TWS Bluetooth Headset Chip Market Overview and Analysis

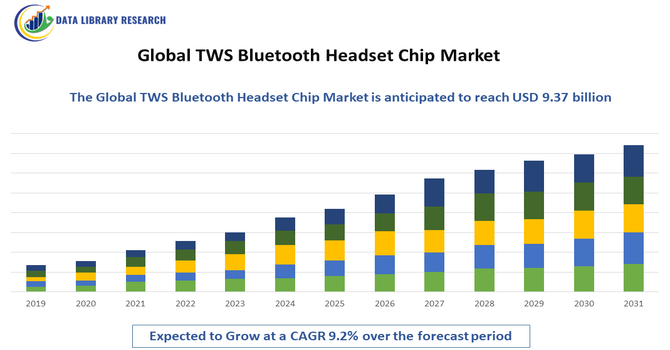

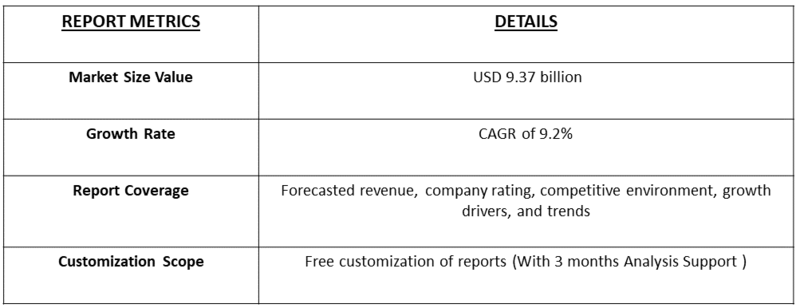

- The Global TWS Bluetooth Headset Chip Market size was valued at approximately USD 2.5 billion in 2025 and is projected to reach around USD 9.37 billion by 2032, growing with a CAGR of 9.2% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global TWS Bluetooth Headset Chip Market is experiencing strong growth driven by the surging global demand for wireless audio devices, particularly True Wireless Stereo (TWS) earbuds and headsets, as consumers increasingly prefer cord-free connectivity for convenience, portability, and enhanced multimedia experiences. The removal of headphone jacks in modern smartphones has further accelerated the adoption of TWS devices, fueling the need for advanced Bluetooth headset chips. Advancements in Bluetooth technology—such as Bluetooth 5.3 and later versions—enable improved connectivity, low-power consumption, longer battery life, and superior audio quality, making these chips essential components in next-generation wireless headsets.

TWS Bluetooth Headset Chip Market Latest Trends:

The Global TWS Bluetooth Headset Chip Market is undergoing rapid evolution with several key technological and consumer-driven trends shaping its trajectory. A major trend is the integration of advanced features such as AI-powered audio processing, active noise cancellation (ANC), and adaptive sound optimization directly on chipsets, enhancing user experience with superior sound quality and intelligent performance adjustments. Approximately 70 % of new TWS chips now support these advanced features, including integrated DSP modules, dual-mode connectivity, and high-resolution audio codecs, driving adoption in mid- to high-end devices. AI and smart features—such as voice assistant compatibility and environmental sound adaptation—are increasingly embedded at the silicon level, allowing processors to manage both audio and auxiliary functions like voice recognition seamlessly.

Segmentation: Global TWS Bluetooth Headset Chip Market is segmented By Chip Type (Single-mode Bluetooth chips, Dual-mode Bluetooth chips), Bluetooth Version (Bluetooth 5.0, Bluetooth 5.1, Bluetooth 5.2, Bluetooth 5.3), Feature Support (Standard Audio Chips, ANC-Enabled Chips, AI/Voice Assistant-Integrated Chips), Application (Consumer TWS Earbuds, Gaming Headsets, Professional & Enterprise Headsets), End User (Mass Consumer Electronics, Premium Audio Device Manufacturers, OEM/ODM Manufacturers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rapid Growth in Demand for True Wireless Audio Devices

The global surge in adoption of true wireless stereo (TWS) earbuds and headsets is a primary driver for the TWS Bluetooth headset chip market. Consumers increasingly prefer wireless audio solutions due to convenience, mobility, and compatibility with modern smartphones that no longer support wired audio ports. Rising usage of TWS devices for music streaming, gaming, virtual meetings, and fitness activities has significantly increased demand for high-performance Bluetooth chips. Additionally, growing penetration of affordable TWS products in emerging economies is driving large-scale chip shipments, supporting sustained market growth.

