Respiratory Syncytial Virus Lateral Flow Test Market Overview and Analysis

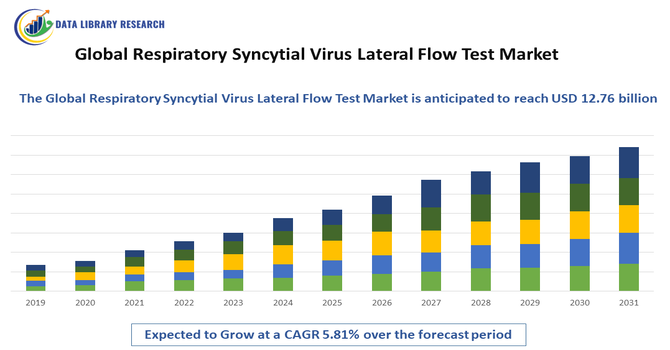

- The Global Respiratory Syncytial Virus (RSV) Lateral Flow Test Market size was estimated at USD 6.27 billion in 2025 and is projected to grow at a CAGR of 5.81% from 2025-2032, reaching to USD 12.76 billion in 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Respiratory Syncytial Virus (RSV) Lateral Flow Test Market refers to the sector focused on rapid, point-of-care diagnostic tests designed to detect RSV infections. These lateral flow assays offer quick results, ease of use, and minimal equipment requirements, making them ideal for hospitals, clinics, and diagnostic laboratories. Rising prevalence of RSV, especially among infants, the elderly, and immunocompromised patients, combined with demand for timely diagnosis and treatment, drives market growth. Increasing adoption of point-of-care testing further expands market opportunities globally.

Respiratory Syncytial Virus Lateral Flow Test Market Latest Trends

The Global Respiratory Syncytial Virus (RSV) Lateral Flow Test Market has witnessed a shift toward rapid, point-of-care diagnostic solutions that provide results within minutes. Increasing adoption of multiplex testing, integration with digital reporting systems, and development of highly sensitive and specific assays are shaping the market. Growing awareness among healthcare providers about early detection of RSV in infants, elderly, and immunocompromised patients is driving demand. Additionally, the use of non-invasive sampling methods and home-testing kits is emerging as a key trend, reflecting the market’s focus on convenience, efficiency, and accessibility for both clinical and community settings.

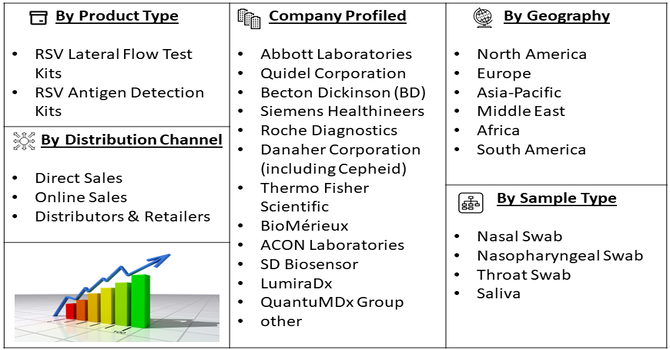

Segmentation: The Global Respiratory Syncytial Virus (RSV) Lateral Flow Test Market is segmented by Product Type (RSV Lateral Flow Test Kits and RSV Antigen Detection Kits), Sample Type (Nasal Swab, Nasopharyngeal Swab, Throat Swab and Saliva), Distribution Channel (Direct Sales, Online Sales and Distributors & Retailers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of RSV Infections

The increasing incidence of RSV infections, particularly among infants, young children, and the elderly, has driven demand for rapid and accurate diagnostic tools. Seasonal outbreaks of RSV place significant pressure on healthcare systems, necessitating quick detection to prevent severe respiratory complications and hospitalizations. Lateral flow tests offer timely results, facilitating early intervention, isolation, and treatment. This heightened awareness and clinical need for point-of-care diagnostics have accelerated market adoption, making RSV lateral flow tests essential in pediatric, geriatric, and community healthcare settings globally.

- Advancements in Point-of-Care Testing Technologies

Technological advancements in lateral flow assay design, including improved sensitivity, specificity, and ease of use, have significantly boosted market growth.

Portable and rapid RSV lateral flow tests allow healthcare providers to conduct diagnostics outside traditional laboratories, reducing turnaround time and improving patient management. Integration with digital reporting systems and automated readers further enhances accuracy and workflow efficiency. For instance, in June 2024, Roche received FDA Emergency Use Authorization for its cobas® liat SARS-CoV-2, Influenza A/B & RSV nucleic acid test, an automated RT-PCR assay delivering results in just 20 minutes using nasopharyngeal or anterior nasal swabs. This rapid, portable testing solution underscored the growing demand for quick, point-of-care RSV diagnostics, accelerating the adoption of lateral flow tests and strengthening the Global Respiratory Syncytial Virus Lateral Flow Test Market.

