Ventilation Equipment Rental Market Overview and Analysis

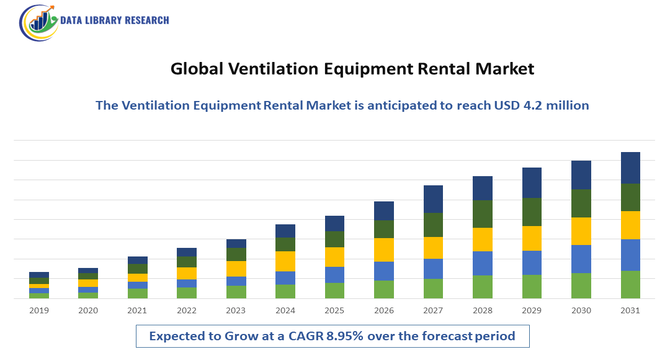

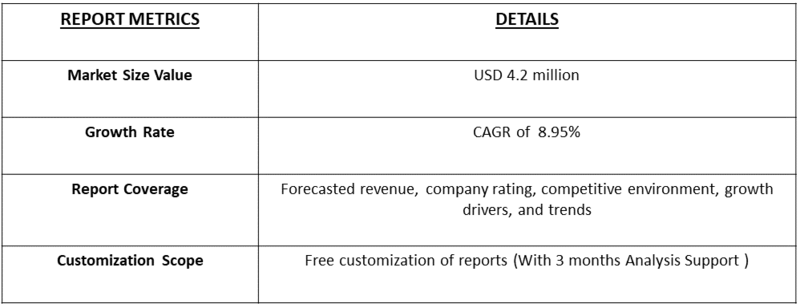

- The Global Ventilation Equipment Rental Market size was estimated at USD 2.98 billion in 2025 and is projected to reach USD 4.2 million by 2032, growing at a CAGR of 8.95% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Ventilation Equipment Rental Market is experiencing steady growth, primarily driven by rising industrial safety requirements, increased maintenance and shutdown activities, and the growing need for cost-effective temporary ventilation solutions across high-risk environments. Industries such as oil & gas, chemicals, construction, utilities, mining, and manufacturing rely on rented ventilation systems to ensure adequate airflow, remove hazardous fumes, and maintain safe working conditions in confined or enclosed spaces. Companies increasingly prefer renting over purchasing due to the high capital cost of advanced ventilation units, the need for periodic maintenance, and the short-term nature of many industrial projects.

Ventilation Equipment Rental Market Latest Trends

The Global Ventilation Equipment Rental Market is witnessing several notable trends, driven by advancements in industrial safety technologies and evolving project requirements across multiple sectors. The major trend is the rapid adoption of high-efficiency, low-energy portable ventilation systems, as industries aim to reduce operating costs while maintaining strong airflow performance in confined or hazardous environments. There is also growing demand for smart, sensor-enabled ventilation units that can monitor air quality, temperature, humidity, and particulate levels in real time, helping companies enhance compliance and improve worker safety.

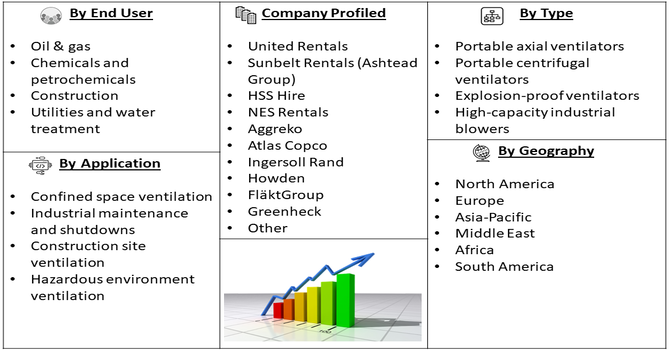

Segmentation: Global Ventilation Equipment Rental Market is segmented by Equipment Type (Portable axial ventilators, Portable centrifugal ventilators, Explosion-proof ventilators, High-capacity industrial blowers), Application (Confined space ventilation, Industrial maintenance and shutdowns, Construction site ventilation, Hazardous environment ventilation), End User (Oil & gas, Chemicals and petrochemicals, Construction, Utilities and water treatment), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Industrial Safety Regulations and Confined Space Compliance Requirements

A major driver for the ventilation equipment rental market is the growing enforcement of global safety standards related to confined spaces, hazardous environments, and worker air-quality protection. Regulatory bodies such as OSHA, NIOSH, ISO, and regional safety authorities mandate the use of proper ventilation systems in areas where there is a risk of toxic fumes, combustible gases, dust accumulation, or oxygen depletion. Many industries—especially oil & gas, chemicals, utilities, mining, and construction—frequently operate in environments that require continuous air circulation to maintain safe working conditions.

