Suture Materials in Dentistry Market Overview and Analysis

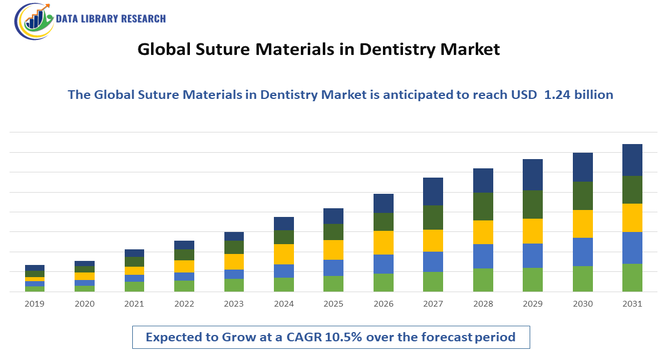

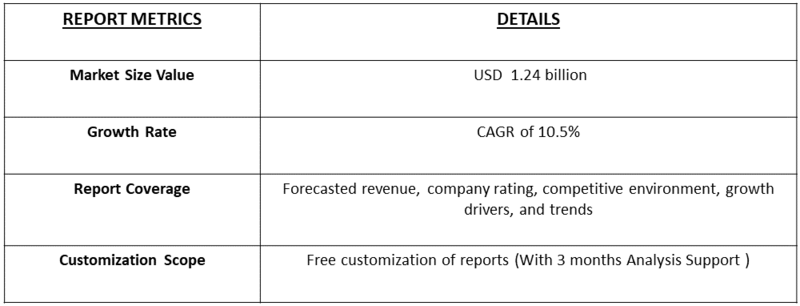

- The Global Dental Sutures Market was valued at USD 501.64 million in 2025 and is expected to reach USD 1.24 billion by 2032, growing at a CAGR of 10.5% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Suture Materials in Dentistry Market is experiencing steady growth driven by the rising prevalence of dental disorders and the increasing volume of oral surgical procedures worldwide. Growing demand for dental implants, periodontal surgeries, and tooth extraction procedures is significantly boosting the need for reliable and biocompatible suture materials. Advancements in dental care infrastructure, coupled with rising awareness about oral health and aesthetic dentistry, are further supporting market expansion. Additionally, the increasing adoption of minimally invasive dental procedures has elevated demand for high-quality absorbable and non-absorbable sutures that promote faster healing and reduce infection risks.

Suture Materials in Dentistry Market Latest Trends

The Global Suture Materials in Dentistry Market is witnessing several key trends that are shaping clinical practice and product development. A prominent trend is the growing adoption of advanced absorbable sutures, which dissolve naturally and reduce the need for follow-up visits, enhancing patient comfort and compliance. There is also increasing use of synthetic, bioengineered suture materials that offer superior tensile strength, minimized tissue reaction, and predictable absorption profiles. Additionally, antibacterial and drug-eluting sutures are gaining traction to prevent post-surgical infections and promote faster healing. Integration of innovative materials such as nanofibers and biocompatible polymers is enhancing performance outcomes.

Segmentation: Global Suture Materials in Dentistry Market is segmented By Suture Type (Absorbable sutures, Non-absorbable sutures), By Material Type (Natural suture materials, Synthetic suture materials), By Application (Dental implant procedures, Periodontal surgeries, Tooth extraction and oral surgeries), By End User (Dental hospitals and clinics, Ambulatory surgical centers, Academic and research dental institutes), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Volume of Dental Surgical and Implant Procedures

The increasing number of dental surgical procedures worldwide is a major driver of the Global Suture Materials in Dentistry Market. Growth in dental implant placements, periodontal surgeries, tooth extractions, and oral reconstructive procedures has significantly increased demand for reliable suturing solutions.

In 2022, WHO reported that severe periodontal disease affected approximately 1 billion people globally, accounting for nearly 4.8% of total global direct health expenditures. This substantial disease burden significantly increased the volume of dental surgical and implant procedures, driving consistent demand for effective wound-closure solutions. Consequently, the Global Suture Materials in Dentistry Market expanded, with heightened adoption of advanced dental sutures to support improved healing, reduced complications, and efficient management of rising periodontal treatment costs.

- Advancements in Biocompatible and Absorbable Suture Materials

Technological advancements in suture material development are strongly driving market growth. The introduction of advanced absorbable and synthetic sutures with improved tensile strength, controlled absorption rates, and minimal tissue reaction has enhanced clinical outcomes in dental procedures. These materials reduce infection risk, eliminate the need for suture removal, and improve patient comfort. Innovations such as antibacterial-coated sutures and bioengineered polymers are gaining popularity among dental professionals. Additionally, manufacturers are focusing on developing sutures tailored specifically for oral environments, which require high moisture resistance and flexibility. Continuous product innovation aligned with evolving clinical needs is significantly boosting adoption across dental clinics and hospitals globally.