- Technological Advancements in Bluetooth and Chip Integration

Continuous advancements in Bluetooth technology, including Bluetooth 5.2, 5.3, and LE Audio, are strongly driving market expansion. These innovations enable lower power consumption, reduced latency, improved connection stability, and enhanced audio quality, making advanced Bluetooth chips essential for next-generation TWS devices. Moreover, integration of features such as active noise cancellation, AI-based audio enhancement, voice assistant support, and dual-device connectivity within compact chipsets is encouraging manufacturers to adopt upgraded solutions, thereby accelerating overall market growth.

Market Restraints:

- High Design Complexity and Cost Pressure on the Manufacturer

The development of advanced TWS Bluetooth headset chips involves high design complexity due to the need to integrate multiple functions such as low-power connectivity, digital signal processing, active noise cancellation, AI-based audio optimization, and battery management within a compact chipset. This increases research and development costs and extends product development cycles. Additionally, intense price competition in the consumer electronics market forces chip manufacturers to offer cost-effective solutions, often compressing profit margins and limiting the ability of smaller players to invest in innovation, thereby restraining overall market growth.

Socioeconomic Impact on TWS Bluetooth Headset Chip Market

The Global TWS Bluetooth Headset Chip Market has generated notable socioeconomic impacts by driving innovation in consumer electronics, enhancing connectivity, and enabling affordable, high-quality wireless audio experiences. Widespread adoption of TWS headsets has stimulated employment across semiconductor design, manufacturing, and software development, while fostering growth in related industries such as smartphones, wearables, and IoT devices. Rising demand encourages investment in R&D and advanced manufacturing technologies, strengthening regional economies. However, supply chain challenges and high initial costs can create disparities in access. Overall, the market contributes to technological advancement, improved communication, and enhanced productivity, supporting both economic growth and social connectivity worldwide.

Segmental Analysis:

- Dual-mode Bluetooth Chips segment is expected to witness the highest growth over the forecast period

Dual-mode Bluetooth chips hold a significant share of the market as they support both classic Bluetooth and Bluetooth Low Energy (BLE), enabling seamless connectivity and optimized power consumption. Their flexibility makes them highly suitable for modern TWS earbuds that require stable audio streaming alongside low-power operations, driving strong value generation in USD million terms.

- Bluetooth 5.2 segment is expected to witness the highest growth over the forecast period

Bluetooth 5.2 represents a key segment due to its support for LE Audio and improved synchronization between left and right earbuds. This version enhances audio quality, reduces latency, and improves energy efficiency, making it a preferred choice for next-generation TWS devices and contributing substantially to market value.

- ANC-Enabled Chips segment is expected to witness the highest growth over the forecast period

ANC-enabled chips account for growing market value as active noise cancellation becomes a standard feature even in mid-range TWS products. These chips integrate advanced signal processing capabilities to reduce ambient noise, boosting demand from consumers seeking immersive audio experiences.

- Mass Consumer Electronics segment is expected to witness the highest growth over the forecast period

Mass consumer electronics manufacturers represent a major end-user segment, as they produce high volumes of cost-effective TWS devices. Their focus on scalability and affordability drives consistent demand for Bluetooth headset chips globally. Mass consumer electronics manufacturers represent a major end-user segment, as they produce high volumes of cost-effective TWS devices. Their focus on scalability and affordability drives consistent demand for Bluetooth headset chips globally.

- Asia-Pacific region is expected to witness the highest growth over the forecast period

The Asia-Pacific region is projected to experience the highest growth in the Global TWS Bluetooth Headset Chip Market over the forecast period due to rapid technological adoption, a large consumer base, and rising disposable incomes. Countries like China, India, Japan, and South Korea are driving demand for TWS headsets through increasing smartphone penetration, growing interest in wireless audio devices, and expanding e-commerce platforms.

In March 2025, xMEMS’ Lassen MEMS micro-tweeter eliminates the need for a separate piezo amplifier, enabling more compact TWS earbud designs. Its launch and upcoming mass production are expected to boost the North America TWS Bluetooth Headset Chip Market by driving demand for miniaturized, high-performance audio components and fostering innovation in next-generation wireless earbuds.

Additionally, the presence of major semiconductor manufacturers and extensive electronics supply chains in the region supports local production and innovation. Favorable government policies, investments in research and development, and a tech-savvy youth population further accelerate market expansion, positioning Asia-Pacific as a dominant and fast-growing hub in the global TWS Bluetooth headset chip industry.