- Increasing Frequency of Industrial Shutdowns, Maintenance Projects, and Emergency Operations

The growing number of industrial maintenance, repair, and overhaul (MRO) activities is another strong driver of market growth. Industries such as refineries, chemical plants, manufacturing facilities, and power generation units routinely conduct shutdowns and turnaround operations that require temporary, high-capacity ventilation to ensure safe entry and continuous airflow in enclosed or confined structures. For instance, in November 2023, Andrews Sykes Group, a company specializing in renting out temporary climate control and power solutions (like large fans or emergency heaters), announced a strategic move: they are expanding into Germany. The company opened a new branch in Hamburg, marking its official entry into the German market.

This decision is all about growing their service reach and building a new customer base throughout the German region. These needs are typically short-term, making rentals the most cost-efficient option. Additionally, emergency situations—such as chemical leaks, fire incidents, and natural disaster recovery—create urgent demand for portable ventilation systems for rapid fumigation, air purification, and worker safety.

Market Restraints:

- High Maintenance and Operational Cost Associated

One major challenge is the high maintenance and operational cost associated with advanced ventilation systems, such as explosion-proof or high-capacity industrial blowers. Rental providers must invest heavily in upkeep, certification, and periodic replacement of equipment, which increases rental pricing and can discourage cost-sensitive customers, especially small contractors and firms in developing regions. Another restraint is the limited awareness and inconsistent safety practices in emerging markets, where many industries still rely on inadequate or makeshift ventilation solutions to reduce expenses. This lack of safety culture reduces the adoption of rented equipment despite regulatory requirements.

Socio-Economic Impact on Ventilation Equipment Rental Market

The global ventilation equipment rental market has made a real difference in people’s lives and local economies. By renting rather than buying expensive equipment, businesses, hospitals, and construction sites could easily maintain safe, healthy air without huge upfront costs. This helped protect workers, reduced sick days, and kept operations running smoothly. The market also created jobs in equipment maintenance, logistics, and rentals, supporting communities. Small and medium businesses could adopt advanced ventilation solutions they otherwise couldn’t afford, improving public health and workplace safety. Thus, the rental market not only made air quality solutions more accessible but also boosted productivity, supported economic growth, and helped people stay healthier in their everyday environments.

Segmental Analysis:

- Portable Axial Ventilators segment is expected to witness the highest growth over the forecast period

Portable axial ventilators account for a significant share of rental demand due to their lightweight design, high airflow capacity, and ease of deployment in confined or enclosed work environments. These units are widely used for short-term industrial projects because they offer efficient air movement, fast fume extraction, and effective cooling in tight spaces such as tanks, tunnels, basements, and pipelines. Their cost-effectiveness, portability, and suitability for diverse industries make them one of the most frequently rented ventilation solutions globally.

- Industrial Maintenance and Shutdowns segment is expected to witness the highest growth over the forecast period

Industrial maintenance and shutdown operations are a major driver of ventilation equipment rental demand, as facilities such as refineries, chemical plants, and manufacturing units require temporary, high-capacity ventilators to ensure safe working conditions during cleaning, repair, or inspection activities. These operations often involve confined spaces with limited airflow, making rented ventilation systems essential for worker safety and regulatory compliance. The short-term nature of shutdowns makes rentals far more practical than equipment ownership, boosting this segment’s growth.

- Oil & Gas segment is expected to witness the highest growth over the forecast period

The oil & gas sector represents one of the dominant end users of rented ventilation equipment due to the inherently hazardous environments found in refineries, offshore rigs, storage tanks, and pipelines. Strict safety standards related to toxic gases, volatile compounds, and confined space entry require continuous air circulation, which is efficiently fulfilled through rental solutions. The sector’s frequent maintenance cycles, turnaround activities, and emergency ventilation requirements further increase its reliance on rented high-performance ventilators.

- North America region is expected to witness the highest growth over the forecast period

North America is expected to witness the highest growth over the forecast period, driven by its strong industrial and infrastructure activities, strict enforcement of workplace safety regulations, and the widespread need for temporary ventilation solutions across high-risk sectors such as oil & gas, chemicals, utilities, and construction.

The region’s frequent industrial maintenance shutdowns, demand for advanced explosion-proof ventilators, and rapid adoption of technologically enhanced air-movement systems further contribute to its leading position in the Global Ventilation Equipment Rental Market. For instance, in January 2024, ClimateCare, a leading network of residential HVAC contractors in Canada, updated its buying program to give all members full access to Carrier’s Canadian product lineup. This made it easier for local contractors to purchase Carrier equipment, strengthening Carrier’s presence nationwide. The move also supported growth in the North American ventilation equipment rental market by increasing availability and adoption of high-quality HVAC systems for both short-term projects and long-term rentals.