Market Restraints:

- High Cost of Advanced and Specialized Suture Materials

The key restraints in the Global Suture Materials in Dentistry Market is the relatively high cost associated with advanced and specialty sutures. Absorbable, antibacterial-coated, and bioengineered synthetic sutures are significantly more expensive than conventional options, which can limit their adoption, particularly in small dental clinics and cost-sensitive markets. In many developing regions, patients often pay out-of-pocket for dental procedures, leading practitioners to opt for lower-cost alternatives to keep treatment affordable. The higher pricing of premium suture materials can therefore restrict market penetration and slow adoption, despite their clinical benefits such as improved healing and reduced infection risk.

Socioeconomic Impact on Suture Materials in Dentistry Market

The Global Suture Materials in Dentistry Market has generated meaningful socioeconomic impacts by supporting oral healthcare quality, workforce development, and medical manufacturing. Advanced suture materials improved surgical outcomes, reduced complications, and shortened recovery times, lowering long-term healthcare costs for patients and providers. The market created skilled employment in biomedical manufacturing, dental supply chains, and clinical training. Growing adoption in emerging economies expanded access to modern dental procedures, improving productivity and quality of life. However, cost differences between premium and conventional sutures limited affordability for low-income populations. Thus, the market contributed to better oral health standards, economic activity, and innovation while highlighting the importance of equitable access to essential dental care materials worldwide.

Segmental Analysis:

- Absorbable Sutures segment is expected to witness highest growth over the forecast period

Absorbable sutures hold a prominent position in the Global Suture Materials in Dentistry Market due to their convenience and improved patient comfort. These sutures naturally degrade within the body over time, eliminating the need for removal and reducing follow-up visits. They are widely used in dental implant surgeries, periodontal procedures, and oral surgeries where soft tissue healing is critical. Absorbable sutures minimize the risk of infection and tissue irritation, making them particularly suitable for the moist oral environment. Continuous advancements in polymer technology have improved their tensile strength and absorption predictability. Growing preference for minimally invasive dental procedures and enhanced post-operative care outcomes is driving strong demand for absorbable sutures globally.

- Synthetic Suture Materials segment is expected to witness highest growth over the forecast period

Synthetic suture materials are increasingly preferred in dentistry due to their consistent quality, biocompatibility, and predictable performance. These materials offer superior tensile strength, reduced tissue reaction, and better resistance to oral fluids compared to natural sutures. Synthetic sutures are available in both absorbable and non-absorbable forms, providing flexibility for various dental procedures. Their controlled absorption rates support effective wound closure and faster healing. Rising adoption of advanced dental treatments and increasing focus on infection prevention are accelerating the shift toward synthetic materials. Ongoing innovations in bioengineered polymers and antibacterial coatings are further enhancing their clinical value, supporting steady growth of this segment.

- Dental Implant Procedures segment is expected to witness highest growth over the forecast period

Dental implant procedures represent a major application segment in the global market, driven by increasing demand for tooth replacement and restorative dentistry. Successful implant placement requires precise soft tissue management and secure wound closure, making high-quality sutures essential. Suture materials used in implant procedures must ensure stability, promote healing, and reduce the risk of infection. The rising popularity of cosmetic dentistry and improvements in implant technology are contributing to the growing number of implant surgeries worldwide. Additionally, an aging population and increased awareness of oral aesthetics are fueling demand. These factors collectively support strong growth of suture materials in dental implant applications.

- Dental Hospitals and Clinics segment is expected to witness highest growth over the forecast period

Dental hospitals and clinics are the primary end users of suture materials in dentistry due to their high patient volumes and wide range of surgical procedures. These facilities routinely perform extractions, periodontal surgeries, and implant placements that require reliable suturing solutions. The availability of skilled dental professionals and advanced surgical infrastructure supports the adoption of high-quality suture materials. Increasing investments in dental care facilities and rising patient expectations for safe and effective treatments are driving demand. Additionally, dental clinics are increasingly adopting advanced absorbable and synthetic sutures to improve clinical outcomes and patient satisfaction, reinforcing growth within this end-user segment.

- North America segment is expected to witness highest growth over the forecast period

North America holds a significant share of the Global Suture Materials in Dentistry Market due to advanced dental care infrastructure and high awareness of oral health. The region benefits from widespread adoption of advanced dental procedures, including implants and cosmetic dentistry.

In February 2025, a research published in an article titled, Comparative Evaluation of Different Suture Materials during Periodontal Flap Surgeries: A Randomized Clinical Trial, reported that a clinical study impacted North America’s Suture Materials in Dentistry Market by validating the superior handling and healing outcomes of ePTFE sutures in periodontal surgery. Its evidence-based findings influenced clinician preference, supported standardized surgical protocols, and guided procurement toward premium suture materials, driving demand for advanced products that enhance patient outcomes, operational efficiency, and satisfaction within dental practices.

Strong presence of leading dental product manufacturers, favorable reimbursement policies, and high healthcare expenditure support market growth. Additionally, continuous technological advancements and rapid adoption of innovative suture materials enhance treatment outcomes. The growing aging population and increasing focus on preventive and restorative dental care further contribute to sustained demand, positioning North America as a key contributor to market value.