To Learn More About This Report - Request a Free Sample Copy

TWS Bluetooth Headset Chip Market Competitive Landscape:

The Global TWS Bluetooth Headset Chip Market is highly competitive, with numerous semiconductor and technology companies striving to innovate and capture market share by developing advanced Bluetooth SoCs and audio chipset solutions that offer low power consumption, enhanced connectivity, superior audio quality, and integrated features such as active noise cancellation and AI audio processing. Major players leverage strong R&D capabilities, strategic partnerships with OEMs, and broad product portfolios to address diverse requirements across premium, mid range, and entry level TWS devices. Continuous innovation—especially around Bluetooth 5.x standards, integrated voice assistants, and adaptive protocols—intensifies competition as companies seek design wins with leading TWS headphone and earbud brands globally.

Key Players;

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- Apple Inc.

- Realtek Semiconductor Corp.

- Broadcom Inc.

- NXP Semiconductors

- Texas Instruments Incorporated

- Samsung Electronics

- Nordic Semiconductor ASA

- Dialog Semiconductor PLC

- Infineon Technologies AG

- STMicroelectronics N.V.

- Cypress Semiconductor Corporation

- Zhuhai Jieli Technology

- Bestechnic Technology

- Shenzhen Bluetrum Technology

- Actions Technology

- Huawei Technologies Co., Ltd.

- Airoha Technology Corp.

- PixArt Imaging Inc.

Recent Development

- In September 2025, Skullcandy’s Uproar TWS earbuds, equipped with Bluetooth 5.4, quad-mic ENC, fast-charging, and multipoint pairing, enhance user experience with superior sound, connectivity, and versatility. Their adoption drives demand for advanced TWS Bluetooth headset chips globally, encouraging innovation, higher performance standards, and expansion of the wireless audio semiconductor market.

- In December 2024, Airoha Technology’s launch of the AB1595 AI-integrated wireless audio chip is set to reshape the Global TWS Bluetooth Headset Chip Market. By consolidating multiple functions into a single SoC, it enhances performance, reduces costs, and accelerates adoption of AI-powered TWS devices, strengthening market growth and innovation globally.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is booming because most new smartphones no longer have headphone jacks, forcing users to switch to wireless earbuds. Advancements in Bluetooth 5.0 and beyond have improved connection stability and battery life. Additionally, the high demand for features like noise cancellation and voice assistants (like Siri or Alexa) requires more powerful and efficient chips.

Q2. What are the main restraining factors for this market?

Growth is challenged by the high cost of developing smaller, more advanced chips that don't drain batteries quickly. There is also intense price competition, especially with many low-cost "clone" products entering the market. Furthermore, global semiconductor supply chain disruptions and the technical difficulty of keeping audio perfectly synced between two separate earbuds can limit production.

Q3. Which segment is expected to witness high growth?

The Bluetooth 5.2 segment is expected to witness the highest growth over the forecast period due to its enhanced data transfer rates, low energy consumption, and improved audio quality. These features make it ideal for next-generation TWS headsets, driving adoption in consumer electronics, wearables, and IoT devices worldwide.

Q4. Who are the top major players for this market?

The market is led by semiconductor giants that design the "brains" of the headsets. Key players include Qualcomm, Apple (with its H-series chips), MediaTek (Airoha), Realtek, and Bestechnic. These companies are the primary suppliers for major brands, focusing on making chips smaller while adding smarter features like AI-driven sound tuning.

Q5. Which country is the largest player?

China is the largest player in the TWS chip market. It serves as the world’s primary manufacturing hub for both the chips and the final headsets. China has a massive ecosystem of specialized factories and homegrown tech companies that produce millions of units for both local consumers and global export every month.

List of Figures

Figure 1: Global TWS Bluetooth Headset Chip Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global TWS Bluetooth Headset Chip Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global TWS Bluetooth Headset Chip Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global TWS Bluetooth Headset Chip Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global TWS Bluetooth Headset Chip Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America TWS Bluetooth Headset Chip Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America TWS Bluetooth Headset Chip Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America TWS Bluetooth Headset Chip Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America TWS Bluetooth Headset Chip Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America TWS Bluetooth Headset Chip Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America TWS Bluetooth Headset Chip Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe TWS Bluetooth Headset Chip Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe TWS Bluetooth Headset Chip Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe TWS Bluetooth Headset Chip Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific TWS Bluetooth Headset Chip Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific TWS Bluetooth Headset Chip Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific TWS Bluetooth Headset Chip Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa TWS Bluetooth Headset Chip Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa TWS Bluetooth Headset Chip Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa TWS Bluetooth Headset Chip Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa TWS Bluetooth Headset Chip Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa TWS Bluetooth Headset Chip Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model