Additionally, increasing awareness of worker health and safety is encouraging companies to invest in advanced ventilation equipment to reduce exposure to dust, fumes, and hazardous gases. The growing adoption of rental solutions allows businesses to access state-of-the-art systems without large upfront costs, offering flexibility for short-term projects and peak demand periods. This combination of regulatory pressure, industrial expansion, and cost-effective rental options is fueling rapid growth in the North American ventilation equipment market.

To Learn More About This Report - Request a Free Sample Copy

Ventilation Equipment Rental Market Competitive Landscape

The competitive landscape of the Global Ventilation Equipment Rental Market is fragmented and competitive, with a mix of large multinational rental firms, specialist ventilation and blower manufacturers that offer rental/leasing programs, and regional rental providers. Key competitors compete on fleet breadth (portable axial/centrifugal/explosion-proof units), rapid deployment capabilities, maintenance & certification programs, IoT-enabled monitoring, safety training, and turnkey project services. Consolidation, strategic partnerships with contractors and EPC firms, and investments in energy-efficient and explosion-proof equipment are common strategies to gain market share.

Key Player:

- United Rentals

- Sunbelt Rentals (Ashtead Group)

- HSS Hire

- NES Rentals

- Aggreko

- Atlas Copco

- Ingersoll Rand

- Howden

- FläktGroup

- Greenheck

- Systemair

- Vent-Axia

- Carrier

- Trane Technologies

- Daikin

- Johnson Controls

- Siemens

- ABB

- Wilo

- Alimak

Recent Development

- In November 2025, Daikin Applied Americas acquired an exclusive license to Sorbent Ventilation Technology (SVT) from enVerid Systems, gaining sole rights to manufacture, sell, and distribute SVT in North America. Building on its initial integration, Daikin permanently added the patented air-cleaning technology to its portfolio, strengthening its leadership in energy-efficient HVAC solutions and supporting customers’ indoor air quality, sustainability, and energy-efficiency goals.

- In March 2025, The Department of Energy’s Office of Environmental Management completed commissioning a nearly USD 500 million ventilation system at its Waste Isolation Pilot Plant in New Mexico. The Safety Significant Confinement Ventilation System (SSCVS) featured two main buildings: the Salt Reduction Building, which prefiltered salt-laden air from underground, and the New Filter Building, which housed fans and HEPA filters to further purify the air.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the rising need for compliance with stringent air quality regulations in industrial and construction settings, especially for confined spaces or hazardous materials. Growth is also fueled by the increasing frequency of natural disasters (floods, fires) requiring temporary dehumidification and air cleaning. The rental model provides cost-effective, immediate solutions for projects that have temporary or unpredictable ventilation needs, avoiding permanent system purchase.

Q2. What are the main restraining factors for this market?

A key constraint is the high transportation and logistics cost associated with moving bulky ventilation equipment to and from distant project sites. The market also faces challenges due to lack of standardization in rental equipment specifications, making it difficult for customers to compare offerings across different providers. Furthermore, the required technical expertise to install and operate specialized industrial ventilation equipment can be a barrier for smaller, non-expert clients.

Q3. Which segment is expected to witness high growth?

The Industrial and Manufacturing Segment is projected to witness high growth. This sector frequently requires temporary, specialized ventilation for processes like welding, abrasive blasting, and coating, where high levels of fumes or dust are generated. The need to protect workers from specific airborne contaminants and comply with Occupational Safety and Health Administration (OSHA) standards ensures that the flexible rental of specialized air movers and air scrubbers remains in high demand.

Q4. Who are the top major players for this market?

The market is led by global equipment rental firms and specialized HVAC service providers. Top major players include United Rentals, Inc., Aggreko PLC, Ashtead Group PLC (Sunbelt Rentals), and Herc Rentals Inc. Competition focuses on maintaining a large, diverse, and well-maintained fleet of specialized equipment, providing 24/7 service and technical support, and expanding their geographic footprint to offer rapid response and delivery across multiple industrial hubs.

Q5. Which country is the largest player?

The United States is the largest country player in this market. Its dominance stems from its vast industrial and manufacturing base, a high volume of construction and infrastructure projects, and the presence of the world's largest, most geographically comprehensive equipment rental companies. Crucially, the US has extremely strict air quality and worker safety regulations, making the reliable rental of compliant ventilation gear a consistent and high-priority necessity.

List of Figures

Figure 1: Global Ventilation Equipment Rental Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Ventilation Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Ventilation Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Ventilation Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Ventilation Equipment Rental Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Ventilation Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Ventilation Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Ventilation Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Ventilation Equipment Rental Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Ventilation Equipment Rental Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Ventilation Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Ventilation Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Ventilation Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Ventilation Equipment Rental Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Ventilation Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Ventilation Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Ventilation Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Ventilation Equipment Rental Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Ventilation Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Ventilation Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Ventilation Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Ventilation Equipment Rental Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Ventilation Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Ventilation Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Ventilation Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Ventilation Equipment Rental Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Ventilation Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model