These innovations have expanded the adoption of RSV lateral flow tests in hospitals, clinics, and home-testing environments, driving global demand and reinforcing the importance of rapid, on-site diagnostics in managing seasonal and high-risk RSV outbreaks.

Market Restraints:

- Limited Accuracy Compared to Molecular Diagnostics

Despite their convenience, RSV lateral flow tests often exhibit lower sensitivity and specificity than molecular methods such as RT-PCR. False negatives can delay diagnosis, while false positives may lead to unnecessary treatments or isolation measures. Variability in test performance due to operator skill, sample quality, or environmental conditions can undermine clinical confidence. This limitation constrains the widespread adoption of lateral flow tests in high-risk or critical care settings, where precision is paramount. Consequently, healthcare providers may prefer molecular diagnostics for definitive RSV detection, creating a challenge for lateral flow test manufacturers in expanding their market share.

Socioeconomic Impact on Respiratory Syncytial Virus Lateral Flow Test Market

The RSV Lateral Flow Test Market significantly influences public health outcomes and healthcare efficiency. Rapid detection of RSV reduces hospitalizations, lowers treatment costs, and prevents unnecessary antibiotic usage, enhancing healthcare resource allocation. Early diagnosis enables timely intervention, particularly in vulnerable populations such as infants and the elderly, minimizing morbidity and mortality rates. The widespread availability of point-of-care tests also supports rural and underserved communities by bridging diagnostic gaps. Economically, improved RSV management reduces the burden on healthcare systems, decreases caregiver absenteeism, and promotes cost-effective disease surveillance, fostering broader societal benefits and increased healthcare equity globally.

Segmental Analysis:

- RSV Lateral Flow Test Kits segment is expected to witness the highest growth over the forecast period

The RSV lateral flow test kits segment is expected to witness the highest growth over the forecast period due to increasing demand for rapid, point-of-care diagnostics. These kits provide clinicians with fast, reliable results, enabling timely intervention for vulnerable populations such as infants, young children, and the elderly. Growing awareness of RSV complications, combined with rising hospitalizations during seasonal outbreaks, has fueled adoption. Moreover, advancements in kit design, including improved sensitivity, user-friendly formats, and compatibility with home-testing environments, have expanded their market penetration, driving the segment’s dominance globally in both clinical and non-clinical settings.

- Nasopharyngeal Swab segment is expected to witness the highest growth over the forecast period

The nasopharyngeal swab segment is projected to experience the highest growth as it remains the gold standard sample collection method for RSV detection. Its ability to capture sufficient viral load ensures high diagnostic accuracy, which is critical for reliable results. Hospitals, clinics, and laboratories continue to prefer nasopharyngeal swabs over alternative specimens due to established clinical protocols. Additionally, increased training and adoption of minimally invasive swabbing techniques have improved patient compliance. Rising RSV awareness and the need for rapid, accurate testing in pediatric and geriatric populations further contribute to the strong growth of this segment worldwide.

- Distributors & Retailers segment is expected to witness the highest growth over the forecast period

The distributors and retailers segment is expected to witness the highest growth owing to the expanding network of healthcare supply chains and the rising demand for rapid RSV diagnostic solutions. Distributors ensure timely delivery of test kits to hospitals, clinics, pharmacies, and community health centers, supporting point-of-care testing. Retail channels, including online platforms and pharmacy chains, have facilitated easier access for home-based testing, particularly during peak RSV seasons. Growing partnerships between manufacturers, distributors, and retail chains have enhanced product availability, enabling widespread adoption. These trends collectively drive the expansion of this segment globally across both urban and rural regions.

- North American Region is expected to witness the highest growth over the forecast period

North America is anticipated to witness the highest growth in the RSV lateral flow test market due to a combination of advanced healthcare infrastructure, high awareness of RSV risks, and strong adoption of point-of-care diagnostics.

The U.S. and Canada have well-established healthcare systems with significant investments in pediatric and geriatric care. Seasonal RSV outbreaks drive demand for rapid testing, supported by government programs and hospital initiatives. For instance, in March 2025, Bluebird Kids Health, a pediatric-focused healthcare services company, secured USD 31.5 million in funding, co-led by F Prime and .406 Ventures, with contributions from AIF and Juxtapose. This investment highlighted growing financial commitment to pediatric and geriatric care, supporting advanced diagnostic solutions and driving adoption of Respiratory Syncytial Virus lateral flow tests across North America.