To Learn More About This Report - Request a Free Sample Copy

Suture Materials in Dentistry Market Competitive Landscape:

The competitive landscape of the Global Suture Materials in Dentistry Market is characterized by a mix of global medical device manufacturers, specialty dental product companies, and rapidly expanding regional players. Competition is driven by product innovation focused on biocompatibility, tensile strength, absorption profiles, and antibacterial properties to meet diverse clinical needs in dental implantology, periodontal therapy, and oral surgeries. Companies are investing in research and development to introduce advanced synthetic and absorbable suture materials that enhance healing outcomes and reduce postoperative complications. Strategic partnerships with dental clinics, training programs for clinicians, and expansion of distribution networks are key strategies to strengthen market position. Additionally, mergers and acquisitions, geographic expansion into emerging markets, and regulatory approvals are shaping the competitive dynamics as providers vie to address growing demand for high-quality dental sutures worldwide.

The major players for this market are:

- Johnson & Johnson

- Medtronic PLC

- B. Braun Melsungen AG

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Ethicon (a subsidiary of Johnson & Johnson)

- TEI Biosciences

- Dentsply Sirona

- 3M Company

- Henry Schein, Inc.

- Hu-Friedy Mfg. Co., LLC

- Integra LifeSciences

- Samyang Biopharmaceuticals Corporation

- Peters Surgical

- Assut Europe Srl

- Sharpoint Medical

- Metrica, Inc.

- Resorba Medical GmbH

- Surgipro, Inc.

Recent Development

- In February 2025, research published by Clinical Oral Investigation, reported that evaluated advancements in dental suture materials, emphasizing surface coatings such as zinc oxide nanoparticles, silver nanoparticles, and antimicrobial agents to enhance tensile strength and infection control. Findings indicated performance improvements, though efficacy in oral environments remained constrained by high microbial load. The study influenced the Global Suture Materials in Dentistry Market by informing product innovation, supporting clinical research, and reinforcing infection prevention protocols.

- In December 2024, research published by Journal of Research and Advancement in Dentistry, reported that study influenced the Global Suture Materials in Dentistry Market by emphasizing evidence-based selection of suture materials tailored to clinical needs. Its findings reinforced demand for diverse suture options addressing handling efficiency, patient comfort, and plaque control. The research guided practitioner awareness, supported informed procurement decisions, and encouraged manufacturers to optimize product portfolios rather than promote a single superior suture solution.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because of the rising popularity of dental implants and advanced oral surgeries. As more people seek cosmetic dentistry and dental restorations, the need for high-quality sutures to close incisions increases. Additionally, an aging population with more dental health issues is driving the demand for specialized surgical materials.

Q2. What are the main restraining factors for this market?

Growth is limited by the increasing use of dental adhesives and tissue glues, which are seen as faster and less painful alternatives to traditional stitches. High costs for premium, specialized sutures and the risk of post-surgical infections can also deter patients. Furthermore, limited access to advanced dental care in developing regions slows down market expansion.

Q3. Which segment is expected to witness high growth?

The Absorbable Sutures segment is expected to see the highest growth. Dentists and patients prefer these materials because they dissolve naturally in the body, eliminating the need for a second painful appointment to remove them. Their convenience and reduced risk of tissue irritation make them the top choice for soft tissue surgeries.

Q4. Who are the top major players for this market?

The market is led by global medical device giants and dental specialists. Key players include Ethicon (Johnson & Johnson), Dentsply Sirona, Hu-Friedy Group, B. Braun Melsungen, and Osteogenics Biomedical. These companies dominate by offering a wide variety of needle shapes and thread materials specifically designed for the tight spaces of the human mouth.

Q5. Which country is the largest player?

The United States is the largest player in the dental suture materials market. This is driven by its high number of dental implant procedures and a very strong focus on advanced oral healthcare. The presence of major manufacturing hubs and high consumer spending on both necessary and cosmetic dental surgeries keeps the U.S. in the lead.

List of Figures

Figure 1: Global Suture Materials in Dentistry Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Suture Materials in Dentistry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Suture Materials in Dentistry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Suture Materials in Dentistry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Suture Materials in Dentistry Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Suture Materials in Dentistry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Suture Materials in Dentistry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Suture Materials in Dentistry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Suture Materials in Dentistry Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Suture Materials in Dentistry Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Suture Materials in Dentistry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Suture Materials in Dentistry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Suture Materials in Dentistry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Suture Materials in Dentistry Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Suture Materials in Dentistry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Suture Materials in Dentistry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Suture Materials in Dentistry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Suture Materials in Dentistry Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Suture Materials in Dentistry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Suture Materials in Dentistry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Suture Materials in Dentistry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Suture Materials in Dentistry Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Suture Materials in Dentistry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Suture Materials in Dentistry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Suture Materials in Dentistry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Suture Materials in Dentistry Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Suture Materials in Dentistry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model