution Market by demonstrating improved kidney preservation, enhanced transplant outcomes, and wider adoption of advanced portable perfusion technologies.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the global rise in organ failure cases due to aging populations and chronic diseases like diabetes. As the gap between organ demand and supply widens, there is an urgent need for technologies that keep organs healthy longer outside the body. Advances in "warm perfusion," which mimics blood flow, are significantly increasing the pool of viable donor organs.

Q2. What are the main restraining factors for this market?

Growth is limited by the high cost of specialized perfusion machines and the expensive chemical solutions required for each procedure. These costs often place a heavy burden on healthcare systems and patients. Additionally, the complex logistics of organ transport and the lack of highly trained surgical teams in developing regions restrict the widespread adoption of these advanced preservation methods.

Q3. Which segment is expected to witness high growth?

The Machine Perfusion segment is expected to witness the highest growth. Unlike traditional "cold storage" in an ice box, machine perfusion actively pumps oxygen and nutrients through the organ. This allows doctors to assess an organ's health before surgery and even "repair" damaged organs, making it the preferred choice for high-stakes transplant procedures in modern hospitals.

Q4. Who are the top major players for this market?

The market is led by specialized medical technology companies focused on transplant surgery. Key players include TransMedics, XVIVO Perfusion, OrganOx Limited, and Paragonix Technologies. These companies dominate by developing proprietary "organ care systems" that maintain hearts, lungs, and livers in a near-physiologic state during transit, drastically improving transplant success rates.

Q5. Which country is the largest player?

The United States is the largest player in this market. This is due to its highly advanced healthcare infrastructure, a high volume of transplant surgeries, and significant investment in biotechnology. The presence of the world's leading transplant centers and a robust insurance reimbursement system for high-tech medical procedures keeps the U.S. at the forefront of organ preservation innovation.

List of Figures

Figure 1: Global Organ Preservation and Perfusion Solution Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Organ Preservation and Perfusion Solution Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Organ Preservation and Perfusion Solution Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Organ Preservation and Perfusion Solution Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Organ Preservation and Perfusion Solution Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model