Additionally, strong presence of market-leading diagnostic companies and rapid regulatory approvals facilitate faster product launches. For instance, in May 2023, Hologic Inc. received FDA approval for its Panther Fusion SARS-CoV-2/Flu A/B/RSV assay, a molecular diagnostic test designed to detect and differentiate four prevalent respiratory viruses: SARS-CoV-2, influenza A, influenza B, and respiratory syncytial virus (RSV). The assay helps overcome challenges posed by overlapping clinical symptoms, facilitating more accurate diagnosis and informed treatment decisions. Thus, the consumer awareness, home-testing adoption, and technological advancements together reinforces North America’s position as the fastest-growing regional market globally.

To Learn More About This Report - Request a Free Sample Copy

Respiratory Syncytial Virus Lateral Flow Test Market Competitive Landscape

The Global RSV Lateral Flow Test Market is characterized by intense competition among leading diagnostics companies, including Abbott Laboratories, Quidel Corporation, Becton Dickinson, and Siemens Healthineers. Key players are investing in research and development to enhance test accuracy, reduce turnaround times, and introduce multiplexed assays that detect multiple respiratory pathogens simultaneously. Strategic collaborations, mergers, and regional expansions are common, aimed at strengthening market presence. Product innovation, regulatory approvals, and adoption of user-friendly, point-of-care testing solutions are crucial differentiators. Emerging players focusing on affordable and rapid home-testing kits further intensify competition, driving technological advancement and market growth globally.

The major players for above market are:

- Abbott Laboratories

- Quidel Corporation

- Becton Dickinson (BD)

- Siemens Healthineers

- Roche Diagnostics

- Danaher Corporation (including Cepheid)

- Thermo Fisher Scientific

- BioMérieux

- ACON Laboratories

- SD Biosensor

- LumiraDx

- QuantuMDx Group

- Beckman Coulter

- Axis Shield

- Trinity Biotech

- Hangzhou Clongene Biotech

- Fortress Diagnostics

- Healgen Scientific

- Shenzhen Bioeasy Biotechnology

- MP Biomedicals

Recent Development

- In October 2024, QIAGEN secured FDA approval for its QIAstat-Dx Respiratory Panel Mini test, developed to assist clinicians in diagnosing upper respiratory infections in outpatient settings. The test simultaneously detects five common viral pathogens—influenza A, influenza B, human rhinovirus, respiratory syncytial virus (RSV), and SARS-CoV-2—offering a comprehensive, rapid diagnostic solution that supports informed clinical decision-making.

- In September 2024, Roche Diagnostics obtained Emergency Use Authorization (EUA) for its cobas Liat SARS-CoV-2, Influenza A/B, and RSV nucleic acid test. This automated multiplex real-time PCR (RT-PCR) assay, compatible with the cobas Liat system, enables efficient, precise detection of multiple respiratory pathogens, enhancing diagnostic accuracy and workflow efficiency in clinical settings.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing due to the increasing incidence of respiratory infections among infants and the elderly. Growing awareness of the importance of early diagnosis to prevent complications is a major driver. Furthermore, the convenience of lateral flow tests, which provide results in minutes at the point of care, makes them essential for clinics and emergency rooms.

Q2. What are the main restraining factors for this market?

Growth is limited by the lower accuracy and sensitivity of rapid lateral flow tests compared to lab-based PCR testing. Sometimes, a negative result still requires a secondary lab test to be certain. Additionally, the seasonal nature of the virus means demand fluctuates significantly, making it difficult for manufacturers to manage inventory and steady revenue year-round.

Q3. Which segment is expected to witness high growth?

The Point-of-Care (POC) Testing segment is expected to see the highest growth. Because RSV can progress quickly in young children, doctors need immediate results to decide on treatment. These easy-to-use kits are increasingly being used in pediatrician offices and urgent care centers, reducing the need for patients to wait for external laboratory results.

Q4. Who are the top major players for this market?

The market is led by major global diagnostic companies that specialize in rapid testing technology. Key players include Abbott Laboratories, QuidelOrtho, BD (Becton, Dickinson and Company), Roche, and Thermo Fisher Scientific. These companies dominate by providing reliable, high-speed test kits that are widely distributed to hospitals and pharmacies across the globe.

Q5. Which country is the largest player?

The United States is the largest player in this market. This is due to a highly developed healthcare infrastructure, high awareness of pediatric health, and a strong emphasis on rapid diagnostic screening during the winter "flu and RSV season." Significant healthcare spending and the presence of leading diagnostic manufacturers further solidify its top global position.

List of Figures

Figure 1: Global Respiratory Syncytial Virus Lateral Flow Test Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Respiratory Syncytial Virus Lateral Flow Test Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Respiratory Syncytial Virus Lateral Flow Test Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model